FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Trimegah Bangun Persada: Commissioning Underway, Earnings Growth Supported by Higher JV Ownership (NCKL.IJ Rp1,535; BUY TP Rp1,800)

- NCKL aims to focus on cost efficiency and commissioning in FY26, with KPS Phase 1&2 commissioning lifting nameplate capacity to ~305kt Ni.

- Earnings quality structurally improves from FY26F, driven by higher effective JV ownership with ONC’s 40% stake fully reflected.

- Resume coverage with Buy rating and higher TP of Rp1,800, supported by stronger earnings visibility and a more sustainable operating profile

To see the full version of this report, please click here

Macro Strategy: Interpreting the Signals

- Rising yields and weaker IDR renew rate-hike concerns, yet FX trends, liquidity conditions, and BI policy suggest low probability.

- Recent SRBI yield moves reflect liquidity calibration, not tightening, keeping rate hikes unlikely while delaying potential rate cuts.

- BI calibrates SRBI awards to balance liquidity and credit as limited FX intervention and seasonal USD demand pressure.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

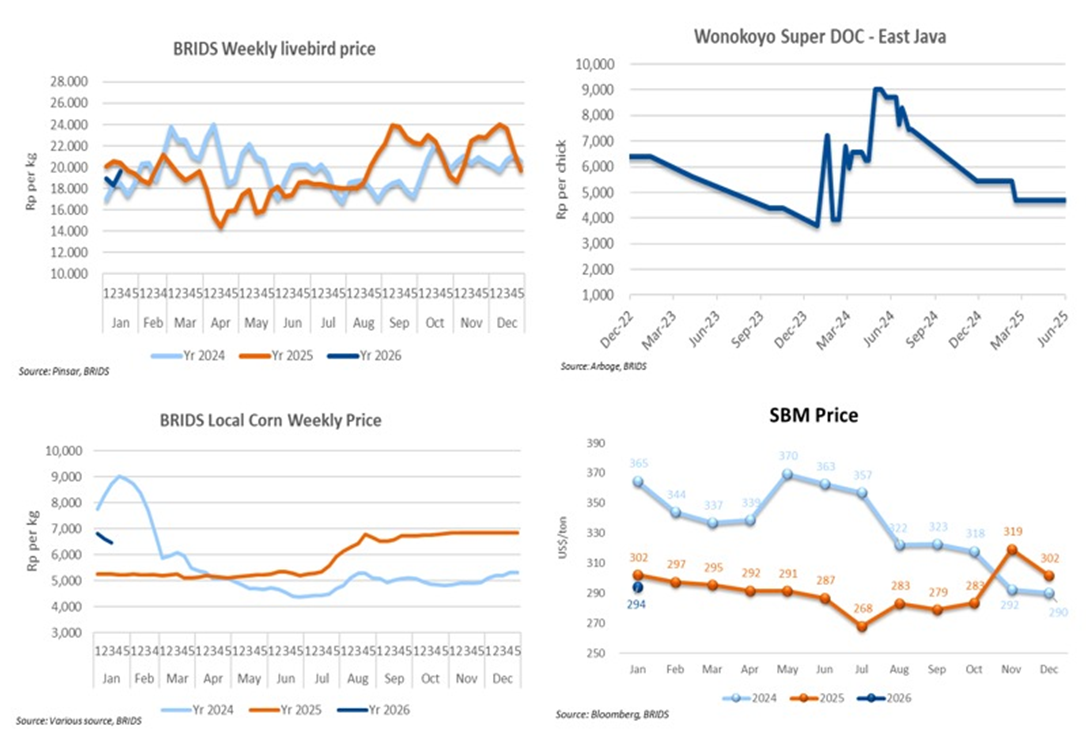

Poultry (Overweight): 3rd Week of January 2026 Price Update

- Livebird prices extended their uptrend to Rp20.6k/kg toward end-week trading, lifting the weekly average in the third week of Jan26 to Rp19.7k/kg (+7% wow).

- No official update on DOC, though channel checks suggest prices remained steady at around Rp6.0k/chick.

- Local corn prices continued to trend lower to Rp6.43k/kg, pulling the weekly average in the third week of Jan26 down to Rp6.45k/kg (–2% wow).

- SBM prices edged slightly higher to US$300/t, while the MTD Jan26 average remained unchanged at US$294/t (–3% mom; –3% yoy).

- Following last week’s uneven recovery, the improvement in LB prices points to a gradual normalization in demand, likely supported by the resumption of MBG-related activities. At the same time, continued softness in corn prices and still-contained SBM costs are providing cost-side relief, helping to stabilize integrator margins. (Victor Stefano & Wilastita Sofi – BRIDS)

MARKET NEWS

MACROECONOMY

|

Indonesia: Finance Ministry Plans to Issue Domestic FX-denominated Government Bonds The Finance Ministry plans to issue domestic FX-denominated government bonds (SBN Valas) to absorb export proceeds, following the rollout of new rules requiring exporters to keep 50% of FX earnings in state banks for 12 months (DHE SDA). The issuance schedule will be announced after the regulation is enacted. The policy aims to strengthen FX reserves, which rose only US$0.8bn in 2025 despite a US$38.5bn trade surplus. Proceeds will be used flexibly, with issuance timing adjusted to market conditions and liquidity. (MoF)

|

SECTOR

Commodity Price Daily Update Jan 26, 2026

.png)

CORPORATE

BBTN Plans Up to Rp6tn Fundraising via Tier II Capital and Bond Issuance

BBTN plans to raise up to Rp6 trillion in 2026 through two funding schemes to strengthen its capital base and support business expansion, particularly housing loans. The bank targets issuing Rp2 trillion in Tier II capital in 1H26, with expectations that Danantara will participate as an investor, and an additional Rp4 trillion in bonds to be issued across 1H26 and 2H26. (Kontan)

CBDK Injects Rp250bn Capital into Subsidiary IPN

CBDK has injected Rp250bn in capital into its subsidiary, PT Industri Pameran Nusantara (IPN), through the issuance of 14.7 million Series B shares with a nominal value of Rp17,000 per share. All newly issued shares were fully subscribed by CBDK. (Kontan)

CLEO Advances Net Zero Goals

CLEO is strengthening its net zero commitment through solar energy expansion, having generated 18.3 million kWh from PLTS in 2022–2025 and cutting nearly 15,950 tons of CO₂ emissions. The company will add another PLTS-equipped plant in 2026, raising total capacity to 8 MWp, while continuing environmental programs and business expansion. (Emiten News)