FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Coal Sector: Rising Indonesia production, but demand and cost curve remain supportive for price (OVERWEIGHT)

- Indonesia’s Jul24 coal production rose +10.7% mom/ +3.2% yoy to 72Mt, driving an improved 7M24 growth to 5.8% yoy (477Mt).

- China and India’s 6M24 imports have remained resilient, while Indonesia’s high production cost continues to offer support for price.

- We maintain OW rating on the sector but shift our preference to UNTR amid the ST supply risk from Indonesia.

To see the full version of this report, please click here

Bank Syariah Indonesia: In line 1H24 net profit supported by financing growth and lower provisions (BRIS.IJ Rp 2,610; BUY TP Rp 2,700)

- BRIS booked net profit of Rp1.7tr in 2Q24 (flat qoq, +24% yoy), bringing its 1H24 NP to Rp3.4tr (+20% yoy), i.e., in line with ours and consensus.

- NIM declined to 5.1% in 2Q24 (-23bps qoq, -76bps yoy), but the CoC remained robust at 0.9%, supported by improving MSME loan quality.

- We maintain our FY24F forecasts and TP of Rp2,700; reiterate our Buy rating with superior earnings growth vs. its peers as the key catalyst.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS

RESEARCH COMMENTARY

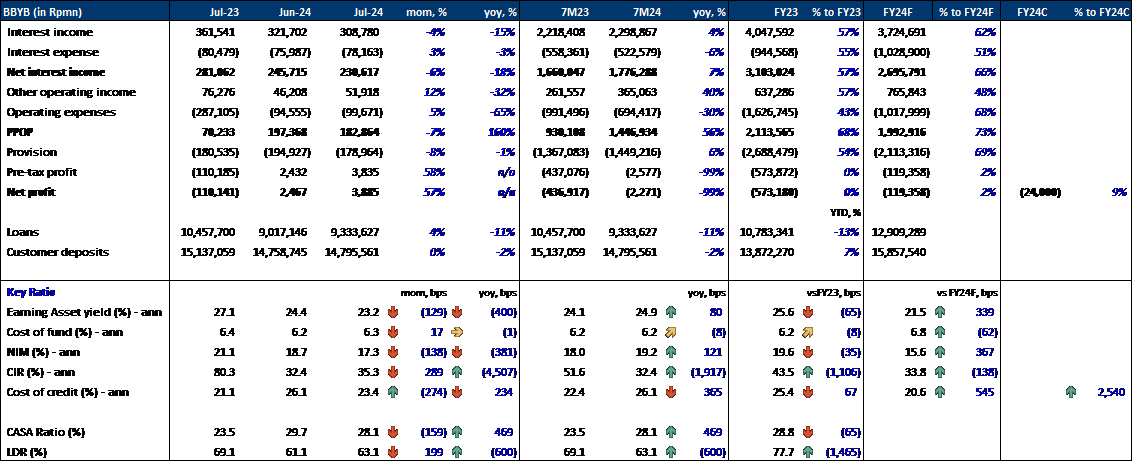

BBYB Jul24 Bank Only Results

7M24 Insight:

- Net Profits: In 7M24, BBYB's NP remained at negative Rp2bn, but it’s a huge improvement over Rp437bn losses in 7M23 as the bank booked 56% yoy PPOP growth and only 6% yoy higher provisions.

- NIM: Net interest income grew 7% yoy, despite the -11% yoy loan contraction, supported by a higher NIM of 19.2% (from 18.0% in 7M23). NIM was higher thanks to the flat CoF and higher EA yield.

- Other operating income and expense: Other operating income grew 40% yoy while opex declined 30% yoy, resulting in a CIR of 32% (from 52% in 7M23).

- Loans and Customer Deposits: In 7M24, loans still contracted by 11% yoy, while customer deposits declined by only 2% yoy. Hence, LDR was lower at 63% (from 69% in 7M23), providing room for growth.

- CoC: CoC rose to 26.1% (from 22.4% in 7M23), as the slight increase in provisions (+6%) was amplified by the -11% loan contraction.

Jul24 Insight:

- Net Profits: In 7M24, BBYB booked NP of Rp4bn (+57% mom from a low base), despite the 7% lower PPOP, as provisions declined by 8% mom.

- NIM: NIM declined to 17.3% (-138bps mom, -381bps yoy), mainly due to the decline in EA yield to 23.2% (-129bps mom, -400bps yoy).

- Loans and Customer Deposits: Loans increased 4% qoq (still -11% yoy), while customer deposits were flat qoq (-2% yoy). Hence, LDR rose to 63% in Jul24 from 61% in Jun24 but

- still below the 69% reported in Jul23.

- CoC: CoC was reported at 23.4%, 274bps lower than Jun24 but still 234bps higher than Jul23, despite the lower provisions (-8% mom, -1% yoy).

Summary:

- Overall Performance: In our view, BBYB’s Jul24 results were decent as it was able to grow its loan, albeit with lower NIM. Furthermore, the lower CoC came with higher loan loss provisions, indicating that the bank has lesser write-off and better asset quality. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

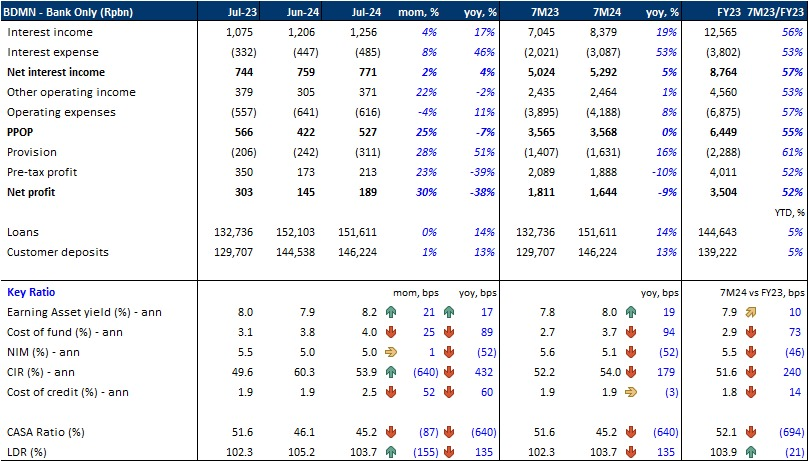

BDMN Jul24 Bank Only Results

7M24 Insight:

- Net Profits: In 7M24, BDMN’s net profits reached Rp1.6tr (-9% yoy), impacted by flat PPOP and a 16% increase in provisions.

- CIR: CIR rose by 179bps yoy to 54.0% due to an 8% yoy increase in opex, driven by a 6% yoy rise in personnel expenses.

- NIM: NIM dropped to 5.1% (-52bps yoy) in 7M24, as CoF rose to 3.7% (+94bps yoy) due to a decline in CASA to 45.2% (-640bps yoy), despite a 19bps yoy improvement in EA yield to 8.0%.

- Loans and Customer Deposits: In 7M24, loans and customer deposits grew by 14% and 13% yoy, respectively. LDR was reported at 103.7% (-155bps mom, +135bps yoy).

- CoC: CoC was flat yoy at 1.9% in 7M24, despite a 16% yoy rise in provisions, as loans grew 14% yoy.

Jul24 Insight:

- Net Profits: BDMN reported net profits of Rp189bn (+30% mom, -38% yoy) in Jul24.

- CIR: CIR reached 53.9% (-640bps mom, +432bps yoy) in Jul24. The monthly improvement was driven by a 22% mom increase in other operating income, while the yearly higher CIR was due to an 11% yoy rise in opex, mainly attributed to a 12% yoy increase in personnel expenses.

- CoC: CoC was reported at 2.5% (+52bps mom, +60bps yoy) in Jul24, as provisions increased to Rp311bn (+28% mom, +51% yoy).

- NIM: NIM was recorded at 5.0% (flat mom, -52bps yoy), as CoF rose significantly to 4.0% (+25bps mom, +89bps yoy), despite an improvement in EA yield to 8.2% (+21bps mom, +17bps yoy).

Summary:

- Overall Performance: In our view, BDMN’s results were weak. Its CoF remained high as the bank’s CASA continued to decline significantly, which was not offset by the increase in EA yield, resulting in a compressed NIM. Moreover, its notable rise in CoC to 2.5% in Jul24 indicates a possible issue within its loan book. Furthermore, its high LDR poses an ongoing risk to its liquidity and NIM going forward. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

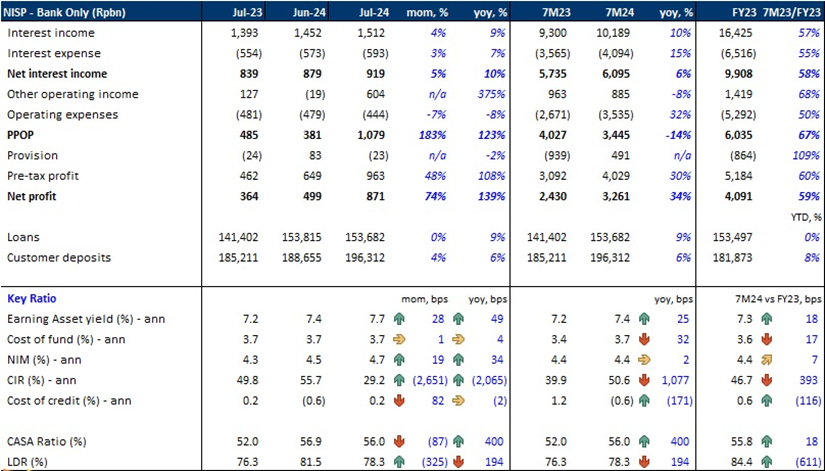

NISP Jul24 Bank Only Results

7M24 Insight:

- Net Profits: In 7M24, NISP’s net profits reached Rp3.3tr (+34% yoy), supported by a provision reversal of Rp491bn, despite a 14% yoy decline in PPOP.

- CIR: CIR reached 50.6% (+1,077bps yoy) as opex grew 32% yoy, largely due to a 77.4% yoy increase in other expenses.

- NIM: NIM remained flat at 4.4% in 7M24, as the 32bps yoy rise in CoF to 3.7% was offset by a 25bps yoy increase in EA yield.

- Loans and Customer Deposits: In 7M24, loans and customer deposits grew by 9% and 6% yoy, respectively. LDR was reported at 78.3% (-325bps mom, +194bps yoy). CASA reached 56.0% (87bps mom, +400bps yoy).

Jul24 Insight:

- Net Profits: NISP reported net profits of Rp871bn (+74% mom, +139% yoy) in Jul24, driven by a rise in NII (+5% mom, +10% yoy), a decline in opex (-7% mom, -8% yoy), as well as other operating income amounting to Rp604bn.

- CIR: CIR improved significantly to 29.2% (-2,651bps mom, -2,065bps yoy) in Jul24, marking the monthly lowest since Apr23.

- NIM: NIM improved to 4.7% (+19bps mom, +34bps yoy) in Jul24, as CoF remained at 3.7% (+1bps mom, +4bps yoy) and EA yield rose to 7.7% (+28bps mom, +49bps yoy).

- CoC: CoC was reported at 0.2% in Jul24.

Summary:

- Overall Performance: In our view, NISP’s results were relatively good, as it’s one of the banks that managed to maintain a stable CoF in Jul24 amid the high interest rate environment, which helped sustain its NIM. Furthermore, despite the elevated CIR in 7M24, Jul24’s CIR has shown an improvement. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

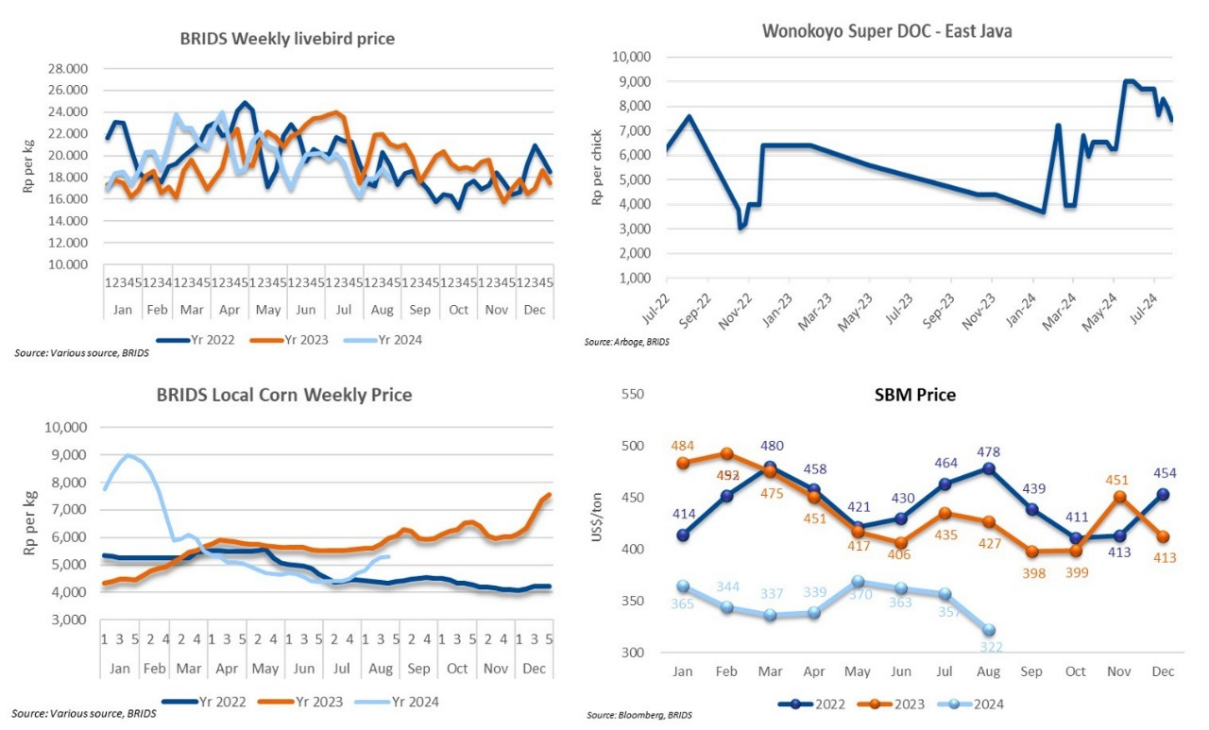

Poultry – 4th week of August 2024 Price Update

- Livebird (LB) prices declined to their YTD low of Rp15.5k/kg in the last week of Aug24, bringing the average price down to Rp17.9k/kg in the fourth week of Aug24. This represents a 1.6% wow decline from the previous week's average livebird price of Rp18.8/kg.

- There is no new data on DOC, but our source indicated that DOC remained soft at Rp4-5k/chick.

- The local corn price recently declined to Rp5.1k/kg from its MTD high of Rp5.4k in the third week of Aug24. This brings its weekly average to Rp5.3k/kg in the last week of August 2024, which is relatively stable wow.

- The average soybean meal (SBM) price remained relatively stable and low at around US$312/t in the fourth week of Aug24. The average price in Aug24 was US$322/t (-10% mom, -24% yoy).

- Despite the decrease in LB prices, we anticipate that the overall margin will remain positive thanks to the lower feed costs. (Victor Stefano & Wilastita Sofi – BRIDS)

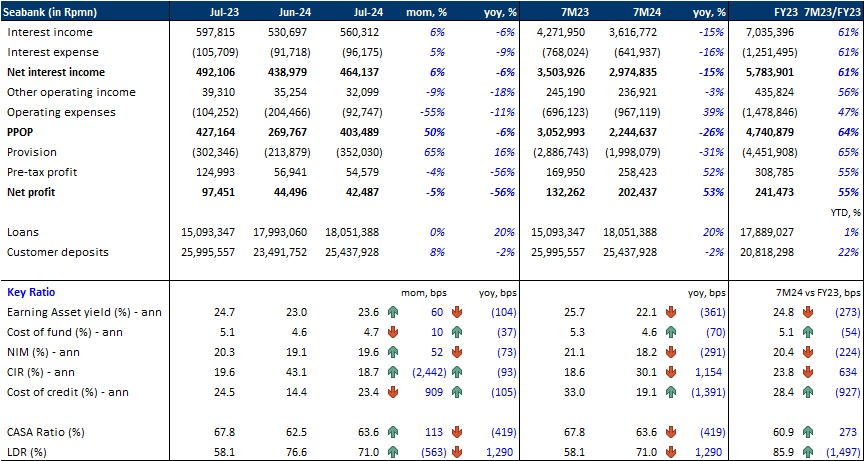

Seabank Jul24 Results

7M24 Insight:

- Net Profits: In 7M24, Seabank’s net profits reached Rp202bn (+53% yoy), driven by a 31% decline in provisions, despite a 26% yoy decrease in PPOP.

- CIR: CIR increased to 30.1% in 7M24 from 18.6% in 7M23, due to a 39% yoy rise in opex, mainly attributed to promotion expenses of Rp148bn (+214% yoy), Rp104bn of which was incurred in Jun24.

- NIM: NIM declined by 291bps yoy to 18.2% in 7M24, despite a 70bps yoy reduction in CoF to 4.6%, due to a 361bps yoy drop in EA yield to 22.1%.

- Loans and Customer Deposits: In 7M24, loans grew 20% yoy, while customer deposits declined by 2% yoy. LDR was reported at 71% (-563bps mom, +1,290bps yoy).

- CoC: CoC improved to 19.1% in 7M24 from 33.0% in 7M23.

Jul24 Insight:

- Net Profits: Seabank reported net profits of Rp42.5bn (-5% mom, -56% yoy) in Jul24, mainly due to an increase in provisions to Rp352bn (+65% mom, +16% yoy).

- CIR: CIR declined to 18.7% (-2,442bps mom, -93bps yoy) in Jul24. The significant monthly improvement in CIR was due to the high base of promotional costs of Rp104bn incurred in Jun24.

- CoC: CoC was reported at 23.4% (+909bps mom, -105bps yoy) in Jul24, up from the low base of 14.4% reported in Jun24.

- Loans and Customer Deposits: Loans were flat mom, while customer deposits grew 8% mom in Jul24.

- NIM: NIM was recorded at 19.6% (+52bps mom, -73bps yoy). On a yoy basis, NIM declined, despite a 37bps drop in CoF to 4.7%, as EA yield decreased by 104bps yoy to 23.6%. On a monthly basis, CoF increased by 10bps mom, while EA yield rose 60bps mom, resulting in a monthly NIM improvement.

Summary:

- Overall Performance: In our view, Seabank’s 7M24 results were still impacted by the promotional expenses incurred last month in response to heightened competition in the digital banking space. However, the Jul24 CIR has returned to normal, indicating that the promotional cost incurred in Jun24 was a one-off. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

MACROECONOMY

China Caixin Manufacturing PMI Rose to 50.4 in August 2024

China’s manufacturing expanded in Aug24, according to Caixin, with the PMI rising to 50.4 from July's 49.8. New orders returned to growth, driving faster production expansion amid better underlying demand conditions. However, foreign demand fell marginally for the first time ytd, amid reports of deteriorating conditions. (Trading Economics)

Indonesia Inflation Reached 2.12% yoy in August 2024

Inflation in August 2024 reached 2.12% yoy, slightly below our estimate of 2.19% and in line with the consensus of 2.11%. Monthly deflation continued for the fourth consecutive month, with the headline CPI declining by 0.03% mom. Core inflation reached 2.02%, aligning closely with our estimate of 2.05% (consensus: 1.98%). This is the first time core inflation has surpassed 2% since Sep23, driven by increases in gold jewelry, coffee powder, sugar, rice with dishes, house rentals, and cooking oil. (BPS)

Indonesia Manufacturing PMI Fell to 48.9 in August 2024

Indonesia manufacturing extended the contraction in Aug-24 with a PMI of 48.9, lower than 49.3 in Jul-24. Production and new orders fell with a contraction pace at the steepest since Aug-21. Foreign orders declined at a quickest pace since Jan-23. (S&P)

SECTOR

Directorate General of Highways Receives Budget Ceiling of Rp32.31tr for 2025

The Directorate General of Highways of the Ministry of Public Works and Housing has been allocated a budget ceiling of Rp32.31tr for the fiscal year 2025. This budget will be used for road infrastructure (Rp10.12tr), bridge infrastructure (Rp5.28tr), routine preservation of national roads and bridges, as well as revitalization (Rp8.92tr). Additionally, it will be utilized for enhancing highway connectivity (Rp4.08tr), support for the Nusantara Capital City (Rp1.66tr), improving accessibility of flyovers, underpasses, and tunnels (Rp61bn), and management support (Rp2.19tr). (Investor Daily)

CORPORATE

AUTO Realized Capital Expenditure of Rp295bn

AUTO has realized capital expenditure amounting to Rp295bn, which is equivalent to 59% of this year's total capex of Rp500bn. According to AUTO, most of this capital expenditure has been used for routine capex, such as capability enhancement, automation, and digitalization that the company is currently developing. Additionally, AUTO is optimistic that performance in 2H24 will be better compared to 1H24. (Kontan)

NeutraDC, a subsidiary of TLKM, Collaborates with 3 Companies in the AI-Ecosystem

PT Telkom Data Ekosistem (NeutraDC), a subsidiary of TLKM, has announced a strategic collaboration related to the AI-Ecosystem. This partnership is marked by the signing of a Memorandum of Understanding (MoU) with three companies: PT Hewlett Packard Enterprise (HPE) Indonesia, Cirrascale Pte. Ltd., and DataCanvas Limited. The collaboration aims to boost market interest in AI-based data center needs in Indonesia and the regional area. (Emiten News)