FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Bank Central Asia: Solid 3Q24 performances; FY24F NIM and loan growth guidance upgraded (BBCA.IJ Rp 10,650; BUY TP Rp 12,800)

- BBCA’s higher loan growth and improving NIM offset the higher CoC, resulting in 3Q24 net profit of Rp14.2tr (+1% qoq, +16% yoy), in line.

- Mgmt surprisingly raised its FY24F NIM guidance from 5.5-5.6% to 5.7-5.8%, while maintaining its CoC at c. 4% and LaR ratio at c. 6%

- We maintain BUY with a higher TP of Rp12,800 as we tweaked our FY24-25F earnings by +3%, resulting in a higher FY25F ROE.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

Banks (Overweight) – Initial Thoughts on Potential Debt Forgiveness on Written-off Loans

https://kumparan.com/kumparanbisnis/23lzek8Wy0t?utm_source=App&shareID=M7owHMDt2f13&utm_medium=wa

- Overall, the regulation would primarily ensure that banks do not pursue additional collections on loans already settled by insurance. The immediate effect would be relatively contained, as it will reduce potential collection fees shared with insurance companies.

- However, since the regulation has not been finalized, scenarios with a more substantial impact on banks remain possible. Firstly, if bad credit histories in SLIK are removed, it may affect future credit disbursement, leading banks to be more cautious. This could result in slower loan growth and potentially higher CoC (due to riskier new loans).

- Secondly, if the regulation also applies to future loans—i.e., no double collection from insurance and bad-debt collection—it could affect NPL management strategies, shifting the focus more towards restructuring and adjustments in insurance premiums.

- On a positive note, it may encourage more economic expansion in the MSME segments, facilitating faster recovery in the middle-to-lower income sectors. (Victor Stefano & Naura Reyhan Muchlis - BRIDS)

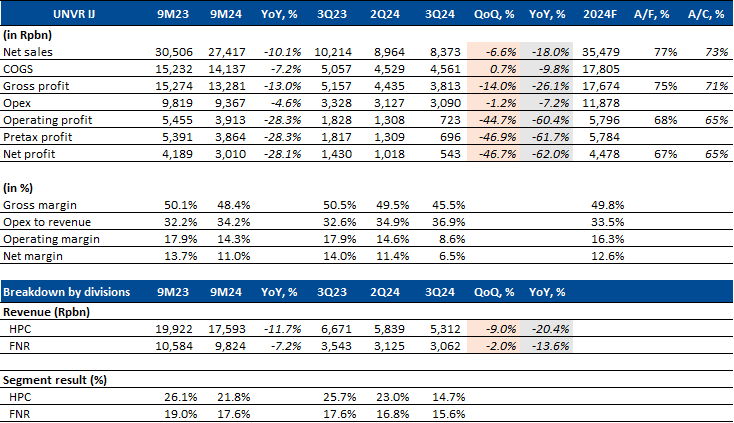

UNVR (Sell, TP: Rp2,200) – 3Q24 results: Below estimates with continued weak revenue

- UNVR reported 3Q24 net profit of Rp543bn, down 62% yoy and -47% qoq, bringing 9M24 net profit to Rp3tn, down 28% yoy. The 9M24 net profit reached 66% of our FY24F and 65% of the consensus estimate, i.e., below.

- Weak sales, coupled with lower margins and higher opex (including transformation costs), continued to pressure 3Q24 earnings.

- Both the HPC and FNR segments reported lower revenues in 9M24 and 3Q24, impacted by price instability and customer stock reductions. In 3Q24, UVG declined by 16% yoy, while UPG fell by 2% yoy. UNVR anticipated improved performance starting in 3Q25. (Natalia Sutanto & Sabela Nur Amalina – BRIDS)

|

Bank Central Asia: Solid 3Q24 performances; FY24F NIM and loan growth guidance upgraded (BBCA.IJ Rp 10,650; BUY TP Rp 12,800)

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY Banks (Overweight) – Initial Thoughts on Potential Debt Forgiveness on Written-off Loans https://kumparan.com/kumparanbisnis/23lzek8Wy0t?utm_source=App&shareID=M7owHMDt2f13&utm_medium=wa · Overall, the regulation would primarily ensure that banks do not pursue additional collections on loans already settled by insurance. The immediate effect would be relatively contained, as it will reduce potential collection fees shared with insurance companies. · However, since the regulation has not been finalized, scenarios with a more substantial impact on banks remain possible. Firstly, if bad credit histories in SLIK are removed, it may affect future credit disbursement, leading banks to be more cautious. This could result in slower loan growth and potentially higher CoC (due to riskier new loans). · Secondly, if the regulation also applies to future loans—i.e., no double collection from insurance and bad-debt collection—it could affect NPL management strategies, shifting the focus more towards restructuring and adjustments in insurance premiums. · On a positive note, it may encourage more economic expansion in the MSME segments, facilitating faster recovery in the middle-to-lower income sectors. (Victor Stefano & Naura Reyhan Muchlis - BRIDS)

UNVR (Sell, TP: Rp2,200) – 3Q24 results: Below estimates with continued weak revenue · UNVR reported 3Q24 net profit of Rp543bn, down 62% yoy and -47% qoq, bringing 9M24 net profit to Rp3tn, down 28% yoy. The 9M24 net profit reached 66% of our FY24F and 65% of the consensus estimate, i.e., below. · Weak sales, coupled with lower margins and higher opex (including transformation costs), continued to pressure 3Q24 earnings. · Both the HPC and FNR segments reported lower revenues in 9M24 and 3Q24, impacted by price instability and customer stock reductions. In 3Q24, UVG declined by 16% yoy, while UPG fell by 2% yoy. UNVR anticipated improved performance starting in 3Q25. (Natalia Sutanto & Sabela Nur Amalina – BRIDS)

MARKET NEWS |

|

|

||||||||||||||||

MACROECONOMY

Banks of Canada Reduced its Key Benchmark Rate to 3.75%

The Bank of Canada on Wednesday reduced its key benchmark rate by 50 basis points to 3.75% and hailed signs the country has returned to an era of low inflation. "Today's interest rate decision should contribute to a pickup in demand," Macklem said, adding that the BoC would like to see growth strengthen. (Reuters)

Indonesia: Prabowo to Introduce Presidential Decree Easing Debt for 6mn Farmers and Fishermen

Prabowo is expected to roll out a Presidential Decree (Perpres) that erases the debt of 6mn fishermen and farmers. The debt, some of which can be traced back to 1998 during the monetary crisis, was already written off by the banks, but the collection efforts continue to be carried out. This prevents farmers and fishermen from getting loans. (Bisnis)

Indonesia: Free Nutritious Meal Program Set to Launch January 2, 2025

The Free Nutritious Meal Program is scheduled to start on January 2, 2025, according to the Head of National Nutrition Agency Dadan Hindayana. The first batch will be delivered to 3mn students in Jan25, then expand to 6mn in Apr25, then 15mn in Jun25. (Bisnis)

SECTOR

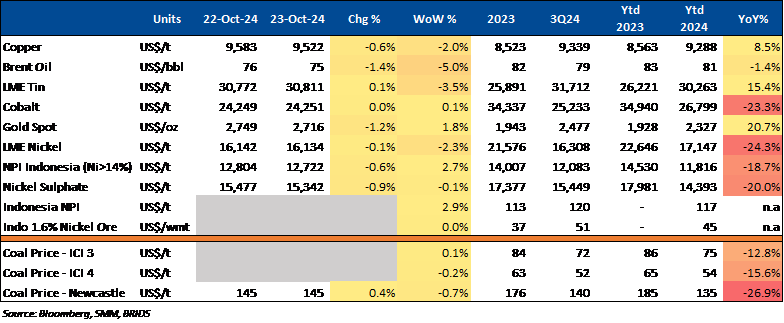

Commodity Price Daily Update Oct 23, 2024

Positive Impact of 0% Down Payment Policy on Vehicle Financing

Bank Indonesia (BI) continues to enhance public purchasing power by extending the down payment (DP) incentive for vehicle loans to a minimum of 0%, effective from January 1, 2025, to December 31, 2025. Various financing companies have expressed that this policy will have a positive impact on the multifinance industry. (Kontan)

CORPORATE

Freeport to Apply for Extension of Copper Concentrate Export License

PT Freeport Indonesia (PTFI) plans to apply for an extension of its copper concentrate export license following a fire at the sulfuric acid plant in the Manyar Smelter, Gresik. Freeport stated that it is currently collaborating with the Indonesian government to secure an export license for copper concentrate until the smelter operations are fully restored. Previously, PTFI received an export license for copper concentrate and anode slime on July 2, 2024, valid until December 2024. According to existing regulations, PTFI is required to pay a 7.5% export duty on copper concentrate. (Kontan)

ISAT to Launch NextFleet AI and Biometric Fleet Management for Logistics

ISAT is set to introduce its NextFleet fleet management system, incorporating AI and biometric technology, aimed at the logistics sector. This move targets increased B2B revenue with innovative products. According to ISAT, the NextFleet Biometric solution will be available by early 2025, enhances security through facial recognition and fingerprints, while also streamlining transactions for users. (Bisnis)

PTBA Partners with KAI and Semen Batubara to Enhance Coal Unloading Capacity

PTBA, PT Kereta Api Indonesia (Persero), and SMBR have signed a Memorandum of Understanding to improve coal unloading capacity in the Kertapati area. This collaboration aims to enhance coal unloading capabilities in Palembang while maximizing the potential of each company under mutually beneficial and good corporate governance principles. (Kontan)

Telkomsel Ventures Launches Tinc Batch 9 Accelerator Program for Startups

Telkomsel Ventures, a subsidiary of Telkomsel, has launched its accelerator program, Tinc Batch 9. In collaboration with AppWorks, the program aims to support the growth of startups in Indonesia by optimizing Telkomsel's network and assets. (Kontan)

TBIG Amends US$325mn Loan, Extending Repayment to 2029

TBIG has signed an amendment to its US$325mn Revolving Loan Facility Agreement, originally dated April 18, 2023, extending the final repayment date to October 2029. (Company)