FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Summarecon Agung: Soft Pre-sales but Remains a Bargain in the Sector (SMRA.IJ Rp 535; BUY TP Rp 800)

- SMRA’s robust 9M24 results were primarily driven by the mixes of product handover from pre-sales during 3Q22-2Q23.

- We lower our FY24-26F pre-sales target by 6-11% and adjust revenue recognition schedule, leading to a downward FY25-26F NP by 4-5%.

- We maintain our Buy rating with a lower TP of Rp800, as we assigned a higher disc. to RNAV to incorporate a weaker pre-sales outlook.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS

SECTOR

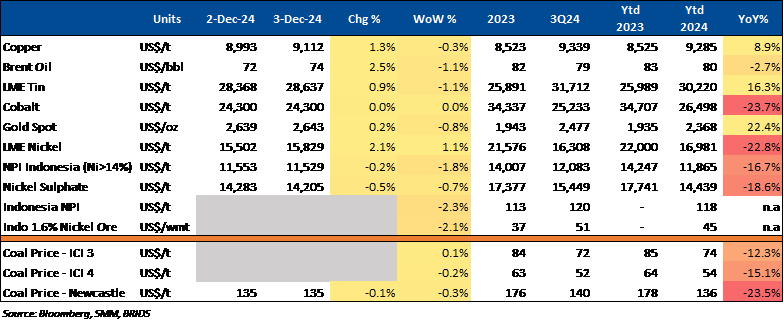

Commodity Price Daily Update Dec 3, 2024

Automotive: Indonesian Automotive Industry Faces Tough Challenges

The Indonesian automotive industry is struggling with a sluggish market, worsened by the government's planned 12% VAT increase in 2025. Car manufacturers are also concerned about the new tax regulations from Law No. 1/2022, which introduces higher vehicle taxes (PKB and BBN-KB). Gaikindo warned that these tax hikes could raise car prices significantly, with impacts of Rp12mn for a Rp200mn vehicle and up to Rp24mn for higher-priced vehicles (Rp400mn). Due to high interest rates and the looming tax increases, Gaikindo has reduced its 2024 sales target from 1.1mn units to 850k, with a 15% decline in sales compared to 2023. (CNBC)

Automotive: Chinese EV Maker Eyes Indonesian Market

Chinese automakers continue expanding into Indonesia, with Changan Auto reportedly planning to enter the local EV market. According to Periklindo, several brands, including Changan, Geely (via Aletra), and MAB, are committed to assembling EVs in Indonesia. (Kontan)

Minister of Communication and Digital Invites Preachers to Combat Online Gambling

Minister Meutya Hafid has urged preachers (DAI) to combat online gambling through advocacy and by improving digital literacy. He highlighted the need for awareness in vulnerable communities and collaboration with stakeholders for educational initiatives. Efforts are also underway, in collaboration with the Indonesian Child Protection Commission, to protect children from harmful online content. The Ministry has blocked over 5.3mn gambling-related sites, aiming to create a resilient society against online gambling. (Kemkomdigi TV)

SKK Migas Signs First New Gross Split Contract for Central Andaman

SKK Migas and a consortium of Harbour Energy Central Andaman Ltd. and Mubadala Energy (Central Andaman) RSC Ltd. signed the Central Andaman oil and gas block contract, the first under the new Gross Split scheme. The consortium paid a US$300k signing bonus and provided a US$1.5mn performance guarantee. Additionally, the Ministry of Energy and Mineral Resources announced the second phase of the 2024 oil and gas block auction, offering six blocks, including five direct offers and one regular auction. (Kontan)

CORPORATE

BFIN to Distribute Rp421.1bn Interim Dividend

BFIN will distribute an interim dividend of Rp421.1bn, or Rp28/share (yield: 3.1%). Key dates: cum date (regular/negotiated) on 11th Dec24, ex-date on 12th Dec24, and recording date on 13th Dec24. Payment is scheduled for 19th Dec24. (Bisnis)

EMTK to Conduct MESOP of 75mn Shares

EMTK is set to carry out a private placement of 75mn shares. The new shares will have a nominal value of Rp20 each. The MESOP program will be offered at an exercise price of Rp436 per share. Based on this pricing scheme, the private placement under the MESOP program is valued at Rp32.7bn. MESOP program is scheduled to take place on December 11, 2024, with the announcement of the program's results slated for December 13, 2024. (IDX)

MTEL Competes Closely with TOWR in Fiber Optic Assets

MTEL is set to announce the acquisition of fiber optic assets from PT Ultra Mandiri Telekomunikasi on December 4, 2024. This move reinforces Mitratel’s position as it competes with PT Sarana Menara Nusantara Tbk (TOWR), which leads in fiber optic ownership with 220,975 kilometers, compared to Mitratel’s 36,257 kilometers. The acquisition aims to enhance Mitratel’s market presence in the telecommunications sector. (Investor Daily)

TBIG to Distribute Rp566.4bn Interim Dividend

TBIG will distribute an interim dividend of Rp25/share (yield: 1.3%), amounting to Rp566.4bn for its 22.65bn shares as of 9M24. Key dates: cum date (regular/negotiated) on 11th Dec24, ex-date on 12th Dec24, recording date on 13th Dec24, and payment on 27th Dec24. (Bisnis)

WIFI Partners with Link Net to Boost ICT Solutions

WIFI's subsidiary, WEAVE, collaborates with Link Net to enhance ICT solutions in Indonesia. Link Net provides GPON-based infrastructure, while WEAVE handles internet services, installations, and maintenance, aiming to expand high-quality internet access nationwide. (IDX)