BRIDS Market Pulse

In the spotlight

- Market: JCI saw another correction of -1.5% w-w, in-line with the performance of ASEAN markets. Foreign investors were net sellers with -US$148mn of outflow, bringing YTD outflow to US$611mn. We noted similar flows across EMs for the week and YTD.

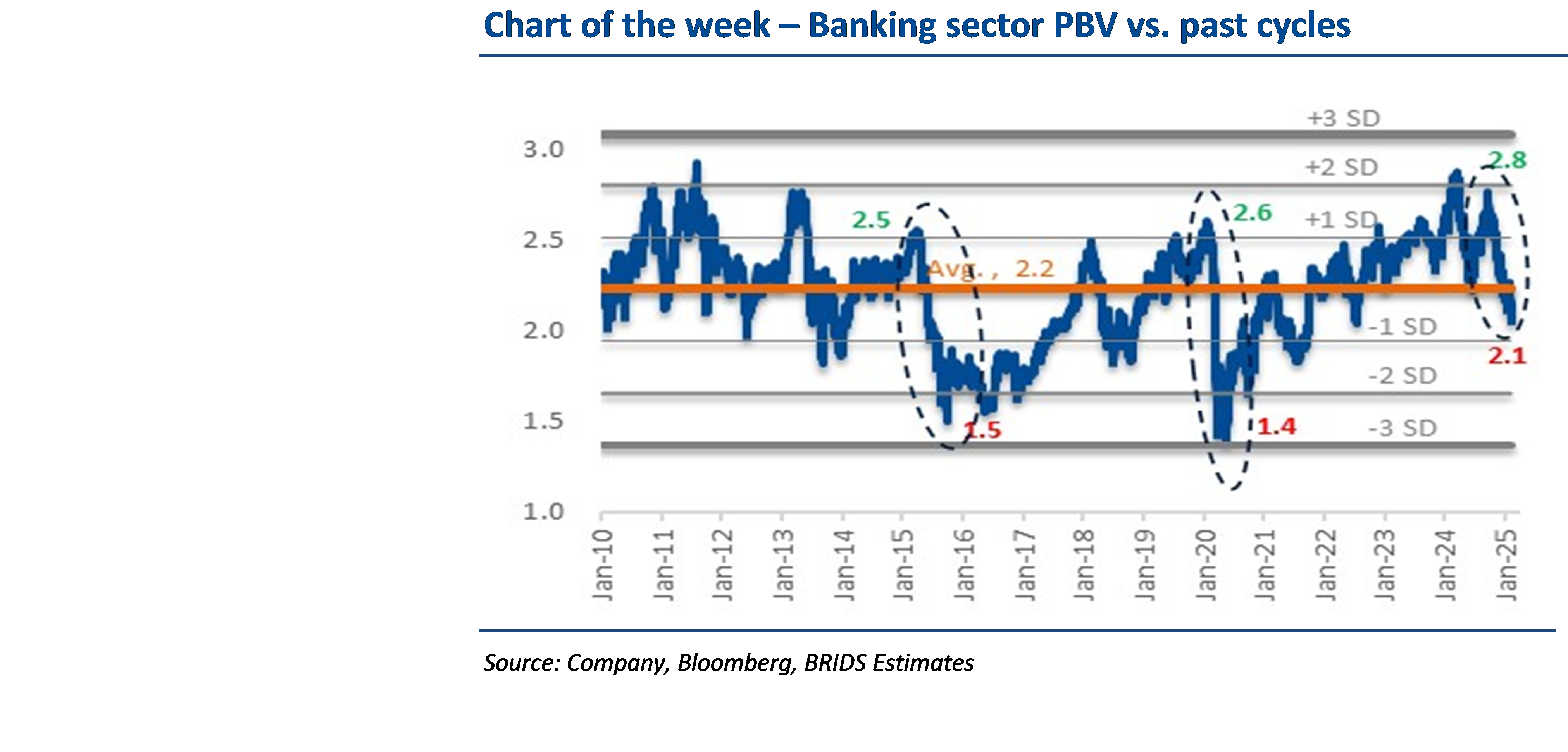

- Banking sector valuation: Our banking analyst Victor sees that although banks’ valuations have derated, their PBV has yet to hit bottom in the past two downcycles (i.e., FY15-16 and FY19-20). We also see banks continuing to face asset quality risk and tight liquidity. We maintain Neutral rating on the sector with BBCA (Buy, TP Rp11,900) as our top pick.

- BBRI FY24 results: in-line with consensus estimates’ low expectations. FY24 net profit of Rp60tr (flat yoy), with lower NIM and higher CoC offset by higher non-interest income. 4Q24’s CoC improved to 2.8% (3Q24: 3.2%) but was largely driven by provision reversal of Pegadaian. Mgmt expects 7-9% loan growth, 7.3-7.7% NIM, and 3.0-3.2% CoC.

- UNVR FY24 results: another miss due to soft 4Q24 revenue amid de-stocking. Following the FY24 results miss, we cut our FY25/26 net profit forecasts by 10%/13% due to lower volume, lower ASP, and higher opex. Mgmt guides that stock reduction will continue until 1Q25. We upgrade our rating to Hold with TP Rp1,500.

- Telco sector: market concern over price war is resurfacing following ISAT’s weaker-than-expected 4Q24 results (93% of our FY24F), which saw its subscribers falling by 4mn and an indication of price cuts in mobile starter packs. TLKM responded to this concern stating that issues stating that Telkomsel’s By.U serves as a tactical move to build a second-tier digital brand within strict timeline. We currently have an OW rating on Telco sector, with a preference for ISAT (Buy, TP Rp3,200).

- Commodities: A mixed week in coal with ICI1-3 and Newcastle correcting 1.5-6.1% w-w, but ICI4-5 recovering 0.5-1.9% w-w. We see a positive surprise from China’s inventory restocking at port which started to gain traction.

… Read More 20250217 BRIDSMarketPulse