FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Poultry: Potential re-rating intact from strong FY24-25F earnings growth and light funds’positioning

- Despite the potentially lower LB prices in Suro month, we remain bullish given the expected higher margin from lower feed costs.

- The relatively light position of funds suggests 2Q24 earnings beat could re-rate the sector in our view.

- We maintain our Overweight rating on the sector, foreseeing higher margins to support growth. CPIN remains our top pick in the sector.

To see the full version of this report, please click here

To see the full version of this snapshot, please click here

RESEARCH COMMENTARY

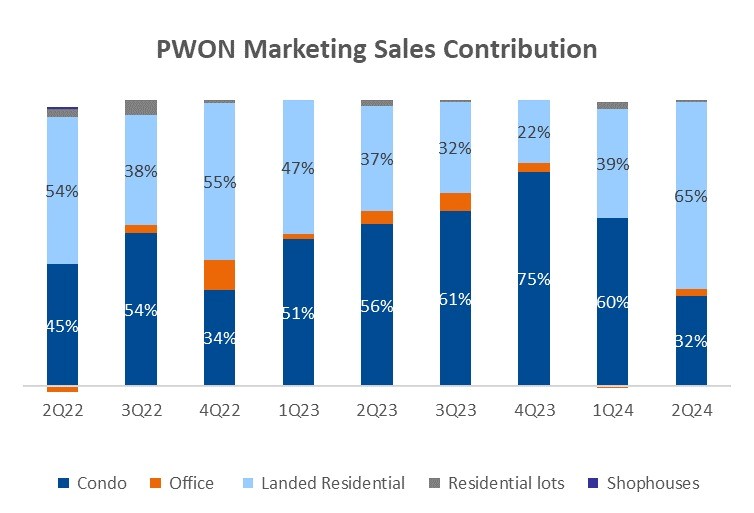

PWON 1H24 Marketing Sales: In-Line with The Company's Target (51%); Landed-Residential Contribution Exceeded High-Rise

- PWON booked marketing sales of Rp385bn in 2Q24, (flat 0%qoq, +27%yoy), bringing its 1H24 Marketing sales to Rp771bn (+28%yoy), in-line with the company's FY24F target of Rp1.5tr (51%) and above our last estimates of Rp1.3tr (58%).

- We noticed that landed residential contributed 65% to 2Q24 marketing sales (vs. FY16-FY23 average at ~30%), exceeding condo contribution of 32%. The company previously targeted a 60% contribution from high-rise and 40% from landed residential in FY24F.

- Grand Pakuwon Landed House contributed the most to overall 2Q24 pre-sales (36% contribution), followed by Pakuwon City landed house with 29%, with no new launches so far this year. We believe the achievement stemmed from the VAT incentives (official VAT-exempted pre-sales numbers are yet to be released).

- Meanwhile, for its high-rise portfolio, we noticed that there's not much of an improvement in terms of overall units sold, both qoq and yoy. Clayson and Lancaster project at Pakuwon Mall Surabaya, which broke ground in 1Q24, did not book any pre-sales in 2Q24.

- Terms of payment are relatively unchanged from 1Q24; 51% mortgage, 18% cash, and the rest coming from installment and balloon payment. The price range is also relatively unchanged with >60% coming from the Rp1-5bn range, similar to the 1Q24 and 1H23 conditions.

- We are currently reviewing our marketing sales forecast, yet we believe PWON story for FY24F-FY25F will lie in its recurring revenue strength as high-rise property demand is yet tofully recover. We maintain our Buy rating with 56% disc.to.RNAV-based TP of Rp610, PWON currently trades at 71% discount to RNAV (vs. 3-yr historical avg. of 63% and current peers average of ~73%). (Ismail Fakhri Suweleh – BRIDS)

MARKET NEWS

MACROECONOMY

Indonesia’s Foreign Exchange Reserves Increased to US$140.2bn in Jun24

Bank Indonesia (BI) reported a surge in Jun FX reserves to US$140.2bn, up from May's US$139bn, attributed to tax and services revenue and foreign loan withdrawals. BI expressed confidence in maintaining sufficient foreign exchange reserves in the coming months, pointing to robust export performance, a financial account surplus, and favorable investment returns. (Bank Indonesia)

Indonesian Government to Implement Additional Import Duties

The government will implement additional import duties in the form of safeguard duty (BMTP) and anti-dumping duty (BMAD) to protect domestic products. According to the Minister of Trade, there are at least seven commodities that will be subject to additional import duties, namely textiles and textile products, ready-made clothing, electronic ceramics, cosmetics, other ready-made textiles, and footwear. The amount of BMTP and BMAD is still being calculated and the amount will refer to the spike in import volume in the last three years. (Kontan)

US Job Market Added 206k Jobs in Jun24

The US job market added 206k positions in June 2024, exceeding analyst expectations of 190k. However, this figure falls slightly below the revised May data of 218k (originally reported as 272k). Revisions also lowered the April job growth to 108k (down from 165k). (Trading Economics)

US Unemployment Rate Rose to 4.1% in Jun24

The US unemployment rate climbed to 4.1% in June 2024, marking the highest level since November 2021. This represents an increase from 4.0% in the prior month and defied market predictions of a steady rate. (Trading Economics)

CORPORATE

BBTN Officially Cancelled the Acquisition of Muamalat

BBTN has confirmed that it has cancelled the acquisiton of Muamalat after conducting due diligence. The corporate action was initially designed by BBTN as part of an effort to spin off their sharia business unit (UUS) into a sharia bank (BUS). (Bisnis)

MCAS Aims for Double Digit Growth Profit in 2024

MCAS aims to achieve double-digit profit growth in 2024. According to MCAS, its income may remain flat or experience a slight decline. However, profitability is targeted to grow in double digits, primarily supported by Clean Energy, Software as a Service (SaaS) & IT, and Digital Cloud Advertising segments. Additionally, this year the company will focus on expansion, including into the electric vehicle ecosystem. (Kontan)