BRIDS Market Pulse

In the spotlight

- JCI posted a minor correction of -0.5% w-w, following the strong rally in the previous week. Asian EM peers were flattish w-w, with China the only market recording strong gain of +3.5% w-w. Within JCI, the Media (SCMA, +28% w-w) Auto (ASII, +13%) and heavy equipment (UNTR, +8% w-w) led the sectoral performance, while the large-cap sectors underperformed with Banks, Consumers, and Telco down 1.2%, 1.4% and 2.1%, respectively. Indonesian equity market is the only market within Asia which recorded positive flows of foreign funds (+US$168mn), marking the second consecutive week of inflows (cumulative of US$580mn). We believe this is likely in anticipation of MSCI EM index rebalancing to be conducted by end of this month.

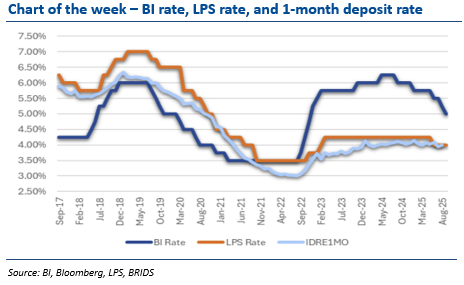

- BI delivered yet another 25bps surprise rate cut. Bank Indonesia lowered its policy rate by another 25 bps to 5.00%, bringing total cuts to 100 bps YTD and 125bps over the past 12 months, which mirrors both the Covid-era easing cycle and the 2016 moderation period. Since the unexpected rate cut in July, we noted that BI has fully shifted to a pro-growth stance, with further moderation of loan growth (to 7% in Jul25 from 7.7% in Jun25) appears to be one of the key reasons. Under this setting, our macro team’s optimistic case expects BI rate to potentially reach 4.75% by end-2025, as the central bank continues to push for lower lending rates and stronger credit growth.

- Banks: Liquidity battle between fiscal and monetary policy. Our Banking sector analyst Victor Stefano sees BI’s recent rate cut to potentially help lower banks’ CoF, especially if LPS also cut its rate in Sep25. However, we see govt’s higher FY26 tax revenues target could pose risks of lower loan demand, higher CoF, and higher NPL, subject to magnitude and timing difference. We retain Neutral rating on the sector with BBCA as our LT stock pick as we remain cautious on asset quality.

- Domestic funds’ Jul25 cash and top stocks. Our tracker observed that domestic funds’ cash position was reduced to an average 6.9% at end of Jul25, down 70bps from 7.6% from Jun25, albeit still above FY25’s low of 6% in Mar25. TLKM, BMRI and BBRI were the top stocks held by domestic funds. Our tracker also noted that funds were accumulating MDKA, ASII and GOTO, while reducing positions in ICBP, BBNI and KBLF during the month.

- INCO: On track for growth acceleration. We expect INCO’s revenue and earnings growth to accelerate in 2H25 and FY26, supported by higher nickel matte payability & ore production. Its HPAL projects remain on track for 4Q26 commissioning, with upside risk of an earlier timeline. We raised FY25 EPS est. by +25% but slightly trimmed FY26-27 and reiterate Buy rating with a higher SOTP-based TP of Rp4,700.

- Commodities: further recovery in Indonesian coal price, with ICI3 and ICI4 rebounding to US$58.6 and US$43.3/t on increased buying from China and supply tightness for ST deliveries. The rising buyers’ interest is well aligned with the drop in China’s coal inventory at port (exh. 10), signaling seasonal restocking is potentially on track by end of 3Q. On the nickel front, NPI prices have demonstrated similar recoveries, with Indonesian NPI up to US$11.4k/t.

… Read More 20250825 BRIDSMarketPulse