FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

XL Axiata: Merger plan to offer upside; reiterate Buy rating as we see deal risks to be manageable (EXCL.IJ Rp 2,580; BUY; TP Rp 3,300)

- We believe the planned MergeCo to generate better consumer experience and thus, expect value accretion potentials from the deal.

- We see upside to our current valuation (DCF-based TP of Rp3,300) from the combined spectrum allocations and tower sites optimization.

- Maintain Buy rating. We believe risks on the deals are manageable, as both parties appear committed and with IOH’s merger as a precedent.

To see the full version of this report, please click here

To see the full version of this snapshot, please click here

RESEARCH COMMENTARY

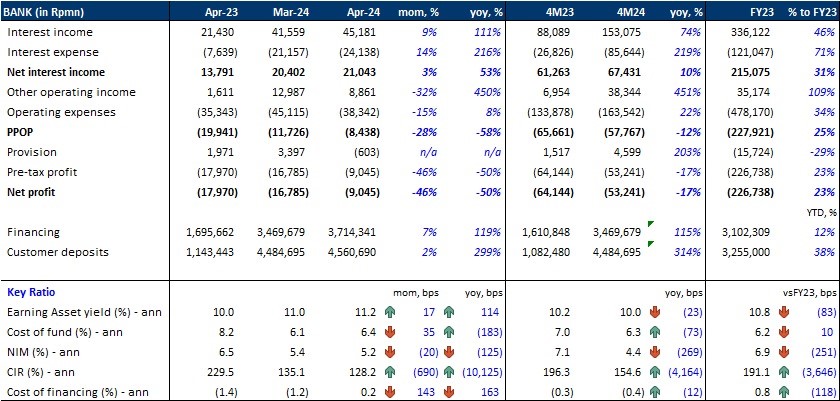

BANK Apr24 Results

- In Apr24, BANK recorded a net loss of Rp53.2bn despite recording NII of Rp67.4bn (+10% yoy) as opex rose 22% to Rp163.5bn due to a 35% yoy increase in both promotional and other expenses.

- NIM fell to 4.4% (-269bps yoy) due to a 23bps decline in the EA yield and despite the 73bps decrease in CoF as the LDR fell to 81% from 148% in the previous year.

- CIR improved to 154.6% (-4,164bps yoy) due to a 10% and 451% rise in NII and other operating income, respectively.

- In Apr24, BANK reported a 50% yoy decline in its net loss to Rp9.0bn as CIR declined significantly to 128.2% (-10,125bps yoy) due to a 53% surge in NII to Rp21.0bn and a 450% yoy rise in other operating income to Rp8.9bn.

- On a monthly basis, the net loss was down by 46% due to a 690bps decline in CIR. NIM declined to 5.2% (-20bps mom) despite a 17bps rise in the EA yield to 11.2% as the CoF rose to 6.4% (+35bps mom).

- The LDR was recorded at 81% (-6,685bps yoy) as customer deposits grew 314% while financing growth was recorded at 115%.

- Compared to FY23, NIM was 251bps lower in 4M24 as the EA yield declined 83bps and CoF increased 10bps. However, CIR improved 3,646bps. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

BBHI Apr24 Results

- BBHI reported a 15% yoy rise in net profits to Rp141.2bn in 4M24, supported by a significant increase of 10% and 199% in NII and other operating income, respectively.

- In 4M24, the NIM increased to 9.2% (+38bps yoy) as the 36bps increase in the EA yield to 12.0% was able to offset the 45bps rise in the CoF to 6.4%.

- As of 4M24, CoC remained low at 0.4% (+19 bps yoy) and CIR was flat at 50.9%.

- In Apr24, net profits declined to Rp29.8bn (-9% yoy) as the CoC climbed to 1.3% (+102bps yoy) due to a rise in provisions to Rp7.3bn (+381% yoy).

- However, NIM was recorded at 9.3% (+27bps yoy) as CoF remained flat at 6.0% while the EA yield surged to 12.0% (+34bps yoy).

- On a monthly basis, CoF saw an improvement of 47bps mom to 6.0%. However, the EA yield fell 51bps mom. Thus, NIM declined 30bps mom.

- Furthermore, CIR rose 194bps mom, resulting in a 6% decline in PPOP. Also, net profits decreased by 17% due to the 128bps rise in CoC.

- While deposits increased 4% yoy, loans declined 5% yoy, resulting in an LDR of 141% (-1,246bps yoy).

- Compared to FY23, the EA yield was flat and CoF was higher. Thus, NIM was 16bps lower than in FY23. The CIR was 641bps higher in 4M24. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

.jpg)

INTP Apr24 Volume

- Based on Ministry of Industry data, industry vol growth reached 17.3 Mt in Jan-Apr 24 (flat yoy), but if we exclude Grobogan, industry vol contracted by 2% yoy. Most of the growth came from Kalimantan (due to IKN) with 21% yoy growth, Nusa Tenggara with 11% yoy growth, and Central Java (due to infrastructure projects but partially also due to Grobogan inclusion) with 18% yoy growth.

- INTP sales vol reached 5.1 Mt (+7% yoy) in Jan-Apr 24, driven by Central Java (+69% yoy) due to Grobogan inclusion, Kalimantan (+8% yoy), and Nusa Tenggara (+8% yoy). If we strip out Grobogan, INTP sales vol was relatively flat (-0.8% YoY). INTP’s market share reached 30.7% in Apr24, the highest since Grobogan inclusion in Dec-23. Overall, INTP’s sales vol was broadly inline at 26% of our FY estimate.

- As expected, Industry and INTP’s MoM sales in Apr24 recorded declines (-37%/-33%) due to truck restrictions pre-Lebaran and the fewer working days in Apr24. (Richard Jerry, CFA & Christian - BRIDS)

MARKET NEWS

MACROECONOMY

Indonesia Property Prices Rose by 1.89% yoy in 1Q24

Residential property prices in Indonesia rose by 1.89% yoy in 1Q24, accelerating from a 1.74% increase in 4Q23. This growth was observed across all property categories, with small house prices increasing by 2.41% (vs. Q4’s 2.15), medium houses by 1.60% (vs. 1.87%), and large properties by 1.53% (vs. 1.58%). (Bank Indonesia)

CORPORATE

AMRT to Distribute Dividends of Rp1.19tr

AMRT agreed to distribute dividends of Rp1.19tr or equivalent to Rp28.68/share, reflecting a payout ratio of 35% of its 2023 net profit of Rp3.4tr. Throughout 2023, the company recorded net revenue of Rp106.94tr (+10.3%yoy). AMRT's good performance was supported by the food segment, which contributed Rp75.65tr, while the non-food segment contributed Rp31.3tr. (Bisnis)

SSIA Subsidiary Acquired by Djarum Group Entity Valued at Rp3.1tr

SSIA's subsidiary, PT Suryacipta Swadaya was acquired by the Djarum group entity, PT Anarawata Puspa Utama for Rp3.1tr. Anarawata Puspa Utama will take over 55,808,781 shares of PT Suryacipta Swadaya owned by SSIA worth Rp169.8bn. Suryacipta Swadaya will also issue 962,701,486 new shares. To gain control, Anarawata Puspa Utama will also absorb the issuance of new shares by Suryacipta Swadaya worth Rp2.9tr. SSIA will still hold 63.5% of the entire issued and fully paid capital in Suryacipta Swadaya. (Kontan)

KLBF Agreed to Disburse Dividends of Rp1.4tr, Received Approval for a Rp1tr Buyback

KLBF plans to pay a cash dividend of Rp1.4tr, accounting for 52% of the FY23 net profit of Rp2.76tr. Investors will receive Rp31/share. Furthermore, KLBF has received approval for a Rp1tr buyback, with a plan to net 625mn shares. The buyback, which is expected to begin from 16 May 2024 to 15 May 2025 with the help of an exchange member, aims to boost investor confidence in the company's shares' fundamental value. (Emiten News)

MIDI: To Disburse Dividends of Rp155.4bn, 30 New Stores Opened

MIDI has agreed to distribute Rp155.4bn in cash dividends for FY23, equivalent to Rp4.65/share. The AGMS reported that the dividends distributed accounted for 30% of the consolidated profit for the parent entity in 2023.

In other news, MIDI opened 30 new stores in 1Q24, but still fell short of its target of 200 by 2024. The company's performance slowed in Q1 due to long holidays like Eid, significantly impacting the realization of additional outlets. The management acknowledges that this slowdown takes place in Q1 each year. (Emiten News)

SIDO to Disburse Dividends of Rp540bn

SIDO will distribute cash dividends of Rp540bn with a DPS of Rp18/share. The dividend funds come from SIDO's net profit for fiscal year 2023, which reached Rp950.64bn (-13.9% yoy). The following is SIDO's dividend distribution schedule:

- Regular Market and Negotiated Market: Cum Dividend: 27 May 2024, Ex Dividend 28 May 2024

- Cash Market: Cum Dividend: 29 May 2024, Ex Dividend: 30 May 2024, Recording Date: 29 May 2024, Payment: 6 June 2024. (IDX)

Telkomsel Recorded 48% Fiberization Growth Outside Java as of Mar24

Telkomsel, with Telkom Group's support, has recorded 48% growth in special fiberization outside Java, reaching above 75% in all Indonesian regions, with the growth accelerating in the first quarter of 2024. (Kontan)