FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Astra International: 1H24E preview: possible earnings beat, driven by strong financials and qoq HE improvement (ASII.IJ Rp 4,540; BUY; TP Rp 5,100)

- We expect ASII’s 1H24 auto revenue/OP to decline by -13%/-45%, and financial segment revenue/OP to expand by 12%/18% yoy.

- We expect HE’s 2Q24 earnings to improve +25% qoq, driving a potential beat for ASII’s 1H24 consolidated earnings.

- We reiterate our BUY rating with a TP of Rp 5,100; 2H24E 4W sales will be a critical driver for ASII’s 2H24 earnings

To see the full version of this report, please click here

To see the full version of this snapshot, please click here

RESEARCH COMMENTARY

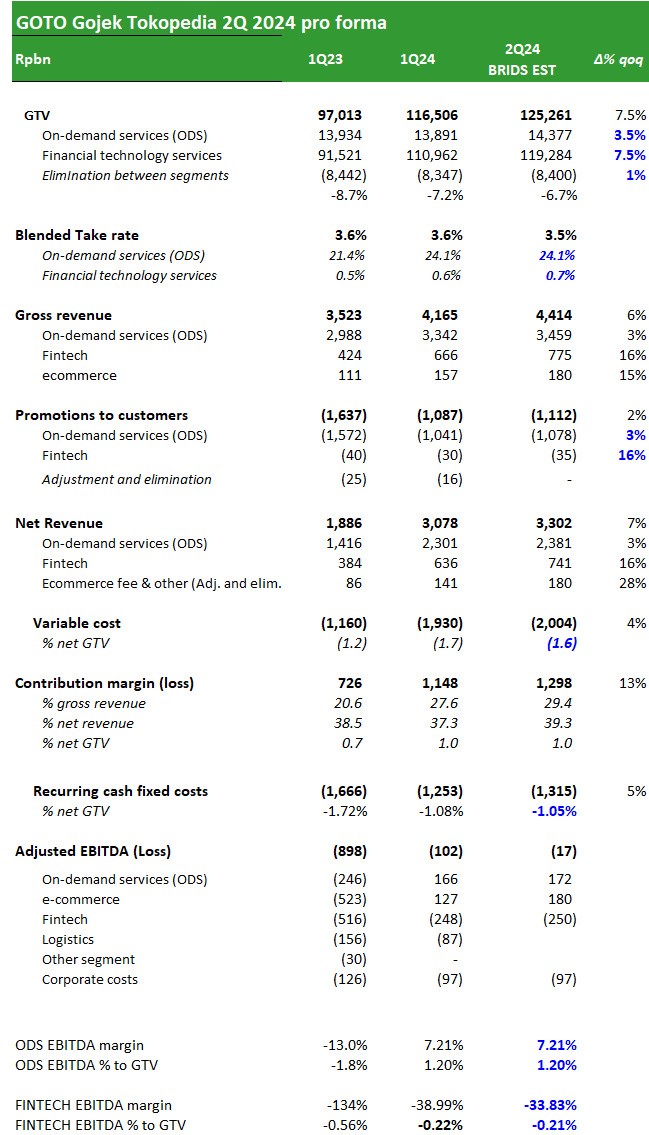

GOTO 2Q24 Preview - BRIDS

- We expect ODS to continue offering innovative solutions. We expect slightly better GOTO ODS GTV growth of close to +3 - 4% qoq in 2Q24, despite the Lebaran month, as new services are introduced.

- We see GOTO as committed to FinTech penetration and loan growth. We expect Loan growth to continue in 2Q24 circa 7% qoq, prudently we believe to control NPL. As per Data.AI, the Gopay app trended well in finance downloads in June '24, at no.2 spot behind only the DANA app. This is consistent with previous months. Gopay is at the 12th spot in June in all app downloads in Indonesia (considering Sosmed and gaming in front). Gopay is ranked no.4 in finance active users behind Dana, BRIMO & BCA Mobile in June.

- We expect an EBITDA loss in 2Q24, with improvement on qoq basis, closer to breakeven. We expect some cost efficiencies (variable and non variable) to be further achieved in 2Q. We expect a larger EBITDA contribution from Tiktok Shop / Tokopedia (Rp60bn/month). (Niko Margaronis – BRIDS)

MIKA 1H24 Results: Inline with Ours and Consensus Expectation

- MIKA reported 2Q24 Net Income of Rp312bn (+7.9%qoq, +40.1%yoy), bringing its 1H24 net profit to Rp601bn (+32.5%yoy). This achievement has reached 52.5% and 52.8% of our and consensus expectations, respectively, i.e. In-Line.

- EBITDA Margin showed an improvement of 280bps yoy and 160bps qoq to the 38% level, pillared by an increasing drugs margin and improvement in overall salary costs as a % of revenue.

- More details on volume development will be provided on post-earnings call July 22,2024 @4PM JKT time. (Ismail Fakhri Suweleh - BRIDS)

.jpg)

MACROECONOMY

European Central Bank Left Interest Rates Unchanged at 3.75%

The European Central Bank left interest rates unchanged at 3.75% on Thursday. The ECB reiterated that borrowing costs will remain “sufficiently restrictive for as long as necessary” to ensure inflation returns to 2%. (Bloomberg)

PMI Bank Indonesia is Recorded at 51.97% in 2Q24

Prompt Manufacturing Index (PMI) Bank Indonesia (BI) is recorded at 51,97% in 2Q24, lower than 1Q’s 52,8%. Expansion rate in several industries such as Metal and Rubber softened, while others like textile and clothing contracted. (Bank Indonesia)

SECTOR

Indonesia to Launch Nickel & Tin Online Tracking System

Indonesia will launch an online tracking system next week for nickel and tin shipments to increase government revenue and improve mining governance. The tracking system to be launched on Monday, known as SIMBARA, was first implemented on coal in 2022 and Indonesia has planned to widen its implementation to other minerals it produces. (Reuters)

CORPORATE

DOID Established a New Subsidiary

DOID has established a new subsidiary, namely PT Katalis Investama Mandiri (KIM). KIM was established as a sub-holding company to support DOID’s long-term strategy in the environmental, social, and governance sectors. The establishment of KIM will not have a material impact on the operational activities, legal, financial condition, or going concern of the company. (IDX)

JPFA Strengthens Probiotic Chicken Business Line

JPFA is strengthening its probiotic chicken business line through the Olagud brand. To cater to the probiotic chicken market's demands, JPFA has expanded by constructing a broiler chicken farm in the Tonjong Village Area, Pasaleman, Cirebon, West Java. This broiler chicken farm area has a closed house of 40,000 m2 which has been operating since 2023. (Kontan)

Toyota Hilux Rangga, Prius and GR Yaris Release at GIIAS 2024

Toyota officially released 3 new products at GIIAS 2024, including the Toyota Hilux Rangga, Prius Hybrid, and GR Yaris Facelift. The Toyota Prius has two variants: Hybrid Electric Vehicle (HEV) and Plug-in Hybrid Electric Vehicle (PHEV). The Toyota Hilux Rangga is built on a platform called “Innovative International Multi-Purpose Vehicle”, and Toyota GR Yaris Facelift has several changes, the most noticeable being the changes in the body kit, rear lights, and the addition of automatic transmission options. (Uzone)