|

TMT Selected News |

||||||||||||

LOCAL NEWS

EXCL (Buy, TP:2,800) - Block Trades – Apr 16, 2025

Total Block Transaction Value: Rp9.81tn, with ombined volume: ~3.32bn sharesbroken down as:

- The Equalisation block – Sinarmas acquires shares from Axiata to reach 34.8% stake (joint control)

60tn @ Rp3,189/share

Volume: ~2.38bn shares

Rp2.20tn @ Rp2,350/share

Volume: ~940mn shares

- The Buyback – EXCL repurchases shares from dissenting shareholders post-merger

Closing price: Rp2,190 (-15.18%) — showing post-merger pressure despite strategic block trades.

Comment: This transaction closely matches the 2.38bn shares (13.1%) that Axiata sold to Sinarmas as part of the merger agreement, allowing both parties to hold 34.8% of EXCL and jointly control the company. (Niko Margaronis & Kafi Ananta – BRIDS)

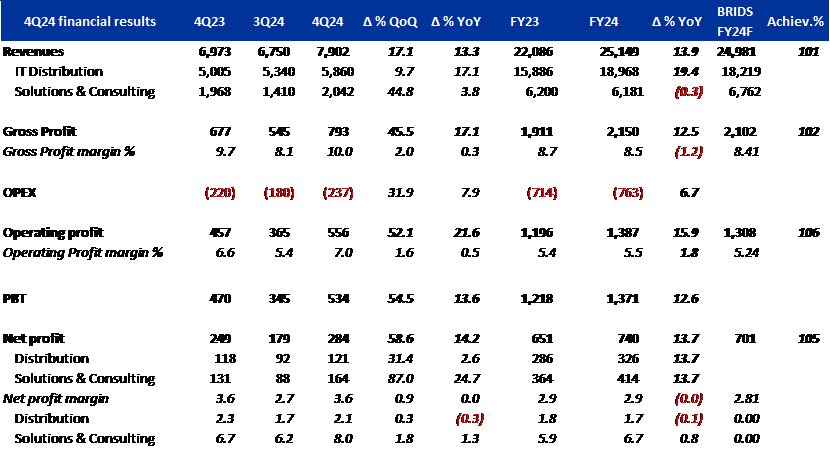

MTDL (Buy, TP: Rp800) 4Q24 Results – Strong Seasonal Finish

As expected, MTDL posted a solid 4Q:

- Net profit surged +58.6%qoq / +14.2%yoy to IDR 284bn

- Revenue hit IDR 7.9tn (+17.1%qoq / +13.3%yoy), driven by year-end order fulfillment and strong Infinix smartphone sales

- S&C revenue was soft (-0.3%yoy), but a rising share of high-margin services supported profitability

- Completed Phase 2 warehouse expansion (adds 18k sqm) ensures long-term distribution capacity (5–7 year horizon)

FY24 guidance beaten:

- Revenue up 14% (vs. 13% target)

- Net profit up 14% (vs. 8% target)

- ROE maintained at 18%, ~40% div.payout ratio

FY25 target:

- 10% revenue & profit growth, backed by diversified business model and strong execution across both S&C and distribution.

- New JV with FPT (Vietnam) focused on cybersecurity & AI just kicked off in Jan — expected to enhance solution offerings and contribute meaningfully over the medium term.

Valuation:

- MTDL currently trades at 8.9x/8.1x PE 2024-25 based on 10% NP growth in 2025, while historically trading over 10x. (Niko Margaronis & Kafi Ananta – BRIDS)

EXCL x FREN Merger Updates in IDX

The merger is efffective from 16 Apr 2025

- EXCL listed 5.07bn new shares on IDX

- FREN is delisted on 17 Apr 2025

Merger Structure:

- FREN & ST merged into EXCL (surviving entity)

- Share swap only — no cash injection

- FREN: 1 → 0.011 EXCL

- ST: 1 → 0.005 EXCL

- Total new shares issued: 5.07bn

- Post-merger EXCL shares: 18.2bn

Valuation Basis:

- FREN valued at Rp11.89tr

- ST at Rp10.52tr

- Total deal: Rp22.41tr

Ownership Post-Merger:

- Sinarmas gets ~21.7% via share swap

- Will increase to 34.8% by paying US$475mn (US$400mn upfront + US$75mn deferred) to Axiata

- Axiata’s stake drops from 47.9% → 34.8%

- Public holds 30.4%

- Axiata & Sinarmas now share joint control of EXCL holding 34.8% each. (IDX)

BELI completed its latest stock option programs MESOP II, III

- Exercise Price: Rp406/share

- Total Options Offered: 3.00bn shares

- Taken Up: 2.86bn shares (95.4%)

- Period: 15 Mar – 14 Apr 2025

- Total New Shares Issued: 2.86bn

- Total Shares Outstanding: 133.86bn (+2.2% dilution)

- Current Share Price: Rp412 (as of Apr 16, 2025)

- Remaining 138mn options can still be exercised in future windows. (IDX)

INET Expands Digital Infrastructure with Data Center, Submarine Cable, and International POP

INET is strengthening its position in the digital sector through B2B service expansion and international market entry. The company has launched a Point of Presence (POP) in Singapore and completed the first phase of its data center at Cyber Building, Jakarta—now 70% occupied—with phase two expected by June 2025. This facility will link over 58 POPs across Java to boost efficiency and service reach. INET is also planning to build a 20 Tbps submarine cable to support future demand in cloud, gaming, and AI sectors, with contracts targeted for 2Q25 and construction starting by late 2025 or early 2026. To finance the expansion, the company is considering a bond issuance later this year. (Emitennews)

IOH Data Traffic in South Sumatra +17.8% yoy During Eid

Traffic spiked during Lebaran, driven by YouTube, TikTok, and gaming apps. Network quality held steady, supported by >155 optimization points incl. Sultan Mahmud Badaruddin II (SMB II) Airport & major toll roads. This signals growing monetization potential beyond Java. (Suara Sumsel)

XL Axiata Data Traffic Surges in Jateng, NTB & Lampung During Ramadan–Eid

Between Mar 28–Apr 6, 2025, XL Axiata saw strong traffic spikes in Central Java, NTB, and Lampung.

West Sumatra, North Sumatra, and Aceh also ranked in the top 10. This reflects XL’s expanding user base and data monetization push beyond Java—especially in Sumatra.

(Radar Palembang)

MyRepublic Targets 2 Million Subscribers with Nationwide Expansion and Tech Innovation

MyRepublic is accelerating its expansion efforts, aiming to reach 2 million active subscribers by the end of this year. Currently serving over 1.1 million customers—surpassing its initial target—the company plans to enter 15 new cities across the country. MyRepublic is also developing technological innovations, including lighter FAT boxes and antennas, as well as exploring the use of pre-connected cables with new connector standards to reduce network deployment costs. (Kontan)

Indosat Rolls Out Biometric Verification for eSIM Migration

Indosat now requires biometric verification for users switching from physical SIM to eSIM, adding a security layer against fraud and identity misuse. This supports Kominfo’s push for safer eSIM adoption, which offers dual protection when paired with biometric checks. New rules also limit NIK usage to max 3 numbers per operator (total 9 across all telcos). (Liputan6)

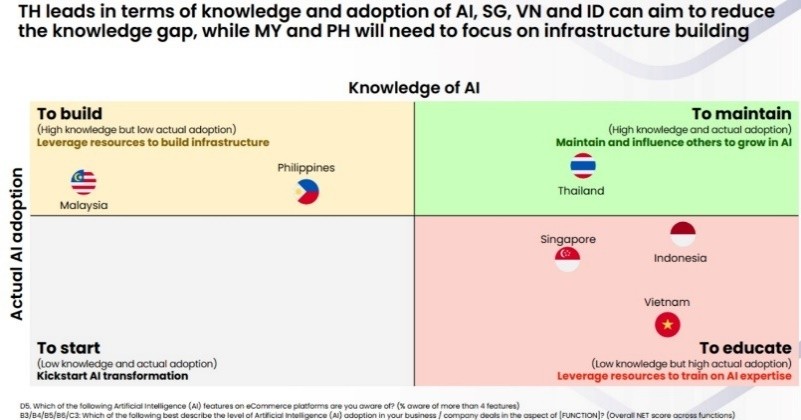

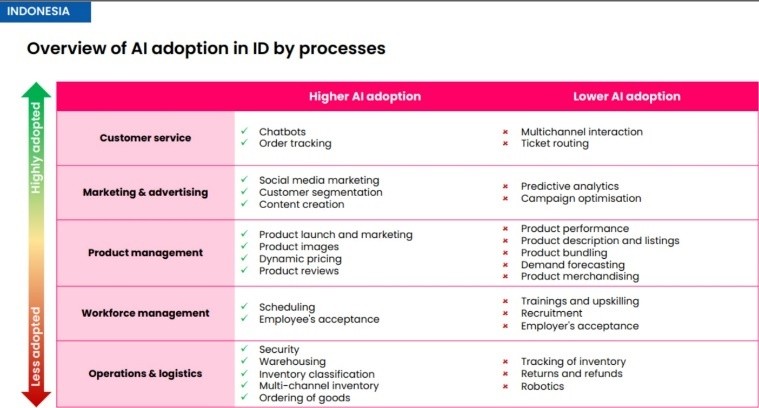

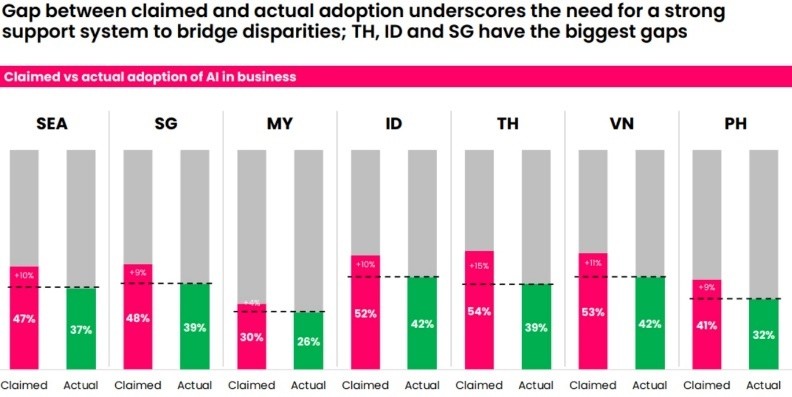

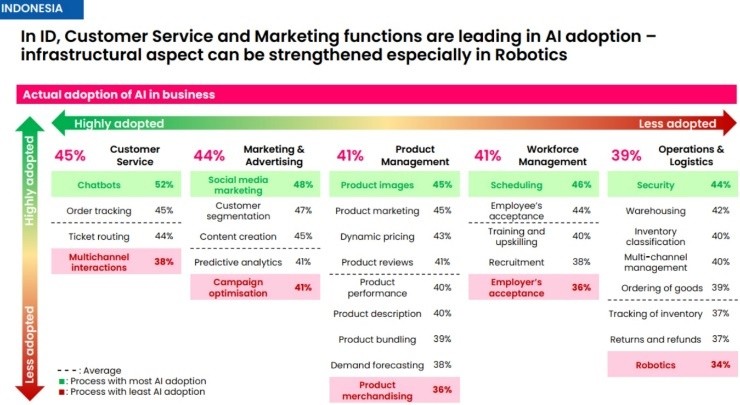

Indonesia’s AI Adoption in eCommerce: High Engagement, Infrastructure Still Catching Up

- Perception Towards AI: 94% of Indonesian sellers agree that AI upskilling boosts productivity, and 83% see long-term cost savings. However, 78% cite AI as costly/time-consuming, and 95% of employees still prefer familiar tools.

- AI Adoption in eCommerce: Actual AI adoption stands at 42% (2nd highest in SEA) but skewed to customer-facing areas like marketing and CS. Logistics, product ops, and backend systems lag.

- AI Readiness Index: 30% of Indonesian sellers qualify as “AI Adepts” (vs. 24% SEA avg), while 50% are still in the “Aspirants” phase. Key gaps include robotics, product bundling, and HR tech.

- Readiness & Adoption Across Markets: Indonesia ranks among the SEA leaders, along with Vietnam. Main constraints are operational—returns, restocking, and warehouse automation still manual.

- eCommerce Feature Usage & Preference: Top-used AI tools: chatbots, seller assistant, translations. 48% of sellers want more AI tools; others request stronger platform support and training.

Source: Lazada x Kantar – “Bridging the AI Gap” SEA Seller Survey (2025, n=208 for ID)

OTHER FOREIGN TRENDS

OpenAI Unveils Codex CLI and 2 Agentic Models (o3, o4-mini)

OpenAI just launched Codex CLI, an open-source terminal tool that lets developers to code, edit files, and run shell commands via natural language. The Codex model remains proprietary, but the CLI interface is now open source—lowering adoption barriers and accelerating ecosystem uptake.

Also introduced: agentic models o3 & o4-mini (now powering ChatGPT Pro), which can reason, plan, and autonomously use tools like Python, browser, and file readers—a real step toward fully autonomous AI agents.

From Investor perspective:

- Codex CLI = open-source ecosystem growth play

- o3/o4 = AI automation unlock → next-gen monetization path

- $1mn grant pool to drive CLI adoption & API usage

- Opens runway for deeper enterprise + developer stickiness

Agent models are still in early phase - security, trust, and reliability remain key watchpoints. (Yahoo Tech, TechCrunch)

AI Updates by Dr. Eric Schmidt ex-Google CEO

AI + Biotech Convergence: we're at a 3–4/10 on maturity, but it’s ramping fast.

Example: AI generates drug hypotheses → robotic lab tests overnight → loop restarts. The goal is to map all human druggable targets in 2 yrs.

AI is underhyped. It’s moving from chatbots to agents that plan, reason & self-learn.

In 1 yr: AI could replace most programmers + match grad-level math.

In 3–5 yrs: AGI Artificial General Intelligence

In 6 yrs: ASI; Super AI (self-improving, beyond humans).

The Risks & Ethics is that AI can cure diseases—but also engineer biothreats. Bio-risks may outpace countermeasures. Open-source models bring power but also bring in risk proliferation.

Global AI Arms Race: China’s investing heavily. U.S. must treat AI/biotech as strategic ally with Japan, EU, Israel. Without strong funding, U.S. universities risk brain drain + long-term innovation loss.

(https://www.youtube.com/watch?v=L5jhEYofpaQ, Special Competitive Studies)

Alibaba steps up AI adoption in auto industry with Nio, BMW deals

Alibaba Group is ramping up its AI commercialization in the automotive sector through new partnerships, including with Chinese EV maker Nio, which will integrate Alibaba’s Qwen large language models into its smart cockpits to enable AI-driven interactions. Nio is also exploring Alibaba’s AI coding tool, Tongyi Lingma, to enhance R&D efficiency. This collaboration follows an expanded partnership with BMW on LLM adoption and reported talks with Tesla, highlighting Alibaba’s growing footprint in the car industry’s AI transformation. (SouthChinaMorningPost)

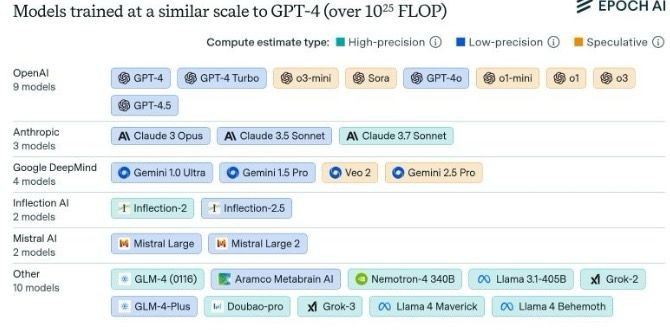

AI at GPT-4 Scale and Beyond

6 new models (Grok-3, Claude 3.7 Sonnet, GPT-4.5, Gemini 2.5 Pro, Llama 4 Maverick, Llama 4 Behemoth) have reached the 10²⁵ FLOP training scale—matching or surpassing GPT-4. These high-compute models cost tens of millions to train and will face scrutiny under the EU AI Act starting August 2025. Expect more to come as the pace accelerates. (EpochAI)

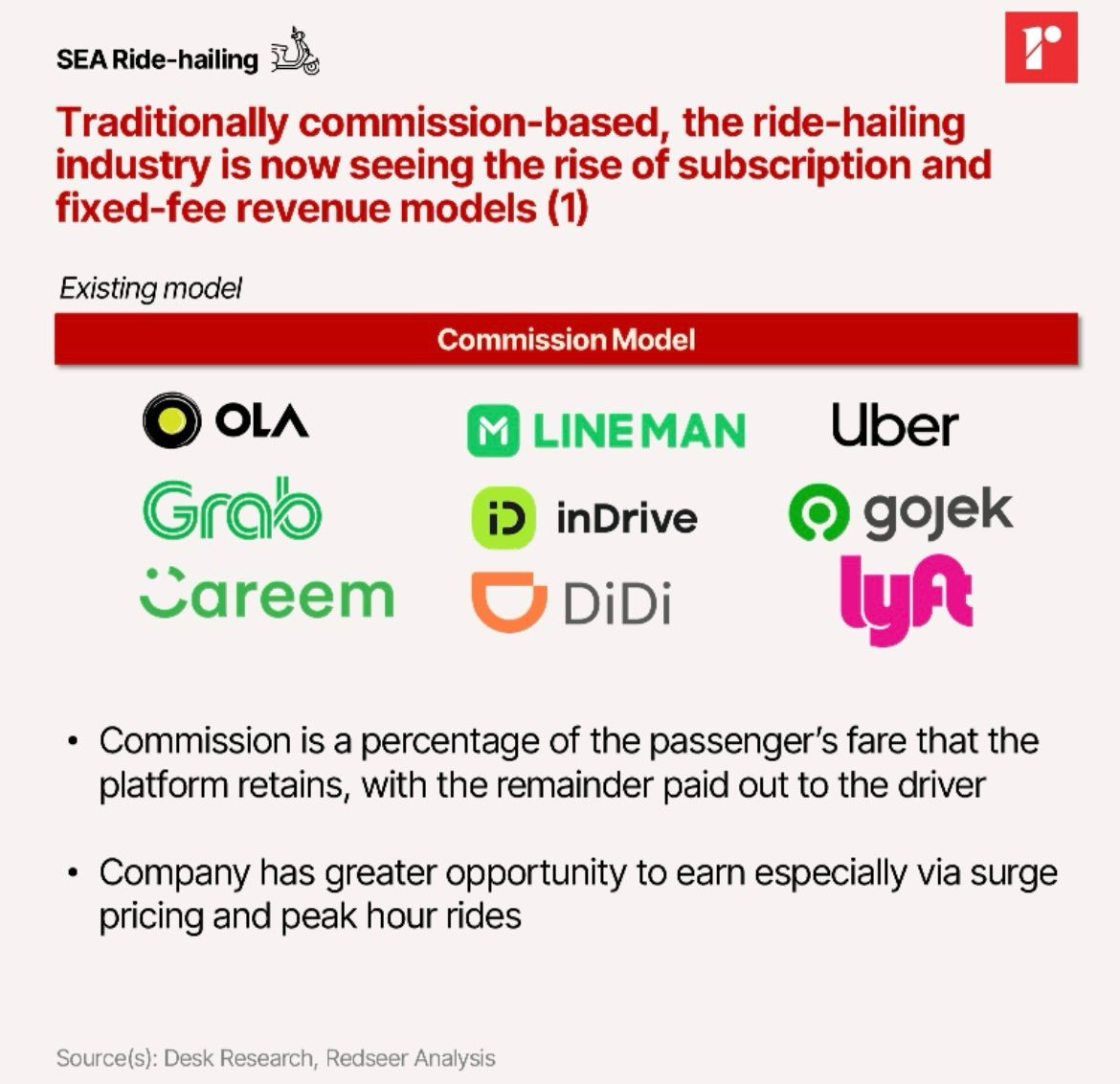

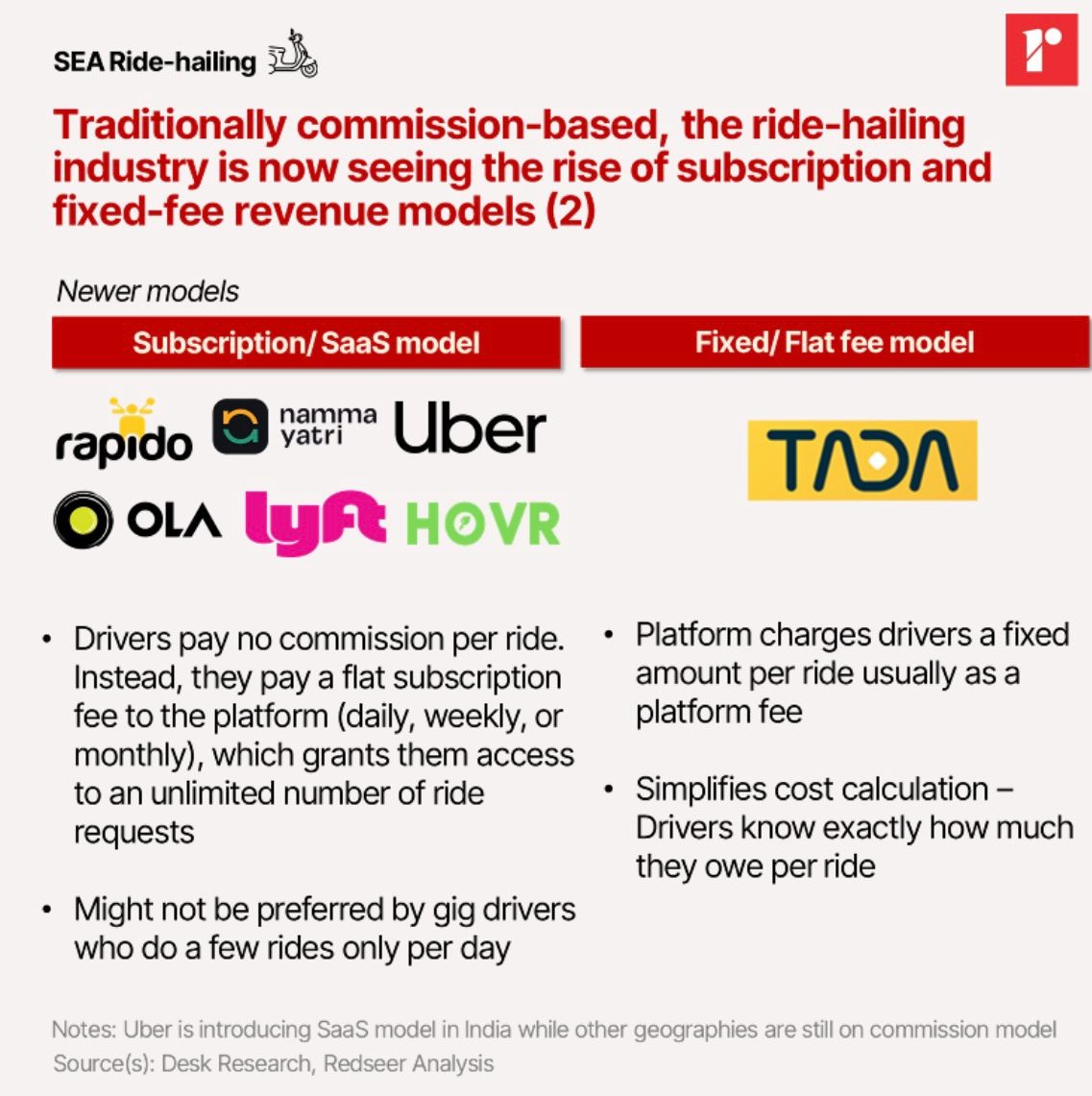

SEA Ride-hailing Sees New Monetization Trends

Southeast Asia’s $30B ride-hailing market, long driven by commission-based models (e.g., Grab, Gojek), is seeing a shift toward subscription (Uber, Rapido, Lyft) and flat-fee (TADA) models. These approaches aim to boost driver earnings and offer more predictable costs. However, success will hinge on how well platforms manage marketing spend and driver incentives to stay competitive. (Redseer)

In a first, Japan issues cease-and-desist order against Google

In a historic move, Japan’s FairTrade Commission has issued its first-ever cease-and-desist order against Google, accusing the tech giant of violating anti-monopoly laws by forcing Android phone manufacturers to preinstall Google Play and Chrome in easily accessible spots on the home screen, limiting fair competition from other search engines. The commission revealed that since at least Jul20, Google also tied ad revenue sharing to strict conditions, such as making Chrome the default browser and not preinstalling rival apps. These practices impacted around 80% of Android phones in Japan. Google must now halt these actions and issue compliance guidelines or face penalties. While Google expressed “deep regret,” it claims manufacturers choose its apps based on quality, not pressure. This move places Japan alongside the U.S. and Europe in ramping up scrutiny of Big Tech’s market power. (TheJapanTimes)

Temu pulls its U.S. Google Shopping ads

Temu stopped running Google Shopping ads in the U.S. on April 9, causing its App Store ranking to drop from the top 3 to 58th in just three days. Its ad impression share plummeted and disappeared by April 12. This coincided with the Trump administration’s toughened stance on Chinese imports, raising tariffs to 125% while keeping a moderate approach with other trade partners. (SearchEngineLab)

To see the full version of this News, please click here