|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

Metal Mining: Nickel Ore Premium Might be Here to Stay; Tin Price Rebound on Supply Tightness (NEUTRAL) · Jan25 tin exports declined -67% mom due to a delay in export permits, supporting tin price, though exports are back on track by mid-Feb. · Ni ore premium rises on a strong restocking phase, whilst NPI rose to US$12k/ton after Gunbuster downsized its operations. · We reiterate our Neutral rating on the sector, with TINS, NCKL, and ANTM as our top picks and winners from this situation. To see the full version of this report, please click here

Telco: Meeting with Komdigi: Pressing on new auctions; Pending Regulations and Vendors' Response (OVERWEIGHT) · We hosted Komdigi representatives, who shared updates on pending 1.4GHz regulation as vendors finalize 5G TDD compatibility and costs. · Komdigi plans to hold 2.6GHz and 700MHz auctions in 2025, prioritizing 2.6GHz for 5G, while 3.5GHz remains unavailable until 2028. · We believe MNOs currently hold greater strengths than future BWA players and maintain our view on MNOs’ growth through FMC strategies. To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

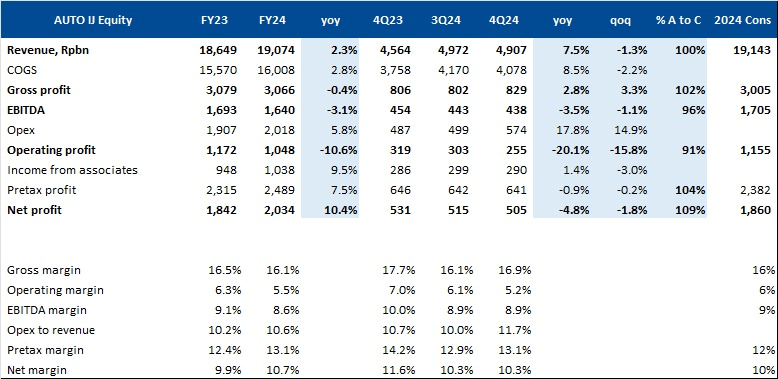

RESEARCH COMMENTARY AUTO (Not Rated) - FY24 Results · AUTO recorded NP of Rp2.03tr in FY24 (+10% yoy, 109% of cons or above), driven by growth on income from associates (+9.5% yoy), which was able to offset declining margin (-40/-50 bps lower on GPM/EBITDAM) and lower revenue growth (only +2% yoy). 4Q24 NP reached Rp505bn (-1.8% qoq/-4.8% yoy). · Revenue reached Rp19.07tr (+2% yoy, 100% of cons or in-line) in FY24, with 4Q24 revenue reaching Rp4.9tr (-1.3% qoq/+7.5% yoy). This is in-line with the 4W recovery in 2H24 of 11% vs. 1H24, while AUTO 2H24 revenue was 7% higher vs. 1H24 revenue. · However, GPM and EBITDA margin declined, by 40bps and 50 ps respectively in FY24, mostly due to rising opex (+6% yoy, thus opex to revenue increased from 10.2% in FY23 to 10.6% in FY24). Some items that increase significantly: professional fees (+23% yoy) and repair & maintenance (+51% yoy). · Income from associates grew by 9.5% yoy to Rp1.03tr, mostly driven by Denso (+24% yoy), which able to offset declining growth on other smaller associates (GS Battery -8%, Akebono Brake -29% yoy, Inti Ganda Perdana -26% yoy). · AUTO is trading at a forward PER of 4.9x, at -1 std dev of its 5-year mean. (Richard Jerry, CFA & Sabela Nur Amalina – BRIDS)

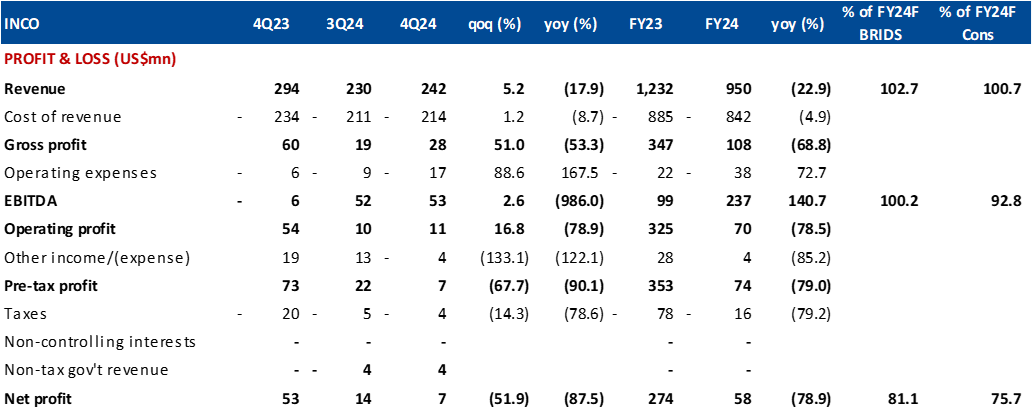

INCO (HOLD, TP: Rp3,900) - FY24 Results · 4Q revenue slightly grew to US$242mn, +5.2% qoq, though FY24 revenue saw a -23% yoy decrease, reaching 103%/100% of ours/cons estimate · INCO recorded a professional fee of US$8mn in 4Q24, which increased opex to US$17mn, +89% qoq and operating profits down to US$11mn, +17% qoq. · There was an asset revaluation on KNI call option of US$10.2mn in 4Q24, which brought pre-tax profits down to US$7mn, -68% qoq. The main changes on the revaluation is the LME nickel price assumption that was lowered to US$17.1-17.6k/ton from US$17.4-19.5k/ton · Thus, 4Q NP declined to US$7mn, -52% qoq, whilst FY24 NP also declined -79% qoq to US$58mn, reaching only 81%/76% of ours/cons estimate. (Timothy Wijaya – BRIDS)

SRTG (Not Rated) - KTA Notes · Saratoga’s blue-chip holdings include Adaro, AlamTri, Merdeka Copper Gold, and Tower Bersama, where monetization options like a dual listing or stake sale are being considered. In growth investments, key assets include MPMX (2W distribution), Samator Indo Gas (Indonesia’s largest industrial gas company, with CVC holding a 35% stake and a potential buyout), and Brawijaya Hospital, a premium chain with 7 hospitals in the pipeline, including a Taman Mini facility and an IPO target in 6-7 years. Other holdings include ZAP Clinic (100+ beauty clinics, expanding into skincare) and MGM Bosco Logistics (cold-chain provider adding one facility per year). · SRTG trades at a 53% NAV discount, driving a shift in IR strategy to improve market perception and liquidity. With a 9.7% free float, shareholder discussions focus on the valuation gap. Dividend income supports debt repayment and distribution, while MDKA and ADRO ramp up production, reducing the need for external fundraising. The focus remains on strategic monetization and expanding healthcare and logistics via Brawijaya and MGM Bosco.

MARKET NEWS |

||||||||||||

SECTOR

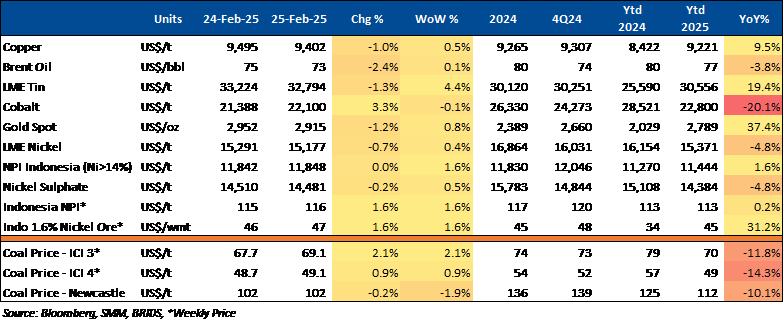

Commodity Price Daily Update Feb 25,2025

Coal Exports to Use HBA Starting March 1, 2025

The Ministry of Energy and Mineral Resources (ESDM) has issued a new regulation requiring Indonesian coal exports to use the Indonesian Coal Reference Price (HBA), replacing previous standards such as the Indonesia Coal Index (ICI) and Newcastle Coal Futures. The implementation of HBA as the export standard will commence on March 1, 2025. (Kontan)

2025 Eid Homecoming: Government Ensures 20% Toll Discount and Pothole-Free Roads

The government held a coordination meeting at Kemenko Polkam to ensure readiness for Ramadan and Eid al-Fitr 1446 H, covering security and travel policies. Deputy Coordinating Minister confirmed efforts to facilitate the holiday period, including a 20% toll discount and ongoing discussions on airfare reductions, expected to exceed the 10% cut during the previous holiday season. (Kontan)

Indonesia and Apple Reach an Agreement on iPhone 16 Sales Ban

The Indonesian government and Apple Inc. have reached an agreement to lift the sales ban on the iPhone 16, with a deal expected to be signed soon, possibly this week, according to Bloomberg News. Neither Apple nor Indonesia’s Ministry of Industry has issued an official statement, but the latest developments indicate that the ban's removal is imminent, allowing Indonesian consumers to access Apple's latest device officially. (Kontan)

CORPORATE

BUKA: Emtek's Subsidiary Acquires 9.73bn BUKA Shares

The controlling shareholder of BUKA, PT Kreatif Media Karya (KMK), has accumulated 9.73bn shares of BUKA. KMK purchased 9.73bn shares of BUKA, representing 9.44% of the total issued and paid-up shares of BUKA. The transaction value reached Rp1.34tr, with a purchase price of Rp138 per share. (Bisnis)

DOID Signs Loan Facility Agreement with BNI, BCA, and Bank Mandiri

DOID, together with its subsidiary PT Bukit Makmur Mandiri Utama (BUMA), has signed an amendment to its loan facility with BNI, Mandiri, and BCA. This accordion facility has an aggregate principal amount of US$250mn, consisting of a USD-denominated facility of up to US$75mn and an IDR-denominated facility of up to Rp2.88tr. (Kontan)

Honda Expands Certified Used Car Services in Cikarang

PT Honda Prospect Motor (HPM) launched Honda Cikarang Used Car, its first certified used car dealership in Cikarang, Bekasi. The dealership offers certified pre-owned vehicles along with sales, after-sales services, and body and paint facilities, providing a comprehensive solution for customers in one location. (Kontan)

ISAT and Cisco Collaborate to Enhance Cybersecurity in Indonesia

ISAT and Cisco have announced a strategic partnership to strengthen cybersecurity defenses for businesses in Indonesia. This collaboration responds to the growing complexity of digital risks, particularly for companies operating in hybrid and multi-cloud environments. ISAT and Cisco are offering a comprehensive suite of services, including consulting, managed services, Firewall, Secure Service Edge (SSE), Extended Detection and Response (XDR), Multi-Factor Authentication (MFA), and Splunk for data analytics and threat monitoring. (Investor Daily)

Unilever and Nestlé Exit Plant-Based Meat Amid Leadership Change

Unilever plans to sell The Vegetarian Butcher as demand for plant-based meat declines, while Nestlé scales back its Garden Gourmet brand. The market shrank to US$1.6bn in 2023 as consumers favor fresh foods. (Kontan)

Meanwhile, Unilever ousted CEO Hein Schumacher, replacing him with finance chief Fernando Fernandez to accelerate its turnaround. (Reuters)