|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

Cement: Bag pricing continue to improve in Nov24; A conservative outlook from SMGR meeting (NEUTRAL)

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

BRIDS FIRST TAKE

To see the full version of this report, please click here.

To see the full version of this report, please click here.

To see the full version of this report, please click here.

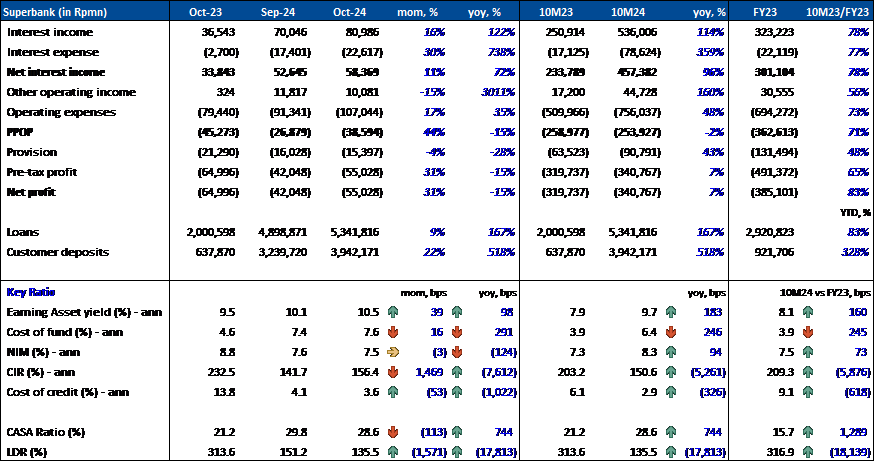

RESEARCH COMMENTARY Superbank - Oct24 Results 10M24 Insights:

Oct24 Insights:

Summary:

MARKET NEWS |

|

|||||||||||

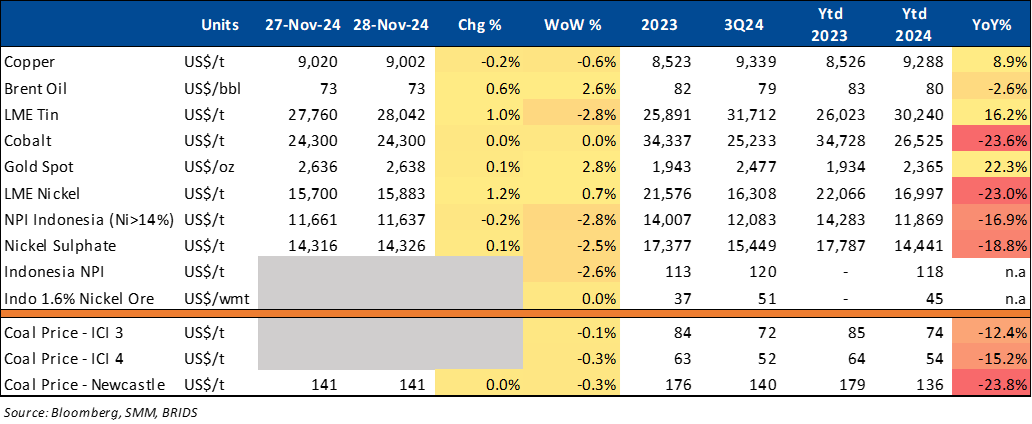

SECTOR

Commodity Price Daily Update Nov 28, 2024

Harbolnas Targeted to Increase Transactions by 16%

The government aims to boost consumer spending with two programs, Harbolnas and BINA, running from December 10 to 16, 2024. Harbolnas, focusing on domestic MSMEs, features approximately 480 curated businesses, while BINA promotes offline shopping at retail stores and malls until the December 29, 2024. Airlangga Hartanto, the Economic Affairs Minister, highlighted the need for public awareness, and Moda Simatupang, Director General of Consumer Protection, targets a 16% increase in Harbolnas sales to approximately Rp29.8tr, despite the current challenges in consumer purchasing power. (Kontan)

CORPORATE

MDKA to Issue Sustainable Bonds Targeting Fundraising of Rp15tr

MDKA is set to conduct a public offering of its Sustainable Bonds V Merdeka Copper Gold, aiming to raise Rp15tr in total. As part of this offering, MDKA will issue and offer the first tranche of the Sustainable Bonds V Merdeka Copper Gold 2024, with a maximum principal amount of Rp1tr. The offering will consist of two series: Series A and Series B, with bond interest payments made quarterly. The first interest payment is scheduled for March 24, 2025. (Investor Daily)

UNTR Reports Heavy Equipment Sales of 3,764 Units as of 10M24

UNTR recorded a total heavy equipment sales volume of 3,764 units from January to October 2024. This represents a -19.77% yoy decline compared to the 4,692 units sold in 10M23. YtD sales of Komatsu equipment were primarily driven by the mining sector, accounting for 66% of total sales. Other contributions came from the forestry sector at 8%, construction at 14%, and agriculture at 12%. UNTR has set a target of selling 4,600 Komatsu units in 2025, reflecting a +6% yoy growth. (Bisnis)

Wuling Reaches 160,000 Units and Expands Exports to ASEAN

Wuling marked the production of 160,000 vehicles at its Cikarang plant and launched Cloud EV exports to ASEAN. Over seven years, it has established itself as a key EV player with nine vehicle lines. This milestone reflects Wuling's commitment to sustainability and Indonesia-China collaboration. (Kontan)