|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

Property: VAT Discount Extension As Expected, Yet Still Supportive for 2H25 Pre-Sales; Maintain OW (OVERWEIGHT) · 100% VAT discounts for property <Rp5bn is extended until Dec25. We believe the policy is likely to be continued until 1H26F. · We see the policy could offer upside in 2H25 pre-sales from higher-than-expected VAT-exempted product demand. · Maintain our OW Rating with CTRA as our top pick, as it possesses key traits of winning developers. To see the full version of this report, please click here

Macro Strategy: Liquidity in Motion · Liquidity improves on stronger fiscal disbursement, but lending remains muted; banks expect funding costs to ease gradually. · Despite improved liquidity, banks stay cautious, channeling funds to short-tenor instruments and SBN amid declining SRBI. · Thailand-Cambodia tensions escalate but remain localized; Indonesia appears insulated, with limited risk of financial market spillover. To see the full version of this report, please click here

BRIDS FIRST TAKE · United Tractors: Jun25 Operational – Soft Komatsu Sales, Pama Recovered But Still Behind Target (UNTR.IJ Rp 24,175; BUY TP Rp 23,800) To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS |

||||||||||||

MACROECONOMY

Indonesian Government Prepares New Stimulus Without Electricity Subsidy to Boost Economy in 2H25

The Indonesian government will launch a new stimulus package in the 2H25 to boost economic growth, focusing on discounts for airfares, toll roads, and train tickets, particularly for the year-end holiday season, while excluding electricity bill subsidies. Additional measures include accelerating ministry and agency spending, enhancing labor-intensive housing credit and public housing programs, and expanding cash-for-work initiatives. The tourism sector will receive support through bundled travel packages and VAT subsidies, continuing similar efforts carried out during the Eid and school holiday periods. (Kontan)

SECTOR

|

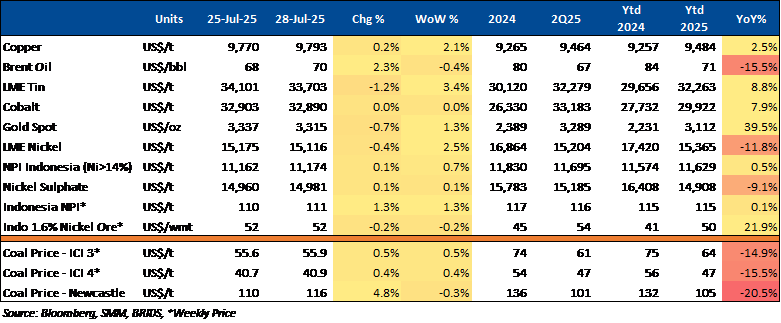

Commodity Price Daily Update July 28, 2025 |

Telco: Komdigi Opens 1.4 GHz Spectrum Selection for Broadband Wireless Access

Komdigi has launched the selection process for the 1.4 GHz spectrum to support BWA services in 2025.

- The initiative aims to expand fixed broadband coverage, improve download speeds, lower access costs in rural areas, and accelerate fiber deployment.

- The spectrum is divided into three regional clusters: Regional I (Java, Papua, Maluku Utara), Regional II (Sumatra, Nusa Tenggara), and Regional III (Sulawesi, Kalimantan).

- Participants must hold relevant telecom licenses, be unaffiliated with other bidders, and submit a bid bond plus a technical proposal targeting up to 100 Mbps for households over five years.

- The selection will be conducted via price-based e-Auction, with mandatory participation across all regional clusters but the possibility of winning in select zones.

- Key dates include e-Auction account registration on 11–13 August (reservation by 8 August) and document download from 11–20 August 2025. (Komdigi)

CORPORATE

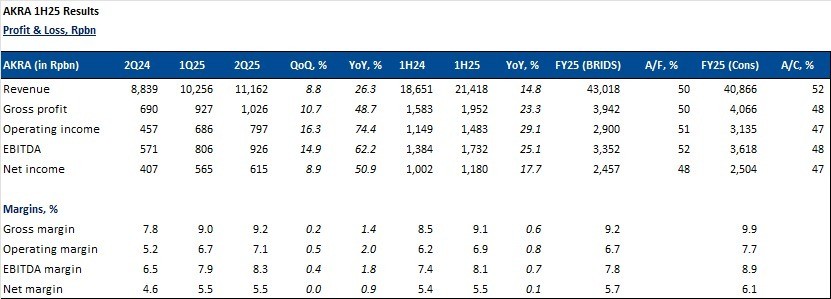

AKRA (Buy, TP Rp1,500): 2Q25/ 1H25 headline

- 2Q25 net profit: +8.9% qoq/ +50.9% yoy

- 1H25 net profit: +17.7% yoy (at 47%/ 48% of BRIDS/ Cons FY25F - slightly ahead vs. historical)

CMRY Posts Solid 1H25 with 24% Profit Growth, Driven by Food Segment

CMRY recorded a 16.6% yoy revenue increase to Rp5.14tr in 1H25, driven primarily by a 31.8% surge in the food segment to Rp3.35tr. However, dairy product sales declined 4.1% yoy to Rp1.79tr. Export sales grew 34.8% yoy, though only through dairy, while domestic dairy sales fell nearly 5%. In contrast, local food sales rose significantly. Net profit jumped 23.9% yoy to Rp993.80bn, while total assets slipped slightly to Rp8.15tr. Cash reserves also dropped 36.9% to Rp803.47bn, and equity declined 2.9% amid a rise in liabilities. (Bisnis)

HRTA Extends BMRI Loan Facility and Achieves 56% of FY25 Sales Target

HRTA extended its working capital credit facility with BMRI until July 2026, covering HRTA and subsidiary GHA’s combined facility of Rp2.7tr. The extension supports HRTA’s business expansion and liquidity. As of mid-2025, HRTA booked Rp15tr in sales—56% of its FY25 target, up 82% yoy—driven by strong domestic gold demand. HRTA targets Rp26.8tr in revenue and Rp602bn in net profit this year. (Bisnis)

INCO Targets Pomalaa Nickel Project Completion by 3Q26

INCO is aiming to complete its Pomalaa nickel mining project by the 3Q26. The company currently forecasts nickel prices to range between US$15,000 and US$16,000 per ton. According to INCO, the investment decision for the Pomalaa project, developing both a mine and a smelter in partnership with Huayou and Ford, was made in 2022. As of Apr25, the project has reached 20.22% construction progress, with a total capital expenditure of US$0.5bn already invested. (Bisnis)

MEDC Completes Acquisition of 24% Interest in PSC Corridor

MEDC has finalized the US$425mn acquisition of Fortuna International (Barbados), Inc., securing an indirect 24% stake in the PSC Corridor from Repsol E&P. This strategic move strengthens MEDC’s upstream portfolio, particularly in South Sumatra—home to major gas fields supplying long-term contracts in Indonesia and Singapore. The deal was first announced on June 26, 2025, and is expected to support company’s long-term growth in Indonesia’s gas sector. (Emiten News)

MIND ID Targets Tripling National Aluminium Capacity to 900,000 Tons by 2029

MIND ID, through PT Indonesia Asahan Aluminium (Inalum), aims to boost national aluminium production capacity to 900,000 tons per year (KTPA) by 2029, up from the current 275,000 KTPA. This initiative seeks to narrow the gap between national aluminium supply and demand, which currently stands at 1.2mn tons annually. Domestic aluminium consumption is projected to rise by around 600% over the next 30 years, driven largely by the growth of the electric vehicle (EV) and EV battery industries. (Kontan)

TLKM EGMS Scheduled for September 3, 2025

TLKM will convene its Extraordinary General Meeting of Shareholders (EGMS) on Wednesday, September 3, 2025. Shareholders eligible to attend are those registered in the Shareholders Register by August 11, 2025. (IDX)