|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

Banks: Better liquidity to support NIM amid the potential continuous tight competition in lending (OVERWEIGHT)

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS |

|

|||||||||||

RESEARCH COMMENTARY

Industry and INTP Aug24 Volume

Industry Volume:

- Aug24: Flat 0% mom/+1.1% yoy, mostly from Central Java (+15% yoy), Yogyakarta (+9% yoy), Kalimantan (+7.5% yoy).

- 8M24: +2.3% yoy.

- Aug24 bag/bulk growth: -1.0% yoy/+6.1% yoy.

INTP Volume:

- Aug24: -0.9% mom/+12.9% yoy (+0.2% mom/+3.5% yoy ex-Grobogan). Demand came mostly from Central Java (+63% yoy), Yogyakarta (+49% yoy), and Kalimantan (+20% yoy).

- 8M24: +10.2% yoy.

- Market share: Aug24 at 30.3% (-30 bps mom).

Comment: INTP sales volume is still in line with our estimation (62% of our estimation vs 3-years seasonality of 63%), with 3.5% yoy growth in Aug24 after excluding Grobogan. INTP has increased its pricing in late Aug, which we expect would translate to retail level within 1-2 months. As per last analyst meeting, we still expect one more price increase in Sep24, although we think it would depend on industry situation. We have a BUY rating for INTP with a TP of Rp8,800. (Richard Jerry, CFA & Christian Sitorus – BRIDS)

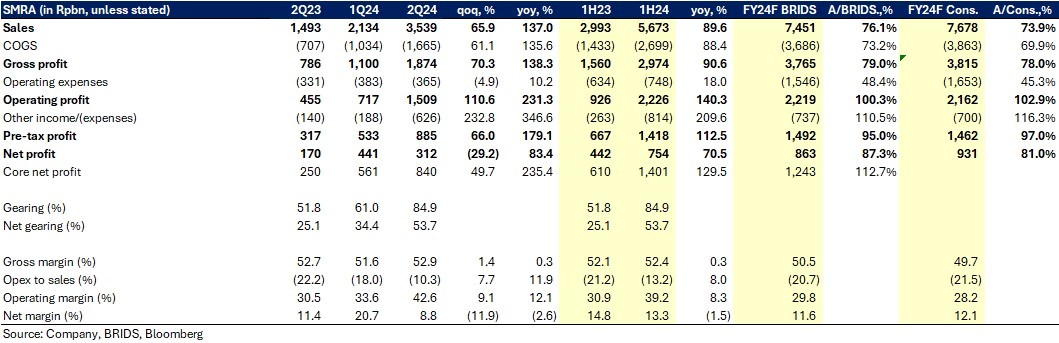

SMRA 1H24 Results: Above Our and Cons Expectation

- SMRA managed to book Rp312bn net profit in 2Q24 (-29%qoq; +83%yoy), bringing its cumulative 1H24 achievement to Rp754bn (+71%yoy), which forms 87% of our and 81% of consensus estimates.

- The better-than-expected achievement stemmed from the strong top-line growth of 90%yoy, mainly coming from houses (+191%yoy to Rp3.5tr), while its Mall and Retails grew 29%yoy. We believe this is also a mix contribution of recognition from; Initial Launch of Summarecon Crown Gading in 4Q22 (Rp710bn pre-sales), also Bogor's Pinewood Extension in the same period (~Rp300bn pre-sales).

- SMIP paid Rp402bn of taxes (BPHTB) from the transfer of MKG assets; while SMRA paid Rp192bn of final taxes from the transaction, forming a total of Rp592bn tax-related expenses (7.5% from Rp8tr asset value) from the transfer on SMRA's book. This is in-line with our estimates

- (see last note: https://link.brights.id/brids/storage/33219/20240715-SMRA.pdf). (Ismail, Wilastita – BRIDS)

MACROECONOMY

Bank Indonesia Reduces the BI Rate by 25 basis points to 6.0%

Bank Indonesia (BI) has initiated its easing cycle by reducing the BI Rate by 25 basis points to 6.0%, in line with our expectations, though contrary to consensus, which anticipated no change. The rate cut was based on two key factors: 1) Clearer Federal Reserve outlook and 2) IDR sustained strengthening. Going forward, we maintain our view that this rate cut opens the door for another 25bps cut in 4Q24. (Bank Indonesia)

The Federal Reserve Cut Interest Rates by 50 basis points

The Federal Reserve cut interest rates by 50 basis points on Wednesday, and lifted forecasts for further rate cuts this year, as the central bank kicks off a rate-cut cycle to shore up the economy following a prolonged battle against surging inflation. Fed members now see the benchmark rate falling to 4.4% this year, suggesting two 25bps rate cuts in the remainder of 2024, compared with a prior estimate in June of just one 25bps cut in FY24. In 2025, Fed members see the rates falling to 3.4%, down from a prior forecast of 4.1%, before eventually declining to 2.9% in 2026, down from a prior forecast of 3.1%. (Investing)

CORPORATE

DOID Issues Rp1tr Bonds

DOID, through its subsidiary PT Bukit Makmur Mandiri Utama (BUMA), announced the issuance of Bonds II BUMA 2024 with a principal value of up to Rp1tr. This initiative aims to strengthen the company's funding diversification strategy and reinforce its capital structure. The bonds are offered in three series: Series A with a term of 370 calendar days, Series B with a 3-year term, and Series C with a 5-year term from the issuance date. (Emiten News)

MEDC’s Subsidiary Engages in Exploration of Samosir Geothermal Block for US$228mn

MEDC's subsidiary, Medco Power Indonesia, has been assigned the Preliminary Survey and Geothermal Exploration (PSP-E) of Samosir by the Ministry of Energy and Mineral Resources. The PSP-E is estimated to have a geothermal potential of up to 40 MW. This project is expected to require an investment of around US$228mn, with a projected workforce absorption of 175 people. (Bisnis)

SILO has Completed the Implementation of the Voluntary Tender Offer

Sight Investment Co. Pte. Ltd officially holds 55.4% of SILO shares after completing the voluntary tender offer transaction. Sight Investment increased its ownership by 5.85bn shares. According to data from IDX, the total value of SILO's non-regular transaction in the negotiation market is Rp16.68tr (Rp2,850/share). (Bisnis)

UNTR Raises Komatsu Sales Target to 4,500 Units

UNTR has increased its sales target for Komatsu heavy equipment to 4,500 units for the year 2024, up from the previous target of 4,000 units. According to UNTR, as of July 2024, the company has sold 2,515 units of Komatsu (- 29% yoy). By July 2024, UNTR recorded a market share of 28% for Komatsu. Meanwhile, Komatsu sales in July alone reached 368 units. (Bisnis)

WIFI and ICONVEST Partner for Affordable Internet

WIFI and PT Indonesia Connectivity Investasi (ICONVEST) have signed a Memorandum of Understanding (MoU) to collaborate on developing affordable internet services. The partnership aims to enhance business portfolios by sharing competencies and capacities. The partnership is projected to further boost performance and deliver accessible, unlimited internet to the public. (Emiten News)