FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Oil and Gas: Possible gas export ban is unlikely to materialize (NEUTRAL)

- The MEMR mentioned a potential suspension of natural gas exports to prioritize domestic use amidst rising demand.

- Though backed by Presidential Regulation no.22/2017, we believe companies under our coverage are hardly affected.

- We maintain our Neutral stance, favoring WINS>MEDC as we see WINS could benefit from elevated charter rates and higher utilization.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

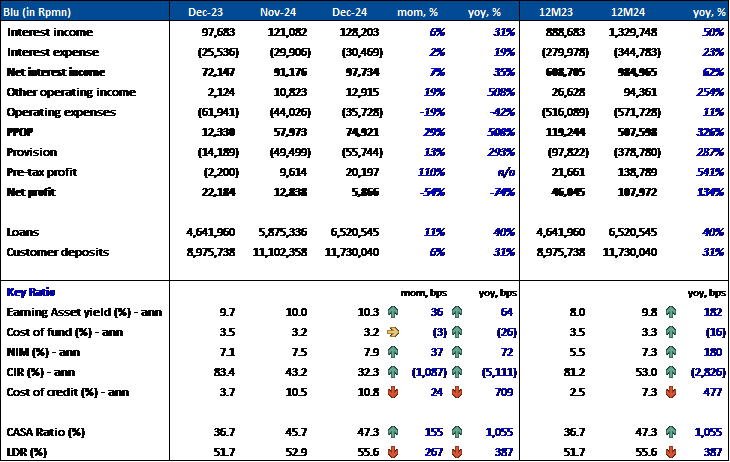

BCA Digital (Blu) - Dec24 Results

FY24 Insights:

- Net Profit Growth Driven by NII: Blu reported a net profit of Rp108bn (+134% yoy) in FY24, driven by a 62% yoy increase in NII, which offset a 287% yoy rise in provisions.

- Significant CIR Improvement: Despite an 11% increase in opex, CIR improved significantly to 53.0% in FY24, down from 81.2% in FY23, primarily due to higher NIM and strong loan growth.

- NIM Boosted by EA Yield: NIM rose to 7.3% (+180bps yoy) in FY24, as CoF decreased to 3.3% (-16bps yoy) and EA yield increased to 9.8% (+182bps yoy).

- CoC Rise Amid Strong Loan Growth: CoC climbed to 7.3% in FY24, up from 2.5% in FY23, as loans expanded by 40% yoy.

Dec24 Insights:

- Net Profit Decline Due to Incurred Tax Expenses: Blu’s net profit fell to Rp5.9bn (-54% mom, -74% yoy) in Dec24, despite a drop in CIR, as tax expenses amounted to Rp14.3bn (effective tax rate: 71%), compared to tax expense reversals in both Nov24 (Rp3.2bn) and Dec23 (Rp24.4bn).

- CIR Declined: CIR dropped to 32.3% in Dec24, from 83.4% in Dec23 and 43.2% in Nov24. The yoy decrease was mainly driven by a 35% yoy rise in NII and a 42% yoy decline in opex (salary expenses: -66% yoy). The mom improvement was largely due to a 19% mom reduction in opex (promotion expenses reversal: Rp6.9bn).

- A Rise in NIM: NIM rose to 7.9% (+37bps mom, +72bps yoy) in Dec24, with a lower CoF at 3.2% (-3bps mom, -26bps yoy) and a higher EA yield at 10.3% (+36bps mom, +64bps yoy).

- Higher CoC: CoC rose to 10.8% (+24bps mom, +709bps yoy) in Dec24.

- Loans and Customer Deposits: Loan growth of 40% yoy (+11% mom) outpaced customer deposit growth of 31% yoy (+6% mom), resulting in a higher LDR of 55.6% (+267bps mom, +387bps yoy). The CASA ratio climbed to 47.3% (+155bps mom, +1,055bps yoy), marking its highest level to date.

Summary:

- Overall Performance: Despite higher tax expenses leading to a net profit decline in Dec24, Blu’s performance in FY24 was solid as the bank managed to lower its CIR and improve its NIM. Furthermore, loan and customer deposit growth remained robust, with the CASA ratio reaching a record high. However, the rise in CoC presents a potential risk to Blu’s future performance, as it has reached one of its highest levels to date. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

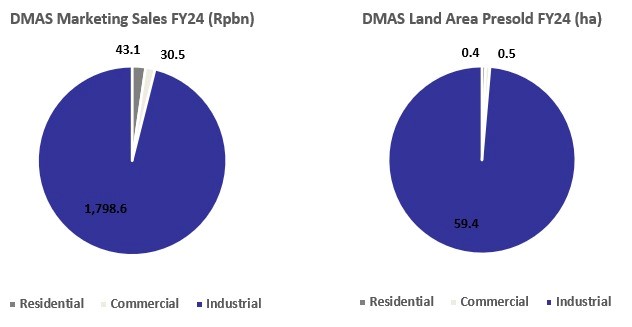

DMAS (Buy, TP Rp190) - Booked Rp1.87tr in FY24 Marketing Sales (In-Line with Our/Co's Guidance)

- DMAS booked marketing sales of Rp428bn in 4Q24 (+23%qoq), bringing its FY24 achievement to Rp1.87tr (+2%yoy), relatively in-line with our estimates of Rp1.83tr (102%) and co's guidance of Rp1.81tr (104%).

- Data center remain dominating with contribution of >60% to marketing sales, which we believe helped sustain industrial land ASP increases from ~Rp2.71mn/sqm in FY23 to ~Rp3.03mn/sqm in FY24 (+11%yoy). Our estimation of current landbank post FY24 marketing sales size is as follows; Industrial 151ha, Commercial 358ha, Residential 171ha, Totaling 680ha).

- Company also continuously improving access to its estate through developing; Deltamas Bhagasasi Flyover, new Japek Selatan II Toll Access (KM 31 & 42), and bridges from High-Speed Train Station Karawang.

- FY25 guidance is pending for an official announcement. We currently have a Buy rating for DMAS with TP of Rp190 based on our 72% disc.to.RNAV, while the stock currently trading at ~76% disc.to.RNAV. (Ismail Fakhri Suweleh – BRIDS)

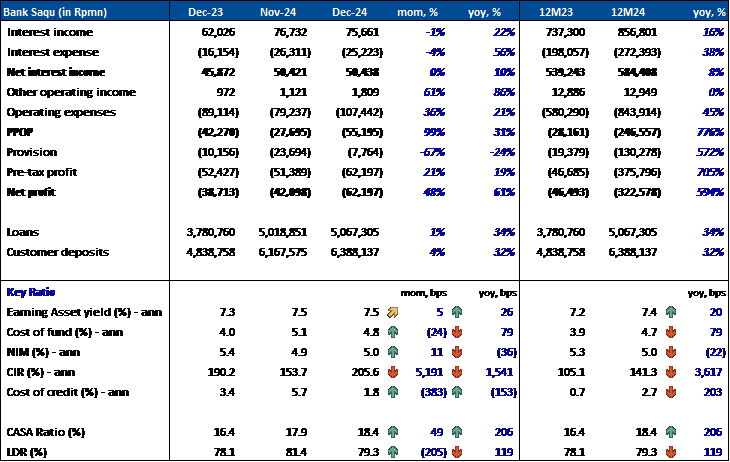

SAQU (Not Rated) - Dec24 Results

FY24 Insights:

- Net Loss Due to Elevated Opex: SAQU reported a net loss of Rp323bn in FY24, despite generating Rp584bn in NII, as operating expenses surged to Rp844bn.

- CIR and Opex: The CIR reached 141.3% in FY24, driven by substantial opex, primarily due to other expenses (Rp365bn) and salary costs (Rp282bn).

- NIM: NIM stood at 5.0% in FY24, with an EA yield of 7.4% and a CoF of 4.7%.

- Given that SAQU launched as a digital bank towards the end of FY23, we believe a yoy comparison may not fully capture the bank's performance trajectory.

Dec24 Insights:

- 48% mom Increase in Net Loss: SAQU’s net loss rose by 48% mom to Rp62bn in Dec24, despite a 67% mom decline in provisions, as NII growth remained flat and opex surged by 36% mom.

- Significant Rise in CIR: CIR increased to 205.6% in Dec24, up from 153.7% in Nov24, primarily due to a 36% mom rise in opex, driven largely by a 164% mom increase in salary expenses.

- Higher NIM: NIM rose to 5.0% (+11bps mom) in Dec24 as the EA yield increased by 5bps mom to 7.5%, and CoF declined by 24bps mom to 4.8%.

- Substantial CoC Improvement: CoC improved to 1.8% in Dec24 from 5.7% in Nov24.

- Loans and Customer Deposits: Loans remained stable at Rp5.1tr (+1% mom), while customer deposits grew to Rp6.4tr (+4% mom), resulting in a lower LDR of 79.3% (-205bps mom). The CASA ratio improved slightly to 18.4% (+49bps mom).

Summary:

- Overall Performance: In our view, the bank’s performance continues to reflect the cost burdens associated with its early development phase, necessitating substantial investment, which in turn has resulted in a high CIR. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

GOTO and Grab Said to Have Revived Merger Talks with 2025 Deal in Sight

GOTO and Grab have revived their merger talks, with a potential deal expected to be finalized in 2025. The discussions, which had previously stalled, have recently gained momentum, and both companies are now determined to complete the merger within the year. An executive involved in the talks emphasized that if the deal does not happen by then, it may not happen at all, with negotiations being led by a top executive from Provident Capital Partners. Meanwhile, GOTO has clarified that there is no agreement regarding a merger plan and that there are no discussions about any deal with Grab. (DealStreetAsia, IDX)

Comment:

- We understand that merger talks have resurfaced due to pressure from activist investors advocating for a deal. However, the company’s official stance does not acknowledge any such initiative.

- In our view, activist shareholders likely see a merger as a way to enhance their future returns and are pushing for it due to its potential benefits, including reduced pricing competition, stronger bargaining power with drivers, and improved long-term profitability. That said, we believe GOTO can still capitalize based on its current situation by leveraging its internal data analytics, driving product innovation in ODS services, and advancing its fintech ambitions, particularly by integrating AI to build long-term value. (Niko Margaronis & Kafi Ananta- BRIDS)

MARKET NEWS

MACROECONOMY

China Retaliates with Tariffs on Coal, LNG, Oil, and Agricultural Products

China retaliates with 15% tariff on coal and LnG, and 10% tariff on oil and agricultural products. (Bloomberg)

SECTOR

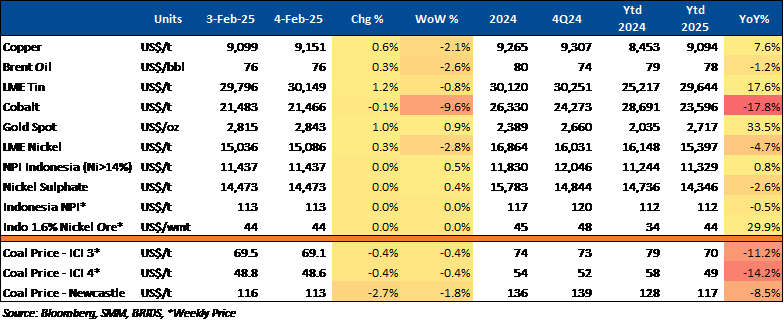

Commodity Price Daily Update Feb 4, 2025

Automotive: IIMS 2025 to Feature New Car Launches

The Indonesian car market is set for increased competition as 31 brands showcase new models at IIMS 2025 from 13–23 Feb25. Geely and BYD will introduce new EVs, Chery will debut the Tiggo Cross SUV and PHEV technology, while Wuling plans to launch two new models. Honda, Toyota, and Suzuki will unveil electrified and concept cars, and Hyundai is expected to launch at least one EV, possibly the Hyundai Inster. Dyandra Promosindo aims to achieve Rp6.7tr in transactions at IIMS 2025, matching IIMS 2024, which sold 19,200 vehicles and attracted 562,000 visitors. (Kontan)

Cigarette: Traditional Retailers Support Tobacco Consumption Awareness Campaign

The Indonesian Traditional Retailers Association (Perpeksi) supports an awareness campaign limiting cigarette sales to those under 21 through prohibition stickers, seeing it as a better alternative to new regulations under PP 28/2024. Perpeksi opposes the ban on cigarette sales near schools, arguing that it harms MSMEs, where cigarette sales account for 60% of revenue. They criticize the policy as a double standard, unfairly targeting the tobacco industry without viable solutions. (Kontan)

CORPORATE

MEDC Addresses Oil Pipeline Leak

MEDC swiftly handled an oil pipeline leak in Desa Tempirai, South Sumatra, through prompt cleanup and infrastructure repairs. The company ensured that operations remained unaffected. Police investigations confirmed that the leak was caused by vandalism, with further inquiries still ongoing. (Emiten News)

PTBA Achieves Coal Sales of 42.9MT in 2024

PTBA recorded its highest-ever coal sales, reaching 42.9MT in 2024, a 15.9% yoy increase. This growth in sales volume was driven by a 30% yoy increase in export volume, which amounted to 20.3MT. In addition to India, exports to Vietnam, Thailand, and Malaysia have also increased. Looking ahead to 2025, PTBA targets coal production of 50MT, sales of 50.1MT, and transportation of 43.2MT. (Kontan)