FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Indofood CBP: From Demand Headwinds to Fiscal Tailwinds (ICBP.IJ Rp8,525; BUY TP Rp11,500)

- Softer domestic and some overseas demand weighed on ICBP’s topline in 3Q25, though margins improved on easing input costs.

- While FY25F topline may fall short of the management’s 7-9% guidance, we believe EBIT margin may reach the upper end of the target (~22%).

- We maintain our Buy call with a revised TP of Rp11,500. We think its current valuation of 9.7x PE FY26F has largely priced in the ST growth softness.

To see the full version of this report, please click here

Indofood Sukses Makmur: A Mixed 3Q25 Results Backed by Agribusiness (INDF.IJ Rp7,175; BUY TP Rp9,400)

- A solid Agribusiness growth and resilient Bogasari margins underpinned INDF’s mixed 3Q25 performance.

- We expect the momentum in Agribusiness to sustain to 4Q25, supported by additional demand from B50 implementation and sustain prices.

- We maintain our Buy rating with a higher SOTP-based TP of Rp9,400, as we roll over our valuation to FY26 earnings.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS

SECTOR

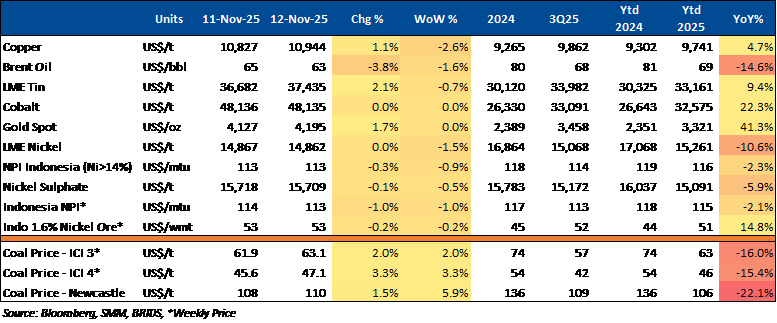

Commodity Price Daily Update Nov 12, 2025

Indonesian Government to Build 100 New Bulog Warehouses Amid Rice Output Surge

Indonesia’s rice production for FY25 is projected to reach 34.77mn tons, up 13.5% yoy. To accommodate the surplus, the government plans to build 100 new warehouses for Bulog, addressing limited storage capacity and reducing rental costs. The project, with an estimated budget of Rp5tr, is still under discussion regarding locations and builders and is unlikely to start this year due to time constraints in FY25. (Kontan)

Indonesian Government to Cut 2026 Coal Production Target Below 700mn Tons

The Ministry of Energy and Mineral Resources (ESDM) signaled that the 2026 national coal production target will be lowered to below 700mn tons amid weakening global demand and slower production growth this year. The ministry said it is conducting a comprehensive review after observing that both coal output and exports have trended lower compared with last year. (Kontan)

SKK Migas Projects Year-End Oil Lifting at 625k bpd

Indonesia’s upstream oil and gas regulator (SKK Migas) projects year-end oil lifting to reach 625k barrels per day (bpd), bringing the 2025 average to 607k bpd, slightly above the state budget target of 605 thousand bpd. (Investor Daily)

CORPORATE

MAPB Directors and Commissioners Exit Shareholdings

MAPB directors and commissioners sold all their shares worth around Rp11.4bn on November 5, 2025, at Rp1,600 per share. The divestment leaves them with no ownership in the company, while MAPB’s stock slipped 0.3% to Rp1,650 the following week. (Emiten News)

MEDC Boosts National Oil Production

MEDC raised Indonesia’s oil output through its new Forel and Terubuk fields in South Natuna, adding about 30,000 BOEPD to support the 2025 target of 605,000 BOPD. Fully developed by local workers, the US$600mn project created over 2,000 jobs and is seen as a model of efficient, locally driven energy development. (Kontan)

PTBA Secures Rp3.56tr Bank Loan for Coal Transport Project

PTBA has secured a Rp3.56tr financing facility from state-owned lenders Bank Mandiri, Bank Negara Indonesia, and Bank Rakyat Indonesia to support the development of the Tanjung Enim–Kramasan coal transportation project. The funding will be used to meet the project’s investment needs, noting that the new transport route is a key component of PTBA’s strategy to strengthen its end-to-end coal logistics infrastructure. (Bisnis)

PTPP to Divest Rp1.7tr Assets

PTPP will divest two subsidiaries worth Rp1.7tr—PT PP Infrastruktur and PT Celebes Railway Indonesia—to refocus on its core construction, infrastructure, and EPC businesses. The move, part of its 2025–2029 “Back to Core” plan, aims to boost cash flow and operational efficiency. (Investor Daily)

WIKA Targets Rp20tr Contracts in 2026

WIKA targets over Rp20tr in new contracts next year, up from Rp17tr in 2025, supported by its transformation plan. As of 9M25, it booked Rp6.19tr in new contracts and Rp9.09tr in sales, mostly from infrastructure and building projects. (Bisnis)