FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Equity Strategy: External Risks Loom, But Improving Domestic Conditions May Cushion Against Further De-rating

- Amid the possibility of further tariffs to be imposed by Trump, we think key risk to watch remains on EM currency and market risk-offs.

- However, we see improving domestic conditions with fiscal discipline to support growth and falling SRBI yield to potentially aid liquidity.

- JCI’s undemanding valuation and intact earnings growth outlook shall buffer valuation; we continue to favor quality stocks and IDR hedge.

To see the full version of this report, please click here

Macro Strategy: Trump’s Tarriff Conundrum

- Trump’s aggressive tariff announcement is expected to have significant market impacts, given its broader and more extensive scope.

- Indonesia's primary risks would arise from financial channels, driven by currency pressure on stronger DXY and risk-off sentiment.

- Positive progress on Indonesia’s fiscal outlook with signal to reduce supply risk, uphold fiscal discipline and support growth improvement.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

BRIDS FIRST TAKE

- Link Net: Link Net new business model as a Fiber Factory (LINK.IJ Rp 2,430; NOT RATED)

To see the full version of this report, please click here

- Bank OCBC NISP: FY24 results: Robust Net Profit Growth Despite Merger Impact (NISP.IJ Rp 1,345; NOT RATED)

To see the full version of this report, please click here

MARKET NEWS

MACROECONOMY

Global Manufacturing Data in Jan25

Global Manufacturing Jan25:

- US Manufacturing PMI reached 51.2, expanding for the first time since July23.

- Japan Manufacturing fell to 48.7, marking the seventh consecutive months of contraction and at the slowest pace since Mar24.

- UK Manufacturing contracted with PMI of 48.2, slightly slower than December's 47, with new orders still declining amid weak domestic demand.

- Eurozone Manufacturing still contracting with PMI of 46.6, the slowest contraction pace in 8 months.

- China Manufacturing expanded slightly with a PMI of 50.1, the slowest expansion in 4 months due to declined foreign orders for two consecutive months. (Trading Economics)

Indonesia Inflation Declined to 0.76% yoy in Jan25

- Inflation in Jan25 declined to 0.76% yoy (-0.76% mom), primarily due to a 50% discount on electricity tariffs for January and February, which contributed -1.47 percentage points to the headline figure. Excluding this discount, inflation would have exceeded 2% yoy, highlighting underlying price pressures. Inflation Breakdown by Component:

- Core Inflation: +2.36% yoy, still influenced by rising gold jewelry and cooking oil prices.

- Volatile Inflation: +3.07% yoy, the highest in five months, driven primarily by surging chili prices.

- Administered Prices: -6.41% yoy, reflecting the electricity tariff discount, which was included in the CPI calculation as it did not alter the nature of the service and was widely accessible. (BPS)

Indonesia Manufacturing PMI Reached 51.9 in Jan25

Indonesia Manufacturing PMI reached 51.9 in Jan25, the highest since May24. Output expanded at the strongest pace since May with Foreign Orders rose for the second consecutive months. Employment increased at the fastest pace in 2.5 years. (Trading Economics)

SECTOR

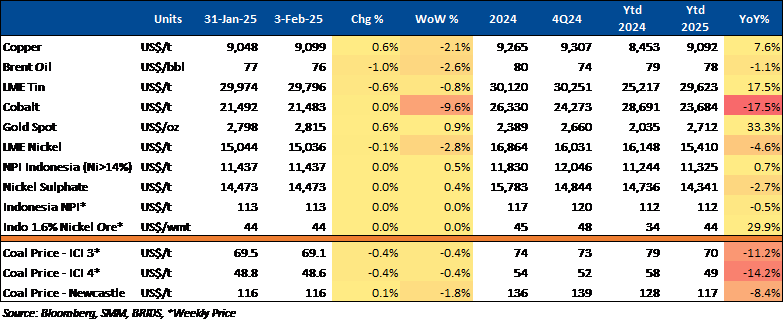

Commodity Price Daily Update Feb 3, 2025

Coal Mining: APBI Responds to Mandatory HBA for Coal Exports

The Indonesian Coal Mining Association (APBI) warns that enforcing Indonesia’s coal benchmark price (HBA) in exports could disrupt market dynamics, as HBA lags behind global indices (updated weekly). While supporting government efforts to regulate prices, APBI urges a thorough review before implementation. (Kontan)

CORPORATE

ADHI Targets a 30-40% Contract Growth in 2025

ADHI aims for a 30-40% increase in new contracts for 2025, dominated by engineering & construction (84%), followed by property (8%), manufacturing (6%), and investment & concession (2%). Contract sources include government (24%), SOEs (33%), private sector (20%), loans (15%), and ADHI itself. As of Dec24, ADHI secured Rp20tr in new contracts, up from Rp15.1tr in Nov24. (Kontan)

BYD to Launch Seal 05 DM-i on Feb25 in China

BYD will officially launch the Seal 05 DM-i plug-in hybrid sedan on February 10, 2025, after starting pre-sales on January 7. Available in three models, it is priced between 89,800–109,800 yuan (US$12,250–US$15,000) or Rp198–243mn. The car features BYD Ocean’s latest design, a transparent rear light, hidden exhaust, and a ducktail design. It includes multiple cameras for enhanced visibility. (MSN)

Freeport Yet to Receive Copper Concentrate Export Permit

The Ministry of Energy and Mineral Resources has not granted an export permit for copper concentrate to Freeport McMoRan (FCX) through PT Freeport Indonesia (PTFI). According to the Ministry of Energy and Mineral Resources Regulation No. 7 of 2023, Freeport's copper concentrate export permit expired on December 31, 2024. (Kontan)

TLKM and Thales Collaborate to Provide Smart City Solutions

TLKM has formed a strategic partnership with Thales through a Strategic Partnership Agreement (SPA). Thales is a French multinational company specializing in the design, development, manufacturing, and support of electronic systems, devices, and equipment for the aerospace sector. This partnership focuses on collaboration to deliver innovative digital security solutions tailored to the Indonesian market while accelerating the development and enhancement of Telkom’s capabilities in the Smart City sector. (Bisnis)