|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

XL Smart Telecom Sejahtera: Post-Merger Scale Rebuilding in Progress (EXCL.IJ Rp 2,600; BUY TP Rp 3,310) · XL’s National Roaming is 100% activated with MOCN to follow, offering Smartfren potential ARPU upside from improved coverage and service. · We expect add’l Rp1tr integration cost in 2H25 before more synergies materialize in FY26 and assumed Rp15-16tr capex in FY25-26. · We maintain Buy rating and raised TP to Rp3,310 (5.2x EV/EBITDA, +0.8 SD) as we roll forward valuation to FY26F, reflecting growth resumption. To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

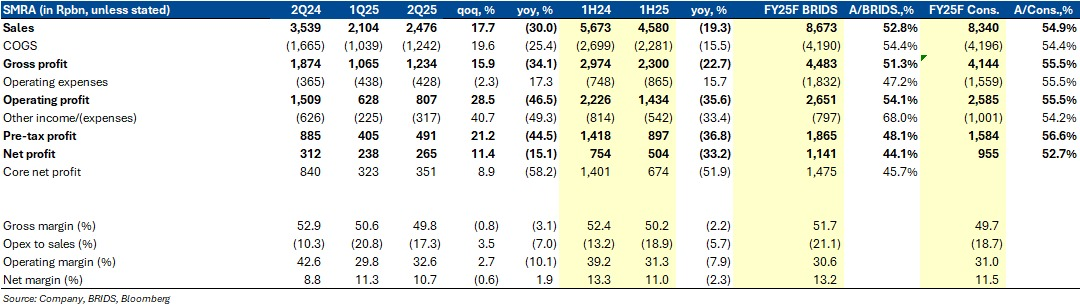

RESEARCH COMMENTARY SMRA (Buy, TP: Rp800) - 2Q25 Results: Slightly Below Ours, In-Line with Consensus · SMRA booked Rp265bn net profit in 2Q25 (-15% yoy), bringing 1H25 achievement to Rp504bn (44%/53% of our/cons. FY25F estimates). · Overall revenue dropped 19% yoy, as property development segment declined 29% yoy to Rp2.9tr, driven by a 36% decline in houses revenue, given last year's high-base. This was not offset by a stable 9% yoy growth in mall and retail segment. Overall revenue achievement, however, remained in-line with our/cons. at 53%/55% run-rate. · GPM compressed across all property development segments (-300bps yoy to 50%) and higher interest expenses of Rp571bn (+10% yoy), dragged down overall net profit run-rate to ours at 44%, yet still in-line with consensus at 53%. We view share price reaction should be limited given the in-line results with cons. (Ismail Fakhri Suweleh & Wilastita Sofi – BRIDS)

MARKET NEWS |

||||||||||||

MACROECONOMY

|

Indonesia to Redirect Rp200tr from BI to State Banks to Boost Lending Newly appointed Finance Minister Purbaya told parliament that the government will withdraw Rp200tr from funds parked at Bank Indonesia and place it in state-owned banks to boost liquidity and lending. Approved by President Prabowo, the move aims to revive growth after a period of tight liquidity. The funds, drawn from idle state cash including SAL and SiLPA, are not loans but deposits to strengthen credit channels. Banks are barred from using them to buy government bonds or SRBI, ensuring support goes to the real sector. (MoF, DPR RI)

US Producer Price Index Fell 0.1% mom in Aug25 US producer prices unexpectedly fell 0.1% mom in Aug25, the first decline in four months, defying expectations of an increase and reinforcing bets for a Fed rate cut next week. Core PPI excluding food and energy also slipped 0.1%, though the measure excluding trade services rose 0.3%. Services costs dropped 0.2%, driven by a sharp fall in wholesaler and retailer margins, while goods prices inched up 0.1%. On a yoy basis, PPI rose 2.6%, with tariff effects still weighing on pricing decisions. (Bloomberg) |

SECTOR

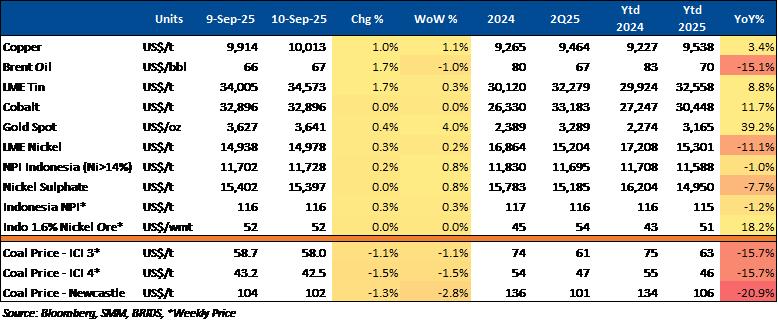

Commodity Price Daily Update September 10, 2025

Indonesian Government Prioritizes Kampung Nelayan Merah Putih

The government will build 100 Kampung Nelayan Merah Putih in 2025 with a Rp2.2tr budget, aiming to boost fisheries infrastructure, community skills, and coastal productivity. The program targets 1,100 villages by 2027 and has entered the contract stage. (Kontan)

CORPORATE

CLEO Boosts 2025 Performance with Innovation and Expansion

CLEO is strengthening competitiveness in the bottled water market through product innovation and expansion. The company launched Cleo 1 Liter Praktis on August 31, 2025, to broaden its portfolio and support growth in H2. CLEO is also completing three new plants in Palu, Pontianak, and Pekanbaru, bringing its total to 35 nationwide. (Kontan)

DMAS Eyes Chinese Manufacturers’ Relocation to GIIC

DMAS confirmed interest from Chinese manufacturers planning to relocate production to its Greenland International Industrial Center (GIIC) in Cikarang, driven by U.S. reciprocal tariffs. GIIC currently hosts around 170 tenants, mostly Japanese automakers. (Bisnis)

MAPI: Singapore’s Pacific Universal Cleared to Acquire Controlling Stake in Indonesia’s MAP

Singapore-based Pacific Universal Investments Pte. Ltd. has received clearance from the Philippine Competition Commission (PCC) to acquire MAPI from controlling shareholder PT Satya Mulia Gema Gemilang, which holds 51%. PCC found no risk of reduced competition, citing sufficient market players. MAP operates 3,832 stores across seven ASEAN countries, including 247 outlets in the Philippines. The approval was issued on Aug. 12, 2025, under the Philippine Competition Act. (InsiderPH)

ITMG Expands Critical Minerals Exposure

ITMG is exploring opportunities to increase its exposure to critical minerals after acquiring a 9.62% stake in nickel company NICE. The company is also assessing other critical minerals such as gold, bauxite, and copper, while strengthening its focus on renewable energy initiatives, including solar power. (Investor Daily)

PGEO Starts Ulubelu Green Hydrogen Pilot Plant

PGEO began building a US$3mn pilot plant in Ulubelu, Lampung, the world’s first to use AEM electrolyzer with geothermal power. Backed by Pertamina, the project supports Indonesia’s clean energy transition and sets a model for future hydrogen development. (Bisnis)