BRIDS Market Pulse

|

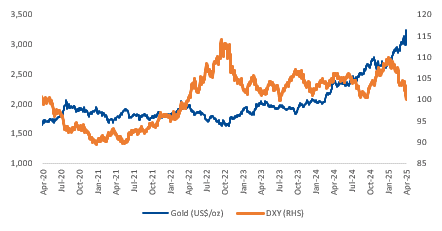

Chart of the week – USD vs. Gold |

In the spotlight

- Volatility starts to ease, though not yet out of the woods. As of 12th Apr25, Trump’s latest escalation (i.e., pushing U.S. tariffs on Chinese imports to 145%) and China’s response (raising tariffs on U.S. goods to 125%) have kept VIX at 30-40, but down from 55 on 7th Apr25. Overall, Trump’s pause, latest exemptions, and China’s latest rhetoric to “not go higher” hint that both sides may see diminishing returns from the tariffs retaliations and signal a possible negotiation. Nonetheless, we think uncertainty remains and volatility could persist (VIX at 30-40) unless there is a concrete deal.

- Weaker USD, US 10Y Yield spike. We believe the surprisingly weak DXY (at ~99-100), which was followed by a rise in 10-year yield to 4.5%, may reflect Treasury outflows from foreign holders such as Japan (US$1.079 trillion of holding as of 3Q24), China ($759 billion), and EU. The shift from USD also may be amplified by tariff pauses, US deficit fears, and concerns against U.S. growth (higher probability of recession).

- Commodities: Benefiting from weak DXY and sentiment shifts. Gold has outperformed (+6.6% w-w), supported by the shift towards safe havens. Overall, the metals space has benefited from the weak USD (copper +4.3%, nickel +2.1% w-w) and the tariff pause, which shifted risk sentiment and drove speculative buying/restocking. Amid lingering uncertainty on global growth (tariff impact), we think gold remains the better option within the commodity market.

- JCI played catch-up with regional markets as expected, down 3.8% w-w. JCI performed on par with the regional peers over the past two weeks, hence still underperformed YTD (-11.5%). Sector performance was mixed last week, with Cons. Staples and Banks outperforming the market, and Technology and Consumer Cyclicals underperforming.

- Flows: despite improving risk sentiment towards and flows by end of the week, foreign investors were overall net sellers in EM, with US$350mn of outflows from Indonesia, bringing YTD outflow to US$2.18bn.

… Read More 20250414 BRIDSMarketPulse