FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Indosat Ooredoo Hutchison: FY24 earnings missed; Growth story intact despite intensified competition and weak consumption (ISAT.IJ Rp 1,920; BUY TP Rp 3,200)

- IOH diversifies growth into non-cellular revenue, driving higher OPEX amid intensified mobile competition and weak consumption.

- IOH’s mobile strategy is intact, focused on rural expansion to boost ARPU with personalization and cross-selling, building competitive moat.

- We adjust our valuation, averaging the 3yr EV/EBITDA and DCF valuation, lowering TP to Rp3,200 while maintaining our BUY rating.

To see the full version of this report, please click here

Macro Strategy: The Caprice and Convulsions

- Indonesia's growth stagnation remains a concern, but recent developments and potential monetary support offer hope.

- The trade war continues to escalate, targeting a wider range and threatening stability, but the market seems prepared.

- The US strategy to lower the 10-year UST yield, beyond the FFR, should enhance market transparency and stability.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

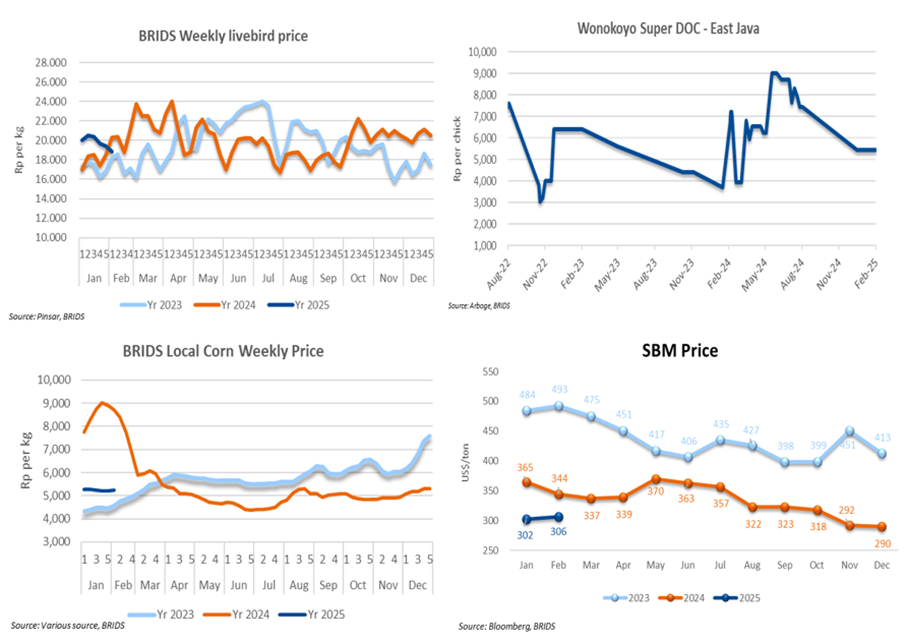

Poultry (Overweight) – 1st Week of February 2025 Price Update

- Live bird prices fell to Rp18.5k/kg, with the weekly average price in the first week of Feb25 at Rp18.8k/kg, down 3.2% wow.

- Day-old chick (DOC) prices remained steady at approximately Rp5.5k/chick.

- Local corn prices slightly increased to Rp5.3k/kg, with the weekly average price unchanged from the previous week at Rp5.2k/kg.

- Soybean meal prices slightly increased to US$306/t in the early week of Feb25, with the average price in Feb25 also at US$306/t (+1% mom, -11% yoy).

- Despite the weakening trend in prices during the first week of February, we believe positive margins can be sustained in 1Q25. (Victor Stefano & Wilastita Sofi – BRIDS)

MARKET NEWS

SECTOR

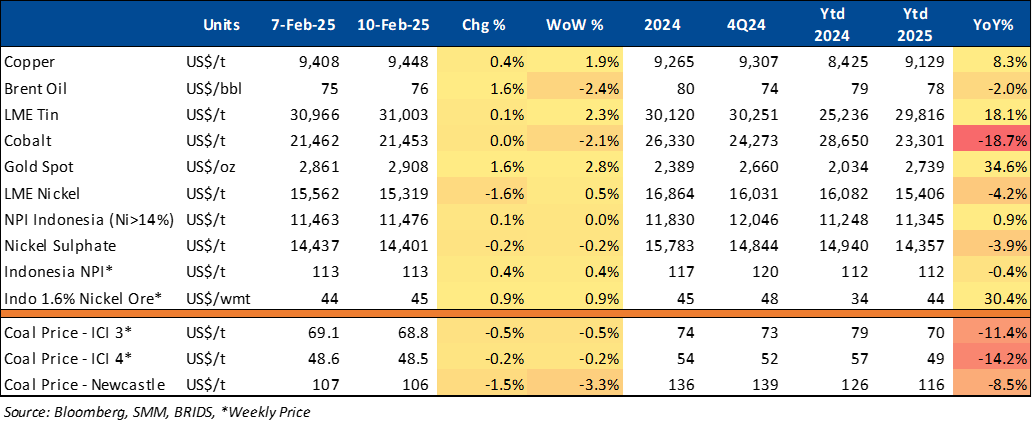

Commodity Price Daily Update Feb 10, 2025

CORPORATE

BREN Completed The Salak Binary Project

BREN's subsidiary, Star Energy Geothermal, has completed the construction of the Salak Binary plant, adding a 15.5 MW (gross capacity) increase to BREN's geothermal power generation capacity. This brings Star Energy Geothermal’s total installed capacity to 901.5 MW, making it one of the largest geothermal power producers in the world. (Emiten News)

DMMX Expands to South America

DMMX has officially introduced its cloud-based digital tablet signage technology across all Xiaomi stores in South America, including Mexico, Chile, Colombia, Peru, and the Central American region. The AI-powered digital signage enables automatic content updates, ensuring that promotions displayed in each store are more relevant and targeted. (Investor Daily)

MDIY Director Increases Stake with Rp241mn Purchase

MDIY Director Rika Juniaty Tanzil increased her MDIY holdings by 146,000 shares at Rp1,650–Rp1,655 on 3rd and 5th Feb5, spending Rp241mn. This raised her stake to 286,000 shares (0.001%) from 140,000 shares. The purchase was for investment. (Emiten News)

PZZA Director Increases Shareholding

PZZA Director Jeo Sasanto raised his stake by purchasing 2.06mn shares at Rp157 per share on 7th Feb25, increasing his ownership to 0.11%. Earlier, on 4th Feb25, Pemberton Asian Opportunities Fund also acquired 11.02mn PZZA shares (0.37%) at Rp159.93 per share. (Emiten News)

TLKM Launches Indibiz WiFi to Enhance MSME Digitalization

TLKM has introduced Indibiz WiFi Managed Service (WMS), a WiFi-based internet solution designed to support the productivity of micro, small, and medium enterprises (MSMEs). WMS Indibiz utilizes WiFi technology with speeds of up to 100 Mbps. Additionally, this service comes with extra features such as paid WiFi vouchers, allowing business owners to provide internet access to their customers. (Investor Daily)

WINS Expands Fleet with Two New Vessels in Early 2025

WINS is preparing two new vessels to optimize its performance at the start of 2025. According to WINS, two new Heavy Load Barges (HLB) are expected to be delivered in Feb25. WINS' management is also considering expanding its fleet further to meet the growing demand for OSV vessels this year. With this fleet expansion, WINS is confident in achieving a 70% utilization target throughout 2025, supported by an increasing demand trend since last year. To fund its capital expenditures, WINS has allocated a budget of US$20mn for this year. (Kontan)