FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Bank Mandiri: FY26 Outlook: Cautious on NIM amid Higher Volume but Lower Opex Provide Buffer for Earnings (BMRI.IJ Rp4,970; BUY TP Rp5,500)

- We expect BMRI FY26 net profit to rebound by 5.6% yoy to Rp52.3tr from its FY25F low base, driven by higher loan growth and lower opex.

- Wholesale loans will remain the growth engine while intensified competition will pose risk on NIM amid potentially lower CoF.

- We adjusted our FY25/26F net profit est. by -1.9/+0.2% and maintain Buy rating with a higher GGM-based TP of Rp5,500.

To see the full version of this report, please click here

Bank Syariah Indonesia: FY26 Outlook: Earnings Supported by Gold Business Amid Intensifying Competition in Wholesale (BRIS.IJ Rp2,250; BUY TP Rp3,200)

- We forecast FY26F net profit of Rp8.5tr (+11.5% yoy), supported by robust loan growth (+14% yoy) and resilient NIM (+13bps).

- While wholesale loan yield could weigh on NIM, the robust consumer loan, supported by gold business, will provide buffer for NIM.

- Maintain Buy rating with a higher TP of Rp3,200. Risks to our view include slower gold financing growth and deteriorating asset quality.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

BRIDS FIRST TAKE

- Astra International: Nov25 4W Wholesales: Astra Mkt Share Inched Up (ASII.IJ Rp6,625; BUY TP Rp7,450)

To see the full version of this report, please click here

MARKET NEWS

MACROECONOMY

|

Indonesia: Retail Sales Grew by 4.3% yoy in Oct25 Retail sales grew by 4.3% yoy (0.6% mom) in Oct25, accelerating from 3.7% yoy (-2.4% mom) in the previous month. The improvement reflects stronger demand ahead of the Christmas holiday season, supported by smooth goods distribution. Growth was mainly driven by sales of cultural and recreational goods, as well as food, beverages, and tobacco. Retail sales growth in November is projected to increase further to 5.0% yoy (1.1% mom), as demand continues to strengthen toward year-end. (Bank Indonesia)

The Fed Lowered the Federal Funds Rate by 25bps to 3.50–3.75% The Fed lowered the federal funds rate by 25 bps to 3.50–3.75% as economic activity continues to expand moderately while job gains slow and unemployment edges higher. Inflation has risen from earlier in the year and remains elevated, prompting policymakers to balance risks to both employment and price stability. The Fed will continue monitoring data and stands ready to adjust policy as needed. It also initiated Treasury bill purchases to maintain ample reserves, with some dissent over the size of the rate cut. (The Fed) |

SECTOR

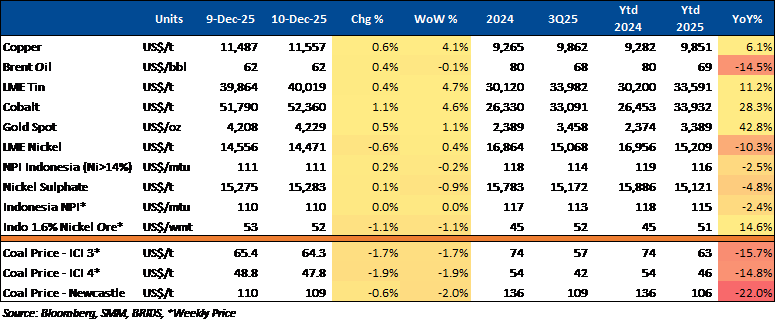

Commodity Price Daily Update Dec 10, 2025

Indonesia Motorcycle Monthly Sales Remain Above 500K Units Despite MoM Decline

Indonesia’s motorcycle market showed mixed performance in Nov25. Monthly sales fell 11.3% mom to 523,591 units, down from 590,362 units in Oct25. Despite the decline, November sales remained within the domestic market’s typical range, which has stabilized above 500,000 units per month since mid-year. On a yearly basis, performance stayed positive, as sales rose from 512,942 units in Nov24. Cumulatively, 11M25 sales reached 5,950,844 units, marginally up 0.35% from 5,929,830 units in the same period of 2024. (Kontan)

CORPORATE

|

BBRI Supports Free Nutritious Meal Program Through Financing of Processing Kitchens BBRI is supporting the government’s Free Nutritious Meal (MBG) program by providing credit facilities for the construction of food-processing kitchens. The bank considers MBG kitchens to be bankable and safe for financing, with each facility estimated to cost between Rp1.8–2.2bn. To date, BBRI has disbursed Rp104.4bn to fund MBG kitchen development across various regions in Indonesia. In addition, BBRI is providing banking and financial services to 3,854 Nutrition Service Units as part of its support for the government’s priority initiative. (Kontan)

BMRI Provides Rp900bn Term Loan to GEMS Entity GEMS, through its subsidiary Borneo Indobara, has secured a Rp900bn term-loan facility from BMRI. The loan agreement was finalized on 10 December 2025. The facility, with a tenor of 5–7 years, will support the company’s cash-flow gap for business expansion, general corporate purposes, and broader group needs. (Emiten News) |