FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Indocement Tunggal Prakarsa: Decent Vol Growth Expectation in FY25F, With Less Intense Competition (INTP.IJ Rp 5,250; BUY TP Rp 8,800)

- INTP’s management expects 2%-3% vol. growth, and an ASP increase in May/Jun25 to pass through rising labor and industrial fuel costs.

- Mgmt sees competition from Chinese players and Semen Merdeka to be more benign, yet the outlook still hinges on strategy.

- Maintain INTP as our top pick in the cement sector. We expect better opex efficiency as RDF usage is rising.

To see the full version of this report, please click here

Wintermar Offshore Marine: Robust FY25 outlook Intact, driven by LT Contracts (WINS.IJ Rp 412; BUY TP Rp 610)

- WINS is mulling over another LT contract to secure the persistently strong daily charter rates.

- Mgmt guides for a slightly higher utilization rate of 70%, but a lower capex of US$20mn as it looks for further vessel acquisitions.

- We maintain a Buy rating on WINS with a TP of 610. Key risks include lower charter and utilization rates.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

Poultry (Overweight) – 2nd Week of February 2025 Price Update

- Live bird prices increased to Rp18.9k/kg, but the weekly average price of Rp18.5k reflects a 1.7% wow decrease in the second week of Feb25.

- Day-old chick (DOC) prices remained steady at approximately Rp5.5k/chick.

- Local corn prices slightly decreased to Rp5.2k/kg, with the weekly average price remaining unchanged since mid-Jan25 at Rp5.2k/kg.

- Soybean meal (SBM) prices fell below US$300/t in the second week of Feb25, bringing the average price for Feb25 down slightly to US$301 (-0.2% mom, -12% yoy).

- The price trend in the second week of Feb25 improved compared to the previous week, except for the live bird price, which experienced a week-on-week decrease. Overall, we are still looking at a solid 1Q25 results. (Victor Stefano & Wilastita Sofi – BRIDS)

MARKET NEWS

MACROECONOMY

|

Chinese Banks Issued a Record CNY5,130bn in New Yuan Loans in Jan25 Chinese banks issued a record CNY5,130bn in new yuan loans in Jan25, far exceeding December’s CNY990bn and the previous record of CNY4,920bn set in Jan24, reflecting the impact of policy stimulus in driving credit expansion. Meanwhile, total social financing also hit an all-time high of CNY7,060bn, surging from CNY2,860bn in Dec24. (Trading Economics)

Indonesia: Prabowo Unveils Rp300tr Savings Effort is Only the First Round Prabowo announced that the government’s savings effort of Rp300tr is only the first round, and the second round of efficiency will amount to Rp308tr. In the second round, efficiency measures target Ministries and Agencies (K/L), with Rp58tr returned to them. The third round will focus on SOEs, aiming for Rp300tr in dividends, of which Rp200tr will go to the state Rp100tr will be reinvested in SOEs. (CNBC Indonesia)

Indonesia: Key Changes in Job Loss Insurance (JKP) Rules

|

SECTOR

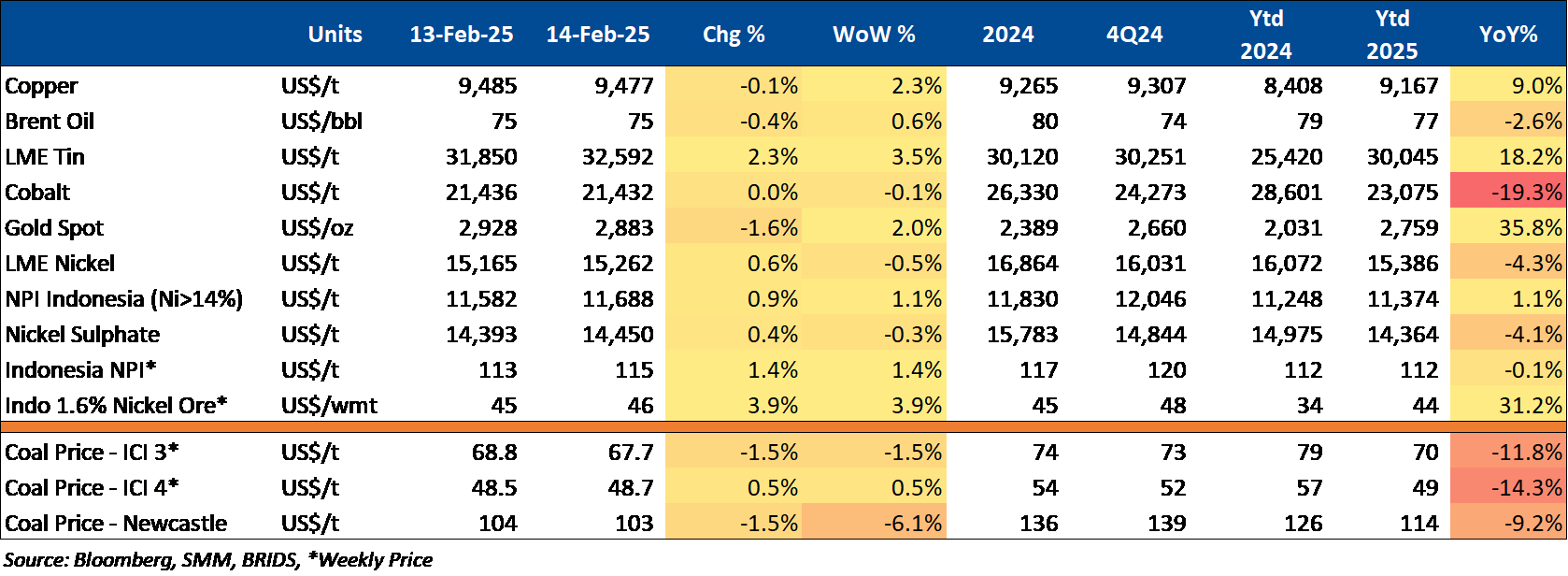

Commodity Price Daily Update Feb 14, 2025

Oil: ICP for January 2025 Increases to US$76.81 per Barrel

The Indonesian Ministry of Energy and Mineral Resources (MEMR) has set the Indonesian Crude Price (ICP) for Jan25 at US$76.81 per barrel. This represents an increase of US$5.20 per barrel compared to the ICP for Dec24, which was US$71.61. According to MEMR, the rise in the ICP for Jan25 aligns with the increase in global crude oil prices. (Kontan)

Telco: Komdigi Prioritizes Affordable Home Internet Over Non-Tax State Revenue in 1.4 GHz Auction

The Ministry of Communication and Digital (Komdigi) has emphasized that the primary goal of the 1.4 GHz frequency band selection is to provide affordable fixed broadband internet services for the public. This initiative aims to deliver high-speed internet access to households at budget-friendly rates rather than prioritizing higher Non-Tax State Revenue (PNBP). Komdigi estimates that home internet services using the 1.4 GHz spectrum could be priced at around Rp100k–150k per month for speeds of 100 Mbps. (Bisnis)

CORPORATE

BMRI Prepares Rp1.17tr for Share Buyback

BMRI has allocated a budget of Rp1.17tr for a share buyback program. The buyback will be carried out within 12 months after receiving approval from investors. According to the plan, the general meeting of shareholders will be held on Tuesday, March 25, 2025. If the plan receives approval from investors, the buyback period will be effective from Wednesday, March 26, 2025, until March 25, 2026. (Emiten News)

HRTA Partners with UNTR and BRMS Entities for Precious Metals Trade

HRTA has signed a gold trading agreement with PT Agincourt Resources, a unit of UNTR, on 13th Feb25, though transaction details remain undisclosed. On the same day, HRTA also amended agreements with PT Emas Murni Abadi (EMA) and PT Linge Mineral Resources (LMR) for gold refining and trading cooperation. The partnership allows for refining and purchasing up to 3,600 kg of gold annually, aiming to strengthen business expansion for all parties. (Kontan)

KEJU Targets 20% yoy Growth for Ramadan and Lebaran

KEJU aims for a 20% yoy increase in product demand during Ramadan and Lebaran, ensuring sufficient stock of Prochiz products. Management noted that cheese consumption consistently rises during this period. To support growth, KEJU continues to enhance its distribution network across general trade, modern trade, and e-commerce channels. (Kontan)

MDIY Opens 1,000th Store in Bulukumba

MDIY has launched its 1,000th store in Bulukumba, South Sulawesi, expanding its reach and providing affordable household essentials locally. This milestone reflects the company’s commitment to equitable access across Indonesia, including remote areas. Over 50% of MDIY’s employees are from outside Java, highlighting its focus on local job creation. (Kontan)