BRIDS Market Pulse

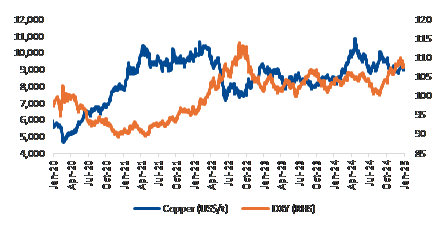

Chart of the week – Copper vs DXY

In the spotlight

- Market: JCI closed the week at -0.8% wow, faring better than ASEAN EM markets, which experienced a notable underperformance on the back of concerns on economic growth. Foreign investors were a net seller in JCI (-US$6.2mn, all market) and across EMs. We noted a mixed flows in banking sector, with net buys in BBRI and BBNI and net sells in BBCA and BMRI, indicating a shift toward high-beta banking stocks amid the recent BI rate cut. Nonetheless, we expect market sentiment to be clouded by developments on US (Trump’s) tariff policy, which may potentially drive DXY to remain on a strong footing.

- SRBI issuance saw a net injection, with yield falling to 6.6-6.7%. We see this as a potential positive for the banking sector’s liquidity, along with the potential upside from DHE policy which may drive stronger deposit and loan growth.

- Trump tariff: US President Trump announced a 25% tariff to be imposed on Canada and Mexico, and an additional 10% tariff on China. While Trump have previously indicated this plan, we see the overall tone of the policy may remain negative for the market, with Canada and Mexico reportedly preparing for retaliation tariffs. We think key risk to watch is on EM currency, especially if China depreciates its RMB.

- US Fed held its policy rate at 4.25-4.50% but with hawkish stance, citing that it is in no rush to cut further. With no rate cut expected until late 1H25, our macro team expects DXY's decline to be limited in ST, especially as other economies (Canada, EU) continue to ease rates.

- Commodities:

- Metals: copper price failed to sustain positive momentum amid reversal in USD, despite a gradual drop in inventory indicating no excess supplies. Meanwhile, the gold price reached all-time high and may likely remain supported amid the heightening volatilities.

- Coal: price correction continues albeit at a slower rate, with Newcastle and ICI4 falling to US$115/ and US$49/t. Seasonal inventory restocking may start in February, looking at historical patterns.

… Read More 20250203 BRIDSMarketPulse