|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

BRIDS FIRST TAKE · Bank Rakyat Indonesia: Jul25 Bank-Only Earnings: NIM Pressure and Lower Recovery Offset Lower Opex and CoC (In Line) (BBRI.IJ Rp 4,170; Not Rated) To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

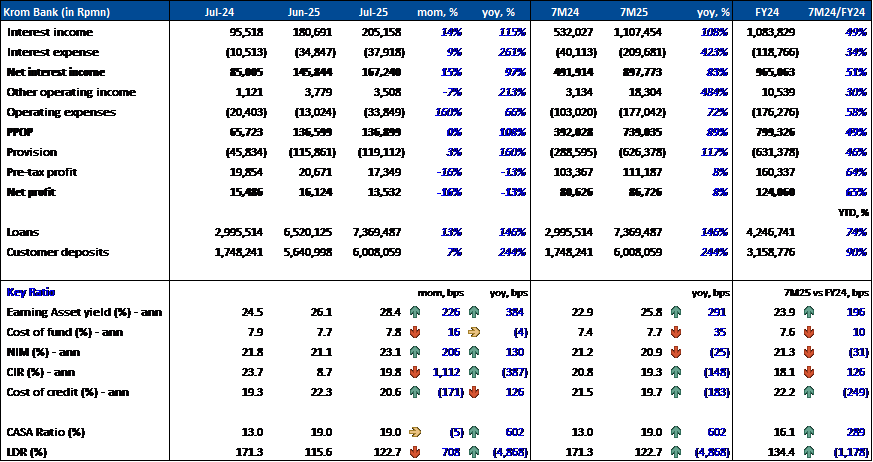

RESEARCH COMMENTARY KROM (Not Rated) - Jul25 Results Jul25 Insights: · Net Profit Decline on Higher Provisions: Net profit fell to Rp14bn (-16% mom, -13% yoy) in Jul25, weighed down by higher provisions (+3% mom, +160% yoy). · CIR: CIR stood at 19.8% in Jul25, down from 23.7% in Jul24 but up from 8.7% in Jun25. The yoy improvement was supported by 97% growth in NII, while the mom deterioration stemmed from higher opex (+160% mom) off last month’s low base. · Higher NIM on Stronger EA Yield: NIM expanded to 23.1% (+206bps mom, +130bps yoy), supported by record-high EA yield at 28.4% (+226bps mom, +384bps yoy), despite CoF inching up to 7.8% (+16bps mom, -4bps yoy). · CoC Remained One of the Highest in the Sector: CoC reached 20.6% in Jul25, down from 22.3% in Jun25 but up from 19.3% in Jul24, remaining among the highest in the digital banking sector. · Loans and Deposits: Loans and deposits grew 13% and 7% mom (+146% and +244% yoy), respectively, resulting in an LDR of 122.7% (+708bps mom, -4,868bps yoy). CASA ratio reached 19.0% (-5bps mom, +602bps yoy). 7M25 Insights: · 8% yoy Net Profit Growth Driven by Strong NII: KROM’s net profit rose 8% yoy to Rp87bn, supported by an exceptional 83% yoy increase in NII. · CIR Decline Despite Higher Opex: CIR fell to 19.3% (-148bps yoy), as robust NII offset a 72% yoy increase in opex, largely from other expenses (+76% yoy). · Lower NIM on Rising CoF: NIM declined to 20.9% (-25bps yoy), as CoF rose 35bps to 7.7%, partly offset by a 291bps increase in EA yield to 25.8%. · CoC Improvement: CoC improved to 19.7% in 7M25 (vs. 21.5% in 7M24). Summary: · Overall Performance: KROM’s Jul25 performance was constrained by higher provisions and elevated CoC (still one of the sector’s highest). A mom surge in opex from last month’s low base also dampened PPOP growth. Looking ahead, the bank’s key challenges lie in sustaining NIM expansion while keeping LDR manageable, alongside improving asset quality to bring CoC down. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

MARKET NEWS |

||||||||||||

MACROECONOMY

Indonesia: Danantara Plans to Raise Up to Rp50tr through “Patriot Bonds”

Danantara plans to raise up to IDR50tn ($3.1bn) through “patriot bonds”, targeting top business leaders via private placement. The bonds, offered in 5- and 7-year tenors at 2% coupons—below market rates—are framed as impact-driven, with proceeds channeled into projects like energy transition under the Indonesia Inc. strategy. (Bloomberg)

Indonesia: LPS Cuts Deposit Guarantee Rate to 3.75% After BI Rate Trim

LPS has lowered its deposit guarantee rate by 25 basis points to 3.75% for commercial banks and 6.25% for rural banks. The adjustment follows Bank Indonesia’s recent decision to cut its benchmark rate to 5.0% in Aug25. The policy, effective from August 28 to September 30, 2025, is aimed at aligning with current economic and banking conditions. (Bisnis)

SECTOR

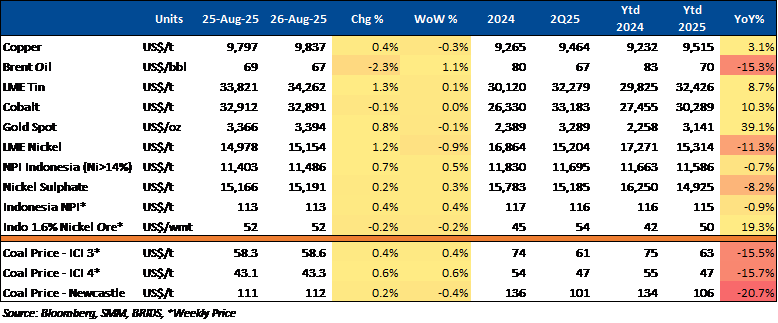

Commodity Price Daily Update August 26, 2025

CORPORATE

KLBF Subsidiary Designated as Central Laboratory for Vaccine and Biotechnology Development

The Directorate General of Pharmaceuticals and Medical Devices at the Ministry of Health has designated PT Kalbio Global Medika, a subsidiary of KLBF, as a center of excellence for vaccine and biotechnology product development. According to KLBF, the laboratory is already equipped with adequate infrastructure, quality management systems, and a proven track record in biological product development. (Kontan)

MTDL Targets Over 50% Growth in Data and AI Business

MTDL aims to grow its data and AI business by more than 50% this year, building on last year’s strong 56% annual growth. The company’s optimism is driven by the shifting role of AI, evolving from a passive information provider to an active entity capable of autonomous decision-making and execution. (Kontan)

TLKM’s NeutraDC Launches AI Solutions and Forms Regional Partnership

At the NeutraDC Summit 2025, Telkom’s NeutraDC unveiled Neutra Compute (GPUaaS) for high-performance AI computing and Neutra Connect for seamless data center interconnection. The company also signed an MoU with Sembcorp Development to develop sustainable data center infrastructure in Southeast Asia, focusing on Singapore and Indonesia. (Investor Daily)