TMT Selected News

LOCAL NEWS

Bank Indonesia Launches QRIS Tap

Bank Indonesia has officially launched QRIS Tap, a new payment feature available starting Friday, March 14. Currently, the feature is only accessible to Android users with Near Field Communication (NFC) technology. QRIS Tap combines QRIS Customer Presented Mode (CPM) with NFC, enabling faster transactions by using radio frequency instead of camera-based QR scanning. This technology enhances speed and security, as the QR code generated in mobile banking apps changes every 30-40 seconds, reducing the risk of misuse. At present, QRIS Tap is not available for iPhone users, as Apple restricts third-party access to NFC technology on its devices. (Kumparan)

Indonesia Issues Permits for Five Apple IPhone 16 Models

Indonesia has issued telecommunications permits for five Apple iPhone 16 models, the communications ministry announced on Friday. This marks a key step toward allowing sales in the country after a previous domestic ban. The move follows Indonesia's approval of local content certificates for 20 Apple products, including the iPhone 16, last week. However, Apple still requires an import permit from the trade ministry before it can officially sell the new iPhones in Indonesia, according to the industry ministry. (Reuters)

Oracle Mulls Data Center Investment in Indonesia's Batam Island

Oracle Corp is in talks with the Indonesian government to establish a cloud services center on Batam Island, favoring Nongsa Digital Park due to its free trade zone status and proximity to Singapore and Malaysia, where Oracle is expanding its cloud operations. This follows Oracle’s US$6.5bn investment announced in October for Malaysia’s first public cloud region. The company aims to broaden its footprint across Asia, with infrastructure projects spanning Japan to New Zealand and India. Oracle currently operates two cloud facilities in Singapore and maintains 50 public cloud regions across 24 countries. Indonesian authorities and Oracle have yet to comment on the discussions. (Reuters)

Indonesia’s E-Commerce Industry: Growth, Challenges & Regulatory Role

- E-Commerce as an Ecosystem

Indonesia’s e-commerce industry integrates logistics, payments, and digital marketing, evolving from traditional marketplaces to social commerce, live shopping, and AI-driven personalization. Competitive pressures demand logistics innovation to lower costs for price-sensitive consumers.

- Economic Contribution & Challenges

E-commerce transactions are expected to hit Rp512tr in 2024, with users reaching 65.65mn. However, logistics, digital payments, and SME adoption remain challenges, requiring industry-regulator collaboration for sustainable growth.

- Logistics: The Backbone of E-Commerce

Logistics inefficiencies outside Java hinder growth. The CEP industry grows at 7.24% annually, but Indonesia lags behind in advanced logistics (4PL & 5PL). New Commercial Postal Services regulations aim to improve efficiency and transparency.

- The Role of Adaptive Regulations

Overly rigid regulations risk stifling business flexibility. Instead, policies should ensure fair competition and innovation, enabling SMEs and large corporations to grow without excessive restrictions.

- Future Outlook

The industry's success depends on adaptability, efficiency, and innovation. A balanced regulatory approach will help strengthen Indonesia’s position in the global digital economy while ensuring fair competition and consumer protection. (Asosiasi E-Commerce Indonesia, Kontan)

AI at Indosat & Telkomsel: ‘Extra Field Workforce’ Without Monthly Salaries

Indosat has introduced its AI-powered agent, Luna, which has helped the company accelerate complaint handling by over 40% compared to traditional processes without AI. With Luna, Indosat can identify urgent complaints that need immediate resolution, significantly speeding up response times. The AI system allows Indosat to prioritize critical issues, ensuring that solving key complaints leads to the resolution of most customer concerns—eliminating the need for manual, case-by-case handling.

Meanwhile, in September 2024, Telkomsel successfully reduced customer complaints by optimizing AI for network planning and operations. The company has enhanced its network through AI-driven automation in over 28mn operational tasks. While other telecom companies are still working on integrating AI, Telkomsel’s AI solutions have already streamlined issue resolution by automatically identifying root causes, helping the company address customer concerns more efficiently. (Bisnis)

FREN’s Controlling Shareholder Announces Decision on Warrant III

Bali Media Telekomunikasi (BMT), controlling shareholder of Smartfren Telecom (FREN), is offering FREN Warrant III holders the opportunity to redeem their shares in the merged entity of FREN and EXCL. This initiative allows warrant holders to exchange their unexercised warrants for options issued by BMT ("BMT Options"), which can later be exercised to purchase shares in the newly merged company, PT XLSMART Telecom Sejahtera Tbk ("XLSMART Shares"). The BMT Option offering has been approved by FREN, with no objections raised. Warrant holders who wish to convert their FREN Warrants III into BMT Options must submit a written request to FREN no later than 10:00 AM WIB on March 24, 2025, via email at corpse.division@smartfren.com. (IDX, Emitennews)

Akseleran Reports Six Borrowers Defaulting on Rp178Bn Loans

Peer-to-peer lending platform Akseleran has informed affected lenders about six borrowers defaulting on a total of Rp178bn (US$11.5mn) in loans. The six defaulting borrowers include:

- PT PDB & affiliates (Rp42.3bn) – Defense equipment supplier

- PT EFI & affiliates (Rp46.6bn) – Engineering, procurement, and construction contractor

- PT PPD & affiliates (Rp59bn) – Sand and stone supplier for the Semarang-Demak toll road project (2020)

- PT CPM & affiliates (Rp9.6bn) – Interior design and contracting firm

- PT ABA & affiliates (Rp15.5bn) – Construction firm handling land procurement for a state-owned enterprise (BUMN)

- PT IBW & affiliates (Rp5.3bn) – Furniture manufacturing company

The company remains committed to resolving the situation. (Katadata)

Techno9 (NINE) to Be Acquired by Singaporean Mining Firm for Rp3.3Tr

PT Techno9 Indonesia Tbk. (NINE) is set to receive fresh capital as Singapore-based Poh Group plans to invest IDR 3.3 trillion (USD 200 million) and acquire a 70% majority stake in the company. The acquisition funds will be allocated to the coal mining sector, marking a strategic move for both companies. Additionally, NINE's information technology (IT) sector will play a crucial role in supporting mining operations. IT infrastructure, including communication networks, servers, and remote area solutions, is essential for efficient mining activities. (CNBC)

Bukalapak (BUKA) Chief Commissioner Resigns

One of the board seats at PT Bukalapak.com Tbk (BUKA) is now vacant following the resignation of Chief Commissioner Bambang Brodjonegoro. His resignation is linked to his appointment as Dean of the Asian Development Bank Institute (ADBI). Bambang Brodjonegoro’s resignation will be effective as of March 31, 2025. As a result, the Chief Commissioner position at BUKA will remain vacant until it is filled in the next General Meeting of Shareholders (GMS). (IDX, Kontan)

TLKM Respects Legal Process

TLKM respects the ongoing legal process regarding alleged corruption in the procurement of the National Temporary Data Center (PDNS) at Kominfo from 2020 to 2024. The case began in 2020 when a Kominfo official allegedly collaborated with a private company to secure a Rp60bn project tender, which continued until 2024. This alleged tender manipulation led to a ransomware attack on PDNS in June 2024. The case could potentially cause hundreds of billions in state losses. In 2023, the PDNS cloud service project was assigned to Telkom, with its budget surging to Rp357.5bn and a final contract price of Rp350.9bn. Telkom again secured the 2024 PDNS cloud service project with a budget ceiling of Rp287.6bn and a contract price of Rp256.5bn. (Bisnis)

OTHER FOREIGN TRENDS

Chinese AI Team Wins Global Award for Replacing Nvidia GPU with Industrial Chip

A team of Chinese researchers has achieved a breakthrough in AI hardware by training a cutting-edge video-generation model, FlightVGM, on AMD’s V80 FPGA chip, surpassing Nvidia’s RTX 3090 GPU in both speed and efficiency. Their system recorded a 30% performance boost and 4.5 times greater energy efficiency, demonstrating the potential of cost-effective, energy-efficient AI solutions. This innovation, developed by scientists from Shanghai Jiao Tong University, Tsinghua University, and Infinigence-AI, won the Best Paper Award at the FPGA 2025 conference, marking the first time a mainland Chinese team has claimed the honor and signaling a major shift in AI hardware optimization. (SouthChinaMorningPost)

Alibaba, Grab, Tencent, Meituan Gear Up for Growth as China Bets on Services to Revive Economy

China’s Minister of Commerce highlighted service consumption as a key growth driver, with the “trade-in” policy expanding in 2025 to boost industrial upgrades. In response, major firms are ramping up efforts: Meituan focuses on retail and global expansion, Alibaba’s Hema plans 100 new stores, Ele.me invests over 1 billion yuan in merchant support, and Grab acquires Malaysia’s Everrise to enhance grocery delivery. In AI, Alibaba open-sourced QwQ-32B, Tencent launched an image-to-video model, and Alibaba Cloud is expanding AI adoption in Japan. (Benziga)

‘World’s first’ fully autonomous AI agent unveiled in China, handles real-world tasks

Chinese engineers have introduced "Manus," the world’s first fully autonomous AI agent, capable of independently completing complex tasks without human input. Unlike AI chatbots like ChatGPT or Gemini, Manus can proactively make decisions, conduct research, and execute tasks, such as finding an apartment by analyzing crime rates, weather, and market trends. Its applications extend to recruitment, software development, and automation, potentially replacing human jobs rather than just enhancing productivity. This breakthrough challenges U.S. AI leadership, raising ethical and regulatory concerns, including liability for AI-made mistakes and the risk of mass unemployment. With regulators unprepared for fully independent AI, Manus could give China a major edge in AI-powered industries. (InterestingEngineering)

China’s ‘Fantastic Four’ Tech Entrepreneurs Reshaping Global Innovation

A new wave of Chinese tech entrepreneurs, known as the "Fantastic Four," is redefining global innovation and strengthening China’s tech rivalry with the U.S. Leading this shift are Liang Wenfeng (DeepSeek), Wang Xingxing (Unitree Robotics), Zhang Yiming (ByteDance), and Frank Wang (DJI), whose companies are making a global impact. Unlike Silicon Valley figures like Mark Zuckerberg and Sam Altman, China’s tech leaders avoid public attention while excelling in an ultra-competitive domestic market that demands adaptability and efficiency. Their quiet but rapid success signals China’s growing dominance in cutting-edge technology. (VNExpressInternational)

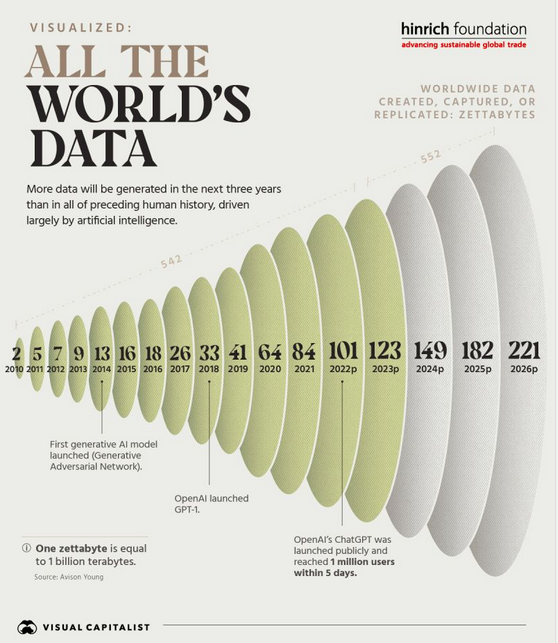

The World Will Generate More Data in Three Years Than in All of Human History

The world is on the brink of an unprecedented data explosion, with 552 zettabytes expected to be generated, captured, or replicated between 2024 and 2026—exceeding the total data produced from 2010 to 2023 (542 zettabytes). According to a Hinrich Foundation and Avison Young report, the rise of AI is a major factor in this surge, with technologies like ChatGPT and generative AI accelerating data creation. As artificial intelligence continues to reshape industries, the demand for data processing, storage, and cybersecurity will skyrocket, highlighting the growing challenges and opportunities in the digital age. (SosMed)

CoreWeave to Deploy One of Europe’s Largest Nvidia AI Clusters in Norway

CoreWeave has chosen Bulk Infrastructure’s N01 data center campus in Norway to host a Nvidia GB200 NVL72 cluster, set to go live by summer 2025. While the exact size remains undisclosed, it is described as one of the largest Nvidia AI deployments in Europe. Located near Kristiansand, the 100% hydropowered campus has 400MW of secured power, with expansion potential up to 1GW. Bulk recently started a 42MW expansion, supported by a US$380mn investment from BGO in June 2024, bringing total backing to over US$700mn since 2020. (DCD)

Starlink's Satellite Broadband Poses Limited Threat to Indian Telcos

Starlink's satellite broadband is said to unlikely to disrupt India's telecom giants Jio and Bharti Airtel, as their home broadband plans offer lower costs, higher speeds, and unlimited data. While global satellite internet plans range from US$10–500 per month with additional hardware costs, Indian telcos provide fiber plans starting at just US$5–7, with 1 Gbps speeds and streaming access for US$47. Given India's price-sensitive market, Starlink's higher costs and data caps make it less competitive for urban users, reinforcing its role in rural and underserved areas. Jio and Bharti have partnered with SpaceX to distribute Starlink services, but regulatory approval is still pending before operations can begin. (TheEconomicTimes)

CoreWeave’s IPO: A Key AI Market Test

CoreWeave, a New Jersey-based AI cloud computing firm, has filed for an IPO, seeking to raise US$4bn at a US$35bn valuation. As one of the first major AI infrastructure IPOs in years, its performance will gauge investor sentiment amid a weak market. The company rents GPUs and CPUs for AI and relies heavily on Microsoft (62% of 2024 revenue). Reports suggest Microsoft scaled back commitments, raising risk concerns, though CoreWeave recently secured an US$11.9bn, five-year AI deal with OpenAI. Other AI IPO candidates, including Genesys, Databricks, and Cerebras, have delayed listings due to volatility. While CoreWeave’s IPO will be closely watched, it may not define the broader market’s trajectory. (Semafor)

Comment: CoreWeave is a comparable tech comp for IOH (ISAT IJ) as it aims to position itself as a full AI stack service provider in SE Asia and APAC.

TikTok & Oracle: U.S. Divestment Talks Intensify

The U.S. is pressuring ByteDance to fully divest TikTok over national security risks, with an April 5 deadline that may be extended. Oracle, TikTok’s cloud partner, is leading talks under “Project Texas 2.0” to enhance data security by:

- Relocating U.S. user data to Oracle-managed servers in Texas.

- Blocking ByteDance employees in China from accessing U.S. user data.

- Allowing Oracle to review TikTok’s source code for potential security risks.

Other bidders include a group led by Frank McCourt, Kevin O’Leary, and Alexis Ohanian, proposing a blockchain-based rebuild, and a separate bid involving MrBeast. Trump suggested Larry Ellison or Microsoft could play a role, though neither has confirmed interest.

Congress insists on full Chinese divestment, while Beijing opposes a forced sale, adding geopolitical tension. (NY Post, Politico).

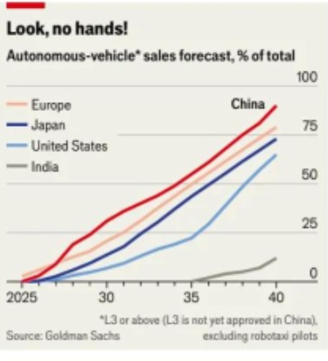

China Leads in Autonomous Driving

China is rapidly advancing in self-driving tech, nearing a “ChatGPT moment.” Local EV makers, like Xpeng, see AV as a key selling point, with robotaxis and ADAS adoption outpacing the U.S.

China runs the world’s largest robotaxi fleet (2,300+ vehicles, led by Baidu) and dominates L2 ADAS production. The government actively supports AV growth with looser regulations, subsidies, and infrastructure investment. L3 testing is now approved, accelerating mass adoption. By 2040, 90%+ of China’s cars are projected to have L3+ autonomy, solidifying its global lead. However, high costs, liability issues, and job losses remain key challenges. (Economist)

Humanoid Robot Race: U.S. Leads in AI, China Dominates Manufacturing

The U.S. excels in AI for humanoid robots, while China leads in agility and cost-effective production. At CES 2025, Nvidia showcased AI-driven robots, while China’s Spring Festival Gala featured Unitree’s advanced motion robots. With over half of the world’s robots produced in China in 2023, its firms benefit from lower costs and increasing mass production, with Agibot planning nearly 1,000 units in 2025 and Unitree offering models as low as $13,800. In contrast, Tesla targets large-scale production of its Optimus robot by 2026 at $20,000–30,000. AI remains the U.S.’s key advantage, with Nvidia, Tesla, and Figure AI leading advancements, but China is closing the gap with DeepSeek’s rising AI capabilities. (VnExpress International)

Drones, robots and China’s next AI darling, key tech developments by FT

- China’s AI push: Manus AI claims to surpass OpenAI’s ChatGPT, though skepticism remains. Government-backed DeepSeek draws investor interest despite concerns over hype.

- NTT’s optical networking bet: Japan’s NTT aims to cut AI data center power use with optical tech, but integration hurdles persist, and its stock underperforms.

- Chinese investments in Musk’s ventures: Over $30mn quietly funneled into SpaceX, xAI, and Neuralink via special-purpose vehicles to avoid scrutiny amid U.S.-China tensions.

- Humanoid robots race: China sees them as the "next big thing" after EVs, while Tesla advances Optimus. Safety and data challenges remain.

- Drones and military growth: Ukrainian and Israeli drone makers target South Korea as it expands its drone force. Global market set to hit $55B by 2030.

- China’s chip and AI ambitions: U.S. execs question China’s chip sustainability, while iFlytek showcases AI-driven animation and health diagnostics.

- Tech industry shift: As EVs and mobile phones slow, AI, drones, and humanoid robots emerge as key growth areas.

To see the full version of this News, please click here