FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Equity Strategy: Jun25 Positioning: What to Add if Investors Trim Banks?

- In May25, domestic funds added positions in Metals, Auto and Retailers while trimming Tech, Consumers, and Petrochemicals.

- Banks’ soft earnings may drive further trimming in the sector; catalysts for Metals remain, but positioning is already high in ANTM and INCO.

- JCI remains attractive versus EM peers on growth outlook and valuation; our picks for 2Q-3Q25 are: BBCA, ICBP, ISAT, and CTRA.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

Healthcare Update: Newest OJK Regulation Stipulates 10% Cost-Sharing of Health Insurance Claim with Policyholders

- In an effort to address overutilization in health insurance claim, OJK now requires a minimum 10% cost-sharing for every claim with policyholders (Co-Payment).

- Maximum out-of-pocket costs are set at Rp300k/claim (Outpatient) and Rp3mn./claim (Inpatient), though insurers may set higher limits if stated in the policy (e.g., 20% co-pay with Rp500k/Rp5mn caps).

Early Take on The Impact to Hospitals:

- Positive: Improve hospitals OCF through upfront payments in private insurance claim.

- Risk: May reduce volumes as patients are now more cost-conscious.

- Resilient players should be the hospitals targeting middle-upper class with strong private patient base, given their better ability to pay.

Top Picks remain MIKA->HEAL->SILO.

We are awaiting comments/latest guidance from hospitals on this new regulation. (Ismail Fakhri Suweleh – BRIDS)

TLKM (Buy, TP Rp3,900) - KTA from our meeting with TLKM

Mobile Strategy: Product Simplification to Drive ARPU Upside

- In Jun25, Telkomsel has streamlined its prepaid portfolio, retaining only Simpati and By.U , while discontinuing Telkomsel Lite and Telkomsel Prabayar. The exit of Telkomsel Lite is expected to remove low-end dilution and support blended ARPU improvement.

- Jun25 will serve as the transition point, as legacy starter packs are phased out and the new pricing structure (e.g., Rp35k for 3GB) becomes the standard.

- Looking ahead, Telkomsel is simplifying its product lineup by phasing out high-volume data packages that has significantly compressed data yields.

- The product streamlining strategy is expected to gradually lift ARPU, followed by a broader effort to push fixed broadband penetration. TLKM believes that low mobile ARPU has been a key barrier to FBB penetration.

- ARPU downside risk remains from legacy services; the company targets legacy revenue to shrink to ~5% of mobile revenue over the next 1.5 years.

WIFI MoU Clarified: Monetizing Idle Infrastructure

- TLKM stated that the cooperation with WIFI remains at the MoU stage. The next step involves a trial period, similar to ongoing collaboration with MyRepublic, before moving toward commercialization.

- The collaboration aims to monetize underutilized capacity in existing IndiHome-covered areas, where penetration remains suboptimal. TLKM opts to lease this capacity under a wholesale agreement with no revenue-sharing.

- TLKM clarified that the partnership is limited to areas with existing IndiHome coverage and it has no intention to expand into new areas or commit additional capex. (Kafi & Erindra – BRIDS)

MARKET NEWS

SECTOR

|

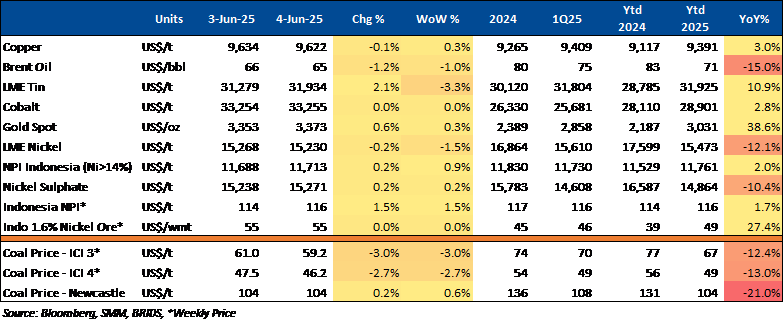

Commodity Price Daily Update June 4, 2025 |

APNI to Launch Nickel Futures Exchange in 2026

The Indonesian Nickel Miners Association (APNI) plans to establish a domestic metals exchange by the first half of 2026, starting with nickel pig iron contracts. Backed by government approval, the exchange aims to boost Indonesia’s role in global nickel price setting. It will be modeled after major exchanges like the LME and Shanghai Futures Exchange. Experts stress the importance of regulatory support and commercial relevance for the exchange’s success. (Kontan)

CORPORATE

|

HOKI Forms Strategic Partnership with Indomarco to Boost Sales HOKI has partnered with Indomarco Adi Prima, part of Salim Group, to strengthen its distribution network and accelerate sales growth in 2025. The collaboration, marked by a National Sales Kickoff event on May 24, 2025, involves PT Gurih Mitra Perkasa (GMC), Indomarco’s distribution unit, and aims to drive sustainable business expansion. (Bisnis)

MEDC Buybacks US$461.52mn in Bonds MEDC repurchased US$461.52mn of bonds via tender offer, covering notes from its subsidiaries Medco Oak Tree (due 2026) and Medco Bell (due 2027). The buyback was part of a strategic move to manage debt, with settlement scheduled for 9 June 2025. (Bisnis)

MIKA to Distribute Rp43 Dividend per Share MIKA will distribute a cash dividend of Rp43 per share for the 2024 fiscal year (yield 1.6%), representing a payout ratio of 52.2%. The distribution was approved at the Annual General Meeting of Shareholders (AGMS). (Kontan)

TLKM Reportedly Considers Divesting AdMedika for US$100mn TLKM is reportedly assessing its investment holdings as part of ongoing efforts to streamline operations and improve efficiency. Bloomberg reports TLKM is exploring a potential divestment of its digital healthcare arm, AdMedika, in a deal estimated at US$100mn. (Bisnis)

UNTR Targets Mineral Expansion with Focus on Copper-Gold Mines in Australia UNTR is exploring international expansion in copper and gold mining, prioritizing potential acquisitions in Australia due to high resource prospects. Other regions considered include Mongolia, Kazakhstan, and Canada. UNTR currently operates two gold mines in Indonesia and aims to produce 200,000–250,000 ounces of gold in 2025. (Kontan) |