FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

RESEARCH COMMENTARY

Automotive (Overweight): Dec24 Data

4W wholesale data:

- Dec24: 80.9k (+9% mom/-5% yoy)

- 2024: 865k (-14% yoy, 101%/102% of our/Gaikindo estimate)

4W retail data:

- Dec24: 82k (+8% mom/-8% yoy)

- 2024: 888k (-11% yoy)

ASII 4W sales:

- Dec24: 42.1k (+7% mom/-11% yoy)

- 2024: 482k (-14% yoy, 100% of our est)

- MS: 53% in Dec-24, 56% for 12M24

2W data:

- Dec24: 403k (-21% mom/-5% yoy)

- 2024: 6.3mn (+1.5% yoy, 99% of our estimate and in line with AISI range of 6.2-6.5mn)

Comment:

- 4W and 2W data were relatively in line with expectations. We think the most interesting part is the fact that ASII's MS dropped 2 months in a row to 53% due to weaker Daihatsu sales. In fact, Daihatsu avg 2H24 monthly sales figure was at 12.9k vs 14.2k in 1H24, despite 4W recovering in 2H24. We need to see whether the trend will remain in upcoming months.

- We expect 4W sales to reach 946k (+10% yoy) in 2025 (Gaikindo: 1mn), while 2W sales is expected to reach 6.4mn (flat yoy) vs AISI’s target at 6.7mn. We have a Buy rating on ASII. (Richard Jerry, CFA & Sabela Nur Amalina – BRIDS)

EXCL (Buy, TP Rp3,500) - MergeCo XLSmart Leadership to be Announced: A Seasoned CEO with Extensive Telco Expertise to Lead

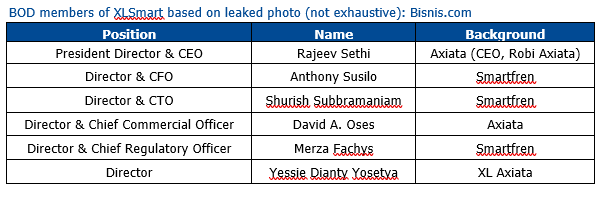

- A leaked photo has unveiled the leadership lineup for MergeCo XLSmart, the newly merged entity.

- An industry heavyweight at the helm of XLSmart. The President Director & CEO will be Mr. Rajeev Sethi, currently serving as the CEO of Robi Axiata in Bangladesh. Mr. Sethi brings extensive global telecom expertise, with a track record of leadership across key markets such as Bangladesh, Myanmar, and India.

- The BOD to be a balanced mix of directors from Axiata, Smartfren, and XL Axiata, reflecting a unified and collaborative approach to drive the XLSmart.

Other news:

- XL Axiata FY24 financial results are expected to be released in the first week of February.

- Plans are in place for an EGMS to secure merger approval, with the annual AGMS scheduled for March.

- Our Take: Building confidence in the integration process

- The leadership profile for XLSmart appears well-suited to bring confidence among investors and shareholders, facilitating the realization of operational integration within a reasonable timeframe and building momentum for XLSmart to achieve the pre-tax USD 400mn run-rate savings quickly. (Niko Margaronis & Kafi Ananta – BRIDS)

MARKET NEWS

MACROECONOMY

Bank Indonesia Estimates Retail Sales Grew 1% yoy in Dec24

Bank Indonesia estimates retail sales grew 1% yoy in Dec24, the highest December's figure since 2022. The November's retail sales growth was revised down to 0.9% yoy from 1.7% yoy. These figures brought the 4Q growth to 1.1% yoy, decline from 5% in 3Q24 and 1.57% in 4Q23. (Bank Indonesia)

US Add 256k Jobs in Dec24

US add 256k jobs in Dec24, the highest in 9 months. The December's figure bring the total job added in 2024 to 2.2mn, indicating a healthy job market in the US. Unemployment rate fell to 4.1% and Average Hourly Earning decelerate to three-month low at 3.9% yoy. (Bloomberg)

SECTOR

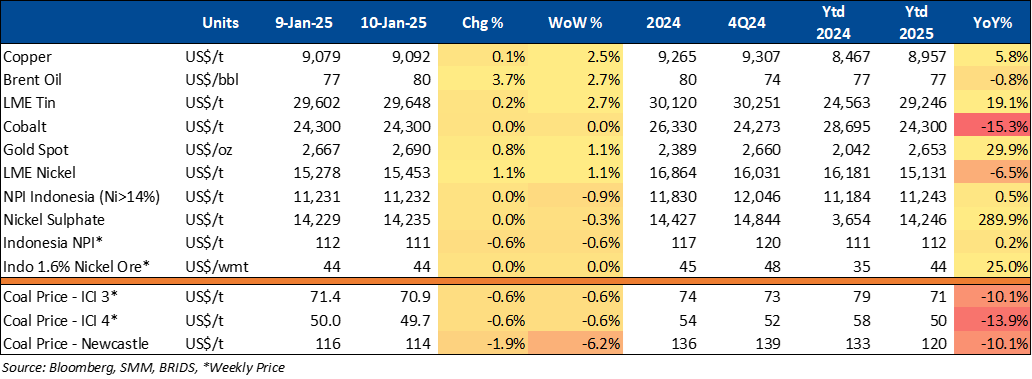

Commodity Price Daily Update Jan 10, 2024

Automotive: Government Signals Shift to VAT Incentive for Electric Motorcycles in 2025

The government plans to replace the 2024 electric motorcycle subsidy program, which provided Rp7mn per unit, with a VAT subsidy (PPN DTP) in 2025. The previous program, which quickly exhausted its 60,000-unit quota due to simple requirements, is being reviewed for a new mechanism, though no implementation date has been announced. (Kontan)

Coal: Indonesia's Coal Production Reached 831mn Tons in 2024

Indonesia's coal production in 2024 reached 831mn tons, 17% higher than the government's target for the year. Sales have also risen to record levels, according to the data. The International Energy Agency reports that global coal consumption has doubled over the past three decades, although demand is expected to plateau by 2027. In most developed countries, coal demand has already peaked and is projected to continue declining until 2027. (Kontan)

Consumer: F&B Industry Urges Reopening of Salt Imports

The government’s partial halt on industrial salt imports has disrupted production in the food and beverage sector, with attempts to use domestic salt resulting in up to 60% production failures due to quality differences. GAPMMI called for solutions to ensure raw material availability and plans to meet with the Coordinating Ministry for Food Affairs. Meanwhile, the Ministry of Industry confirmed that salt imports are still allowed for Chlor Alkali Plant (CAP) industries under Presidential Regulation No. 126/2022 and is working on verification efforts to address industry concerns. (Kontan)

Consumer: Sweetened Beverage Tax Set for 2H25 Implementation

The government will impose a Sweetened Beverages in Packaging (MBDK) tax in the 2H25 to reduce excessive sugar consumption, targeting Rp3.8tr in revenue. While the tax may lower demand and encourage healthier habits, it raises concerns about its impact on industry sustainability. The government is urged to offer incentives for low-sugar producers and run educational campaigns on sugar’s health risks to ensure public support. Revenue from the tax will support health and development programs, promoting sustainable fiscal strategies. (Investor Daily)

CORPORATE

FREN Recorded a 9% Increase in Internet Traffic During the Holiday Season

FREN reported a 9% increase in internet traffic during the Christmas and New Year 2025 period compared to regular days. The most significant surge occurred in West Java and Central Java. Previously, FREN had anticipated this by increasing network capacity in areas predicted to experience a more significant rise in internet traffic. (Investor Daily)

ISAT Partners with ZTE to Provide Internet Access in Rural Areas

ISAT has entered into a collaboration with ZTE Corporation, a global provider of ICT solutions, to leverage ZTE’s microwave technology in delivering reliable and high-speed communication to remote islands and rural areas. The partnership implements more than 550 ultra-capacity microwave backbone links across Indonesia, covering nearly 80% of major cities and remote islands. ZTE’s innovative microwave technology is specially designed to meet Indonesia's needs, offering ultra-capacity and long-distance transmission capabilities. (Investor Daily)

Hyundai to Launch Seven New Models in Indonesia in 2025

PT Hyundai Motors Indonesia (HMID) plans to launch at least seven new models in 2025, including ICE, hybrid, and EV options, to boost sales despite anticipated challenges in the automotive market due to global uncertainties. Recently, Hyundai introduced the New Creta and Creta N Line. While predicting single-digit market growth, Hyundai expects seasonal events like automotive exhibitions and the Lebaran holiday to support the industry. (Kontan)

PGAS Secures Additional Gas Supply from Jabung

PGAS has secured an additional gas supply of 4,651 BBTU from PetroChina International Jabung Ltd (PCJL) from the Jabung Block. This additional gas supply is intended to meet the needs of industrial and electricity customers, in accordance with the allocation set by the government. The utilization of Jabung gas reflects the commitment of both parties, in collaboration with the government through SKK Migas, to ensure the security of domestic energy supply. The Gas Sales and Purchase Agreement is effective from January 1, 2025, to December 31, 2026. (Kontan)

To see the full version of this snapshoot, please click here