|

FROM EQUITY RESEARCH DESK |

|

||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

|||||

|

BRIDS FIRST TAKE

To see the full version of this report, please click here

To see the full version of this report, please click here

RESEARCH COMMENTARY Coal (Neutral) – New Royalty Scheme to Benefit IUPK Holders · The government has unveiled the new coal royalty scheme (formalized under Govt regulation PP 18/ 2025), with new rates that are in-line with the previously indicated scheme earlier in Mar25. · The potential impact of the new royalty rate will vary among different licenses/ contract holders: - IUPK holders (mines under AADI, BUMI, INDY) will effectively see their royalty rate falling to the applicable rate according to their respective brackets (i.e., from 28% to 19% if HBA is at US$120-140/t). - CCoW holders: CCoW holders will effectively see their total taxes payment unchanged since the higher royalty rate (for HBA >= US$90/t) will be offset with the lower levy PHT rate. - IUP holders: IUP holders (PTBA) will effectively see a slight increase in royalty rate when HBA is above US$90/t. · We conservatively estimate a 19% upside for AADI’s FY26 EPS under the new royalty scheme and estimate limited impact in EPS of ITMG and PTBA. · We currently have Buy ratings on the coal names: AADI with TP of Rp9,850, ITMG TP Rp27,300 and PTBA TP Rp3,100. (Erindra Krisnawan – BRIDS)

EXCL (Buy, TP:2,800) - Block Trades – Apr 16, 2025 Total Block Transaction Value: Rp9.81tn, with ombined volume: ~3.32bn sharesbroken down as: · The Equalisation block – Sinarmas acquires shares from Axiata to reach 34.8% stake (joint control) Volume: ~2.38bn shares Rp2.20tn @ Rp2,350/share Volume: ~940mn shares · The Buyback – EXCL repurchases shares from dissenting shareholders post-merger Closing price: Rp2,190 (-15.18%) — showing post-merger pressure despite strategic block trades.

Comment: This transaction closely matches the 2.38bn shares (13.1%) that Axiata sold to Sinarmas as part of the merger agreement, allowing both parties to hold 34.8% of EXCL and jointly control the company. (Niko Margaronis & Kafi Ananta – BRIDS)

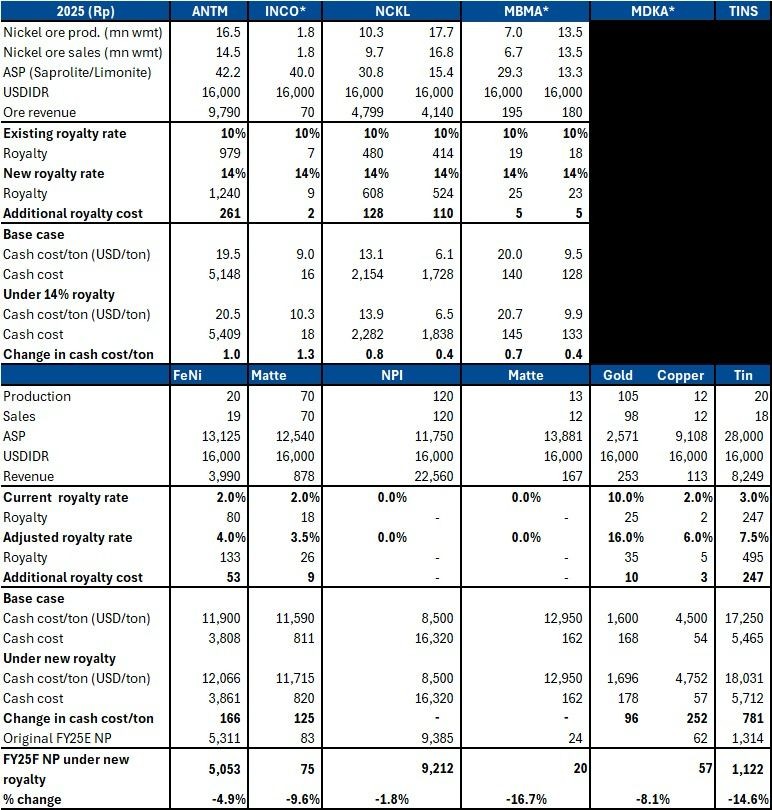

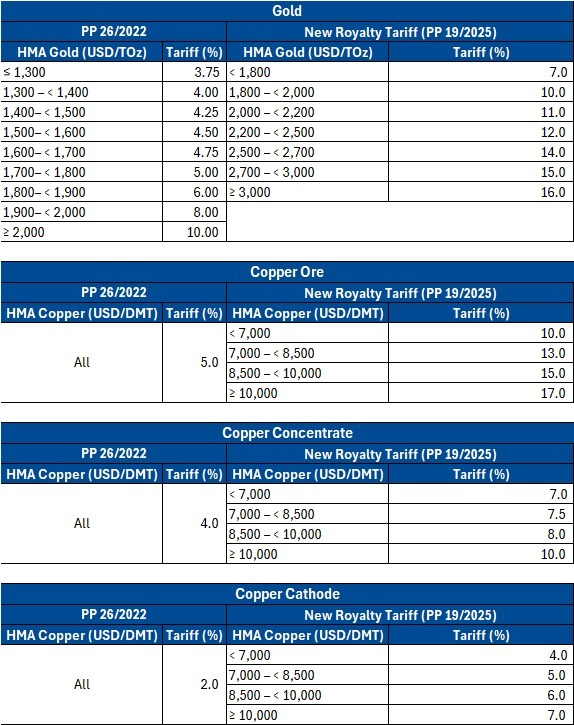

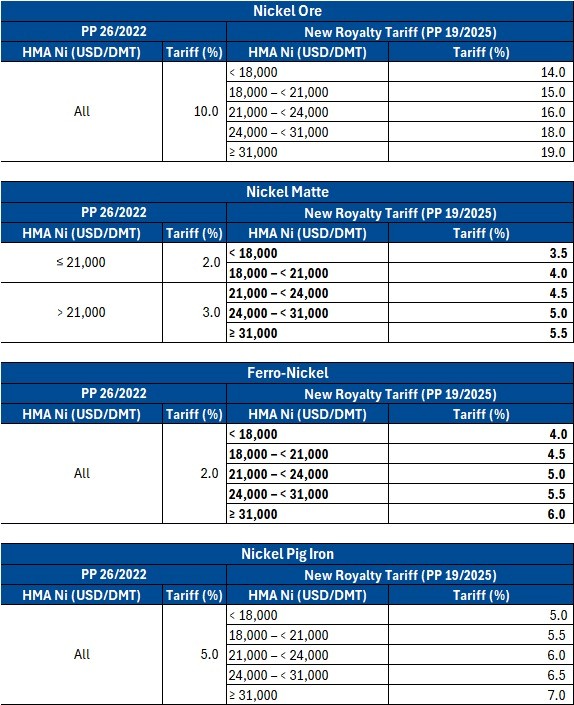

Metal (Neutral) New Royalty Rate is Officially Ratified Through PP19/2025

Comment: · Based on our calculation of metal mining companies under our coverage, the most to least impacted are MBMA (-16.7%) > TINS (-14.6%) > MDKA (-14.5%) > INCO (-9.6%) > ANTM (-4.9%) > NCKL (-1.8%) · The impact is milder than our initial expectation: INCO (-23%) > TINS (-20%) > MDKA (20%) > MBMA (-12%) > ANTM (-10%) > NCKL (-4%) as the new rates are only effective for 8 out of 12 months and we have revised our est. post FY24 earnings. (Timothy Wijaya – BRIDS)

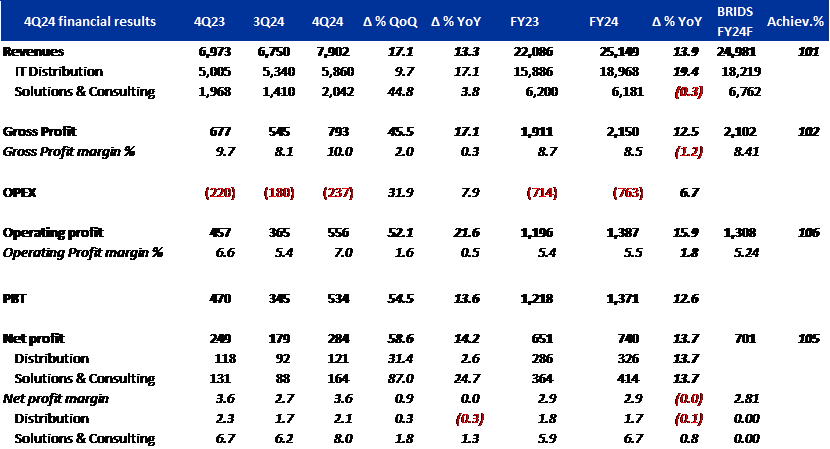

MTDL (Buy, TP: Rp800) 4Q24 Results – Strong Seasonal Finish As expected, MTDL posted a solid 4Q: · Net profit surged +58.6%qoq / +14.2%yoy to IDR 284bn · Revenue hit IDR 7.9tn (+17.1%qoq / +13.3%yoy), driven by year-end order fulfillment and strong Infinix smartphone sales · S&C revenue was soft (-0.3%yoy), but a rising share of high-margin services supported profitability · Completed Phase 2 warehouse expansion (adds 18k sqm) ensures long-term distribution capacity (5–7year horizon)

FY24 guidance beaten:

FY25 target:

Valuation:

TINS (Buy, TP: Rp2,300) – Earnings Call KTA · Since Tin is exempt from US' tariff list, TINS continues to export to the U.S. (9% in FY24). · 2025 RKAP prod./sales volume set at 21.5kt. Though the 1Q25 production figure have been lagging behind due to rainy weather, there are also existing inventories from Dec'24 to boost sales. · 2025 cash cost is targeted at US$20-21k/ton, which was an increase from US$17.8k/ton in FY24 due to the usage of B40 fuel and rising material and spare part costs. · Historical dividend payout ratio are around 30%-40%, though mgmt noticed that there might be demand from the gov't to increase payout ratio. (30%=4.7% yield, 40%=6.3% yield, 50%=7.9% yield). (Timothy Wijaya – BRIDS)

MARKET NEWS |

|||||||||||

MACROECONOMY

|

Bank Indonesia Estimated Mar25 Retail Sales Growth at 0.5% yoy Bank Indonesia estimated March 2025 retail sales growth at 0.5% yoy, raising 1Q25 growth to 1% yoy after revisions. Excluding 2020, this was the weakest Ramadhan performance on record, with FnB sales—typically a key driver—up just 1.4%, far below the usual 10% average. (Bank Indonesia)

China’s 1Q25 GDP Grew 5.4% China’s 1Q25 GDP grew 5.4%, beating expectations but lagged in nominal growth due to deflation. Industrial output rose 7.7% and retail sales 5.9%, signaling stronger consumption, though supply still leads demand. Housing showed early stabilization, but investment and starts remain weak. April trade data hints at slowing momentum as US tariffs weigh where urgent stimulus may be needed. (Bloomberg)

Indonesia Considers Boosting U.S. Wheat Imports to Balance Trade Apindo suggests increasing U.S. wheat imports to help reduce the trade deficit with the U.S. Aptindo sees no issue with the proposal, noting that Indonesia’s flour industry sources wheat from various countries. While U.S. wheat is of higher quality, it is also more expensive. Flour prices depend on multiple factors, including exchange rates. Strengthening trade ties with the U.S. is seen as possible due to the industry's good relationship with U.S. wheat organizations. (Kontan)

US: Powell Reaffirms Fed’s Commitment to Curb Tariff-Driven Inflation The Fed Chairman Jerome Powell reaffirmed the Fed’s commitment to preventing tariff-driven price spikes from fueling persistent inflation, emphasizing the need to keep long-term expectations anchored. He reiterated the Fed’s dual mandate of stable prices and maximum employment and stressed the institution’s legal independence from politics. (Bloomberg) |

SECTOR

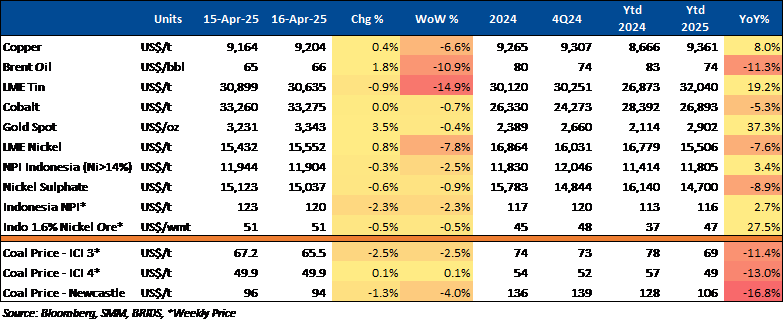

Commodity Price Daily Update Apr 16, 2025

Coal: Benchmark Coal Price for Second Half of April Set at US$120.2 per Ton

The Minister of Energy and Mineral Resources has set the Benchmark Coal Price (HBA) for coal sales in the second half of April 2025 at US$120.2 per ton, based on Free on Board (FOB) vessel delivery terms. This represents a decrease of US$3.12 or 2.53% compared to the HBA for the first half of April 2025, which was set at US$123.32 per ton. (Investor Daily)

Consumer: Weak Purchasing Power Weighs on Consumer Credit Growth

Persistently weak purchasing power continues to pressure consumer credit growth in Indonesia, which slowed to 9.4% yoy in Feb25. High interest rates may also continue to suppress demand. Banks are responding cautiously, prioritizing credit quality over aggressive expansion. (Kontan)

CORPORATE

ASII Sells 110,812 Cars in 1Q25 and Maintains 54% Market Share

ASII recorded total car sales of 110,812 units in 1Q25, maintaining a 54% market share—unchanged from last year. Toyota and Daihatsu led contributions with 69,296 and 34,999 units, respectively, followed by Isuzu and UD Trucks with 6,517 units. In the LCGC segment, Astra sold 28,294 units, securing a 69% market share, slightly down from last year’s 74%, in line with the national LCGC slowdown to 41,104 units from 50,055. (Bisnis)

BELI completed its latest stock option programs MESOP II, III

- Exercise Price: Rp406/share

- Total Options Offered: 3.00bn shares

- Taken Up: 2.86bn shares (95.4%)

- Period: 15 Mar – 14 Apr 2025

- Total New Shares Issued: 2.86bn

- Total Shares Outstanding: 133.86bn (+2.2% dilution)

- Current Share Price: Rp412 (as of Apr 16, 2025)

- Remaining 138mn options can still be exercised in future windows. (IDX)

BREN Secures US$139mn Loan

BREN has secured a loan amounting to US$139mn (c. Rp2.34tr) from Sumitomo Mitsui Banking Corporation Singapore Branch (SMBC) and DBS Bank Ltd on April 15, 2025. The loan was obtained through its subsidiaries, with Star Energy Geothermal Pte Ltd receiving US$114.5mn and Star Energy Geothermal (Wayang Windu) Limited receiving US$25mn. The funds will be used to finance project capacity expansion and the development of the Unit 3 geothermal power plant. (Investor Daily)

ESSA to Distribute Rp172bn Dividend

ESSA will pay Rp172.26bn in dividends, or equivalent Rp10 per share (yield: 1.6%), double last year’s payout, supported by a strong cash position and zero debt. The company is progressing on its low-carbon ammonia plant and a new SAF facility in Central Java, both targeting operations by 2028. (Kontan)

EXCL x FREN Merger Updates in IDX

The merger is efffective from 16 Apr 2025

- EXCL listed 5.07bn new shares on IDX

- FREN is delisted on 17 Apr 2025

Merger Structure:

- FREN & ST merged into EXCL (surviving entity)

- Share swap only — no cash injection

- FREN: 1 → 0.011 EXCL

- ST: 1 → 0.005 EXCL

- Total new shares issued: 5.07bn

- Post-merger EXCL shares: 18.2bn

Valuation Basis:

- FREN valued at Rp11.89tr

- ST at Rp10.52tr

- Total deal: Rp22.41tr

Ownership Post-Merger:

- Sinarmas gets ~21.7% via share swap

- Will increase to 34.8% by paying US$475mn (US$400mn upfront + US$75mn deferred) to Axiata

- Axiata’s stake drops from 47.9% → 34.8%

- Public holds 30.4%

- Axiata & Sinarmas now share joint control of EXCL holding 34.8% each. (IDX)

SMGR Plans Rp300bn Share Buyback

SMGR will seek shareholder approval on 23rd May25, for a share buyback of up to Rp300bn, including Rp200bn for market volatility support. (Kontan)

To see the full version of this snapshoot, please click here