BRIDS Market Pulse

In the spotlight

- A positive week for JCI with strong performance and inflows into fundamental names. JCI recorded a strong 4.5% w-w rebound and was the second-best performing market within EM following Korea’s KOSPI index. The strong performance was particularly encouraging as it was led by the blue-chip/ fundamental names (i.e., BBCA +10.3% w-w, BBRI +10.0%, TLKM +14.2%, BMRI +12.3%, ASII +16.9%), which well offset the drop in metals stocks amid sharp correction in gold price. The market also saw the strong return of foreign flows (+US$255mn) into the blue-chip names, putting Indonesia among the few markets with positive foreign fund flows.

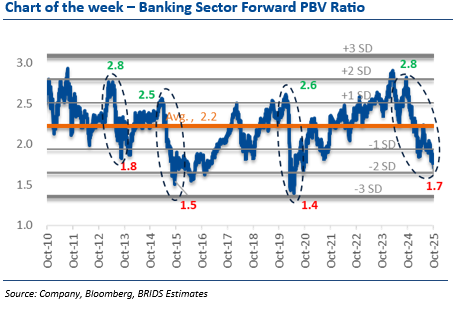

- Week ahead catalysts: 3Q25 earnings, potential trade resolution. With 3Q25 earnings season coming in full steam this week, a few names which have reported last week indicated in-line results for the banks (BBCA and BBNI) and a beat by UNVR. Despite the relatively still soft but in-line 9M25 earnings, share price reaction in banks suggested that most of the soft earnings is well expected, with current valuation at attractive discounts. We believe this could set the stage for further market upside, barring any major negative surprises on the earnings. We also expect positive sentiment to be supported by the potential deal in US-China tariff negotiation this week.

- TLKM: taking the first step toward value unlock. TLKM executed the spin-off of 56% of its fiber assets to TIF, valued at Rp35.7tr net book value, implying an 8.75x EV/EBITDA multiple. We believe potential improvement in utilization shall offer a clear path for value unlocking and potential re-rating toward peer valuation levels. Management guides for a 20-30% stake sale to a strategic partner, targeted after the completion of Phase 2 in mid-2026. We maintain our Buy call with a TP of Rp3,500. The current phase 1 transaction at 8.75x EV/EBITDA implies no immediate upside and is broadly in line with our base case. Assuming the infraco is valued at 11-15x EV/ EBITDA and at conservative EBITDA of Rp10tr, we estimate upside in TLKM’s fair value to Rp3,700-Rp4,100.

- Commodities:

- Metals: Gold experienced a sharp -5.6 % correction, although this is well expected following nine consecutive weeks of rally and stronger USD. Copper price rose +0.9% w-w amid expectations of short-term supply tightness. Nickel was relatively unchanged in LME, with NPI prices remaining soft and relatively resilient MHP.

- Energy: crude oil price rose (Brent +2.2% w-w) amid fresh sanctions on Russia export. Indonesian coal prices continue their positive trajectory with ICI3 and ICI4 rising +1.2% and +1.0% w-w respectively, in line with the seasonal restocking in China’s port.

… Read More 20251027 BRIDSMarketPulse