|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

Astra International: 3Q25 Marks Earnings Bottom; FY26F Recovery Driven by Auto and FinSer (ASII.IJ Rp6,525; BUY TP Rp7,450) · We raised FY26F net profit by +5% to Rp32.8tr, reflecting stronger Automotive margins as Astra’s brand strength limit discounting. · Seasonally strong Nov-Dec 4W industry volume should reinforce the recovery momentum. · Maintain Buy rating with higher TP of Rp7,450 (9.2x FY26F P/E; +1SD), backed by a ~7% dividend yield. To see the full version of this report, please click here

Surya Semesta Internusa: 9M25 Missed Expectation, but Subang’s LT Outlook is Intact; Upgrade to Buy on Better Entry Point (SSIA.IJ Rp1,655; BUY TP Rp2,050) · Soft pre-sales bookings and hotel business performance led to soft 9M25 earnings, with PATMI at only Rp6bn (2/3% of our/cons. FY25F). · SSIA lowered revenue/NP guidance by 8%/34% and we also lowered our PATMI by 34%/30%, reflecting weak hotels and higher MI in 9M25. · Raising our disc. to RNAV to 58% and cut TP to Rp2,050, yet upgrade rating to Buy on better entry level amid intact Subang’s LT EV-hub story. To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS |

||||||||||||

MACROECONOMY

|

Indonesia’s Retail Sales Index Projected to Grow 4.3% yoy in Oct25 Indonesia’s retail sales performance is expected to improve in October 2025, with the Real Sales Index projected to grow 4.3% yoy, up from 3.7% in September. The increase is driven by stronger sales in food, beverages, tobacco, cultural goods, and household supplies, supported by rising demand ahead of the Christmas holidays. (Bank Indonesia) |

SECTOR

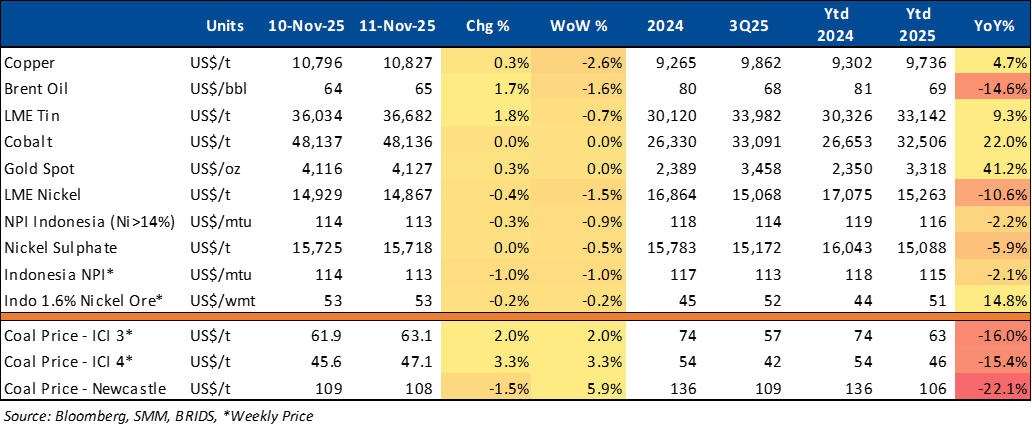

Commodity Price Daily Update Nov 11, 2025

Indonesia: ESDM Allocates Rp4.4tr to PLN

The Ministry of Energy and Mineral Resources (ESDM) allocated Rp4.4tr to PLN in 2025 from a revised Rp14.1tr budget to support rural electrification and free electricity connections for low-income households. The allocation, part of a Rp6.28tr budget increase approved in August, aims to accelerate access to electricity across Indonesia. As of 10 November 2025, ESDM’s budget realization stood at 31.12%, with a year-end target of 91.68%, while total investment for nationwide electrification through 2029 is projected to reach Rp64.09tr. (Kontan)

CORPORATE

BMRI disbursed Rp38.11tr in KUR as of Oct25

BMRI disbursed Rp38.11tr in Kredit Usaha Rakyat (KUR) to 329,012 MSMEs as of Oct25, achieving 93% of its annual target with NPL below 1%. Most funds went to productive sectors, mainly agriculture and services. Since 2008, total KUR distribution has reached Rp300.52tr to 3.56mn borrowers nationwide. (Emiten News)

BREN Allocates US$250mn Capex in 2026 to Boost Geothermal Capacity

BREN plans to raise its geothermal power capacity to 1.9 GW by 2032, allocating US$250mn (Rp4.17tr) in capex for 2026, up from US$100mn in 2025. The company targets 1 GW capacity by 2026, supported by ongoing projects such as Wayang Windu Unit 3 (30 MW), Salak Unit 7 (40 MW), and several retrofit projects adding over 25 MW by 2026. In the long term, BREN aims to add 900 MW of new geothermal capacity and expand its wind energy portfolio to 398 MW by 2032. (Bisnis)

EMTK Distributes Rp305.73 Billion in Interim Dividend

EMTK has announced the distribution of an interim dividend for the 2025 fiscal year totaling Rp305.73bn, equivalent to Rp5 per share. The cum-dividend date in the regular and negotiation markets is set for November 19, 2025, while the ex-dividend date will fall on November 20, 2025. (Bisnis)

GOTO Investors Push to Oust CEO Patrick Walujo Amid Grab Merger Talks

A group of major GoTo Group backers — including SoftBank Group Corp., Provident Capital Partners, and Peak XV — are reportedly seeking to replace CEO Patrick Walujo, a move that could accelerate merger discussions with Grab Holdings Ltd. Several shareholders, including some of GoTo’s co-founders, have signed a memo requesting an extraordinary general meeting (EGM) to vote on Walujo’s removal, citing a 40% decline in GoTo’s market value under his leadership and his perceived opposition to a Grab takeover, according to people familiar with the matter. (Bloomberg)

TPIA–Glencore JV Partners with Aether Fuels to Develop SAF Production Facility in Singapore

Aster Chemicals & Energy Pte. Ltd., the joint venture between TPIA and Glencore, has partnered with Aether Fuels to build a sustainable aviation fuel (SAF) production facility in Singapore. The project will utilize Aether Fuels' Aurora technology. The planned facility is designed to produce up to 50 barrels per day, equivalent to around 2,000 tons of fuel per year. Construction is targeted to begin in 2026, with commercial operations expected to start in 2028. (Bisnis)

UNTR Revises Heavy Equipment Sales Target to 4,500 Units

UNTR has revised its full-year heavy equipment sales target to approximately 4,500 units, down from the initial projection of 4,600 units set earlier this year. The revision reflects slower-than-expected sales growth in the mining and forestry sectors, as national coal production is anticipated to decline this year, leading to lower demand for heavy equipment compared to previous forecasts. (Kontan)