TMT Selected News

LOCAL NEWS

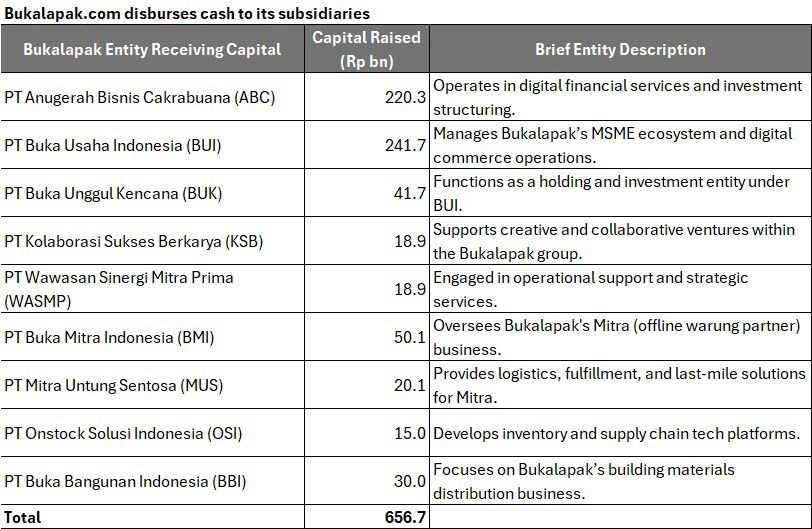

BUKA Injects Rp656bn into Subsidiaries to Strengthen Ecosystem Operations

On April 22, 2025, Bukalapak injected a total of Rp656.65bn into 9 of its subsidiaries through affiliated capital increases to strengthen internal operations across its Mitra, supply chain, and digital commerce ecosystem. All entities are directly or indirectly owned by Bukalapak by over 99%, qualifying the transactions as affiliated under POJK 42/2020. (IDX)

EXCL: Fitch Downgrades XLSMART to BBB-/Stable from BBB; Removes from Rating Watch Negative

Key drivers:

- Axiata-Sinar Mas joint control; no more parental support from Axiata.

- Market share (~24%) nearing Indosat (~26%) post-merger; scale boost to capex and FCF.

- Spectrum expands to 137MHz (Indosat 135MHz, Telkomsel 165MHz).

- 67k sites post-merger; coverage to match Indosat by 2025.

- Sector consolidation to support ARPU recovery after initial dilution.

- Leverage to peak at 2.2x in 2025, easing to 1.6x by 2027.

- 9tr assumed for 5G spectrum capex (2025-26).

Peer Comparison:

- XLSMART weaker than Indosat in EBITDA/mobile, but stronger in broadband (>1mn subs vs 350k).

- Telkom remains far stronger: 50% mobile share, dominant broadband, higher margins, <1.0x leverage. (Fitch)

XLSMART (XL SATU) has launched April 2025 Home Internet Promo

Introduced a "Pay 9 Get 12 Months" campaign offering with 25% discount across home broadband packages.

Unlimited internet without FUP; includes speed boosters, shared mobile quotas, and e-voucher incentives.

- VALUE Package: Rp2.06mn (normal Rp2.75mn), ~Rp172k/month, 30 Mbps (booster 50 Mbps).

- SMART Package: Rp2.15mn (normal Rp2.87mn), ~Rp179k/month, 50 Mbps (booster 75 Mbps).

- FAMILY Package: Rp2.87mn (normal Rp3.83mn), ~Rp239k/month, 100 Mbps (booster 150 Mbps).

Additional "Gelegar Hemat" program: bonus GoPay vouchers up to Rp2mn and mobile data up to 100GB.

Services now available in 127 cities with ~6 million homepasses. Users can pay via Blibli, Tokopedia, Shopee, and Kredivo. (Beritadewata.com, Palpos, from Bali and Palembang regions)

Indosat Leverages AI to Drive Mining Efficiency and GDP Growth

CEO Vikram Sinha calls for AI adoption in mining to raise output & help lift GDP from 5% to 8%.

key points:

- Mining sector potential: $300bn (17% of GDP); current: 10.5%.

- Indosat’s AI Factory (w/ Lintasarta & NVIDIA) delivers full-stack AI, now targeting mining use cases.

- Indosat's internal AI use saved $150mn capex & grew ARPU +6% yoy.

- In talks with Pama, Amman, Vale, Freeport to deploy AI + ICT infra.

- Govt supports sector AI transformation; focus on efficiency, sustainability, digital talent.

- Notes remote infra is feasible if heavy equipment can reach sites. (Jakarta Globe, Bloombergtechnoz)

TOWR Reiterates Conservative 2025 Growth Target

TOWR targets low single-digit organic revenue growth in 2025, per Advisor Adam Gifari. Reflects cautious stance amid industry consolidation (post-XL x Smartfren merger) and macro pressures. (Kontan)

Indonesia Starts e-SIM Migration for Safer Digital Space

Minister Meutya Hafid launched e-SIM rollout (Apr 11) to curb identity abuse & digital crime. e-SIM enables stronger biometric verification, no physical card needed. Gov’t to tighten ID verification rules via new Permenkomdigi. Some NIKs found registered with 100+ numbers—vs legal cap of 3/operator. Telcos already support e-SIM migration, voluntary for now. THis is part of broader National Digital Data Clean-Up. (Melintas.id Bekasi)

XLSMART Begins Merger Socialization in Sulawesi & Kalimantan

XLSMART kicked off regional outreach in Makassar post-merger (Apr 2025) to unify brand presence. Focus areas are Sulawesi & Kalimantan, key to national digital agenda & IKN proximity. XL, AXIS, and Smartfren brands to be retained; expanding into FBB, FMC, and enterprise services. 5G rollout is planned for Makassar, Balikpapan, and Morowali. XLSmart will do no layoffs aiming for full integration of staff. XLSmart combined entity now has 25% market share, IDR45.8tn revenue, 94.5mn users.

By 2027, XLSMART aims to establish itself as Indonesia’s most preferred digital telco, leveraging its post-merger scale, 5G rollout, and multi-brand strategy to lead in mobile, broadband, and enterprise services. (Various Makassar - based media)

AI in Mining Could Add Rp5,200tn to Indonesia’s Economy

AI adoption in Indonesia’s mining sector could unlock up to Rp5,200tn (US$308bn) in economic value by boosting productivity across exploration, operations, and distribution. Key benefits include faster land mapping, supply chain optimization, automation of routine tasks, and enhanced safety. AI also supports sustainability via waste reduction and decarbonization. Challenges include GPU energy consumption, data integration, and workforce adaptation. The government is driving AI adoption through its 3P strategy—Policy, People, Platform—focusing on regulation, talent, and collaboration. (Katadata, Bisnis, ESDM)

Indonesia Needs 100 New Data Centers to Support Growing Digital Economy

Indonesia must build at least 100 new data centers to meet rising demand from its fast-growing digital economy, according to IDPRO. Driven by growth in e-commerce, fintech, healthcare, and AI, projected capacity needs will reach 2–3 GW over the next decade. Infrastructure quality, regulatory support, and ecosystem readiness remain key challenges. Indonesia currently operates ~430 data centers—well behind Singapore (717) and Malaysia (532). (Bisnis)

BytePlus Invests US$10 Million to Expand AI and Cloud Services in Indonesia

BytePlus, the cloud and AI solutions arm of Chinese tech giant ByteDance, is investing US$10mn to expand its operations into Indonesia. Targeting local corporations and business partners, BytePlus brings advanced technologies such as BytePlus Voice, which enables natural voice replication in Bahasa Indonesia—capturing unique intonations and rhythms that reflect the country’s rich cultural diversity. The company also offers regulation-compliant solutions tailored to Indonesia’s specific legal framework, ensuring businesses can scale operations securely while embracing digital transformation. (Bisnis)

High Migration Costs Slow eSIM Adoption in Indonesia

Celios warns that high migration fees—starting from Rp10k—are deterring consumers from switching to eSIM. Director Nailul Huda urges that migration should be free to drive adoption and calls on the government to support awareness, regulation, and operator incentives to ease the cost burden. (Bisnis)

Komdigi Prioritizes 2.6 GHz and 3.5 GHz Spectrum Auction to Boost Digital Acceleration

Komdigi s prioritizing the auction of the 2.6 GHz and 3.5 GHz frequency spectrums to accelerate the country’s digital transformation. In addition to expanding fiber optic and submarine cable networks, the government is also pushing for telecom industry consolidation and the development of low-latency national data centers to support optimal AI integration. (Bisnis)

Despite Weaker Purchasing Power, Pay Later Usage Surges in Indonesia

Indonesia is seeing a surge in the use of BNPL services, despite signs of weakening household purchasing power. As of February 2025, BNPL credit distribution reached Rp36.2tr, marking a 27.6% yoy increase, with total accounts growing 37.3% to 48.3mn. This growth comes amid unusual consumption trends ahead of the Eid holidays, as February saw deflation across the board—monthly (-0.5%), ytd (-1.2%), and annual (-0.1%), driven largely by government electricity tariff discounts for middle class households. Surprisingly, deflation also hit essential categories like food, beverages, and tobacco. (CNBC)

OTHER FOREIGN TRENDS

Google Earnings Beat on Strong Margins

Google's parent company, Alphabet, reported better-than-expected Q1 earnings, with revenue reaching US$90.23bn, up 12% year-over-year, and earnings-per-share of US$2.81, surpassing Wall Street's forecast of US$2.01. Strong performance in search ads, third-party ad networks, and services like YouTube and Google Play contributed to the revenue beat. The company’s cloud division grew 28% to US$12.26 bn, with a 142% surge in operating income. Alphabet also saw an increase in overall profit margins, up to 33.9%. One of the biggest future revenue drivers, its robotaxi service Waymo, now serves 250,000 passengers weekly, marking a fivefold increase from last year. (Barrons)

Perplexity wants to buy Chrome if Google has to sell it

Perplexity has expressed interest in acquiring Chrome if Google is forced to divest it, echoing a similar stance from OpenAI. The DOJ trial highlights concerns over Google’s dominance in search and web infrastructure, with implications for the AI race. (IndiaToday)

Amazon’s Starlink competitor runs into production delays

Amazon’s Project Kuiper, designed to rival SpaceX’s Starlink by launching satellites to provide internet connectivity, is facing significant production delays, according to Bloomberg. The initiative has only completed a few dozen satellites and needs to increase production fourfold to meet a government deadline requiring 1,600 satellites to be launched by next summer. Project Kuiper is far behind Starlink, which has around 8,000 satellites and over 5 million customers. Additionally, Kuiper's satellites have encountered further setbacks due to rocket launch delays, with a planned launch earlier this month being postponed due to weather, now rescheduled for next week. (TechCrunch)

YouTube Shopping Officially Arrives In Malaysia after Indonesia

Google has also launched YouTube Shopping in Malaysia, expanding its partnership with Shopee to let creators monetize by tagging products directly in videos. Viewers can now purchase featured Shopee items without leaving the platform—creating a seamless e-commerce experience. This follows YouTube's earlier rollout in Indonesia (Sept 2024), where the affiliate program debuted in SE Asia, aiming to support local creators and MSMEs. The initiative is part of Google’s broader push to turn YouTube into a shoppable content platform across the region. (Lowyat.net)

Korean undergrads challenge ElevenLabs & OpenAI with open-source voice AI

Two students launched Dia, a 1.6B param TTS model built entirely on free Google TPUs — no funding, no corporate backing.

Why this matters:

- Real-time, multi-speaker, emotional voice synthesis

- Handles non-verbal cues (e.g. laughter, coughing)

- Fully open-source, local deployment — no filters or paywalls

- Early demos rival top players like ElevenLabs

Positioned as the most advanced open-source alternative in voice AI. (Github, Hugging face)

To see the full version of this News, please click here