|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

Consumer: A Laggard Sector with Potential Catalysts to Support Growth; Resuming Coverage with OW (OVERWEIGHT) · We expect govt’s economic stimulus and stronger IDR to support purchasing power and Consumer companies’ earnings in 2H25. · We foresee a decent +6.4%/+5.2% rev/core net profit growth in FY25F, supported by ongoing cost efficiencies to help limit EBIT margin decline. · Resuming our coverage with an Overweight rating given the resilient sector’s growth outlook. Our top pick is ICBP (Buy, TP Rp14,000). To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS |

||||||||||||

MACROECONOMY

|

US Core Inflation Rose Just 0.1% mom in May25 US core inflation rose just 0.1% mom in May25, below forecasts for the fourth straight month, with annual core and headline inflation at 2.8% and 2.4% respectively. The muted gains suggest firms are still absorbing higher tariff costs or delaying price hikes due to policy uncertainty, inventory buildup, or paused levies. Still, goods exposed to tariffs—like toys and appliances—showed notable price increases. Gasoline prices fell 2.6%, easing overall CPI pressure. Shelter remained a key inflation driver, rising 0.3%. Meanwhile, real wages rose 1.4% y-y, supporting consumer spending despite tariff concerns. (Bloomberg)

Indonesia Government Disburses Rp11.94tr PKH Social Aid as of June 2 The Finance Ministry’s DJPB reported Rp11.94tr in disbursed aid for the Family Hope Program (PKH) as of June 2, 2025—41.6% of this year’s budget. The aid reached 10mn beneficiary families, covering needs in food, health, and education. Support includes Rp750,000 for pregnant women or young children, Rp225,000–Rp500,000 for students, Rp600,000 for the elderly and severely disabled, and Rp2.7mn for victims of gross human rights violations. (Kontan) |

SECTOR

|

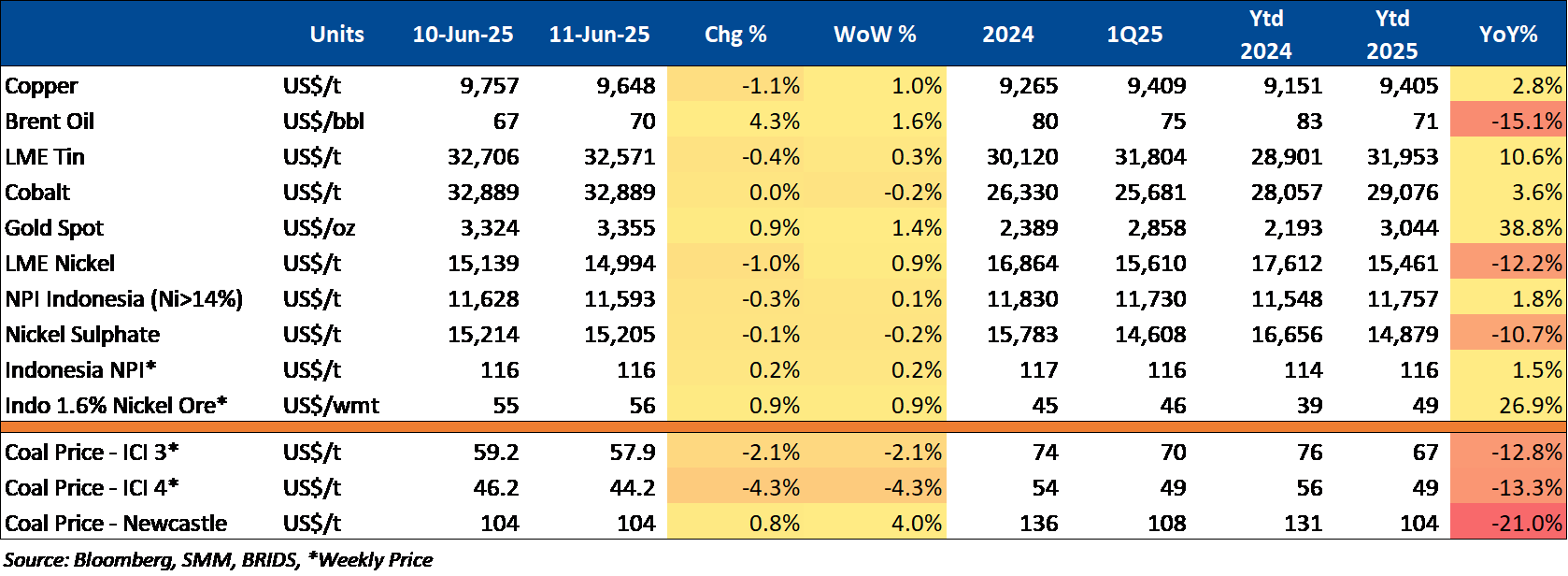

Commodity Price Daily Update June 11, 2025 |

CORPORATE

|

BBNI to Issue Rp5tr in Sustainability Bonds BBNI will issue a sustainable bond worth Rp5tr. This issuance is part of the Bank BNI’s Sustainable Bonds Continuous Public Offering Phase I, targeting a total fundraising of Rp15tr. The first phase of the Sustainable Bonds, valued at Rp5tr, will be offered in two series: Series A and Series B Sustainability Bonds. However, the principal amounts and coupon rates for each series have not yet been determined. (Bisnis)

BFIN Offers Rp1tr in Phase II of Sustainable Bonds VI BFIN has announced the offering of Phase II of the Sustainable Bonds VI BFI Finance Indonesia for 2025, with a total value of Rp1tr. The bonds are offered in three series: Series A worth Rp414.3bn with an interest rate of 6.45% and a tenor of 370 days; Series B worth Rp265.7bn with an interest rate of 6.8% and a tenor of 2 years; and Series C worth Rp320bn with an interest rate of 6.9% and a tenor of 3 years. (Bisnis)

FAST Secures Rp875bn Credit Facility from BMRI FAST has secured a credit facility from BMRI amounting to Rp875bn. FAST and BMRI signed three credit agreement deeds. The first is an investment refinancing loan divided into two tranches of Rp150bn and Rp50bn, respectively, with a loan term of 10 years from the date of the agreement. The second is a term loan of Rp525bn with a loan term of 8 years. The third is a working capital loan of Rp150bn to support the company’s operational needs, with a loan term of 1 year. (Bisnis)

JSMR Serves 1.5mn Vehicles During Eid Holiday JSMR reported optimal operations across all toll roads during the Eid al-Adha 1446 H holiday, serving 1.5mn vehicles. Measures included adding personnel, mobile readers, and road maintenance. A 20% toll discount was applied from June 6–9, 2025, across ten key routes in Trans-Java and Trans-Sumatra. Traffic flow through four main toll gates in Jabotabek reached 1.54mn vehicles during H-1 to H+3. (Kontan) |