BRIDS Market Pulse

In the spotlight

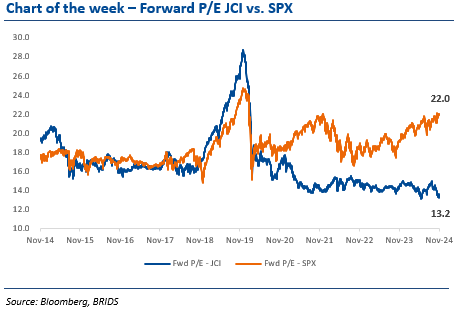

- JCI recorded its worst November monthly performance (-6.1% mom) amid the sixth consecutive week of foreign funds outflow (US$246mn), along with other EMs. Signs of peaking USD (DXY retracing below 107) could also mean peak of Trump trade, at least near-term. JCI’s 12-month forward growth outlook is intact (BRIDS/consensus forecast: +6%/5% yoy) with attractive current earnings yield of 8.4%.

- Banks’ Oct24 results negatively impacted by tight liquidity. BBRI and BRIS posted -19bps and -40bps mom lower NIM respectively in Oct24, reflecting the higher CoF. Meanwhile BMRI, which managed to raise its NIM through higher earnings asset yield, saw its LDR rise to an elevated level of 95.1%.

- Cement Nov24 price checks: Our analyst, Richard Jerry, noted that SMGR/INTP aggregate pricing improved by 0.4%/0.6% mom in Nov24, bringing 3M improvement to 2.3%/3%. All SMGR and INTP products had price increases, with the exception for Semen Gresik (-1.4% mom, but on 3M still improved by 0.9%). However, we maintain our Neutral rating on the sector given the lack of near-term growth catalysts.

- Consumers: potential beneficiary from bigger minimum wage hike. President Prabowo has announced the hike in 2025 minimum wage of 6.5% (vs. 2024 increase of 3.8%). This should bode well for our pick on the Consumers sector (ICBP, Buy PT Rp14,000), albeit slightly negative for the Retailers.

- Commodities: Coal prices continued to remain soft, down -0.2 to 0.7% wow (except for ICI2 +0.5%), despite signs of restocking activities at China ports. We think this continues to indicate tepid demand and ample domestic production in China.

… Read More 20241202 BRIDS Market Pulse