FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Telco: Telco Operators’ Tactical Adjustments Amid 3Q24 Weakness, Poised for 4Q24 Rebound (OVERWEIGHT)

- TSEL stays aggressive with ByU to build a larger presence in the youth segment and lowers prices in Indihome to drive subscriber growth.

- IOH returns to repair mode, campaigning for SIM-card Rp25k/4GB, while XL remains constructive for a second consecutive month.

- We maintain an OW rating for the Telco, expecting 9M24 and FY24 growth in line with our ests, with 3Q24 softness likely to be short-lived.

To see the full version of this report, please click here

Macro Strategy: Welcoming the New Government

- The new president's inaugural speech emphasized commitment to unity and leadership, economic self-sufficiency and equality for all.

- The Merah Putih Cabinet formation signal continuity & stability, more specific ministerial responsibilities and a balanced mix of background.

- Majority parliamentary support leads to an effective government, particularly in implementing policies that align with key agenda.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

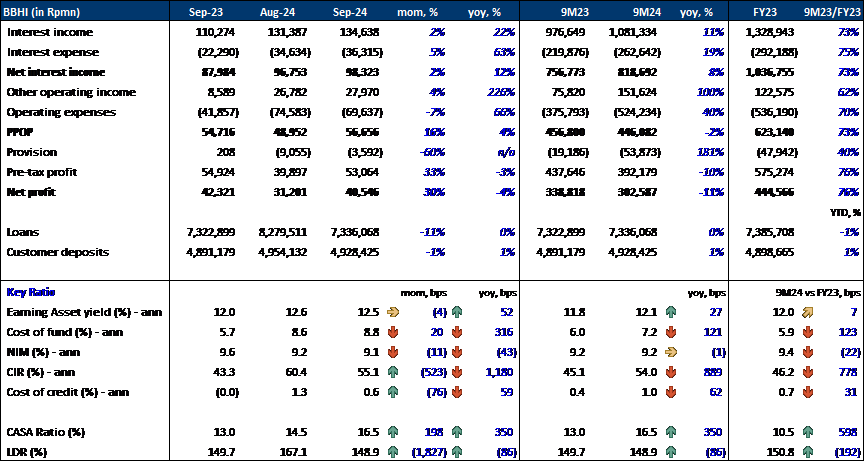

BBHI (Non Rated) - Sep24 Results

9M24 Insight:

- 11% yoy Decline in Net Profit: BBHI reported a net profit of Rp303bn (-11% yoy) in 9M24, driven by a 40% increase in opex and a 181% rise in provisions, which offset the 8% growth in NII and a doubling of other operating income.

- Higher CIR: CIR increased to 54.0% (+889bps yoy) in 9M24 due to a 40% rise in opex, with other expenses and promotional costs surging by 71% and 19% yoy, respectively.

- Stable NIM: NIM remained flat at 9.2% in 9M24 as the improvement in EA yield to 12.1% (+27bps yoy) offset the rise in CoF to 7.2% (+121bps yoy) and LDR remained stable at around 150%.

- Loans and Deposits: Loans were flat yoy, while customer deposits grew by 1%, resulting in an LDR of 148.9% (-1,827bps mom, -86bps yoy).

- CoC: Despite the flat loan growth, the CoC increased to 1.0% in 9M24 from 0.4% in 9M23, due to higher provisions expenses.

Sep24 Insight:

- Net Profit: BBHI posted a net profit of Rp41bn (+30% mom, -4% yoy) in Sep24. Opex and provisions fell by 7% and 60% mom, respectively, though opex surged by 66% yoy.

- NIM Decline: NIM fell to 9.1% (-11bps mom, -43bps yoy) in Sep24, as LDR dropped sharply to 148.9% (-1,827bps mom, -86bps yoy), and CoF rose to 8.8% (+20bps mom, +316bps yoy), despite an EA yield of 12.5% (-4bps mom, +52bps yoy). We believe that the increase in CoF is likely due to intensified competition in the digital banking sector.

- CIR: CIR stood at 55.1% (-523bps mom, +1,180bps yoy) in Sep24. The 66% yoy rise in opex was mainly due to a significant increase in other expenses (+159% yoy), while the 7% mom decline in opex was driven by a 26% mom fall in promotional expenses.

- Loans and Deposits: Loans and Customer deposits declined by 11% and 1% mom, respectively. The CASA ratio stood at 16.5% (+198bps mom, +350bps yoy).

- CoC: CoC stood at 0.6% (-76bps mom, +59bps yoy) in Sep24.

Summary:

- Overall Performance: Despite the higher CASA ratio, CoF remains under pressure, likely due to heightened competition, particularly in the digital banking space. Coupled with the normalization in LDR, this has contributed to a lower NIM. Should these conditions persist, they could pose a risk to BBHI’s future performance. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

ISAT (Buy, TP: Rp13,300) - Key updates on 3Q growth, and sale of fiber assets

- Soft sector 3Q24, in line with our estimate. Based on our latest information, it confirms our expectation for cellular sector growth of about -2% qoq in 3Q24 with lower ARPU, which is closely in line with our expectations for -1.5% qoq softer revenue in 3Q24 for the sector. ISAT is expected to trend at this level.

- IOH to maintain positive growth trajectories in FY24 revenue and EBITDA. The management maintains its view that ISAT has strong fundamentals, and they could see that things are picking up in the last 2 weeks, which is in line with the narrative from sector peers. Hence, we think IOH can still achieve high single-digit growth in FY24 while maintaining the trajectory for double-digit revenue growth

accompanied by robust EBITDA growth.

- Fiber asset sale underway to reward investors. According to international media, ISAT's 92,000 fiber asset sale is underway, with completion to take place by 1Q25. ISAT will continue to own a minority. This will significantly reward ISAT shareholders, who could see a net gain of US$300mn+ or approx. 6% yield at the current ISAT price. The media quotes the asset value at US$1.5bn, but we conservatively expect it at US$1.2bn. (Niko Margaronis – BRIDS)

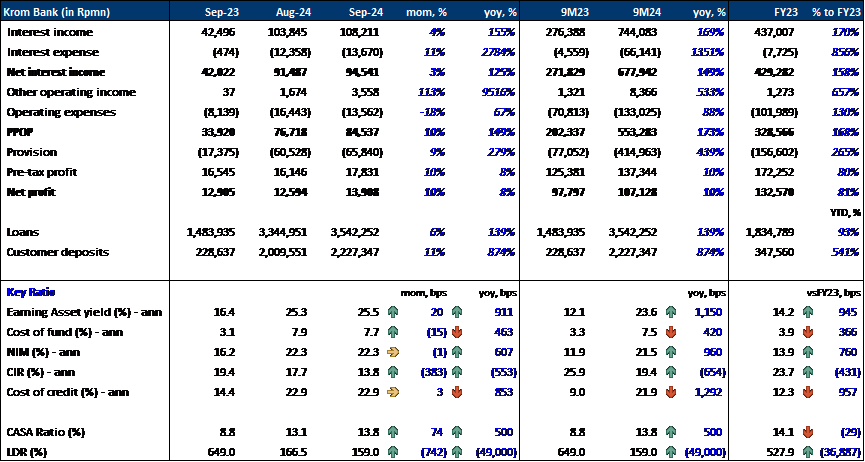

KROM Bank (Non Rated) - Sep24 Results

9M24 Insight:

- Net Profit: KROM reported a 10% yoy increase in net profit, reaching Rp107bn in 9M24, with NIM standing at 21.5%.

- With the bank’s rebranding as a digital bank in late Feb24, we believe monthly comparisons offer the most relevant insights into its performance.

Sep24 Insight:

- 10% mom Net Profit Growth: KROM’s net profit increased to Rp14bn (+10% mom) in Sep24, supported by 10% PPOP growth and 6% loan growth.

- Stable NIM: NIM was stable at 22.3% in Sep24, supported by a 20bps mom increase EA yield to 25.5% and a 15bps decline in CoF to 7.7% as LDR declined.

- CIR Improvement: CIR improved by 383bps mom to 13.8% in Sep24, primarily due to a 3% growth in NII and an 18% decline in opex (with other expenses falling by 40% mom).

- CoC: CoC was flat mom at 22.9% in Sep24. However, it continues to be one of the highest among digital banks.

- Loans and Deposits: Loans and customer deposits grew by 6% and 11% mom, respectively, resulting in an LDR of 159.0% (-742bps mom). The CASA ratio increased to 13.8% (+74bps mom) in Sep24.

Summary:

- Overall Performance: KROM’s ability to maintain a robust NIM while reducing its LDR is commendable. However, the persistently high CoC remains a concern, particularly in comparison to its digital banking peers. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

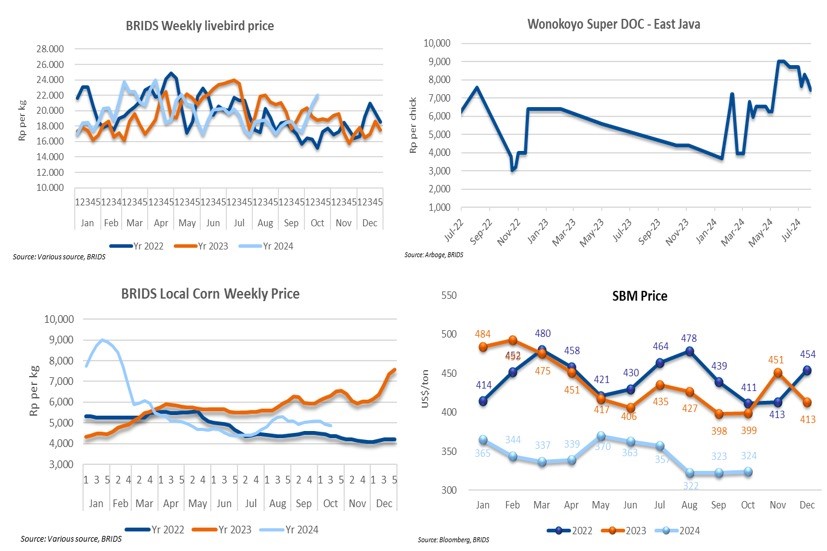

Poultry (Overweight) – 3rd Week of Oct24 Price Update

- Livebird prices remained strong at Rp22.4k/kg, with an average of Rp22.0k/kg in the third week of October, up 6% wow.

- DOC prices remained stable at around Rp5k/chick.

- Local corn prices were relatively stable at Rp4.9k/kg, with the weekly average standing at Rp4.9k/kg in the third week of Oct24, which marks a 1.6% wow decrease from Rp5.0k/kg in the previous week.

- The average soybean meal (SBM) price in third week of Oct24 slightly decreased to c. US$315/t, bringing its average price for Oct24 to US$324 (+0.4% mom, -18.8% yoy).

- We expect a rebound in earnings for 4Q24 due to the recovery in LB prices and a moderate rise in feed costs. (Victor Stefano & Wilastita Sofi – BRIDS)

MARKET NEWS

MACROECONOMY

Chinese Banks Cut the Benchmark Lending on 1Y and 5Y LPR to 3.10% and 3.60%

Chinese banks cut the benchmark lending on the 1Y Loan Prime Rate (LPR) to 3.10% from 3.35% and the 5Y LPR to 3.60% from 3.85%. The cut followed the PBoC's move of reducing the 1Y Medium-Term Lending Facility Rate to 2% in late September, which is expected to spur loan disbursement and reduce interest expense for customers. (Bloomberg)

SECTOR

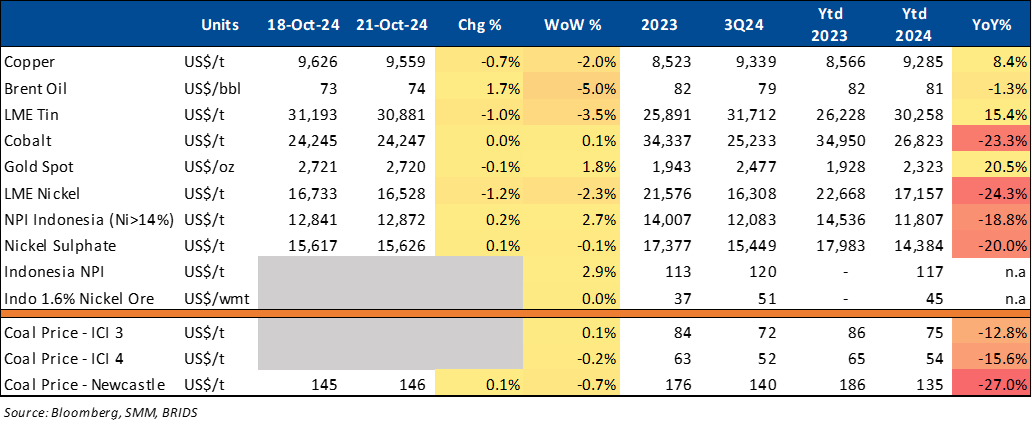

Commodity Price Daily Update Oct 21, 2024

CORPORATE

BBNI’s Mobile Banking Transaction Volume Soared 230% yoy as of Sep24

BBNI reported a 230% yoy growth in mobile banking transactions as of Sep24, with transaction frequency increasing by 150%. This surge followed customers migrating to BNI's new app, Wondr. To maintain growth, BNI plans to introduce promos aimed at targeting customer needs, targeting a 200% yoy rise in transactions during year-end holidays. Popular features include QRIS, transfers, and e-Wallet top-ups. (Kontan)

BRI Life Secures OJK Approval for 2026 Sharia Unit Spin-Off

BRI Life has received approval from the Financial Services Authority (OJK) to spin off its Sharia Business Unit by 2026. Despite low insurance penetration in Indonesia at 2.7%, BRI Life remains optimistic about the growth potential of sharia insurance. (CNBC Indonesia)

BRMS Optimistic About Exceeding 50,000 Troy Ounces of Gold Production by 2024

BRMS is optimistic about exceeding 50,000 troy ounces of gold production by the end of 2024, primarily from open pit mining at Block 1 (Poboya) in Palu, Sulawesi, with an average gold grade of 1-2 g/t. The company recently announced 40mn tons of ore at Poboya, with an average grade of 3.5 g/t, based on JORC standards. A significant portion comes from underground resources with a higher grade of 4.9 g/t. BRMS plans to release reserve data by year-end and aims to begin underground mining, with grades of 3-4 g/t, by the 2H27. (Kontan)

ISAT Prepares Funds for Upcoming Bond Payments

ISAT announces that it has allocated funds to repay the principal amounts of its Shelf-Registered Bonds II Indosat Phase II 2017 Serie D, totaling Rp21bn, and its Shelf-Registered Ijarah Bond II Indosat Phase II 2017 Serie D, amounting to Rp13bn. These payments are due on November 9, 2024. (Company)

NCKL: First IRMA-Audited Mining Company in Indonesia; Aims for 120k Tons of Nickel Production

NCKL has become the first mining company in Indonesia to commit to an audit by the Initiative for Responsible Mining Assurance (IRMA). This initiative, which is part of a voluntary process that includes Harita Nickel, has been recognized by the government for its dedication to responsible mining practices in Indonesia. (Kontan)

In other news, NCKL targets that the two rotary kiln electric furnace (RKEF) smelters currently in operation, Megah Surya Pertiwi (MSP) and Halmahera Jaya Feronikel (HJF), will be able to produce a total of 120,000 tons of nickel content in ferronickel. (Investor Daily)