BRIDS Market Pulse

In the spotlight

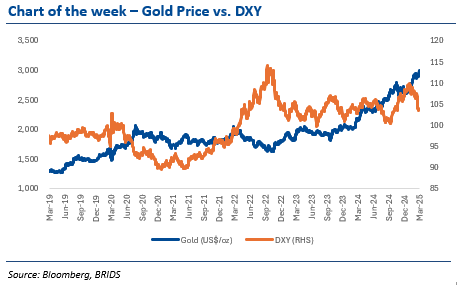

- Market: JCI fell -1.8% w-w, along with most of the regional markets, amid corrections in the US market indices due to concerns on growth outlook. Foreign investors’ outflow returned with -US$226mn w-w, mainly still concentrated in the big banks. EM peers were also hit by foreign outflows across the board. Gold price reached an all-time high level at US$3000/ oz, indicating funds’ flight to safety.

- GOTO FY24 earnings: GOTO reported adjusted EBITDA of Rp399bn (+193% qoq, +3485 yoy), better than consensus analysts’ expectations, though in line with ours. All 3 pillars (ODS, GTF, Ecommerce) were well in positive territory on the back of better Group core GTV, driven by improvement for both ODS and Fintech GTV.

- Banks: more potentials earnings risk. On the back of the news of the potential involvement of SOE banks in the Kopdes Merah Putih initiative, our analyst Victor see additional earnings downside risks. The worst-case scenario may see SOE banks’ CoC rise by 49-82bps in addition to higher liquidity risk. Maintain Neutral rating on the sector with BBCA as our top pick, followed by BTPS and BRIS given their better liquidity and NPL outlook.

- Metals sector down 14% w-w hit by govt’s proposal to increase royalty rate. Based on our calculation of metal mining companies under our coverage, the most to least impacted are INCO (-23% of FY25 projected earnings)> TINS (-20%)> MDKA (20%)> MBMA (-12%)> ANTM (-10%)> NCKL (-4%).

- Coal:

- We see a potential positive impact for IUPK holders from the proposed royalty plan.

- We downgrade our FY25 and LT coal price assumptions to US$110 and US$90/t, respectively, amid our expectation of China’s more aggressive production and persisting high inventory levels, and risk of Russia’s supply re-entering the market.

… Read More 20250317 BRIDSMarketPulse