BRIDS Market Pulse

In the spotlight

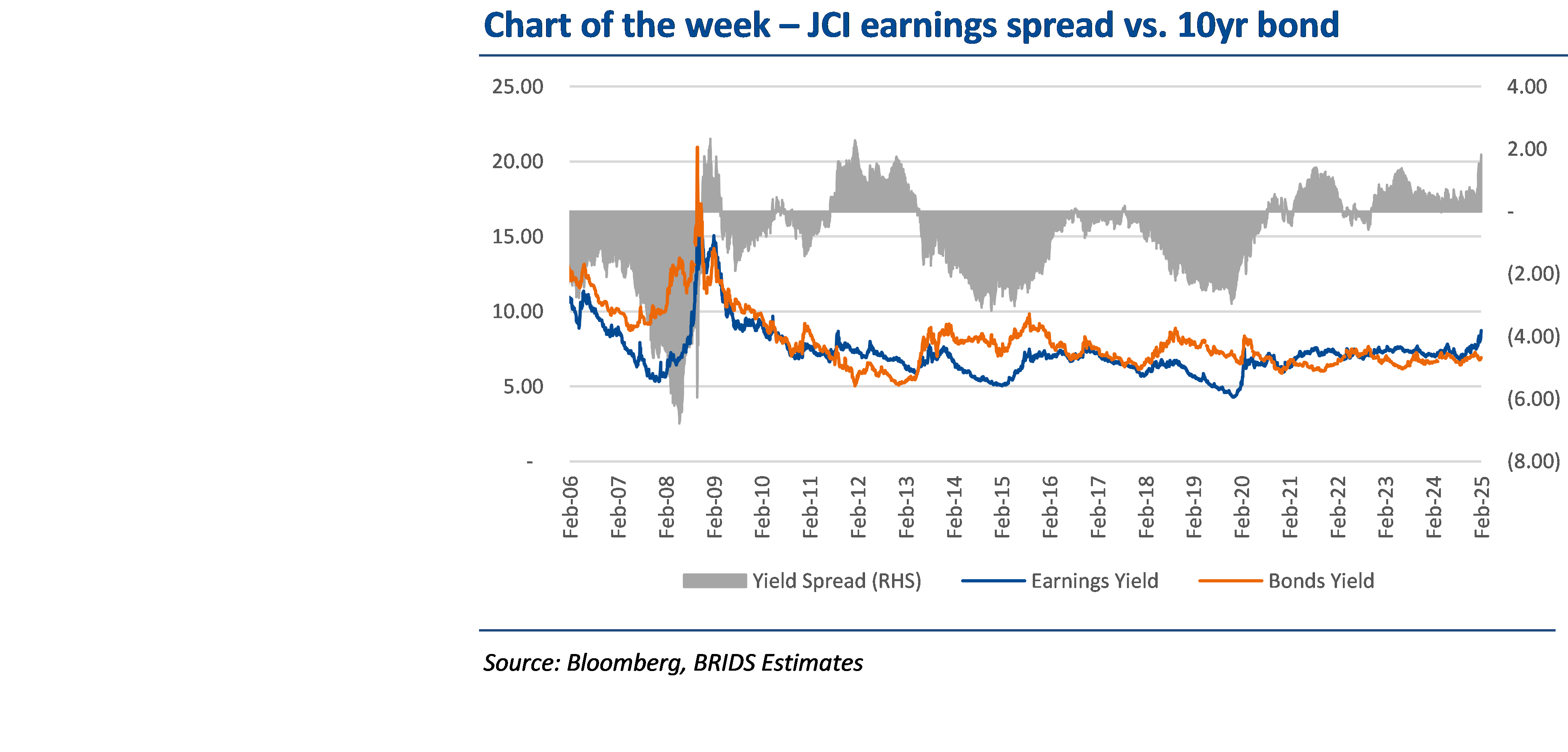

- Market: JCI experienced a sharp correction of -7.8% w-w, underperforming EM peers, amid selloff by foreign and domestic funds. JCI’s drop was triggered by a combination of concerns about govt’s plan to reallocate budget toward investment in SWF Danantara, banks’ Jan25 earnings and weaker IDR. Foreign investors’ outflow rose to US$622mn (from avg YTD of US$145mn), partly also driven by MSCI rebalancing, bringing YTD outflow to US$1,340mn.

- BBRI posted Jan25 earnings of Rp2.0tr (-58% yoy/ -58% mom), but mgmt. indicated that the provision should peak in Jan25. Jan25 NIM fell to 6.6% (-86bps mom/ -60bps yoy) as asset yield dropped (albeit from a high base in Jan/ Dec24), while opex remained high. CoC spiked to 5.6%, bringing provision expenses to Rp5.6tr. In the subsequent conf call, BRI management highlighted that the spike in CoC reflected management overlay on provisioning, which should come lower in the coming months, indicating that earnings should bottom in Jan25.

- Other banks’ Jan25 earnings: BMRI (Buy, TP Rp5,900) and BBNI (Buy, TP Rp5,100) posted Jan25 net profit of Rp4.0tr (+4% yoy, +2% mom) and Rp1.6tr (+10% yoy, +17% mom) respectively. While both banks also suffered from declining NIM amid rising CoF, Jan25 earnings were supported by still low CoCs. Meanwhile, BRIS (Hold, TP Rp2,900) posted Jan25 net profit of Rp590bn (-17% mom, +15% yoy), supported by manageable NIM and CoC.

- ASII FY24 results: ASII (Buy, TP Rp5,900) recorded net profit growth of 0.6% yoy to Rp34.05tr, forming 102%/106% of ours/cons (in line with ours, but above cons). Earnings were driven by 8% equity income growth (ADM & AHM), and growth in financial and agribusiness operating profit (+10%/+32% yoy).

- Commodities: Newcastle coal futures dipped to US$102/t (-0.1% w-w), reflecting market’s expectation of supply growth, while ICI3 and ICI4 held steady at US$69/t and US$49/t (+0.1% and +0.5% w-w respectively) amid ongoing China restocking.

… Read More 20250303 BRIDSMarketPulse