FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Banks: Potentially less-than-anticipated liquidity boost from the revised DHE policy (NEUTRAL)

- Given the more relaxed structure vs the previous DHE policy, the impact on USD supply may be lower than initially expected.

- BMRI has the highest loan portion from the mining sector, which indicates it could benefit more from the revisions.

- Maintain Neutral rating on the sector with BBCA as our top pick, followed by BTPS and BRIS given their better liquidity and NPL outlooks.

To see the full version of this report, please click here

Astra International: FY24 earnings: in line with ours, beat vs. consensus (ASII.IJ Rp 4,590; BUY TP Rp 5,900)

- ASII recorded net profit growth of 0.6% yoy to Rp34.05tr, forming 102%/106% of ours/cons (in line with ours, but above cons).

- Earnings were driven by 8% equity income growth (ADM & AHM), and growth in financial and agribusiness operating profit (+10%/+32% yoy).

- We reiterate our Buy rating with a TP of Rp5,900.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

BRIDS FIRST TAKE

- United Tractors: FY24 earnings: a slight miss vs. ours, in line with consensus est. amid seasonally slower 4Q24 (UNTR.IJ Rp 23,425; BUY TP Rp 31,000)

To see the full version of this report, please click here

RESEARCH COMMENTARY

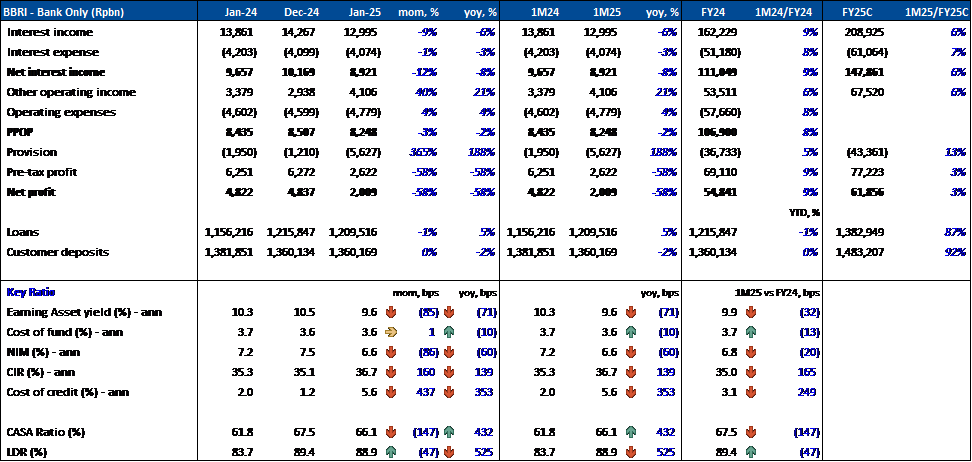

BBRI (Not Rated) Jan25 Bank-Only Results

Jan25 Insight:

- Sinking bottom line: BBRI booked only Rp2.0tr in net profit for Jan25 (-58% mom, -58% yoy), meeting only 3% of consensus FY25 estimates, i.e., below.

- Spike in CoC as expected: CoC spiked to 5.6% in Jan25 due to front-loading activity, as previously guided by management.

- NIM declined as asset yield dropped: NIM fell to 6.6% in Jan25 (-86bps mom, -60bps yoy) as asset yield declined to 9.6% (-85bps mom, -71bps yoy), mainly due to a high base comparison in both months (FY24 asset yield at 9.9%).

- Opex and CIR remained elevated: Opex remained high at Rp4.8tr (+4% mom, +4% yoy), and CIR rose to 36.7%, as lower NIM offset strong other operating income.

- Negative loan growth and flat deposits: Loans declined 1% mom. Deposits remained flat mom, but the CASA ratio declined as TD grew 5% mom while SA and CA declined by 2% mom each.

Summary:

- BBRI’s Jan25 results were weak, as asset yield dropped (though from a high base), opex remained high, and CoC surged, bringing the monthly bottom line to its lowest level in the past few years. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

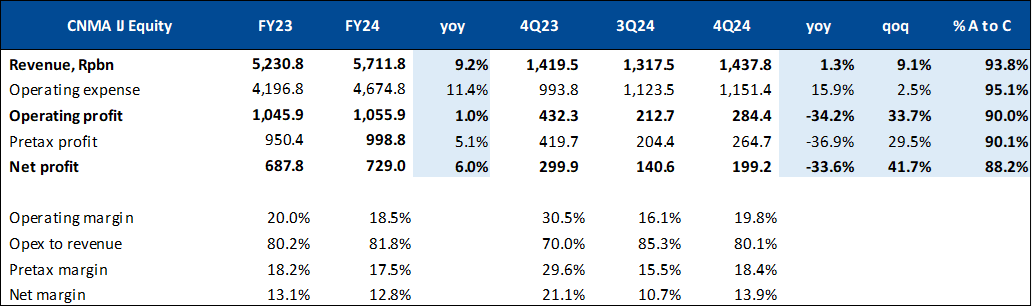

CNMA (Not Rated) - FY24 Result; Below Consensus

Revenue:

- FY24: Rp5.7tr/+9.2% yoy.

- Movie tickets: Rp3.54tr/+12.9% yoy (62.0% contribution to total revenue).

- F&B: Rp1.93tr/+4.5% yoy (33.9% contribution to total revenue).

- Others: Rp235bn /-2.6% yoy (4.1% contribution to total revenue).

Gross profit:

- FY24: +8.8% yoy.

- GPM: 59.7% (Cinema: 50.0%; F&B: 73.8%; Digital: 77.7%).

Net profit:

- FY24: Rp729bn/+6.0% yoy (88% to cons).

- NPM: 12.8% (vs FY23: Rp688bn/13.1%).

Operating numbers FY24:

- 256 cinemas/+6.7% (FY23: 240 cinemas), 1,350 screens/+5.5% (FY23: 1,280 screens) in 65 cities.

- +16 cinemas (12 Java, 4 ex-Java) / +70 screens.

- Total admission: 87.1mn/+3.4% yoy, with 21 local movies with +1mn admission (63.3% contributed by local movie share vs FY23: 45%).

- Average ticket price: Rp44,720 / 8.1% yoy (vs Rp41,368 in FY23).

- Rp24,385 F&B spend per head (54.5% F&B to GBO, lower than previous year of 58.3%).

Comment:

- We observed a significant impact from the decline in Hollywood movie releases in FY24, which affected admissions, particularly in Jabodetabek, where Hollywood films are more popular. As major Hollywood titles underperformed, FY24 results fell below the company's expectations.

- In 1Q25, CNMA expects slower growth during the Ramadan season compared to last year. The mgmt. will focus on untapped markets by adding 50-60 new screens with strong growth potential and views of the government’s Free Nutritious Program as a driver of additional disposable income. (Natalia Sutanto & Sabela Amalina – BRIDS)

MARKET NEWS

MACROECONOMY

Trump Confirms Tariffs on Canada, Mexico, and China

President Donald Trump confirmed that 25% tariffs on Canada and Mexico will take effect on March 4 and announced an additional 10% tax on Chinese imports. The new tariffs on China follow a previous 10% duty imposed earlier this month when tariffs on Canada and Mexico were delayed. The 25% tariffs apply to all Canadian and Mexican imports, except for Canadian energy products, which will be taxed at 10%. (Bloomberg)

SECTOR

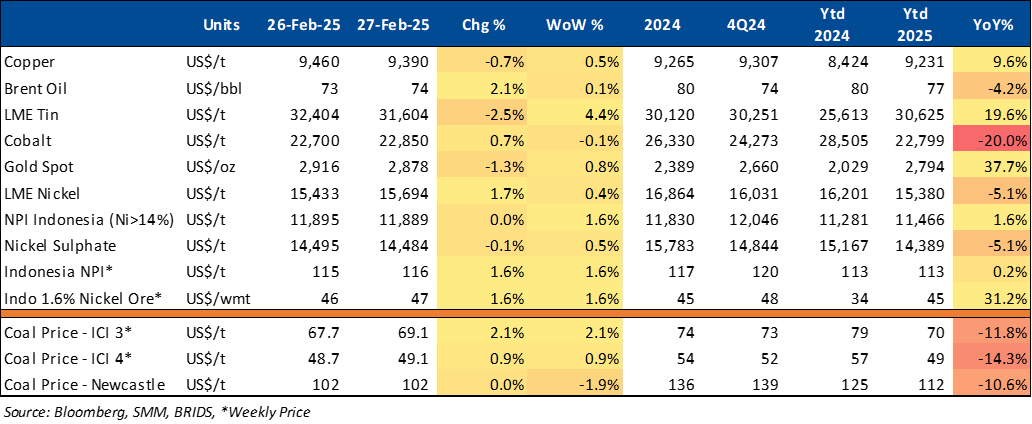

Commodity Price Daily Update Feb 27, 2025

CORPORATE

ASII to Distribute Rp16.34tr in Dividends

ASII plans a Rp406 per share (yield: 8.8%) for 2024, with a 48% payout ratio. This includes a Rp98 interim dividend paid in Oct24 and a Rp308 final dividend to be proposed in May25 (Investor Daily)

Astra Daihatsu Motor Inaugurates New Karawang Plant

PT Astra Daihatsu Motor (ADM) inaugurated its sixth factory, Karawang Assembly Plant 2 (KAP 2), on 27th Feb25. Spanning over 26 hectares, it serves as Daihatsu’s production base outside Japan, featuring modern and eco-friendly manufacturing technology. The inauguration was led by Minister of Industry Agus Gumiwang Kartasasmita and attended by key stakeholders. (Kontan)

AVIA Brands Expands Products and Distribution in 2024

In 2024, AVIA Brands launched 14 new products, five with Green Label Singapore certification, driven by its R&D team. To strengthen market reach, it expanded to 124 owned distribution centers, 15 mini centers, and 38 third-party centers. Retail partnerships grew to 58,600 stores, up by 1,722. Management reaffirmed its commitment to strong customer relationships as a trusted market leader. (Kontan)

EMTK Share Ownership Consolidation by The Family Continues

Alvin W. Sariaatmadja's recent acquisition of ~1.34% in EMTK on February 24 at Rp400 per share increased his stake to 1.51%. This suggests an ongoing consolidation of share ownership by the family, following earlier disclosure that affilated Adikarsa Sarana increased also its stake in EMTK. We identify stakes circa 55.8% directly controlled by the family, with a view for mre disclosures as buyers for the Archipelago shares sales have not been fully accounted yet. (Bisnis)

EXCL and FREN Merger has Reached Komdigi and Waiting Approval

XL Axiata and Smartfren currently awaiting approval from Komdigi. Chief Corporate Affairs Officer of XL Axiata stated that all required documents have been submitted and are under evaluation. The government is assessing whether the combined entity will need to return any spectrum to ensure fair competition and optimal resource utilization. (Bisnis)

INCO Allocates Capex of US$332.1mn in 2024

INCO is allocating a capital expenditure of US$332.1mn throughout 2024 to finance its nickel mining and processing development projects. According to INCO, this capital expenditure is primarily directed towards growth and sustaining capital expenditures. This amount is higher compared to approximately US$286.3mn allocated in 2023. INCO recognizes 2024 as a pivotal year for the development of strategic projects such as Pomala, Bahodopi, and Sorowako Limonite. Futhermore, INCO's production in 2024 reached 71,311 tons, exceeding the annual target of 70,805 tons. This achievement represents a 0.82% yoy increase. Meanwhile, INCO's sales volume in 2024 reached 72,625 tons, reflecting a 2% yoy increase. (Bisnis)