FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

BRIDS FIRST TAKE

- Bank Mandiri: Nov24 bank-only results: Soft net profit on lower NIM and lower recovery income (BMRI.IJ Rp5,675; BUY TP Rp8,200)

To see the full version of this report, please click here

- Bank Negara Indonesia: Nov24 bank-only results: stable growth amid margin pressure (BBNI.IJ Rp4,260; BUY TP Rp7,600)

To see the full version of this report, please click here

- Merdeka Battery Materials: KTAs from 3Q24 earnings call (MBMA.IJ Rp462; BUY TP Rp560)

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

SMGR (Hold, TP: Rp3,900): Sales Volume Nov24

- Nov24 domestic vol: -8.6% mom/-10.3% yoy

- Nov24 total vol: -4.3% mom/-7.8% yoy

- 11M24 domestic/total vol: -3.9% yoy/-4.6% yoy

Comment: SMGR reported in line sales vol. with seasonality (92% of our estimate), but steeper decline in sales vol by than industry and INTP in Nov24 (-6% and -3% mom respectively), which led to lower market share (47.8% in Nov-24, lower than 11M24 average of 49.3%). Bulk and export markets were growing on a mom basis, whereas domestic vol. was relatively weak. We have a HOLD rating for SMGR with a TP Rp 3,900. (Richard Jerry, CFA & Sabela Nur Amalina – BRIDS)

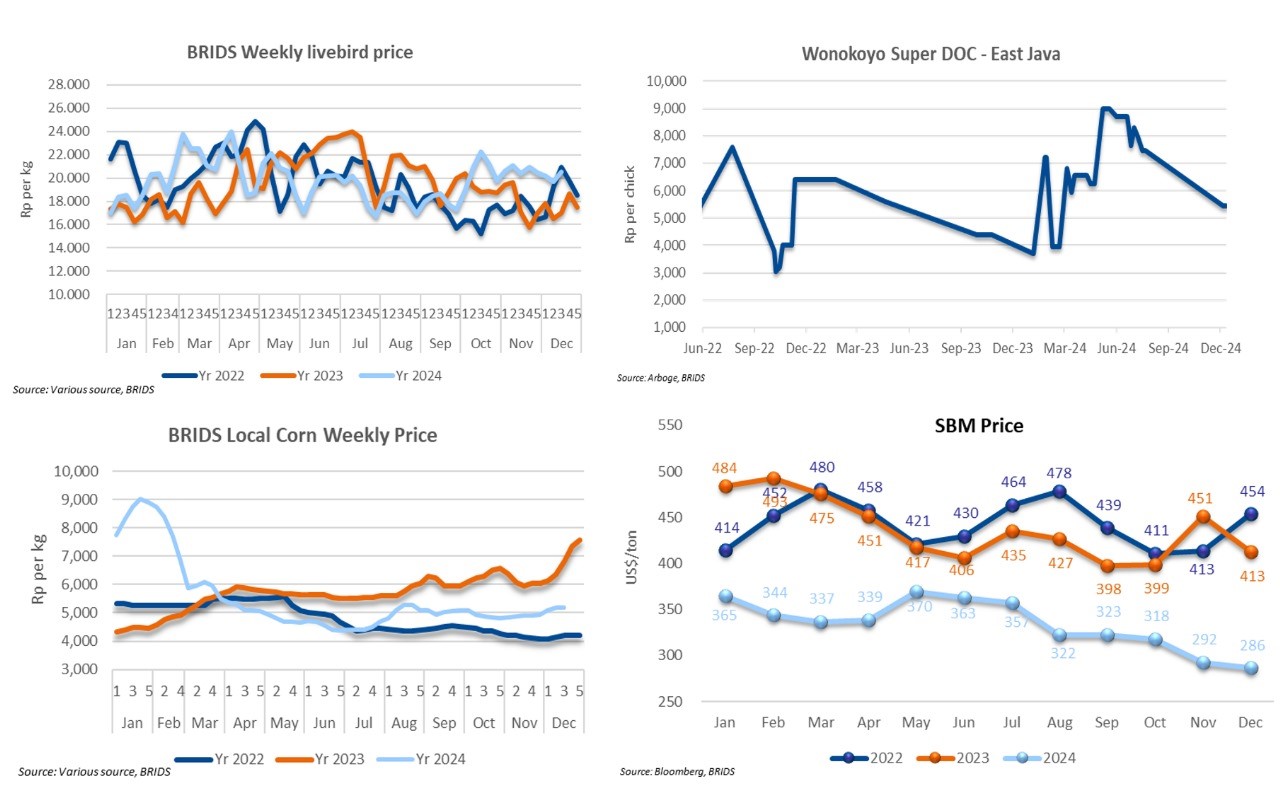

Poultry (Overweight) – 3rd Week of December 2024 Price Update

- Current livebird prices have risen to Rp21.5k/kg. The weekly average price for the third week of Dec24 reached Rp20.5k, reflecting a 4.2% wow increase.

- DOC prices remained steady at approximately Rp5.5k/chick.

- Local corn prices stayed relatively stable at Rp5.2k/kg, with the weekly average price for the third week of Dec24 remaining unchanged at Rp5.2k/kg.

- SBM prices stayed below US$300/t during the third week of Dec24, maintaining the lowest YTD monthly average price for Dec24 at US$286 (-2% mom, -31% yoy).

- We continue to anticipate robust earnings growth momentum in 4Q24, supported by favorable livebird prices and well-controlled feed costs. (Victor Stefano & Wilastita Sofi – BRIDS)

MARKET NEWS

MACROECONOMY

Indonesian Government Overhauls Export of Natural Resources (SDA) Foreign Exchange Parking Rules

The Indonesian government is currently revising regulations regarding the Foreign Exchange Earnings from Natural Resources (DHE SDA). According to sources from Kontan, the government plans to revise the rules on the parking period for DHE as well as the amount of DHE that must be parked. The source mentioned that there is a proposal requiring up to 50% of the DHE to be placed in domestic banks for six months. Currently, exporters of natural resources are required to deposit 30% of their export earnings for three months in domestic banks that conduct foreign exchange transactions. (Kontan)

In other news, the revision of the DHE SDA regulation is expected to be finalized by January 2025. This was discussed in a Finalization Coordination Meeting on the Amendment of Government Regulation No. 36 of 2023. According to the Coordinating Minister for Economic Affairs, the government is still preparing the regulation, and the time frame for its completion is expected to be about a month from now. (Kompas)

US Annual PCE Inflation Accelerated to 2.4% in Nov24

Annual PCE inflation in the US accelerated for a second month to 2.4% in Nov24 from 2.3% in October, but below expectations of 2.5%. Annual core PCE inflation in the US unexpectedly steadied at 2.8% in Nov24, the same as in October while forecasts were pointing to a rise to 2.9%. ( Trading Economics)

US Personal Income Rose by 0.3% in Nov24

US personal income rose by 0.3% from the previous month in Nov24, the smallest increase in three months. Meanwhile, Personal spending in the United States rose by 0.4% from the previous month to an annualized rate of US$20.2tr in Nov24, extending the 0.4% increase from October. (Trading Economics)

SECTOR

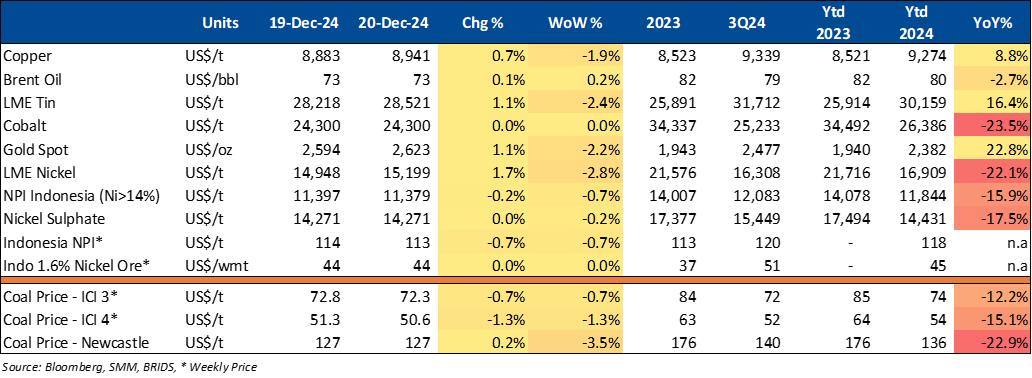

Commodity Price Daily Update Dec 20, 2024

Indonesian Government Plans to Provide PPN DTP Incentives for Electric Motorcycles

The government plans to provide Value Added Tax Paid by the Government (PPN DTP) incentives for electric motorcycles. The Minister of Industry stated that the government is considering incentives for various sectors, including the electric motorcycle industry. Unlike the 2024 scheme, which offered discounts on electric motorcycle units, the new scheme will provide PPN DTP incentives. The government is still determining the exact amount of the incentive. (Kontan)

MBDK Tax is Feared to Threatening the Sustainability of the Beverage Industry

The implementation of the sugary drinks tax (MBDK) is feared to have a counterproductive impact on the sustainability of the food and beverage industry. According to Telisa Aulia Falianty, a Professor at the Faculty of Economics and Business, University of Indonesia, the beverage industry also absorbs many jobs. According to entrepreneurs, a decline in demand could lead to business contraction and lower profits. In the long run, this will reduce the number of jobs. For 2024 and 2025, the government targets tax revenues from MBDK at Rp4.3tr and Rp3.8tr, respectively. (Investor Daily)

CORPORATE

AMRT Targets Opening 800-1000 New Stores in 2025

AMRT continues its expansion by adding new store locations throughout this year. By the end of 2024, the company will have opened over 1,000 new stores. In addition to aggressively opening new stores, AMRT is also closing some stores as part of a strategy to optimize the productivity of each store. According to AMRT, the company targets the opening of 800-1000 new stores in 2025. (Kontan)

BSDE Will Open a New Mall in 2025

BSDE has announced that it will open a new mall in 2025. The mall planned to open next year is Living World Grand Wisata, located in Bekasi. In addition, the company also has mall projects that are currently undergoing expansion or renovation, namely DP Mall Semarang and Epiwalk Lifestyle Center Rejuvenation. (Kontan)

EXCL Partners with Xanh SM for IoT Solutions

EXCL has partnered with Xanh SM to introduce innovative Internet of Things (IoT) solutions for the electric transportation industry. Through this collaboration, all of Xanh SM's electric vehicle fleets will be equipped with IoT devices connected to XL Axiata's network via the IoT Connectivity+ solution. This solution offers real-time device monitoring with enterprise-grade security standards, anomaly detection using artificial intelligence, and analytical features to support future business development. (Kontan)

Mitsubishi Motors Opens Opportunities to Produce Hybrid Cars in Indonesia

Mitsubishi Motors Krama Yudha Indonesia (MMKI) has the opportunity to become a production hub for hybrid cars for the international market. According to Mitsubishi Motors Corporation (MMC), the MMKI factory will play an important role in realizing Mitsubishi's electrification strategy in the future. MMC stated that it plans to produce hybrid models that can later be exported to various countries. (Kontan)