FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Astra International: Raising our FY24F-FY26F est., amid above-expected 2W sales, financial, and HE segment in 3Q24 (ASII.IJ Rp 5,125; BUY TP Rp 5,900)

- ASII posted strong 9M24 earnings (above) due to recovery in auto, along with strong financial and HE segments.

- We lifted our EPS est. by 10%/13%/10% in FY24F/FY25F/FY26F, driven by higher 2W sales, financial, and HE segment.

- We reiterate our Buy rating with a 3% higher TP of Rp5,900. We expect the steady recovery in 3Q24 to continue in 4Q24F onwards.

To see the full version of this report, please click here

Mitra Keluarga Karyasehat: Better entry point emerges as volume headwinds are priced in (MIKA.IJ Rp 2,750; BUY TP Rp 3,400)

- We believe 9M24 earnings (in line) reflected MIKA’s operational excellence in cost-control despite challenges in its inpatient volume.

- Incorporating 9M24 results and latest management guidance, we trimmed our FY24F/FY25F Net Profit by 7%/13%.

- We maintain our Buy rating and DCF-based TP of Rp3,400; current valuation offers better entry points as volume headwinds are priced-in.

To see the full version of this report, please click here

United Tractors: Raising FY24-26F est. post 3Q24 earnings beat; reiterate Buy on bottoming earnings, strong FCF (UNTR.IJ Rp 27,350; BUY TP Rp 31,000)

- UNTR posted robust 3Q24 net profit (+47% yoy/ +22% qoq), driving 9M24 beat, on strong performances of Pama and heavy equipment.

- We raise our FY24-26F net profit est. by 9-15%, taking into consideration expectation of stronger performance from Pama and heavy equipment.

- We reiterate Buy rating on the prospect of bottoming earnings and steady FCF generation, with a higher TP of Rp31k.

To see the full version of this report, please click here

Macro Strategy: US Election: The Lexicon, Scenarios and Impacts

- Telkom’s 9M24 core profit (-5.1%yoy) is in line, impacted by soft topline growth (+0.9% YoY) and a lower adjusted EBITDA margin of 51.5%.

- TSEL's is boosting user productivity with TSEL Lite and ByU is raising data usage with pathway to transcend to FMC by instituting single billing.

- Maintain Buy rating with TP of Rp4,250 (5.7x ‘25 EV/EBITDA), as TLKM pro-growth initiatives and capex efficiencies offer long-term growth.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

ADRO (Buy, TP: Rp3,770) – Potential dividend of up to US$2.6bn

- ADRO’s EGM information stated that it may distribute up to US$2.6bn, in relation with its restructure plan (to spin off AAI).

- This translates to Rp1,346/ share of dividend or 34% yield at current share price. Most importantly, we believe that the planned dividend is to allow existing shareholders to fully cover the purchase of AAI (valuation of US$2.4-2.6bn).

- The EGM is slated for 18th Nov24, with the aim for AAI spin-off to be completed by end of FY24.

Comments:

- We roughly estimate that immediately post spin-off ADRO’s valuation may fall to US$5.8-6.2bn (comprising of US$2.4-2.6bn of cash, market value of ADMR and SIS), implying 19-24% downside from current share price (US$1.4-.1.8bn in value).

- We think this may be offset by the upside from AAI’s valuation, considering that it is only valued at 2-3x PE at the spinoff.

- The key risk on new ADRO is if the market assigns a (bigger) holding company discount which may transpire into bigger downside risk.

- We are currently reviewing valuation of ‘new ADRO’ which will ultimately depend on its renewables’ business valuation. (Erindra Krisnawan – BRIDS)

BBYB (Buy, TP: Rp600) – 3Q24 Earnings Call KTA

FY24 Guidance:

- Loan growth: Initial 2024 loan growth target of 5% remains under assessment due to ongoing audit by the OJK. Management plans to drive commercial banking loan growth while balancing KYC and due diligence requirements with the expansion of commercial and NEO loans.

- Credit Cost: Management expects FY24 credit costs to decrease compared to last year, driven by tightened risk acceptance criteria and evolving market dynamics of its digital loans.

Strategy and Cost Management:

- Reduction provision expenses and write-offs through improved loan evaluation methods and the introduction of risk-based loan pricing.

- Promotion of NEO Loan, the bank's flagship lending product, offering attractive margins. Digital marketing efforts are being executed via Meta, Google, and telecom partners.

- Engaging users through enhanced credit evaluation processes that leverage external data sources.

Loan Portfolio:

- The bank continues to serve the consumer segment while expanding into the corporate sector, targeting industries with lower risk albeit lower margin.

- The current corporate commercial loan portfolio constitutes 23%, with a targeted ratio of 70:30 (consumer: commercial) in the long run.

- Corporate Commercial Ticket Size: On average, Rp250-300bn.

- Corporate Commercial Loan yield: Averages between 9.5% and 10%, with a focus on sectors that offer an optimal balance of quality and return.

Neo Loan:

- Ticket Size: Rp2.5-3.0mn per borrower, with an average tenor of 4 months and a maximum loan limit of Rp15mn.

- Yield: Ranges from 36% to 45%, depending on borrower scoring and characteristics.

- Asset quality: Better than lower market segments (unbankable) due to targeting bankable customers.

Akulaku Finance:

- OJK audit is ongoing, delaying the resumption of lending to Akulaku Finance. Conditions for reactivation are under discussion but remain unresolved.

- Industry-wide KYC revamp will be implemented next year, affecting the bank’s channeling business model with all partners.

- Management anticipates that growth in NEO loans and commercial banking will offset any challenges posed by the tightened KYC processes mandated by regulators. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

ICBP (Buy, TP: Rp13,400) & INDF (Buy, TP: Rp8,000): Key Takeaways from 3Q24 Earnings Call

- ICBP reported solid 9M24 revenue, with 90% of this growth driven by volume. Noodles sales volume increased 7% yoy in 9M24 (2Q24: 11% and 3Q24: 7% yoy), followed by dairy at 8% yoy and Beverages at 7% yoy.

- ICBP reported strong growth from overseas market of 22% in 3Q24 and 15% yoy in 9M24, supported by recovery in Pinehill markets and solid growth in U.S, Canada and North America. Overseas markets contributed 23% to ICBP’s 9M24 revenue

- Bogasari’s wheat flour sales volume increased by +12% yoy, with a lower ASP (down 11% yoy) due to reduced wheat costs. However, the 9M24 Ebit margin remained within guidance range of 6-8%

- ICBP reported higher A&P spending (4.2% of 3Q24 revenue, above the 4% target) to support new product launches, and increased freight costs due to rising export market sales volume. (Natalia Sutanto & Sabela Nur Amalina – BRIDS)

MIDI (Buy, TP: Rp600): Key Takeaways from 3Q24 Earnings Call

- Following solid 3Q24 result, MIDI has revised up its FY24 revenue growth guidance to 14% (vs 13% previously) with a higher SSSG of 9% (up from 8%). The company plans to maintain a trend of net profit growth outpacing revenue growth

- As of 9M24, MIDI has achieved 129 net new stores opening and remains optimistic about surpassing 200 new stores opening by the end of 2024

- In 3Q24, MIDI closed a total of 162 Lawson stores, including 57 standalone and 105 store-in-store. MIDI plans to close the remaining 220 Lawson Store-in-store by Nov24, which will result in additional sunk costs by year-end (pending audited data).

- Lawson’s SSSG in 9M24 was -23% and -17% in 3Q24, while Alfamidi reported 10.1% SSSG in 9M24 and 11.1% in 3Q24, respectively. The company anticipates Oct24 SSSG to remain steady around 9-10%.

- In 3Q24, MIDI launched “Ja-di: (Jajan di Alfamidi) inside Alfamidi stores, offering mixed fruits, juices, ice cream and local snacks as a complementary product. The company expects Ja-di to improve both revenue and profitability while leveraging existing store employees.

- Approximately 51% of MIDI’s stores are located outside java area, showing strong growth. According to Nielsen, Java’s MT growth was weaker at 3.9% yoy, compared to 6.3% growth for total Indonesia in 9M24. (Natalia Sutanto & Sabela Nur Amalina – BRIDS)

MAIN (Buy, TP: Rp1,700): 3Q24 Earnings Call KTA

Feed Segment

- The feed margin in 4Q24 is expected to improve compared to 3Q24, primarily due to anticipated lower raw material costs.

- Malindo slightly decreased its feed prices in 3Q24, due to the lower raw material costs. In 4Q24, if costs remain lower, prices will be adjusted again.

- Overall utilization of feed mills typically ranges from 75-85%. However, the feed mills in Makassar and Grobogan remain underutilized. The break-even point for feed mill utilization is quite low, at around >40%.

DOC and LB Segment

- The break-even point for DOC and live bird prices is typically around Rp6k/chick and Rp19-21k/kg, respectively. Currently, the DOC price is approximately Rp6k/chick.

- Malindo stated that its latest self-culling occurred at the beginning of the year (1Q24).

Processed Food Segment

- The increase in revenue for the processed food segment in 3Q24 was supported by a yoy volume growth of approximately 20-30%. Currently, Malindo's processed food segment volume is 200+ MT/month. The expected break-even point for this segment is around 300 MT/month.

- The percentage of the processed food segment derived from e-commerce remains relatively small. (Victor Stefano & Wilastita Sofi – BRIDS)

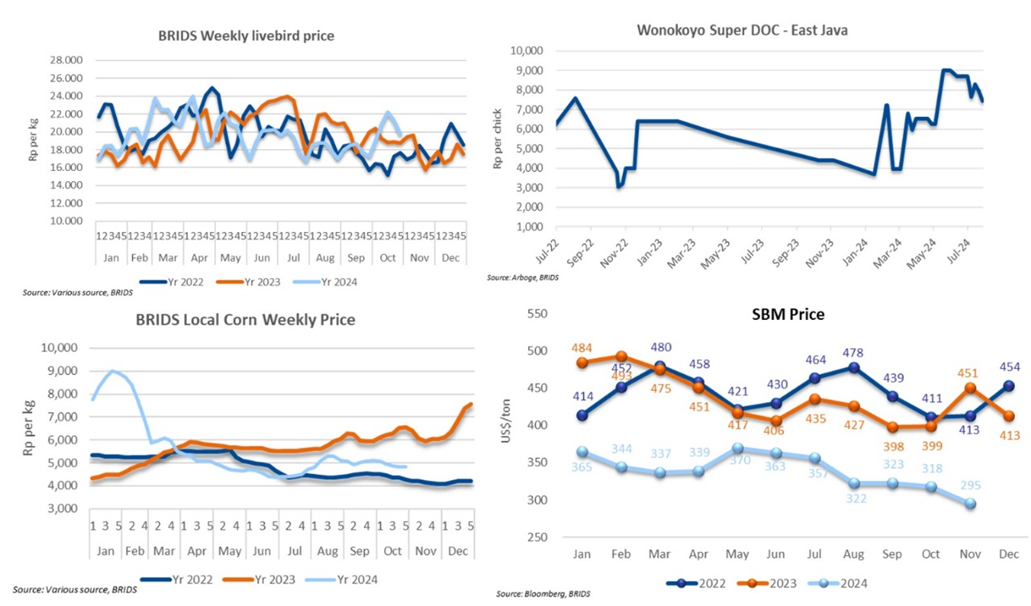

Poultry (Overweight) – 5th week of October 2024 Price Update

- Livebird prices have declined to Rp19.6k/kg, bringing the weekly average to Rp19.8k/kg in the fifth week of October, reflecting a 6.8% wow decline.

- There is no new data on DOC, but our source indicates that the DOC price has edged up to around Rp6k/chick.

- Local corn prices remain flat at Rp4.8k/kg, with a weekly average of Rp4.8k/kg in the fifth week of Oct24.

- The price of soybean meal (SBM) declined to its YTD low at US$295/t in Nov 1, 2024. The average price in Oct24 standing at US$318 (-1.5% mom, -20% yoy).

- We expect an improvement in earnings for 4Q24, driven by the recovery in livebird prices and controlled increases in feed costs. (Victor Stefano & Wilastita Sofi – BRIDS)

MARKET NEWS

SECTOR

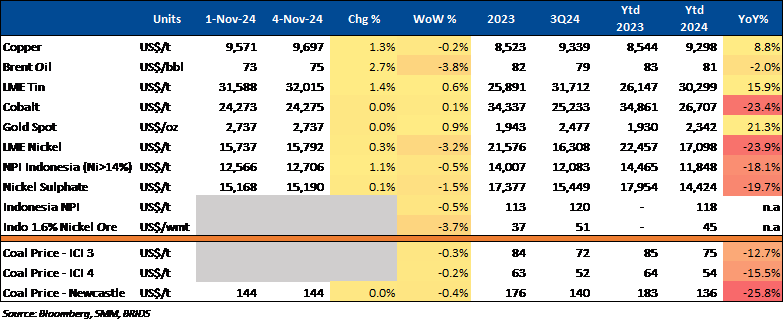

Commodity Price Daily Update Nov 4, 2024

OPEC+ Delays Plan to Increase Oil Production

OPEC+ has agreed to delay the planned increase in oil production for Dec24 by one month. This delay marks the second time amid their efforts to revive supply due to weakening prices. Originally, OPEC+ intended to begin a series of monthly production increases, adding 180k barrels per day starting December 2024, but now they will limit supply for that month. (Bisnis)

CORPORATE

BUKA Ordered to Pay Rp107bn in Lease Dispute; Plans Appeal

BUKA is ordered by the South Jakarta District Court to pay Rp107bn to PT Harmas Jalesveva for terminating a lease agreement. The company plans to appeal to the Supreme Court while asserting minimal operational impact from the ruling. (Bisnis)

NCKL Approves Change in IPO Fund Allocation

NCKL approved reallocating IPO proceeds in its Extraordinary General Meeting with Rp147.2bn set for capital expenditures, including heavy equipment purchases to support increased nickel production and exploration on Obi Island through 2027. Additionally, Rp1.6tr will be used to increase the company’s shareholding in its associated nickel processing and refining entity. (IDX)