FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

|

XL Axiata: 3Q24 Earnings Miss; Aiming to capitalize further on its digital and FMC growth with strong profitability (EXCL.IJ Rp 2,210; BUY TP Rp 3,500)

To see the full version of this report, please click here

Semen Indonesia: Trimming our FY24-26F estimate further amid lower LT volume growth (SMGR.IJ Rp 3,630; HOLD TP Rp 3,900)

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS MACROECONOMY China Plans to Increase the Quota for Local Special Bonds by 6tr yuan Over the Next Three Years China National People’s Congress put out the latest stimulus aimed at reducing local governments’ hidden debt. China plans to increase the quota for local special bonds by 6tr yuan (US$838.1bn) over the next three years. Separately, a total of 4tr yuan has been reallocated from local government budgets to swap out hidden debts over five years. Via the above measures, the hidden debts of local governments are expected to decrease from 14.3tr yuan to 2.3tr yuan by the end of 2028. The local swap will help reduce interest payment burdens by 600bn yuan over the next five years. (SCMP)

Indonesia’s Fiscal Deficit Widened to Rp309.2tr as of Oct24 Indonesia’s fiscal deficit widened to Rp309.2tr or 1.37% of GDP as of Oct24. Gov’t spending rose by 14.1% yoy to Rp2,556.7tr and revenue rose by 0.3% yoy to Rp2,247.6tr. (Bisnis)

US Consumer Sentiment Rises to 73 in Nov24, Boosted by Strong Financial Outlook US consumer sentiment increased to 73 in Nov24, the highest in seven months, compared to 70.5 in Oct24 and above forecasts of 71, preliminary estimates showed. However, the reading does not capture any reactions to election results. The expectations index soared to 78.5, the highest since Jul21, from 74.1 in the previous month. Expectations over personal finances climbed 6% in part due to strengthening income prospects, and short-run business conditions soared 9%. (Trading Economics)

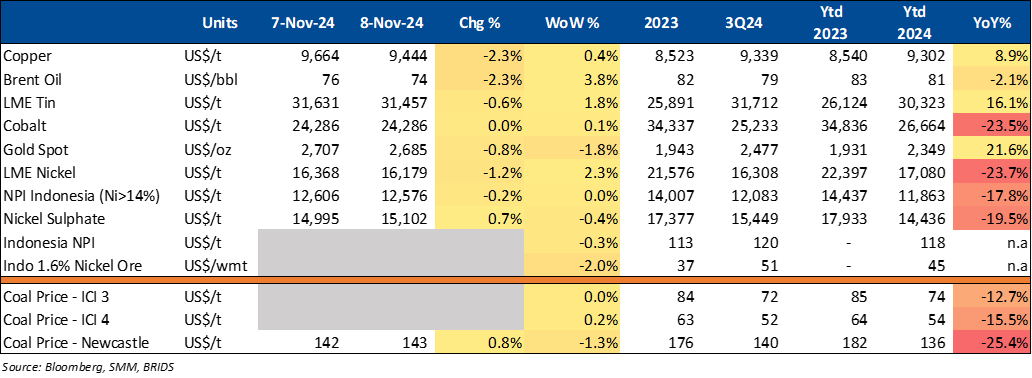

SECTOR Commodity Price Daily Update Nov 8, 2024

Automotive: Jakarta Auto Week 2024 Aims to Boost Year-End Vehicle Sales The Gaikindo Jakarta Auto Week (GJAW) 2024, that will be held at ICE BSD City from November 22 to December 1, aims to increase year-end vehicle sales. Gaikindo has revised its sales target to 850,000 units, emphasizing direct sales with special offers. Over 80 brands, including 27 car brands like BMW and Toyota and 12 motorcycle brands like Harley-Davidson, will participate, along with more than 40 supporting industry brands. (CNN)

CORPORATE FREN Launches Unlimited Suka-Suka Internet with Starting Price at Rp9,000 FREN has launched the Unlimited Suka-Suka internet package, offering flexible options starting at Rp9,000 for 1 GB of data valid for one day. Users can choose between 1 GB to 5 GB packages with no data limits, and even after the quota runs out, access to social media apps like Facebook and YouTube remains available. FREN also plans to expand its network in East Java, Bali, and Nusa Tenggara. (Kontan)

GOTO, Tencent Cloud, and Alibaba Cloud Boost Indonesia's Digital Economy GOTO, Tencent Cloud, and Alibaba Cloud have signed an agreement to enhance cloud infrastructure and develop digital talent in Indonesia. Tencent Cloud will invest US$500mn to build a new data center, while Alibaba Cloud plans to double its training efforts, aiming to train 800,000 people by 2033. The partnership supports Indonesia's digital economy and data sovereignty, with GOTO ensuring local data storage and improved security for users and businesses. (Investor Daily)

INCO and GEM Co Ltd Sign US$1.4bn Investment Agreement INCO and GEM Co Ltd have agreed to enter a strategic partnership for a net-zero nickel smelter project using High-Pressure Acid Leaching (HPAL) technology in Central Sulawesi, with an investment valued at US$1.4bn, or approximately Rp21.93tr. The nickel processing plant is projected to produce 60,000 tons of nickel in the form of Mixed Hydroxide Precipitate (MHP) annually. (Investor Daily)

PGEO Issues 13mn Shares in MESOP Program PGEO has completed Stages I and II of its MESOP program, issuing 13,016,558 shares worth Rp10.4bn. This increases PGEO’s total shares from 41.49bn to 41.51bn. Unexercised options can be used in future MESOP stages, reinforcing PGEO's commitment to shareholder value. (IDX) |