FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Bank Syariah Indonesia:Robust 3Q24 performance (in line);Potential growth outlook in Sharia market remained intact (BRIS.IJ Rp 2,950; HOLD TP Rp 3,000)

- BRIS posted 3Q24 net profit of Rp1.7tr (+2% qoq, +24% yoy, in line), supported by strong loan growth, improving NIM, and stable CoC.

- To further accelerate growth, BRIS aims to leverage its Hajj SA (deposit), gold business (loan), and bancassurance (fee-based income).

- We raised our FY24-25F net profit est. by 4-5%, resulting in higher ROE, increased FV PBV of 2.8x (from 2.6x) and a TP of Rp3,000; maintain Hold

To see the full version of this report, please click here

Medikaloka Hermina: Steady FY24F Growth Outlook Remains Intact Despite Muted Inpatient Volume (HEAL.IJ Rp 1,455; BUY TP Rp 2,000)

- We cut our FY24F/FY25F net profit ests. by 15%/8% due to lower distribution margin and lower land sales ASP.

- We believe 3Q24 would be the bottom of AKRA's performance, yet we believe there may still be ~9% cut in cons. est. to meet mgmt. guidance.

- We reiterate our BUY rating with a 6% lower TP of Rp1,600. We expect recovery from 4Q24F onwards from JIIPE and petroleum/chemical vol.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

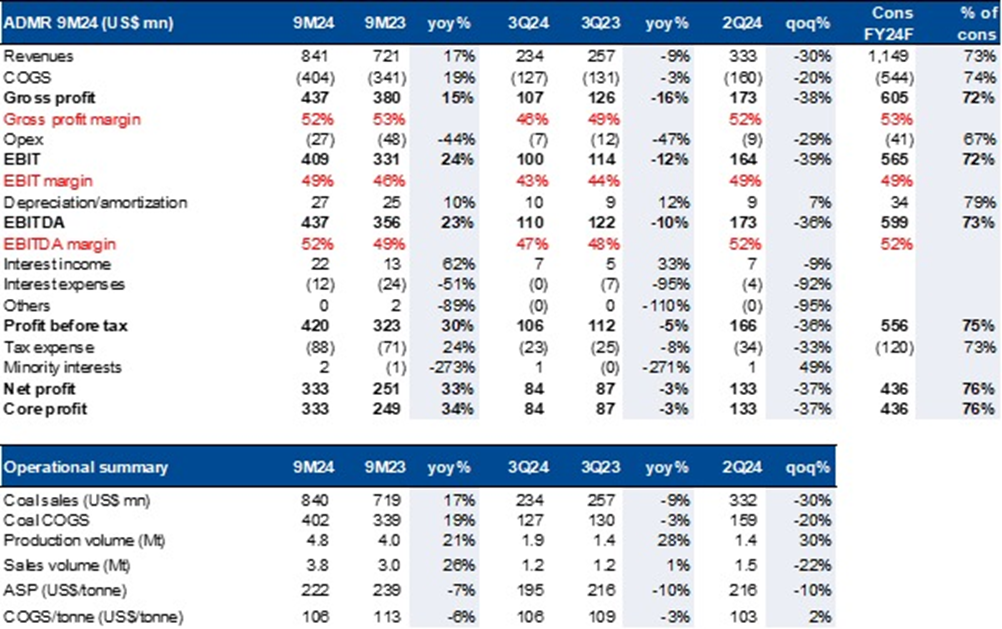

ADMR (Not-Rated): softer 3Q24 earnings; 9M24 Core Profit inline with Cons.

Earnings highlights:

- 3Q24 core profit: US$84mn (-3% qoq/ -37% yoy).

- 9M24 core profit: US$333mn (+34% yoy; 76% of Cons; inline).

- 9M24 EBITDA: US$437mn (+23% yoy; 73% of Cons.; slightly below).

- 9M24 Revenue: US$841mn (+17% yoy; 73% of Cons.; slightly below).

Positives:

- 3Q24 production volume grew at a healthy rate of +30% yoy/ +21% yoy, 9M24 production volume reached 4.8Mt (above at 88-97% of co’s FY24F).

Negatives:

- 3Q24 revenue fell -30% qoq/ -9% yoy on combination of softer ASP and weaker volumes.

- 3Q24 sales volume fell -22% qoq/ +1% yoy due to dry weather in Aug24 which caused shallow water level, delaying coal transportation.

- 9M24 sales volume only formed 69-76% of co’s FY24F (at 3.8Mt).

Impact/ outlook:

- While water level was too shallow in Aug24, the reverse happened in Oct24 due to high rainfall, hence another potential delay in 4Q24 shipment.

- Coking coal price has averaged at US$210/t in 4Q24-QTD hence, FY24F may come in at low end of cons. expectation (US$200-230/t). (Erindra Krisnawan – BRIDS)

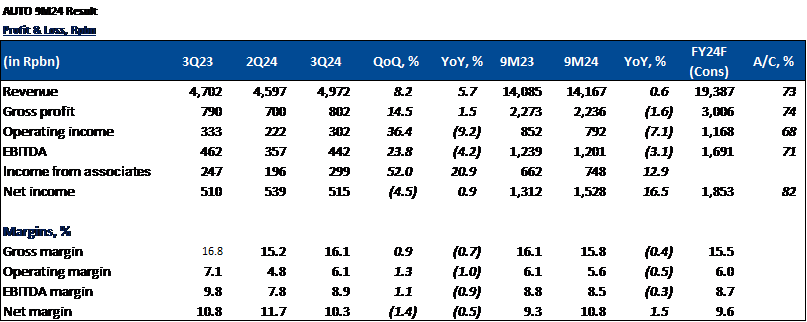

AUTO (Non-Rated) - 9M24 Result: Above-consensus

- AUTO recorded 9M24 NP of Rp1.5tr (+16% yoy, 82% of cons est. i.e., above), with 3Q24 NP at Rp515bn (-4% qoq, as 2Q24 has one-off other income of Rp180bn)

- 9M24 revenue improved by 1% yoy to Rp14.2tr (3Q24: +8% qoq), or inl ine, as 4W segment recovered in 3Q24. GPM/EBIT margin/EBITDA margin also improved by 90/130/110 bps qoq in 3Q24.

- Income from associates was recorded at Rp748bn in 9M24 (+13% yoy), with 3Q24 income reported at Rp299bn (+52% qoq), due to strong profit contribution from Denso (+26% yoy NP growth). (Richard Jerry, CFA – BRIDS)

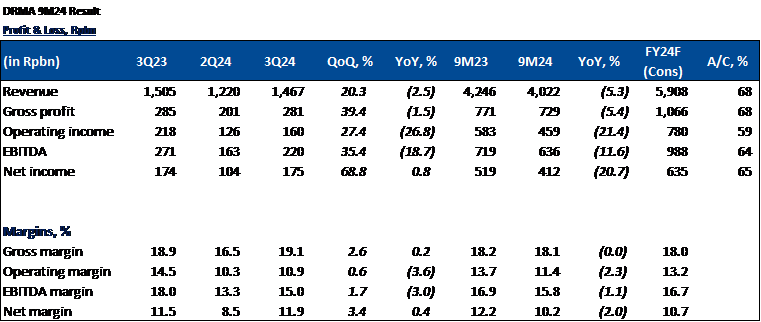

DRMA (Non-Rated) - 9M24 Result: In line revenue, strong recovery in 3Q24

- DRMA posted 9M24 NP of Rp412bn (-21% yoy, 65% of cons est), with 3Q24 NP coming at Rp175bn (+69% qoq). NPM stood at 10.2% in 9M24 (3Q24: 11.9%), with management expecting NPM to remain at 10.5%-10.8% in FY24E.

- Revenue reached Rp4tr in 9M24, or -5% yoy (3Q24: Rp1.47tr, +20% qoq), in line vs. seasonality, helped by recovery in 4W sales and continuity of strong 2W sales in 3Q24 (revenue from AHM improved by 6% yoy). Management expects flattish revenue growth (yoy) for FY24E, implying 4Q24E revenue of ~Rp1.5tr.

- Net income from associaties, Sankei Dharma, declined by 19% yoy, while net income from Dharma Kyungshin improved by 397% yoy. DRMA expects higher revenue from Dharma Kyungshin as there is a plan to assembly KIA in Indonesia. (Richard Jerry, CFA – BRIDS)

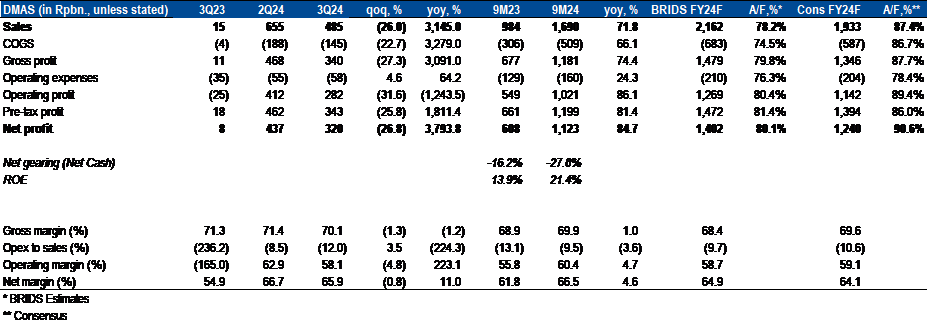

DMAS (Buy, TP: Rp190) - 9M24 Earnings: Inline with Ours, Above Consensus

- DMAS reported a net profit of Rp320bn in 3Q24 (-27% qoq), bringing its 9M24 achievement to Rp1.1tr, which is in line with our expectation (80%) and above consensus estimates (91%).

- Overall revenue in 9M24 grew by 72% yoy, driven mostly by the handover of data center land sales (64.5% overall contribution, with Microsoft contributing 49% at Rp810bn and Princeton Digital Group contributed 10% at Rp171bn).

- Gross margin improved by 1%, while opex to sales dropped by 360bps in 9M24. The Company remained at a net cash position.

- We currently have a BUY rating on DMAS with a TP of Rp190 based on 72% disc. to RNAV, as we view DMAS’ story as a proxy for data center demand to remain intact, with relatively low competition as it possesses infrastructure completeness, proven by its ability to serve tier-IV providers. (Ismail Fakhri Suweleh – BRIDS)

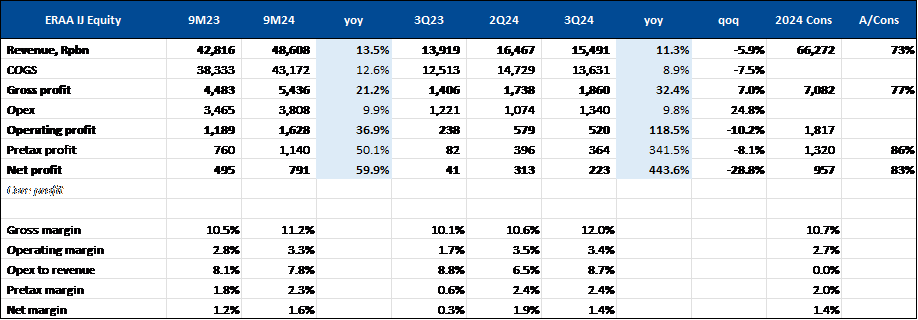

ERAA (Non-Rated) - 3Q24 Result

- ERAA posted 3Q24 revenue of Rp15.5tr (+11.3% yoy, -5.9% qoq), leading 9M24 revenue to Rp48.6tr (+13.5% yoy), achieving 73% of consensus targets.

- 9M24 revenue was driven by cellular phone sales (+14% yoy), computers and electronics (+64% yoy), and accessories (+18% yoy), while operator products declined by 36% yoy.

- 9M24 net profit reached Rp791bn (+59.9% yoy, 83% of cons), with 3Q24 net profit at Rp223bn. Margins improved, with gross margin at 11.2% (vs. 10.5% in 9M23) and net margin at 1.6% (vs. 1.2% in 9M23). (Natalia Sutanto & Sabela Nur Amalina – BRIDS)

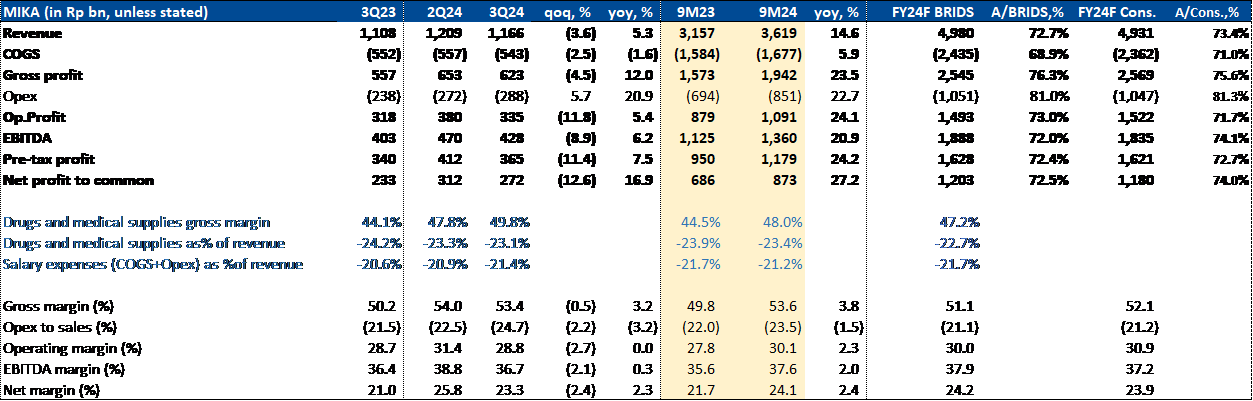

MIKA (Buy, TP: Rp3,400) - 9M24 Achievement: In-Line with Our and Consensus Estimates

- MIKA reported 3Q24 Net Profit of Rp272bn (-13%qoq, +17%yoy), bringing its 9M24 total to Rp873bn (achieving 73% of our and 74% of cons. estimates, thus in line).

- Salary cost remain increasing in 3Q24 as % of its revenue, however drugs margin continues to grow positively, which we believe reflects MIKA's sustained ability to secure higher-intensity cases.

- EBITDA margins remain on-track with company guidance of 37-38%, as well as top-line growth of 15%. Overall results are relatively aligned with our preview (3Q24 Revenue at Rp1.1tr with Net Profit at Rp289bn).

- More details on volume development will be post earnings call on Oct.30,2024 @4PM JKT Time. (Ismail Fakhri Suweleh – BRIDS)

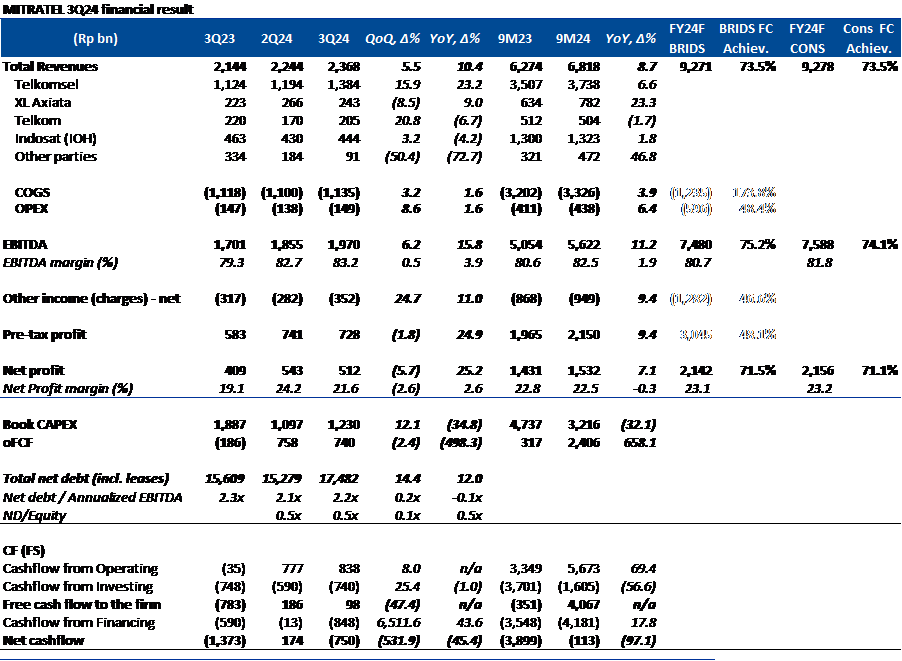

MTEL IJ (Buy, TP: Rp960) – Strong 3Q24 revenue, broadly in-line earnings

9M24 earnings:

- MTEL achieved 9M24 net profit of Rp1.53tr (+7.1% yoy). This is supported by robust topline growth and a resilient EBITDA margin of 82.5%. This result is broadly in line, achieving 71.5%/71.1% of our/cons FY24 forecast.

- 9M24 topline grew by 8.7% yoy, driven by incremental revenue from TSEL, XL, and other third parties, in line with expectations. Mitratel's controlled cost base aided EBITDA margin expansion; however, we expect to maintain our FY24 margin estimate at 80.7% for the year.

3Q24 earnings:

- MTEL’s 3Q24 net profit reached Rp512bn (-5.7%qoq, +25.2%yoy).

- This is owed to strong topline growth (+5.5%qoq, +10.4%yoy) and margin expansion (+50bps qoq, +390bps yoy).

- However, an increase in debt led to higher interest expenses, weighing on 3Q24 earnings.

- MTEL's topline growth in 3Q24 was primarily supported by revenue from the Telkom group. (Niko Margaronis - BRIDS)

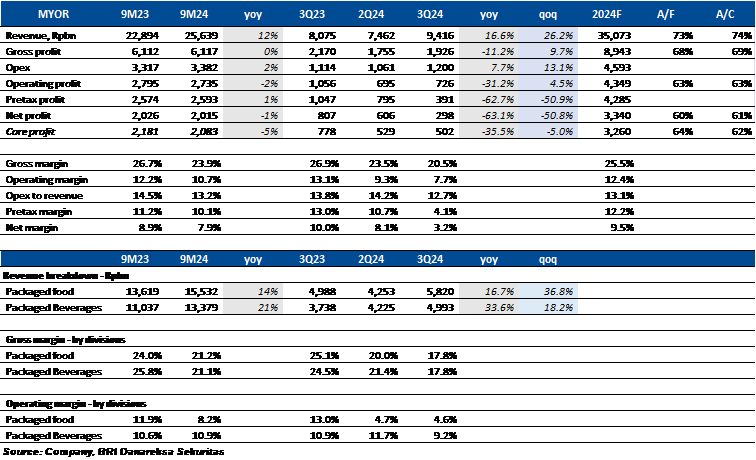

MYOR (Buy, TP: Rp3,350) 3Q24 results: Below estimates on Lower Margins.

- MYOR posted 3Q24 core profit of Rp502bn, down 36% yoy and 5% qoq, bringing 9M24 core profit to approximately Rp2.1tr, down 5% yoy. This 9M24 core profit represents 64% of our FY24F and 62% of consensus estimates, i.e below.

- In 3Q24, MYOR booked solid rev. growth of 16.6% yoy mainly driven by beverages (33.6% yoy) while food saw an increase by 16.7% yoy. However, higher sugar and coffee prices pressured 3Q24 GPM, which declined to 20.5% (2Q24:23.5% and FY23: 26.7%). (Natalia Sutanto & Sabela Nur Amalina – BRIDS)

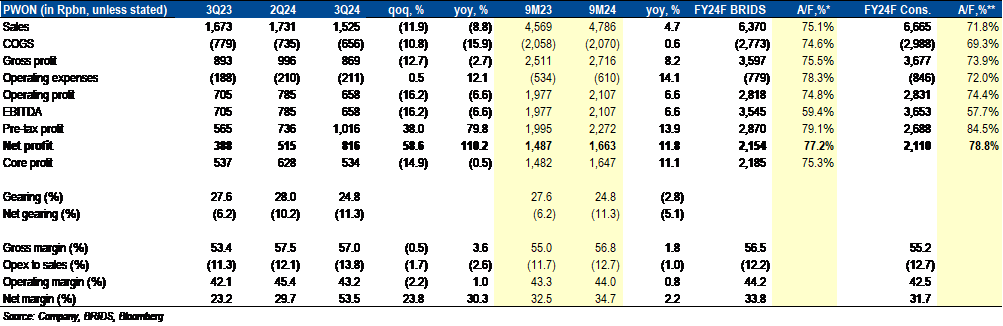

PWON (Buy, TP: Rp640) 9M24 Result: In-Line

- PWON booked net profit of Rp816bn (+59%qoq, +110%yoy) in 3Q24, bringing its 9M24 achievement to Rp1.6tr (+12%yoy), which formed 77%/78% of our/cons. FY24F estimates (i.e., In-Line).

- Overall revenue in 9M24 grew 5% yoy, contributed mostly from recurring revenue (79.5%) with 11%yoy growth.

- Property development revenue remains slow at -15% yoy in 9M24, which is expected due to weak condo market, while handover of Bekasi apartment (Amor Tower-up to ~Rp500bn acc. sales) should be done by 4Q24-1H25.

- Forex gain (non-cash) was recorded at Rp375bn in 3Q24 vs. loss of Rp170bn in 2Q24, due to stabilizing IDR. Stripping out forex gain, 9M24 core profit remained in-line (75% to our FY24F estimates)

- We currently have a BUY rating on PWON with a TP of Rp640 based on ~58% dic.to RNAV, which implies 14.3/13.1 FY24F/FY25F P/E. (Ismail Fakhri Suweleh – BRIDS)

MARKET NEWS

MACROECONOMY

US Job Opening Fell by 418k in Sep24

US Job Openings fell by 418k to 7.4mn in Sep24 from a downwardly revised 7.9mn in August and below market expectations of 7.99mn. It is the lowest level since January 2021, indicating that the labor market is cooling. Number of job quits (3.1mn) and layoffs and discharges (1.8mn) changed a little. (Trading Economics)

SECTOR

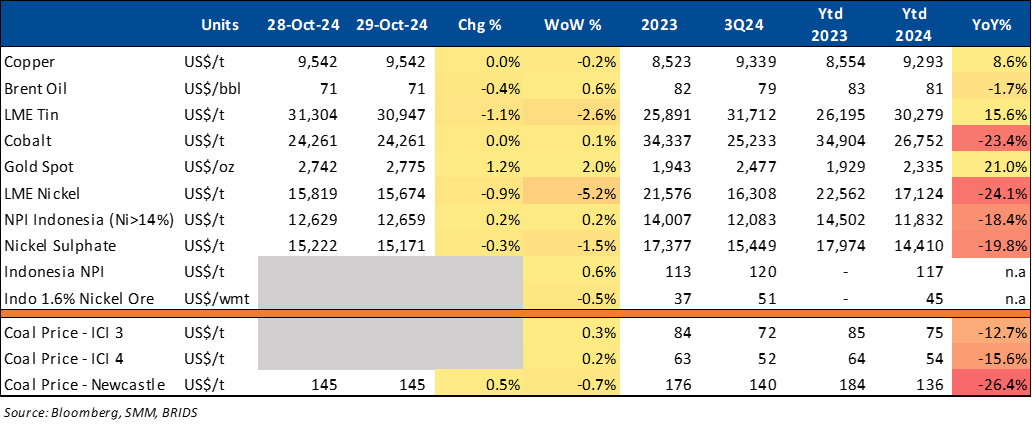

Commodity Price Daily Update Oct 29, 2024

Bank Indonesia Extends Zero Percent Down Payment Policy for Home and Vehicle Loans

Bank Indonesia (BI) has extended its zero percent down payment policy for homeownership loans (KPR) and motor vehicle loans (KKB) until December 31, 2025. The policy allows for a Loan-to-Value/Financing-to-Value (LTV/FTV) ratio of up to 100% for property loans and a minimum down payment of zero percent for vehicle loans, initially set to expire on December 31 this year. Under this policy, buyers can purchase homes, apartments, or new vehicles without a down payment, applicable to all types of properties, including landed houses, apartments, and shop houses. (Kontan)

Property: Consultants and Property Developers Respond to Government's 3mn Homes Program

JLL Indonesia and property issuers have responded to the government’s 3mn homes program, initiated by the new government, expressing cautious optimism about its potential impact on the property market. JLL Indonesia emphasized the need to understand the target demographic and implementation details, suggesting that effective execution could boost the economy significantly. Similarly, CTRA noted that while they are studying the program further, CTRA Group is prepared to contribute land if needed, recognizing the high housing demand. Meanwhile, PANI stated their commitment to assist in providing adequate housing, and the government plans to begin the program in early 2025, targeting the construction of 2mn homes in rural areas and 1 million in urban areas. (Kontan)

CORPORATE

ANTM Conducts Affiliate Transaction worth US$7.6mn

ANTM has conducted an affiliate transaction with PT Feni Haltim (PT FHT) in the form of a shareholder loan from ANTM to PT FHT, valued at US$7.6mn on October 25, 2024. This transaction is intended to provide financial support for the implementation of PT FHT's projects in 2024. (IDX)

BIKE Becomes Exclusive Distributor for United E-Motor

BIKE has officially become the sole distributor of United E-Motor, a local electric motorcycle brand from UNTD. Currently, BIKE operates 620 dealers across 28 provinces in Indonesia and holds the Genio Bike brand, along with being the official distributor for United Bike and Avand. Mgmt. emphasizes that expanding their marketing area is crucial to their strategy, and the company remains optimistic about competing in Indonesia's vast market. (Kontan)

ASLC Achieves 177% Net Profit Growth in 3Q24

ASLC reported a significant surge in net profit in 3Q24, up by 177% yoy, driven by robust revenue growth across all its business units. As of 9M24, ASLC achieved total revenue of Rp618.18bn, marking a 36% increase from Rp453.50bn, with net profit reaching Rp44.6bn, soaring from Rp16.15bn in 9M23. JBA Auction House recorded revenue growth of 43%, reaching Rp201.40bn in 9M24, compared to Rp140.57bn in 9M23. ASLC’s retail used car business, under Caroline.id, posted revenue of Rp416.7bn, up 32% from Rp315.07bn last year. Meanwhile, MotoGadai, ASLC's pawnshop venture, recorded revenue of Rp2.38bn—a 42-fold increase from Rp57mn in 9M23. (Kontan)

EXCL Partners with Huawei for Network Automation

EXCL, through its partnership with Huawei, has achieved AOMM Level 3.0 in network automation, setting a high industry benchmark and improving connectivity quality and efficiency for customers in Indonesia. The collaboration marks a critical step towards EXCL's goal of becoming a fully convergent and automated network provider, enhancing productivity and customer satisfaction. (Emiten News)

TBIG Signs Amendment Agreement for US$35mn Revolving Loan Facility

TBIG signed an amendment agreement related to its US$35mn revolving loan facility with the Overseas Chinese Banking Corporation Limited, originally dated July 28, 2023. Under this agreement, TBIG, as the parent company, and the group of subsidiaries, as the original guarantors, have adjusted terms concerning the loan facility, which received an initial disbursement of US$10mn. The final repayment is now scheduled for October 2025. (Company)

TOWR Announces PMHMETD I Structure and Shareholder Rights Details

TOWR announced its PMHMETD I structure, which includes up to 4.99bn new shares with a nominal value of Rp10/share. Shareholders holding 1,001 old shares as of December 16, 2024, will receive 100 preemptive rights (HMETD), each allowing the purchase of one new share at an exercise price of Rp900. The total emission value is projected at Rp4.49tr, with a maximum ownership dilution of 9.08% after the rights issue, excluding treasury shares. (Company)