|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

Poultry: Lebaran demand disappointed, weighing on sector outlook despite a still decent 1Q25 earnings est. (OVERWEIGHT) · LB prices during 2025 Ramadan and Lebaran fell short of expectations, reflecting weak demand and softer economic activity. · Despite margin pressure from lower LB prices during Ramadan, we still expect decent 1Q25 earnings, with downside risks anticipated in 2Q25. · Maintain OW rating on sound fundamentals and cheap valuations. Pecking order: MAIN, JPFA, CPIN. To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

BRIDS FIRST TAKE · Bumi Serpong Damai: 1Q25 Pre-sales In-Line with Our and Company’s Expectations (BSDE.IJ Rp835; BUY TP Rp1,550) To see the full version of this report, please click here · Ciputra Development: Update Call KTA: Strategy Remains Aligned with Winning Developers’ Traits (CTRA.IJ Rp870; BUY TP Rp1,700) To see the full version of this report, please click here

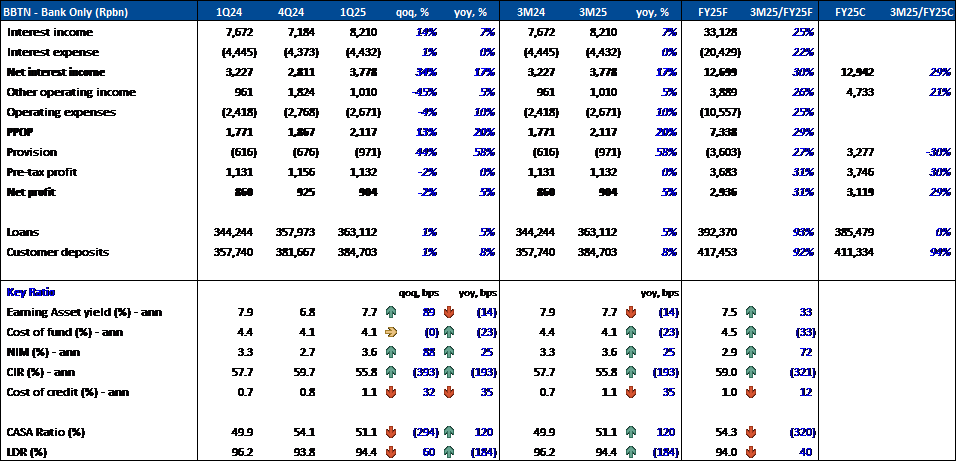

RESEARCH COMMENTARY BBTN (Buy, TP: Rp1,100) - BBTN 1Q25 Results and Concall KTA 1Q25 Insights: · Spectacular 1Q25 NP rebound from 2M25 low base: BBTN booked a net profit of Rp904bn in 1Q25 (-2% qoq, +5% yoy) from only Rp252bn in 2M25, achieving 31%/29% of our/cons FY25F i.e., above. · Changes in accounting standard: The bank changes its accounting treatment for its tiered mortgage rate, allowing it to record higher interest income in early stages. According to the management, the bank has ~Rp30tr in such loans which contribute to ~Rp700bn in interest income in 1Q25 and ~Rp2-3tr for FY25F. · CoC spiked to 1.1%: The changes in accounting standard also resulting in a higher CoC which reach 1.2% in Mar25 bringing its 1Q25’s CoC to 1.1% (+35bps yoy), still within management’s target of 1.0–1.1% for FY25F (vs. FY24’s 0.6%). · Higher NIM supported by contained CoD: NIM improved to 3.6% (+30bps yoy) thanks to the changes in accounting standard and Cost of Deposit which slightly improved to 4.05% in 1Q25 from 4.09% in 4Q24 owing to the lower contribution from big institutional clients. However, we note that this is also caused by the less working days. · Lower LDR to 94%: Loan grew 5% yoy driven by mortgage and corporate loans, lower than the 8% yoy deposit growth. Hence, LDR dropped to 94% in 1Q25 from 96% in 1Q24, but remained stable with 4Q24’s. Comfortable LDR level remained at 93-97%, · Rising NPL and LaR: NPL ratio rose to 3.3% in 1Q25 from 3.2% in 4Q24 with an uptick in non-subsidized mortgage loan which rose to 4.9% from 3.7%, partly offset by the non-housing loan which NPL improved from 2.4% to 1.2%. Consequently, NPL coverage decreased to 105% (from 115%) but management indicated that the changes in accounting standard will bring coverage up to 135% by FY25F.

Summary: · BBTN’s 1Q25 results were robust, as the new accounting standard allows the bank to record positive earnings amid the higher interest income and provisions, which will trigger FY25F earnings revisions in our view. However, asset quality deterioration is in line with our view and should be closely monitored. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

CLEO (Not Rated) – KTA FY24 Earnings Call FY24 Performance Highlight: · Revenue: +29% yoy to Rp2.7tr (FY23: +25% yoy), outperforming industry growth of 4%. · Segment performance: bottled products: +34% yoy and non-bottled products at +24% yoy. · Net Profit: +46.3% yoy, with a net margin of 17.6% (FY23: 15.5%).

FY25 Guidance: · Targeting double-digit growth in revenue and net profit. · Net margin guidance: ~18%. · Capex: ~Rp600bn (similar to FY24).

· CLEO increased its market share to 12%, benefiting from the decline of its competitors. The key priorities are expanding new factories and distribution. In 2025, it plans to build three new factories in Palu, Pontianak, and Pekanbaru. · The mgmt. noted intense competition and weak consumer purchasing power, evident in less enthusiastic Lebaran sales compared to the previous year. Despite 3–5% annual ASP increases, the growth was limited as CLEO followed the market leader’s cashback promotions. (Natalia Sutanto & Sabela Nur Amalina - BRIDS)

UNVR (Hold, TP: Rp1,500) – 1Q25 Net Profit declined 14.6% yoy due to lower revenue and margins, partially offset by reduced royalty expense · UNVR reported 1Q25 revenue of Rp9.5tr, down 6.1% yoy, driven by HPC (-9.1%), while FNR was relatively flat (-0.8%) due to support from festive events. · UNVR implemented a price adjustment in Feb25, which supported margins, especially for palm-related products. · In 1Q25, Volume (UVG) declined by 7% yoy, while price (UPG) grew 1.5% yoy. · UNVR reported lower royalty payments in 1Q25, which partially offset the decline in gross margin and negative revenue growth. · UNVR posted 1Q25 net profit of Rp1.24tr, down 14.6% yoy, accounting for 37% of our FY25F and 38% of the consensus estimate. We view the result as in line, given that royalty payments typically normalize in subsequent quarters. (Natalia Sutanto & Sabela Nur Amalina - BRIDS)

MARKET NEWS |

||||||||||||

SECTOR

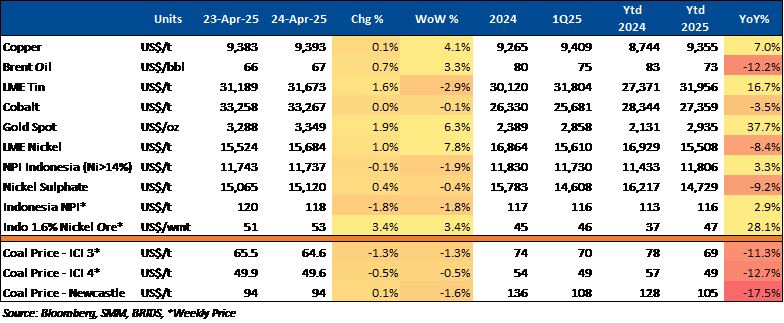

Commodity Price Daily Update Apr 24, 2025

EV: LGES Exits Titan Project, IBC Confirms Dragon Project Still on Track

LGES has withdrawn from Indonesia’s Titan integrated EV battery project, but Indonesia Battery Corporation (IBC) affirmed that the Dragon Project, a joint venture with China’s CBL (a CATL subsidiary), remains on schedule. According to IBC mgmt., both projects continue as planned despite LG’s exit. The Dragon Project, currently progressing in Karawang, is expected to begin its initial production phase by the end of 2026. (Kontan)

CORPORATE

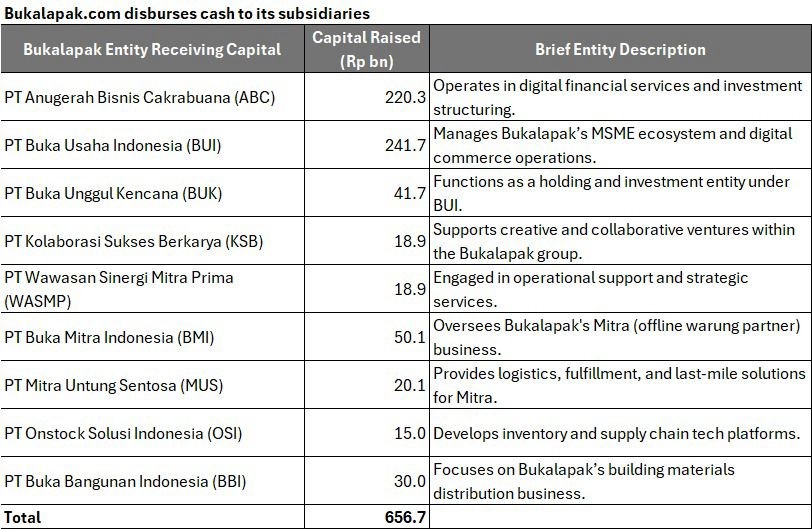

BUKA Injects Rp656bn into Subsidiaries to Strengthen Ecosystem Operations

On April 22, 2025, Bukalapak injected a total of Rp656.65bn into 9 of its subsidiaries through affiliated capital increases to strengthen internal operations across its Mitra, supply chain, and digital commerce ecosystem. All entities are directly or indirectly owned by Bukalapak by over 99%, qualifying the transactions as affiliated under POJK 42/2020. (IDX)

EXCL: Fitch Downgrades XLSMART to BBB-/Stable from BBB; Removes from Rating Watch Negative

Key drivers:

- Axiata-Sinar Mas joint control; no more parental support from Axiata.

- Market share (~24%) nearing Indosat (~26%) post-merger; scale boost to capex and FCF.

- Spectrum expands to 137MHz (Indosat 135MHz, Telkomsel 165MHz).

- 67k sites post-merger; coverage to match Indosat by 2025.

- Sector consolidation to support ARPU recovery after initial dilution.

- Leverage to peak at 2.2x in 2025, easing to 1.6x by 2027.

- Rp4.9tr assumed for 5G spectrum capex (2025-26).

Peer Comparison:

- XLSMART weaker than Indosat in EBITDA/mobile, but stronger in broadband (>1mn subs vs 350k).

- Telkom remains far stronger: 50% mobile share, dominant broadband, higher margins, <1.0x leverage. (Fitch)

GOOD Distributes Rp350bn Dividend and Rp1tr Capex for 2025

GOOD will distribute Rp350.34bn in 2024 dividends or Rp9.5/share (yield: 2.6%), equal to 56.1% of net profit. The company also allocated Rp1tr in 2025 capex for expanding production and warehouse capacity, funded through internal cash and bank loans. (Kontan)

WINS Announces Share Buyback Program of US$3.4mn

WINS has announced a share buyback program valued at US$3.4mn, including brokerage fees and other costs, to repurchase 155mn shares. The buyback will take place from June 4, 2025 - June 3, 2026. Additionally, the Company will hold its Annual General Meeting of Shareholders (AGMS) on Tuesday, June 3, 2025, where shareholders will be asked to approve the proposed buyback plan. (Company)