|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

Property: Picking Quality Names to Ride the Rate Cut Sentiment (OVERWEIGHT) · Property stocks tend to re-rate ahead of or during rate cuts, even though pre-sales remain more dependent on product mix and launches. · Stronger IDR and weak consumption may pave the way for BI rate cut, with local funds already loading up on the property sector. · Maintain OW in the sector; prefer quality names over deep discounts to support sustainable re-rate. Top Picks: CTRA>PWON>SMRA>BSDE. To see the full version of this report, please click here

Ciputra Development: Trimming Our FY25-27F Pre-Sales by 5%; Reiterate Buy Rating as Competitive Advantages Intact (CTRA.IJ Rp 960; BUY TP Rp 1.600) · CTRA’s 1Q25 earnings reflected resilient handover execution and disciplined opex, outperforming peers and company guidance. · Despite a strong 1Q25 pre-sales (29% of FY25F), we lowered our FY25-27F assumptions by 5%, aligning with mgmt’s guidance. · Maintain Buy with a lower TP of Rp1,600; CTRA remains our top sector pick with well-diversified, end-users-oriented projects. To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

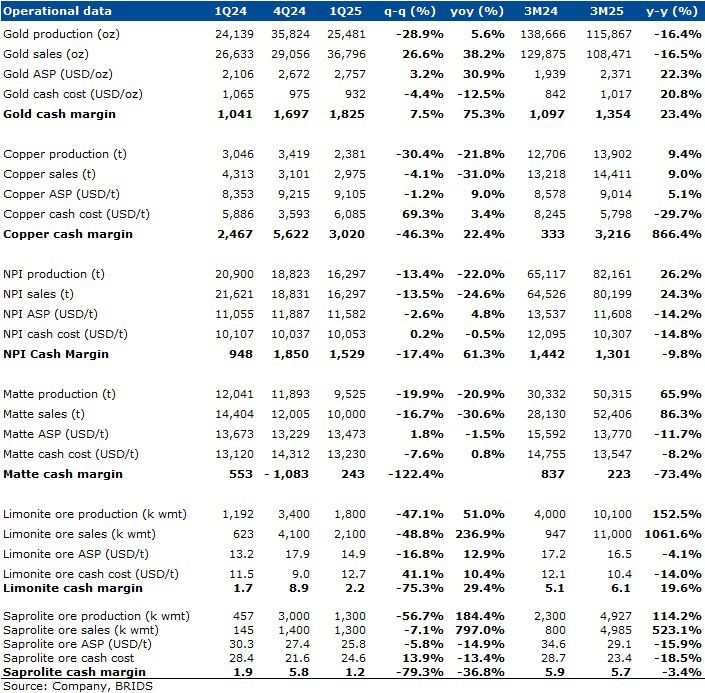

RESEARCH COMMENTARY MDKA (Buy, TP: Rp2,400) & MBMA (Buy, TP: Rp490) – 1Q25 operational results · MDKA recorded a solid 1Q25 operational performance as gold sales grew by +27% qoq, which drove gold revenue up by +44%. However, a negative point is its copper cash cost that fluctuated by +69% qoq. Nonetheless, MDKA ex-MBMA rev. still grew by +29% qoq. · Meanwhile, MBMA recorded -24% qoq weaker revenue, due to rainy weather that disrupted limonite/saprolite production by -47%/-57% qoq, and ore revenue by -57% qoq. Furthermore, as BSI/ZHN smelter is undergoing maintenance, as well as a flood occurring in Mar25, NPI output declined by -14% qoq, and revenue by -17% qoq.

Pani gold · Heap leach operation reached 49% by Mar25 with scheduled operation remain intact in 2026 and CIL in 2028. · Slight resource upgrade per Apr25 to 7.02Moz from 6.9Moz and higher grade of 0.75g/t from 0.7g/t.

TB Copper · PFS is expected to be released soon, which includes a reserve upgrade and higher SLC throughput. · Assessing a low-cost option for extraction of pyrite concentrate through ultrafine grinding and CIL. · Candrian open pit maiden resource announced at 491k Oz gold and 79kt Copper. Maiden resource for Gua Macam should be announced in 4Q25.

TB Gold · Mine life extended through 2030, and transitioned to a larger fleet that will reduce mining cost by c.-23%.

SCM · Saprolite cash cost increase was caused by B40 (+US$1.63/wmt) and lower production volume, though it should trend downwards once rainy season subsides.

NPI/HGNM · Lower NPI output was caused by maintenance in BSI/ZHN. There will be another BSI overhaul in 2Q25, which could keep production volume lower.

HPAL · SLNC started construction in Jan25 with a capacity of 4x22.5ktpa, which should start operating by mid-2026. Per Mar'25, construction progress had reached 14%. (Timothy Wijaya – BRIDS)

MARKET NEWS |

||||||||||||

MACROECONOMY

Bank of England Voted 5–4 to cut Bank Rate by 25bps to 4.25% in May as Expected

The Bank of England voted 5–4 to cut Bank Rate by 25bps to 4.25% in May as expected. Two members preferred a larger cut to 4%, while two opted to hold at 4.5%. The decision reflects continued disinflation progress as external shocks eased and tight policy helped anchor inflation expectations. (Trading Economics)

Indonesia’s Foreign Exchange Reserves Fell to US$152.5bn in Apr25

Indonesia’s foreign exchange reserves fell to US$152.5bn in Apr25, down from US$157.1bn in March — the highest level on record. This marks the lowest level since last November, primarily due to the government’s external debt payments and the central bank’s ongoing efforts to stabilize the rupiah amid persistent global financial market uncertainty. (BPS)

SECTOR

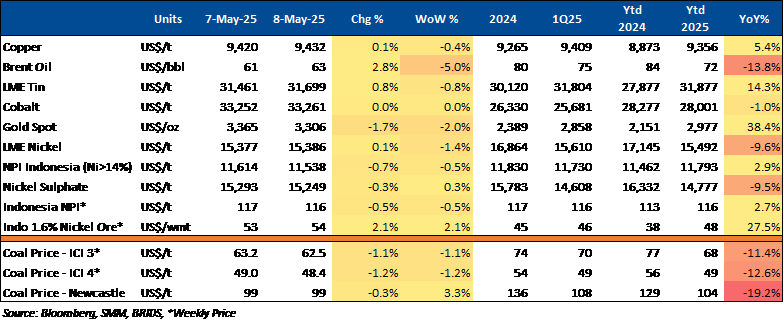

Commodity Price Daily Update May 8, 2025

CORPORATE

ASII Sets Final Dividend of Rp12.46tr for 2024

ASII will distribute a final dividend of Rp12.46tr or Rp308 per share (yield: 6.4%) for 2024, following approval at the annual shareholders meeting on 8 May 2025. This brings the total 2024 dividend to Rp16.43tr or Rp406 per share (yield: 8.5%), including an interim dividend of Rp3.96tr paid on 31 October 2024. (Investor Daily)

BMW Group Indonesia Opens First Integrated BMW-MINI Dealership

BMW Group Indonesia, with dealer partner BMW Eurokars, has opened BMW MINI Eurokars PIK 2 in Tangerang, a Rp200bn facility combining BMW and MINI under one roof. Spanning 5,336 m² with 12 vehicle displays, 11 workbays, and 4 EV charging stations, it adopts the global Retail. Next concept for a personalized, modern, and digital customer experience. (Kontan)

CMRY Launches "Eat Milk" Dairy Dessert Nationwide

CMRY launched "Cimory Eat Milk," a ready-to-eat dairy dessert in three flavors, available nationwide from 1 May 2025. Developed after 1.5 years of research, it targets consumers aged six and above, offering a creamy, convenient dessert option distributed through major retailers. (Kontan)

EMTK Sells Portion of Grab Shares

EMTK has sold 27.4mn shares of Grab Holdings Limited (GRAB) for Rp2.2tr during 1Q25. As of December 31, 2024, EMTK held 79.3mn Grab shares valued at Rp6.1tr; following the sale, its holdings decreased to 51.9mn shares with a fair value of Rp3.9tr as of March 31, 2025. (Emiten news)