FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

BRIDS FIRST TAKE

- AKR Corporindo: FY24 Land Sales Miss; Cautiously Optimistic in FY25 (AKRA.IJ Rp1,170; BUY TP Rp1,600)

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS

MACROECONOMY

China to Expand Subsidies for Consumer Goods and Industrial Upgrades

China will expand subsidies for consumer products and industrial upgrades. Consumers can receive a 15% subsidy, capped at CNY1,500 annually, for purchasing eligible mobile phones, tablets, and smartwatches priced under CNY6,000, with limits on quantities per individual. Additionally, the government has increased the number of subsidized home appliance categories from eight to twelve, while also enhancing funding for industrial equipment modernization. (Bloomberg)

Indonesia FX Reserve Surged to A Record High of US$155.7bn

Indonesia's FX reserves surged to a record high of US$155.7bn, increasing by US$5.5bn from Nov24. The surge was attributed to the government's foreign loan withdrawal, oil and gas export receipts, and tax and service receipts. Bank Indonesia maintains optimism about the reserve due to a positive export outlook and a maintained surplus in the capital and financial account. (Bank Indonesia)

SECTOR

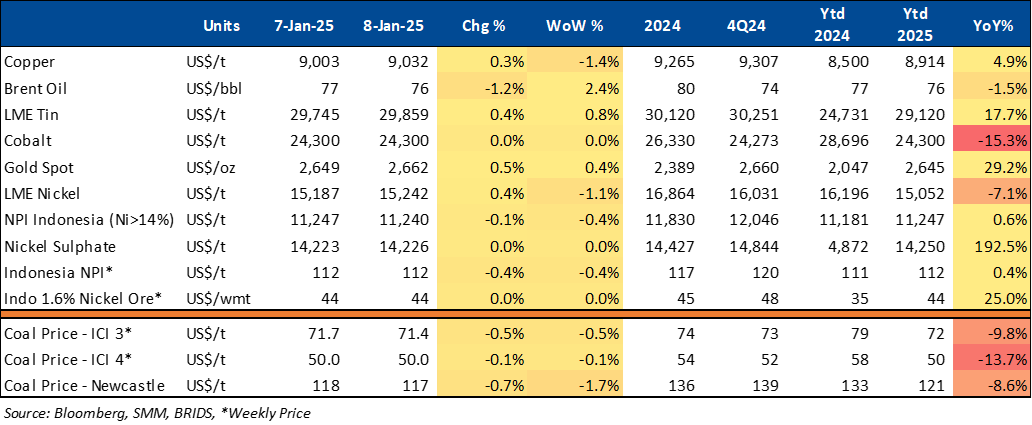

Commodity Price Daily Update Jan 8, 2025

Indonesian Government Revises Regulations on Regional PI in the Upstream Oil and Gas Sector

The Ministry of Energy and Mineral Resources (ESDM) has revised regulations to boost investment in the upstream oil and gas sector. Ministerial Regulation No. 1 of 2025 amends Regulation No. 37 of 2016, focusing on the 10% Participating Interest (PI) for oil and gas working areas. The new rules, effective January 6, 2025, aim to optimize regional involvement and attract investment. A key change in Article 3 requires Regional-Owned Enterprises (BUMDs) managing the PI to be public regional companies with at least 99% government ownership, and they must not engage in other business activities. (Kontan)

Qatar Investors Signed an MoU to Build 1mn Homes

Qatar investors signed an MoU to develop 1mn housing units for middle to lower-income groups. The government will provide state-owned land, including sites in Jakarta and other urban areas, while facilitating investor compliance with local regulations. The initiative reflects growing international trust in Indonesia’s government. (Kontan)

CORPORATE

ACES Injected Rp250bn into Subsidiary KLV

ACES has provided a Rp250bn soft loan to its subsidiary, Kawan Lama Inovasi (KLV), finalized on 7th Jan25. The loan, bearing a 7% interest rate, aligns with the agreement between the two affiliated entities, with ACES holding a 99.98% stake in KLV. (Emiten News)

AMMN Targets 2025 Gold Production with US$1.4bn Capex Allocation

AMMN aims to produce 228mn pounds of copper and 90,000 ounces of gold in 2025, backed by US$1.4bn in capex for 4Q24 to 2025. Focused on cost efficiency and safety, the company remains resilient to market dynamics. Details of the 4Q24 capex will be disclosed in Mar25. (Kontan)

ASLC to Allocate Rp50bn Capex for 2025 Expansion

ASLC, through Caroline.id, plans to invest Rp50bn in 2025 to open four new outlets and expand its trusted used car marketplace. Despite economic uncertainties, the company targets double-digit growth, with exact figures yet to be determined. (Kontan)

EXCL Announced Resignations of Two Directors

EXCL Directors Rico Usthavia Frans and I Gede Darmayusa announced their resignations on Wednesday, January 8, 2025. Similar to Dian Siswarini and Abhijit, their decision to step down was also driven by personal reasons. The resignations will take effect upon approval at the company’s next General Meeting of Shareholders (GMS). (Investor Daily)

UNTR Sets 2025 Gold Sales Target at 240,000 Ounces

UNTR targets gold sales of 240,000 ounces in 2025, up from 235,000 ounces in 2024, reflecting its focus on expanding mineral mining. Additional 2025 targets include selling 4,600 heavy equipment units, 14mn tons of coal, 2mn wmt of nickel ore, and achieving client coal production of 150-152mn tons with overburden removal of 1.2-1.3bn bcm. (Kontan)

PTBA Completed 4Q24 Exploration Worth Rp21.69bn

PTBA reported 4Q24 exploration activities, costing Rp21.69bn, which included coring, open-hole drilling, and geophysical logging at Tanjung Enim, with 59 drill points covering 11,204 meters and 1,707 coal samples for analysis. Exploration at IPC, PTBA's subsidiary, involved 34 drill points over 2,248 meters, costing Rp2.4 billion. PTBA plans to continue exploration at Tanjung Enim in 2025, while IPC focuses on updating geological models and geotechnical studies. (Emiten News)

PTPP to Settle Maturing Bonds and Sukuk Worth Rp200bn

PTPP has allocated a total fund of Rp200bn, sourced from the company's internal cash, to settle the company's financial obligations. These obligations include the Series A of the Sustainable Bond III PTPP Stage II Year 2022 amounting to Rp140bn (coupon: 6.5%, maturity: April 22, 2025) and the Series A of the Sustainable Sukuk Mudharabah I PTPP Stage II Year 2022 amounting to Rp60bn (maturity: April 22, 2025). (Investor Daily)