In the spotlight

- Market: JCI rallied +2.5% w-w, in-line with majority of the EMs and the weaker DXY amid benign developments from the global trade tariffs. Foreign investors remained net sellers, although outflows moderated to US$71mn, bringing YTD outflow to US$718mn. Barring any surprises on the trade tariff front, we see that risk sentiment may remain supportive for flows into EM in the week ahead.

- Metals outperformed: Metal stocks were among the leaders in the market, with MDKA +11%, INCO +10%, ANTM +6% w-w. Despite the still weak LME nickel price, sentiment in the sector was lifted by weak DXY and dissipating news on possible royalty hike. We estimated the impact from the possible royalty hike (from 10% to 15%) to companies under our coverage to be -2% to -9% of FY25F earnings.

- BI kept policy rate unchanged at 5.75%, citing persistently high global uncertainty. BI mentioned that it still sees room for rate cut, in-line with our economist team view of another 25bp of cut.

- Healthcare: With the implementation of KRIS anticipated in 1H25, our analyst Ismail Suweleh published a comprehensive report on the sector’s outlook. We maintain our OW rating on the sector on its consistent profitability improvement but shift our top pick to MIKA (Buy, TP Rp3,400) from HEAL (Buy, TP Rp2,000) previously.

- TLKM: Niko Margaronis reiterated Buy rating on the stock but with a lower TP of Rp3,680 as we expect FY25 to be a transitory year for TLKM.

- Commodities:

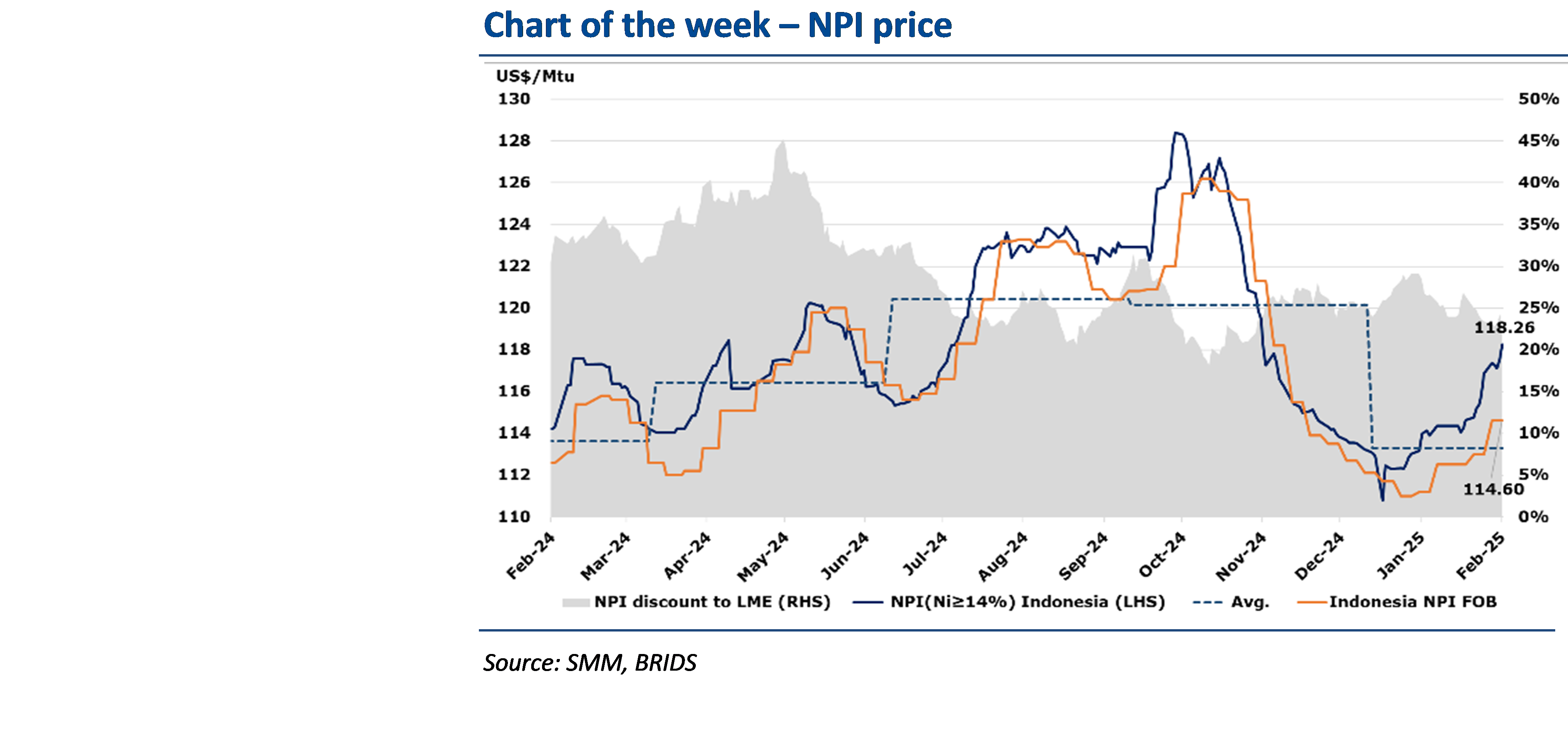

- NPI price rose to US$11.9k/ton (+1.2% w-w) driven by costs that grew from the continued rainy season, disrupting ore shipments in Sulawesi, as well as in the Philippines.

- Tin prices rallied to US$33.7k/ton (+3.2% w-w), the highest since Oct24 supported by tight supply conditions as Indonesia’s exports were delayed until mid-Feb, whilst Myanmar has yet to resume ore exports, and the DRC is facing domestic unrest, which has significantly decreased ore exports to China.

… Read More 20250224 BRIDSMarketPulse