|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

Equity Strategy: Welcoming Danantara

To see the full version of this report, please click here

Astra International: 4Q24E Earnings Preview: In-line with ours, slightly above consensus (ASII.IJ Rp 4,700; BUY TP Rp 5,900)

To see the full version of this report, please click here

Macro Strategy: The Amalgam of Domestic Trends

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

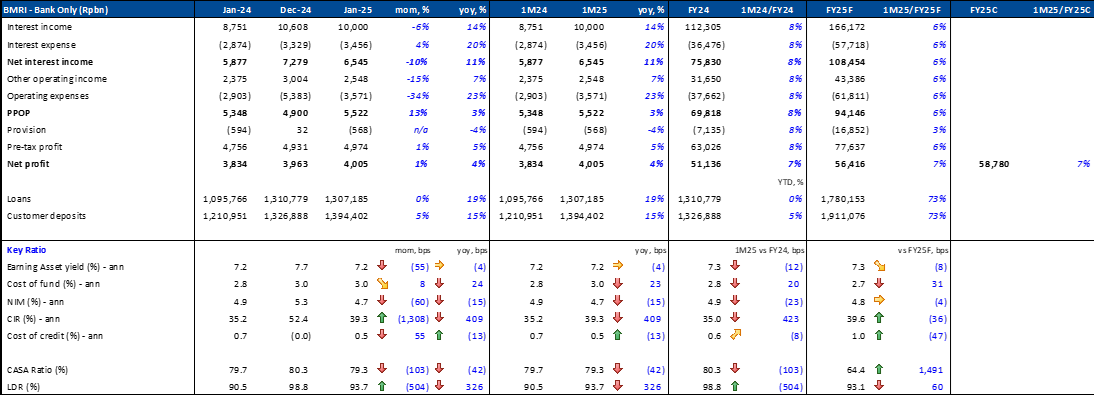

RESEARCH COMMENTARY BMRI (BUY, TP: Rp5,900) - Jan25 Bank-Only Results Jan25 Insights:

Summary:

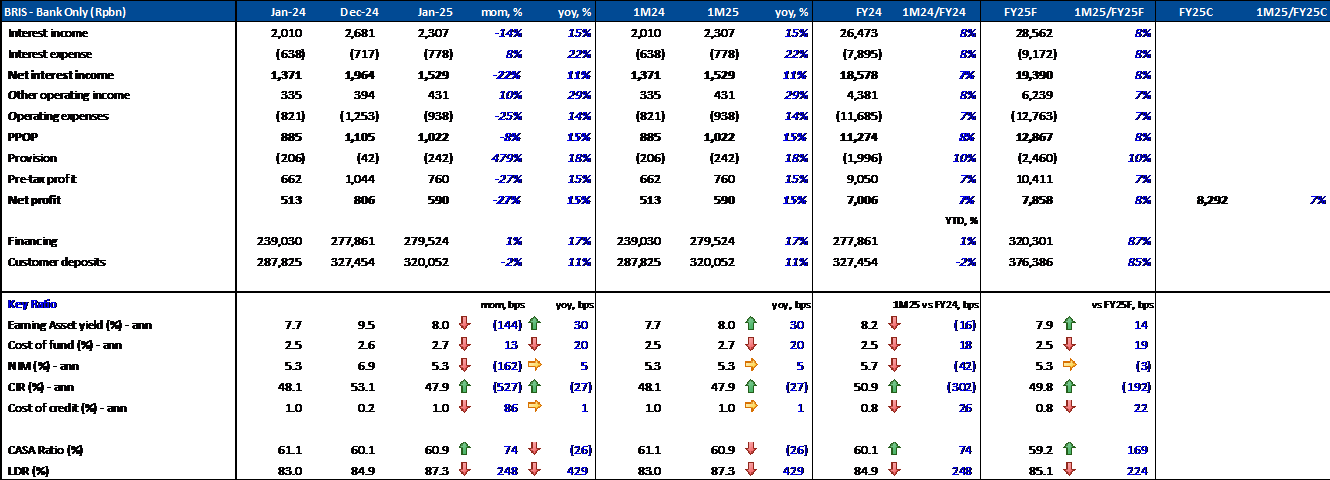

BRIS (HOLD, TP: Rp2,900) - Jan25 Bank-Only Results Jan25 Insight: · Solid net profit growth: BRIS posted Rp590bn in net profit for Jan25 (-27% mom, +15% yoy), meeting 8% of our and 7% of consensus FY25 estimates—broadly in line with expectations. · Strong loan growth and resilient NIM: The mom decline was due to seasonality, while the solid yoy growth came from a 17% increase in loans and a stable NIM of 5.3%, despite higher CoF. · Higher EA yield offsets rising CoF: CoF climbed 20bps yoy to 2.7% amid tight liquidity, but this was countered by a 30bps yoy increase in EA yield, driven by a greater contribution from higher-yield loans. · Opex remains high, but CIR was stable: While opex fell 25% mom, it remained elevated at Rp938bn (+14% yoy). However, CIR held steady at 48%, remaining relatively flat yoy, offset by higher operating income. · LDR still ample: Despite a 2% mom decline in deposits and a 1% mom increase in loans, LDR edged up to 87% in Jan25, still at a comfortable level. · CoC held steady: Following an exceptionally low CoC in Dec24, BRIS’s CoC rose to 1.0% in Jan25 but remained flat yoy.

Summary: · BRIS’s Jan25 results were neutral overall—steady NIM amid higher CoF, contained NIM, and a manageable CoC. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

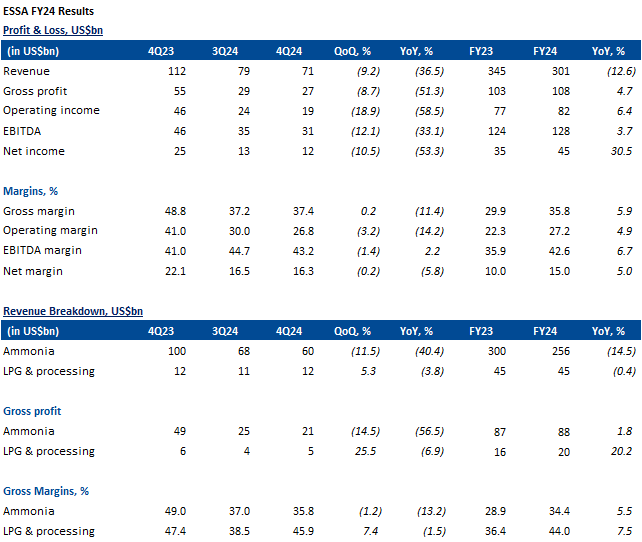

ESSA (Non-Rated) - FY24 Results · ESSA recorded NP of US$45bn (+30% yoy) in FY24, with improvement in margins due to better opex efficiency. NP is still improving despite revenue fallen by 12.6% yoy to US$301bn due to lower ammonia average price (-15% yoy) in FY24. However, revenue is still in-line with company guidance of US$300bn-310bn. · If we break down revenue for each segment, ammonia revenue declined by 14.5% yoy in FY24, while LPG & processing revenue was relatively flattish (-0.4% yoy). Interestingly, despite the ammonia price improvement in 4Q24 by 3% qoq, ESSA recorded revenue decline for ammonia segment by 11% qoq, possibly due to lower volume. · Margins improved, with a GPM of 35.8% in FY24 (+590 bps) and EBITDA margin of 42.6% (+670 bps), contributed mostly from lower opex cost, especially lower maintenance cost (-70% yoy). GPM for the ammonia segment improved by 550bps yoy to 34.4% in FY24, whereas LPG & processing margin improved by 750bps yoy to 44%. · ESSA is currently trading at a trailing PER of 17.8x, at +0.5 std dev of its 5-year mean. (Richard Jerry, CFA & Sabela Nur Amalina – BRIDS)

MBMA (BUY, TP: Rp530) Announces SLNC HPAL https://assets.merdekabattery.com/dist/documents/250224_MBMA_SLNC_HPAL_vF.pdf · SLNC is a 90ktpa HPAL constructed in IMIP in Jan’25, with 18 months of construction phase. · The project is a JV between MBMA (50.1%) and Huayou (49.9%). · The US$1.8bn capex for the project has secured 7-yr US$1.4bn loan, an implies a capex of US$20k/ton. · SLNC will secure a 20-yr ore supply agreement from SCM mine. · MBMA will only consolidate SLNC after 1 year of HPAL operation with positive EBITDA, which should be c.mid 2027. (Timothy Wijaya – BRIDS

MARKET NEWS |

||||||||||||

MACROECONOMY

Indonesia: Prabowo has Officially Launched Danantara

Prabowo has officially launched Danantara, which will be led by Rosan Roeslani. The investment holding will be led by Pandu Sjahrir, while the operational holding will be led by Dony Oskaria. Danantara will serve as the superholding for Indonesia’s seven largest SOEs and the Indonesia Investment Authority (INA), with US$900bn in assets, making it the world’s seventh-largest sovereign wealth fund. The initial US$20bn investment will be sourced from budget reallocations and efficiencies, funding 15–20 projects in 2025. (Kompas)

Indonesia: The MBG Program Has Been Rolled Out in 38 Provinces

The Head of the National Food Agency (NFA) stated that the Free Nutritious Meal (MBG) program has been implemented in 38 provinces and 693 service units within 1.5 months since its launch. Furthermore, the MBG program will continue throughout the month of Ramadan, with adjustments made to the mechanism to allow students to take the meals home. (Investor Daily)

SECTOR

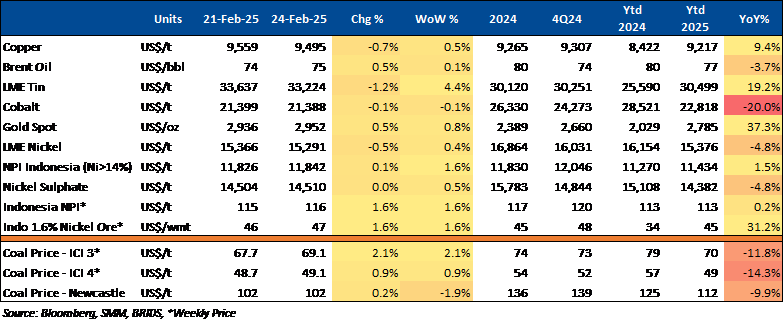

Commodity Price Daily Update Feb 24,2025

Retail: Aprindo Projects Retail Sales to Double Ahead of Ramadan and Eid 2025

The Indonesian Retail Entrepreneurs Association (Aprindo) expects retail sales to surge up to twice the usual rate during Ramadan and Eid 2025. Aprindo Chairman stated that monthly sales growth, typically around 8%–9%, could exceed 16%–20% during this period. Retailers have prepared by securing stock and anticipating distribution challenges to ensure supply availability, particularly for consumer goods and essential items. (Kontan)

CORPORATE

Alibaba commits US$53Bn for AI Infrastructure in Largest Private Computing Project

Alibaba Group Holding will invest at least US$52.4bn in its cloud computing and AI infrastructure over the next three years. The planned outlay exceeds Alibaba’s total spending on AI infrastructure over the past decade and matches half of the initial US$100bn investment in the Stargate AI plan promoted by the U.S. (South China Morning Post)

BYD Launches Sealion 7 in Indonesia

BYD introduced the Sealion 7 at IIMS 2025, priced between Rp629mn and Rp719mn OTR Jakarta. Available in Premium and Performance variants, it features a crossover/SUV body with a sleek design and Double-U Floating Headlights. Alongside the launch, BYD raised prices for models like the Seal, Atto 3, Dolphin, and M6 by Rp4mn to Rp6mn. (Kontan)

DOID’s Subsidiary, BUMA, Offers Rp2tr Sukuk Ijarah

DOID’s main subsidiary, Bukit Makmur Mandiri (BUMA), has announced its first sukuk offering. BUMA is issuing Sukuk Ijarah I Year 2025 with a maximum amount of Rp2tr. The funds from this sukuk will be strategically allocated to support BUMA’s long-term growth in Indonesia, with 50% allocated for capital expenditure, particularly heavy equipment, and the remaining 50% for working capital. (Kontan)

EMTK and BUKA: GIC Sells Entire Stake in Jumbo Negotiated Market Transaction

The planned exit of the Government of Singapore Investment Corporation (GIC), a major sovereign wealth fund from Singapore, from its shareholdings in BUKA and EMTK is not just a rumor. On Feb 24, 2025, a negotiated market transaction involving BUKA and EMTK shares was valued at trillions of rupiah, with the number of shares matching GIC’s ownership stake. (Kontan)

Hyundai to Introduce Ioniq 9 in Indonesia

Hyundai Motors Indonesia plans to introduce the Ioniq 9 following its global debut in Nov24 and Korean launch in Feb25. With a spacious interior for enhanced comfort, the EV aims to gauge market potential and showcase Hyundai’s latest innovations. (Kontan)

WIFI Signs Collaboration Agreement with PLN Icon Plus

WIFI and PLN Icon Plus have signed a collaboration agreement to provide FTTH services. This partnership will integrate WIFI's technology with the extensive infrastructure owned by PLN Icon Plus. The agreement covers various aspects of cooperation, including network development, infrastructure utilization, and service provision for residential and commercial customers. (Kontan)