#ClientRequest #FundamentalReview

Bank Central Asia (BBCA IJ)

Kinerja Keuangan

- Profitability BBCA tetap kokoh ditopang kualitas aset yang sehat dan biaya kredit rendah. Untuk FY26F, laba bersih diproyeksikan tumbuh +2% YoY ke Rp57,6T didorong pertumbuhan kredit lebih tinggi (+7,9%) dan penurunan cost of credit sejalan turunnya suku bunga acuan. Namun, NIM FY26F diperkirakan turun 27bps karena penurunan yield aset produktif di tengah kompetisi kredit wholesale yang ketat.

Prospek Perusahaan

- Fokus ekspansi ke segmen korporasi blue-chip dan perbaikan permintaan KPR akan menopang pertumbuhan kredit 2025–2026. BBCA tetap unggul dengan franchise CASA >80%, menjaga CoF tetap rendah dan risiko kualitas aset tetap terkontrol (NPL gross FY26F: 1.5%). Kami melihat BBCA tetap menjadi top defensive pick di perbankan besar berkat fundamental paling kuat di sektor ini.

Harga & Asing

- Harga Rp8.350, YTD turun -15% seiring tekanan sektor perbankan dan rotasi ke saham siklikal.

- Arus dana asing sebulan terakhir: Buy Rp19T • Sell Rp16,6T → Net Buy Rp2,40T, mencerminkan kepercayaan asing mulai pulih terhadap big banks.

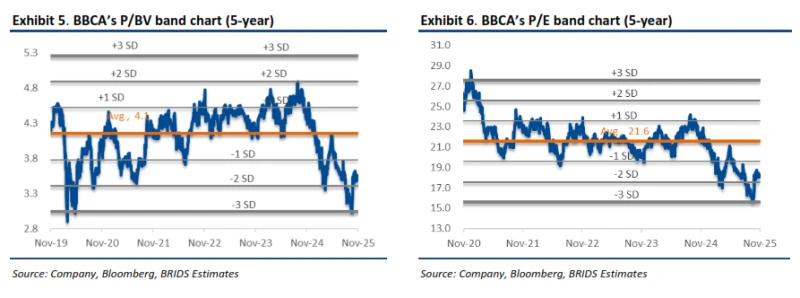

Valuasi & Rekomendasi

- BUY dipertahankan dengan TP Rp10.800 berbasis FY26F, mencerminkan fair value PBV 4.4x dan ROE yang tetap tinggi 19.8%.

- Dengan upside +29.7%, kami menilai penurunan harga tahun ini menjadi peluang akumulasi bagi investor jangka panjang. Risiko utama: turunnya NIM lebih dalam dan perlambatan kredit wholesale.

Disclaimer On – BRI Danareksa Sekuritas