|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

Bank BTPN Syariah: Emerging from the Final Leg of Credit Cycle Pain (BTPS.IJ Rp 1,315; BUY TP Rp 1,500) · BTPS booked a net profit of Rp422bn in 4M25 (+17% yoy), driven by a lower CoC of 8.5% (-483bps yoy). · Loan contraction (flat mom) showed signs of bottoming out, indicating that new disbursements are catching up with maturing loans. · Maintain Buy rating with a higher TP of Rp1,500. Key risk to our call is potential shift in asset quality. To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

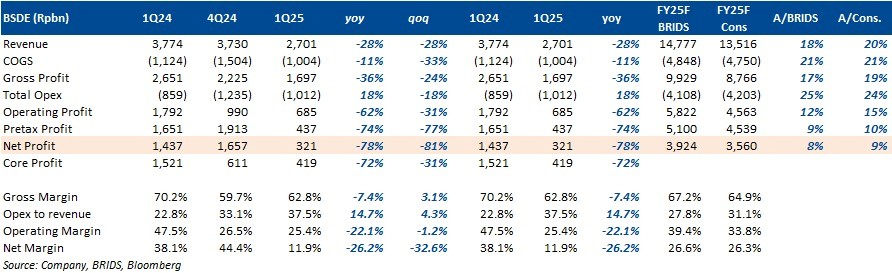

RESEARCH COMMENTARY BSDE (Buy, TP: Rp1,550) 1Q25 Results: Below our and consensus estimates · BSDE recorded 1Q25 net profit of Rp321bn (-31%qoq; -78%yoy), forming only 8%/9% of our/cons. FY25F estimates of Rp3.92tr/Rp3.56tr. · Revenue dropped 28%yoy, primarily driven by significant decline in Land, Houses, and Shophouses sales bookings (-35%yoy) from Rp3.20tr to Rp2.07tr. BSDE noted that the decline was attributed to fewer working days postponing several project handover as well as land sales closing price negotiation. · 4Q24 revenue booking was also higher due to VAT-waived products accelerated handovers. · Opex to revenue was also higher driven by salary costs (+24%yoy) from Rp288bn to Rp357bn, as well as IT costs (+36%yoy), dragging down Net Profit further. We are currently reviewing our FY25F net profit forecast. (Ismail Fakhri Suweleh & Wilastita Sofi – BRIDS)

UNTR (Buy, TP: Rp24,900) – Apr25 operational: Strong Komatsu sales, but Pama’s volume remained soft as expected Komatsu sales: · Apr25: 501 units (+83% yoy/ +21% mom) · 4M25: 1,886 units (+35% yoy; 40% of BRIDS FY25F – ahead)

Mining contracting: · Apr25: 96 units OB +Coal (-12% yoy/ +2% mom) · 4M25: 380 units (-11% yoy; 28% of BRIDS FY25F – below)

Coal mining: · Apr25: 1.1Mt (-16% yoy/ +12% mom) · 4M25: 4.9Mt (-7% yoy; 31% of BRIDS FY25F – in line)

Our take: As indicated in our latest update note, Apr25 production volume for Pama remained restricted by the above-normal weather condition, hampering earnings recovery potential in 2Q25. Nonetheless, positive momentum from Komatsu sales may drive positive sentiment on the share price given cheap valuation at 4x FY25 PE. (Erindra Krisnawan & Kafi Ananta – BRIDS)

MARKET NEWS |

||||||||||||

MACROECONOMY

Indonesia: The Government will Launch a Stimulus Package

The government will launch a stimulus package starting June 5, 2025, including a 50% electricity discount for 79.3mn low-power households, transport and toll discounts during school holidays, expanded food aid for 18.3mn families, wage subsidies for low-income workers and honorary teachers, and extended insurance premium cuts for labor-intensive sectors—all aimed at boosting consumption. (Bisnis)

SECTOR

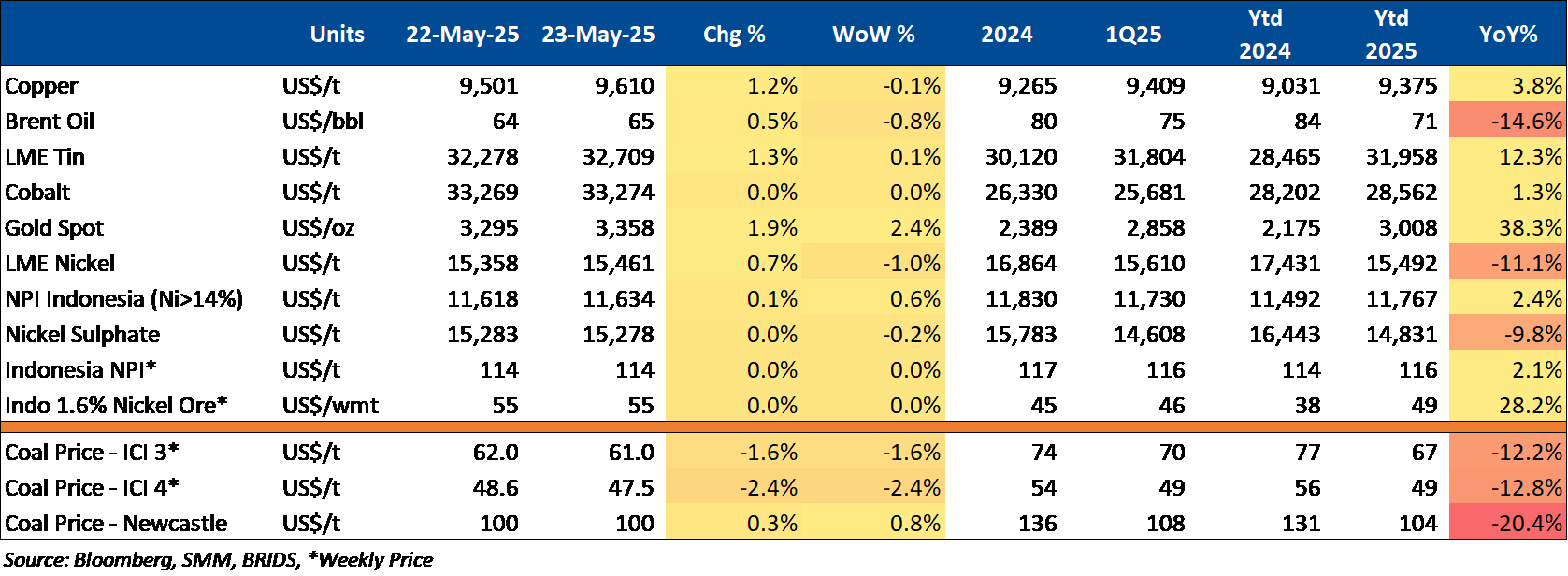

Commodity Price Daily Update May 26, 2025

Indonesia: Gov’t Disburses FLPP and Bulog Absorbs Rice

By mid-May 2025, the government disbursed Rp11.5tr for FLPP housing subsidies, covering 88,482 units. The budget will be raised to support the 3mn housing target. Meanwhile, Bulog spent Rp15.15tr (91% of its Rp16.58tr allocation) to absorb rice, targeting 3mn tons from farmers. (Kontan)

CORPORATE

|

BUKA Reports Results of MESOP I & MESOP II BUKA reported the implementation results of its MESOP I and II for the April–May 2025 period. Under MESOP I, 17.7mn shares were exercised, causing only a minor 0.0172% dilution to shareholders, while over 5bn options remain valid. For MESOP II, no shares were exercised, with around 4bn options still outstanding. Both programs follow agreed vesting schedules. (IDX)

Indomine: Government Considers SMGR Divestment Amid SOE Reforms According to Indomine, the government is considering a partial divestment of SMGR to unlock value and attract foreign investors as part of Danantara’s SOE reform program. The plan includes potentially giving up majority control to a strategic partner to enhance operational efficiency and governance. The move targets SMGR’s undervaluation and anticipates a cement industry rebound. As of now, there is no official filing from the company. (Indomine)

MIDI to Distribute Rp245.7bn Dividend for FY24 MIDI will distribute Rp245.7bn in cash dividends, equal to 45% of its 2024 net profit, as approved in the AGM on May 22, 2025. Shareholders will receive Rp7.35 per share (yield: 1.7%), with payment scheduled for June 18, 2025. Key dates include a cum dividend on June 3 (regular & negotiated market) and June 5 (cash market), and an ex dividend on June 4 and June 10, respectively. (Bisnis)

MTDL to Distributes Rp294.6bn Dividends for 2024 MTDL has declared a dividend of Rp294.6bn, or Rp24 per share (dividend yield of 4.1%). This marks a +14.3% yoy increase compared to the previous year, with a dividend payout ratio of 39.8% for the 2024 fiscal year. (Kontan)

SMGR to Distribute Rp648.75bn Dividend and Appoints New Board SMGR will distribute Rp648.75bn in dividends for 2024, or Rp96.17 per share (yield: 3.5%), representing 90.13% of net profit. The AGM on May 23 also approved a new green brick business and a major board reshuffle, naming Sigit Widyawan as President Commissioner and Indrieffouny Indra as President Director. (Emiten News)

Wuling Hits 3M EVs and Launches Local Battery in Indonesia Wuling Motors has produced 3 million EVs globally, with 40,000 units from its Cikarang plant. It also launched the locally assembled MAGIC Battery and became the first Chinese automaker to localize EV battery assembly in Indonesia, boosting local EV production and sustainability efforts. (Kontan) |