FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

BRIDS FIRST TAKE

- Surya Esa Perkasa: Promising LT Outlook from SAF and Blue Ammonia Projects (ESSA.IJ Rp 850; NOT RATED)

To see the full version of this report, please click here

- Medikaloka Hermina: Favorable Long-Term Prospect Remains Intact (HEAL.IJ Rp 1,390; BUY TP Rp 2,000)

To see the full version of this report, please click here

RESEARCH COMMENTARY

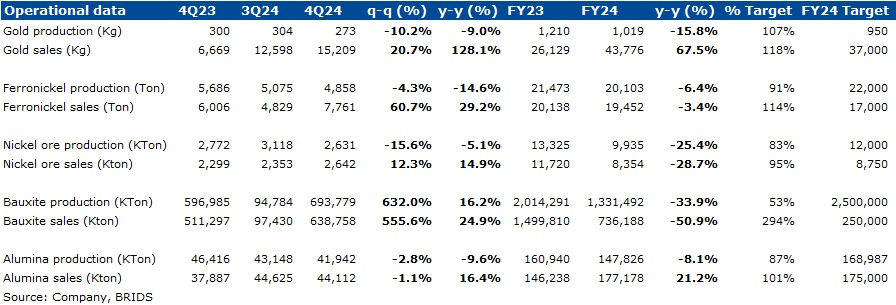

ANTM (Buy, TP: Rp2,000) FY Production and sales figure

- Gold takes center stage as sales volume continues to grow by +20% qoq to 15.2 tons, bringing FY24 sales to a record high of 43.7 tons.

- FeNi sales grew +61% qoq to 7.7kt as lagging sales are realized at the end of year, bringing FY24 sales to 19.4kt, above our expectation of 17kt.

- Nickel ore remains stagnant, with FY24 prod/sales reaching 9.9kt/8.4kt, which was below our estimate at 83%/95%.

- Strong bauxite sales in 4Q after restocking of ICA concluded, yet prod/sales are still below company guidance of 3.5mt/3.0mt. (Timothy Wijaya – BRIDS)

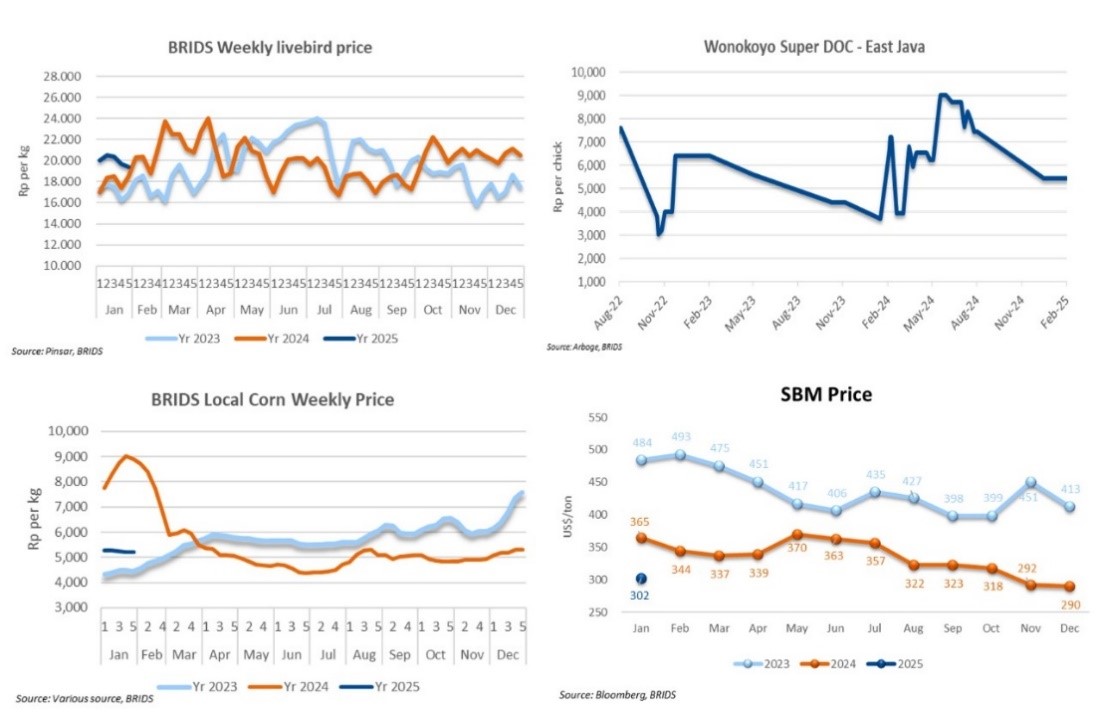

Poultry (Overweight)– 5th week of January 2025 Price Update

- Live bird prices declined to Rp19.2k/kg, with the weekly average price in the last week of Jan25 at Rp19.4k/kg, down 1.6% wow. The average price in Jan25 stood at Rp20.1k/kg (-1.8% mom; +12.4% yoy).

- Day-old chick (DOC) prices remained steady at approximately Rp5.5k/chick.

- Local corn prices stayed stable at Rp5.2k/kg, with the weekly average price unchanged from the prior week. The average price in Jan25 was Rp5.2k/kg (+0.7% mom; -38.1% yoy).

- The average soybean meal price slightly decrease to US$304/t in the last week of Jan25, with the average price in Jan25 stood at US$302/t (+4% mom, -17% yoy).

- Although January typically sees weaker prices, the average live bird price in Jan25 stayed high at Rp20.1k/kg. This deviation from historical patterns may indicate the potential impact of MBG and electricity subsidies on chicken consumption. (Victor Stefano & Wilastita Sofi – BRIDS)

MARKET NEWS

MACROECONOMY

Trump Imposes New Tariffs on Mexico, Canada, and China to Combat Fentanyl Flow

Trump imposed 25% tariff on Mexico and Canada, and another 10% on China, on top of the existing tariff. The tariff will take place in Tuesday in an effort to force Mexico, Canada, and China to curb the fentanyl flow to the US. To soften the blow, Canada's energy products only get 10% tariff. (Bloomberg)

US PCE Rose 2.6% yoy in Dec24

US PCE rose 2.6% yoy in Dec24, the highest since Apr-24, while the Core PCE rose 2.8% yoy. The PCE inflation still support further rate cut in 2025 although recent tariff measure by Trump should pose as a risk to the PCE deceleration. (Bloomberg)

SECTOR

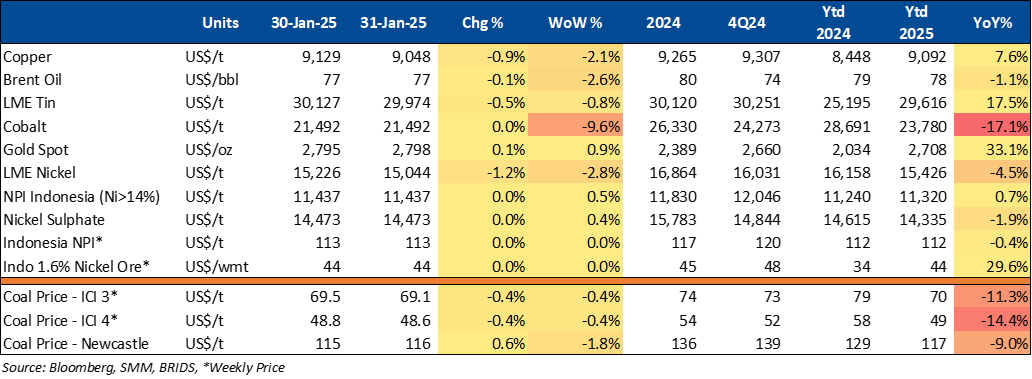

Commodity Price Daily Update Jan 31, 2025

Cement: ASI Urges Moratorium to Protect Cement Industry Profitability

Indonesia’s cement industry struggles with low demand, with utilization at 56.5%, far from the ideal 85%. The Indonesian Cement Association (ASI) calls for a 10-year moratorium with assumption of 3% growth every year on new plants to protect profitability, prevent job losses, and support CO2 reduction efforts. While exports are an option, margins remain low due to regional overcapacity. ASI also urges economic stimulus for infrastructure and affordable housing to boost demand. (Kontan)

CORPORATE

BBRI Plans Rp3tr Share Buyback

BBRI has announced a plan to buy back its shares expected to total up to Rp3tr using the company’s internal cash, will be conducted through both the stock exchange and off-market transactions. It will be completed within 12 months following the Annual General Meeting (AGM) scheduled for 11th Mar25. The buyback period is set to run from 12th Mar25 to 11th Mar26. (Investor Daily)

MYOR Allocates Rp1tr Capex for 2025

MYOR plans to allocate Rp1tr in capital expenditure for 2025, focusing on strengthening its packaged foods and beverages sector to drive expansion and production capacity. This marks a reduction from the Rp2tr capex in 2024, which was also aimed at capacity expansion and product development. (Kontan)

TOWR Secures Rp150bn Loan with Protelindo Guarantee

TOWR secured a Rp150bn loan for Iforte Energi Nusantara from BTPN, with the agreement signed on 30th Jan25. The loan, guaranteed by Protelindo, includes two tranches of up to Rp75bn each for green loans and revolving credit, supporting corporate needs and green projects. The loan term is up to three months from the final drawdown. (Emiten News)

To see the full version of this snapshoot, please click here