|

FROM EQUITY RESEARCH DESK |

|

|||||||||||

|

IDEA OF THE DAY |

|

|

|

|

|

|

||||||

|

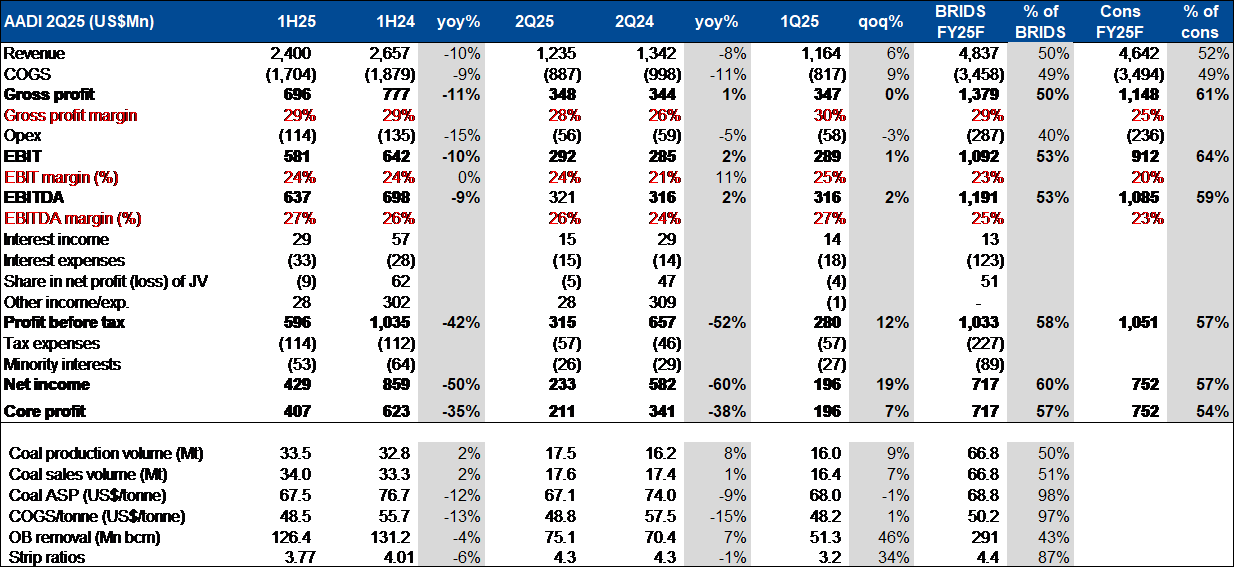

RESEARCH COMMENTARY AADI (Buy, TP: Rp9,850) - 2Q25/ 1H25 Results – Slight Beat on Still Resilient Coal ASP · 2Q25 core profit rose 7% yoy but -38% yoy, bringing 1H25 core profit to US$407mn (-35% yoy) but slightly above our/ consensus forecast (57%/ 54% of FY25F). · 2Q25 revenue rose 6% qoq (-10% yoy), driven by +7% qoq/ +1% yoy increase in sales volume, while ASP fell slightly (-1% qoq/ -9% yoy) to US$67/t. 1H25 revenue of US$2.4bn (-10% yoy) were inline with our/ consensus forecast (50%/ 52% of FY25F). · 1H25 production and sales volume were on track (+2% yoy) and inline with our forecast. · 1H25 cost fell (COGS/t down -13% yoy) and were below our estimates, reflecting the impact of lower royalty rate and cost control. · Overall a decent 1H25 delivery compared to peers, although 3Q may reflect slightly lower margin/ ASP due to the lagging effect on price. (Erindra Krisnawan & Kafi Ananta – BRIDS)

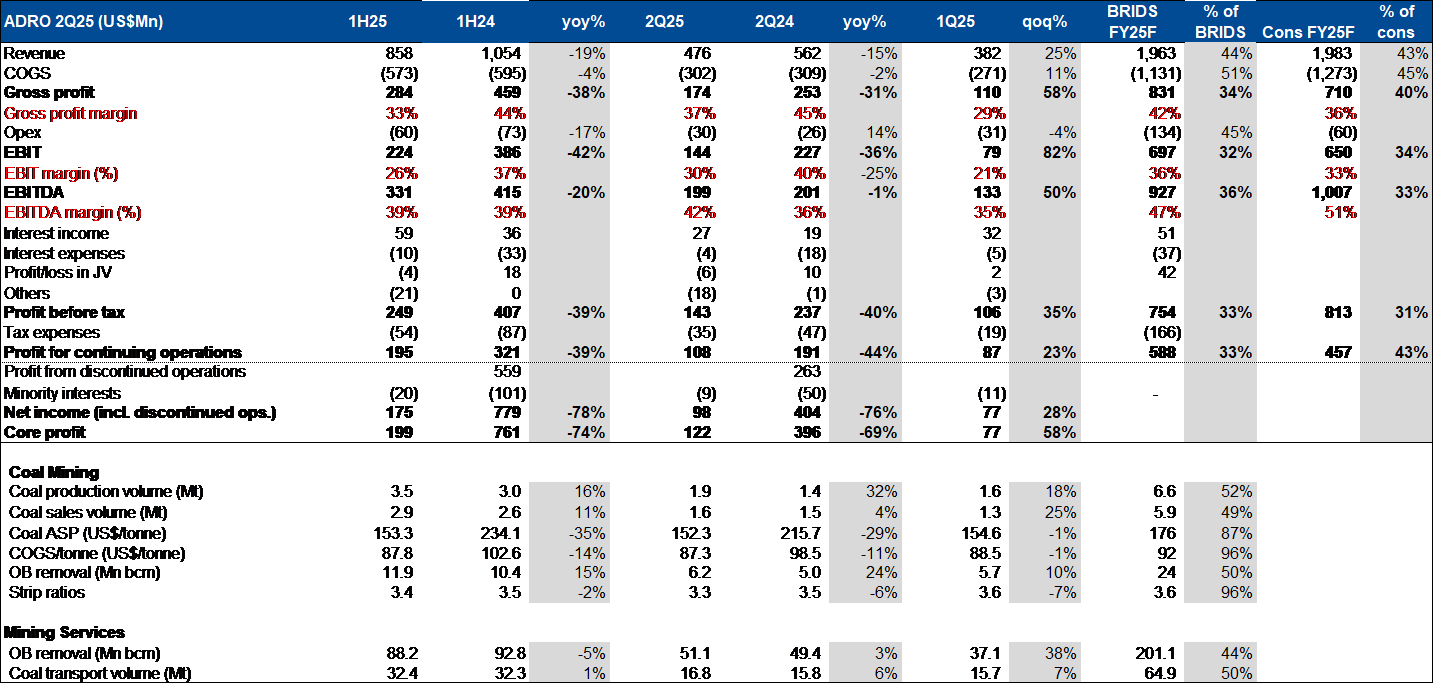

ADRO (Buy, TP: Rp2,630) - 2Q25/ 1H25 Results – Miss Due to Weaker ASP and OB Volumes · 1H25 profit (from continuing operations) and EBITDA fell -39% and -20% yoy respectively and accounted for 33/43% and 36/ 33% of our/ consensus FY25F. · ADMR’s coal ASP fell further to US$152/t in 2Q25, bringing 1H25 ASP to US$153/t (13% below our forecast). · ADMR’s 1H25 production and sales volumes grew 16% and 11% yoy respectively, and is on trac to achieve our forecast (52/ 49% of FY25F). · SIS posted a strong +38% qoq rebound in 2Q25 OB volumes, but still fell short to offset the weak 1Q25 volumes due to high rainfall; 1H25 OB volumes fell -5% yoy, forming only 44% of our FY25F. · Overall, a weak set of 1H25 results, with potentially better 2H25 amid recovery in coking coal price to US$180/t, but is likely to remain below our expectation (FY25F ASP of US$176/t). (Erindra Krisnawan & Kafi Ananta – BRIDS)

ANTM (Buy, TP: Rp3,000) 2Q25/ 1H25 – earnings beat from gold sales and nickel ore · 2Q25 core profit rose +20% qoq/ +95% yoy, bringing 1H25 core profit to Rp4.7tr (+203% yoy, forming 72%/ 69% of our/ cons FY25F. · 2Q25 revenue accelerated +26% qoq/ 126% yoy, driven by strong gold sales volume (+13% qoq/ 76% yoy) and margins, combined with 14% qoq growth in nickel ore, which more than offset the weak FeNi sales. · Expect 2H25 earnings to normalize, but FY25F remains likely above ours and consensus current forecast. (Erindra Krisnawan & Naura Reyhan Muchlis – BRIDS)

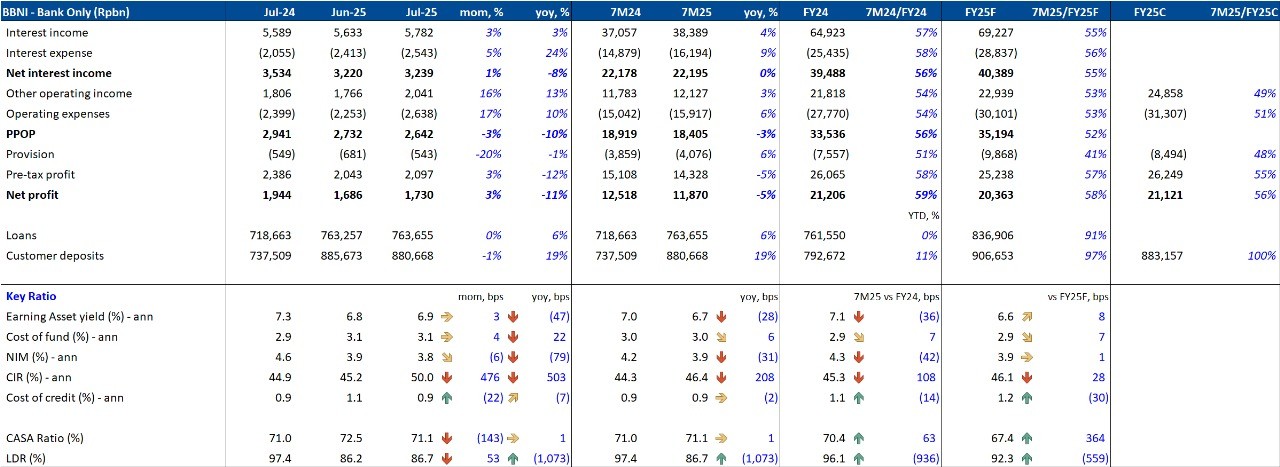

BBNI (Buy, TP: Rp4,800) - Bank-only Jul25 Results Jul25 Insight: · Modest bottom line: BBNI posted net profit of Rp1.7tr in Jul25 (+3% mom, –11% yoy), pressured by continued NIM compression and elevated costs. · NIM stayed below 4%: NIM slipped 6bps mom to 3.8% (–79bps yoy) as CoF stayed steady at 3.1%. · Elevated opex pushed CIR higher: Opex surged to Rp2.6tr (+17% mom, +10% yoy), the highest monthly level YTD, mainly from higher salaries and other expenses, pushing CIR to 50.0%. · CoC stayed low: CoC held at 0.9% in Jul25 (–22bps mom, –7bps yoy). · LDR stayed below 90%: Loans were flat mom, while deposits fell 1%, nudging LDR up to 87% from 86%.

7M25 Insight: · Yoy earnings decline: BBNI booked Rp11.9tr net profit in 7M25 (–5% yoy), in line with our forecast (58%) but slightly behind consensus (56%) vs 7M24’s 58%. · Negative PPOP performance: PPOP turned negative as opex rose 6% yoy while NII was flat. · NIM declined despite stable CoF: CoF stayed at 3.0%, but a 28bps drop in EA yield and lower LDR dragged NIM down 31bps to 3.9%. · Slight rise in provisions, CoC maintained at 0.9%: Provisions rose 6% yoy in line with loan growth, keeping CoC flat at 0.9%, below the FY25 target of 1%. · Above industry deposit growth: Loan growth of 6% yoy and deposit growth of 19% yoy drove LDR down to 87% (from 97% in 7M24).

Summary: · BBNI’s Jul25 results were Neutral, as NIM pressure and rising opex persisted. CoC remained manageable, but earnings momentum stayed weak in line with expectations. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

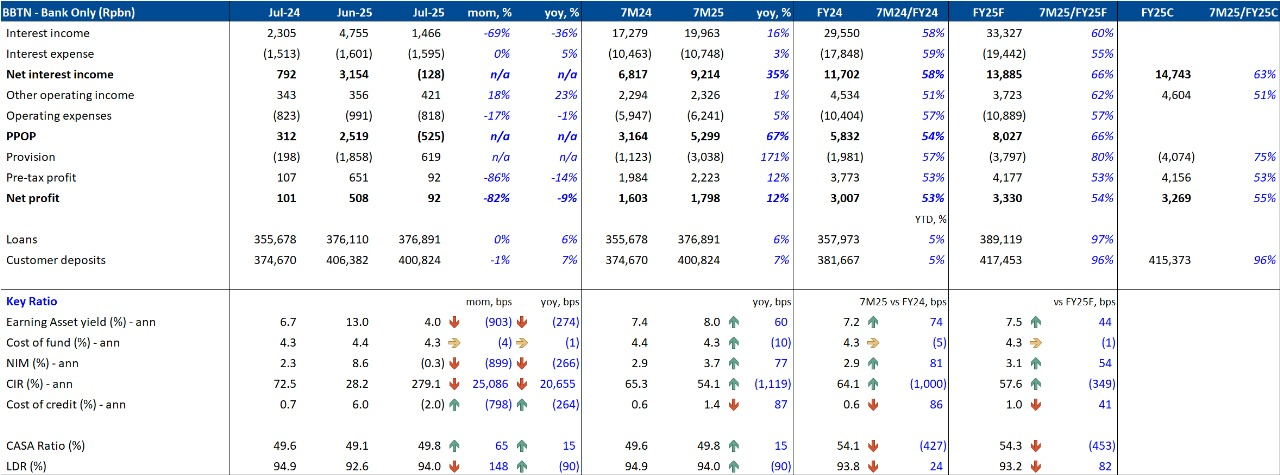

BBTN (Buy, TP: Rp1,400) - Bank-only Jul25 Results Jul25 Insight: · Profitability plot twist: After a strong Jun25, net profit plunged to Rp92bn (-82% mom, -9% yoy) as both NIM and CoC turned negative. · Negative PPOP offset by negative CoC: PPOP was negative at Rp525bn, but a Rp619bn provision reversal kept the bottom line positive. · Tanked asset yield put NIM in the red: EA yield dropped to 4.0% in Jul25, likely from the partial reversal of front-loaded asset yield in Jun25. · Slightly better CoF: CoF improved 4bps mom to 4.3%. · CoC turned negative: Provision reversal drove CoC to -2.0% in Jul25.

7M25 Insight: · Resilient bottom-line growth: BBTN booked Rp1.8tr net profit (+12% yoy), achieving 54% of our and 55% of consensus FY25F forecasts, in line with expectations (7M24: 53%). · NIM expanded on front-loaded asset yield: NIM climbed 77bps yoy to 3.7%, with EA yield rising 60bps yoy to 8.0%, supported by accounting changes. · More than doubled credit cost: CoC reached 1.4% (+87bps yoy), surpassing management’s initial 1.0–1.1% FY25 target but within revised guidance (~1.5%). · Opex growth moderated: Lower Jul25 opex slowed 7M25 opex growth to 5%, cutting CIR by 1,119bps yoy, helped by 35% NII growth. · LDR stayed ~94%: Deposits grew 7% yoy vs 6% loan growth, lowering LDR from 95% (7M24) to 94%.

Summary: · BBTN’s 7M25 results were weak, with margin reversal eroding Jul25 profitability despite provision reversal support. Still, YTD results stayed in line due to a low base in Jul24. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

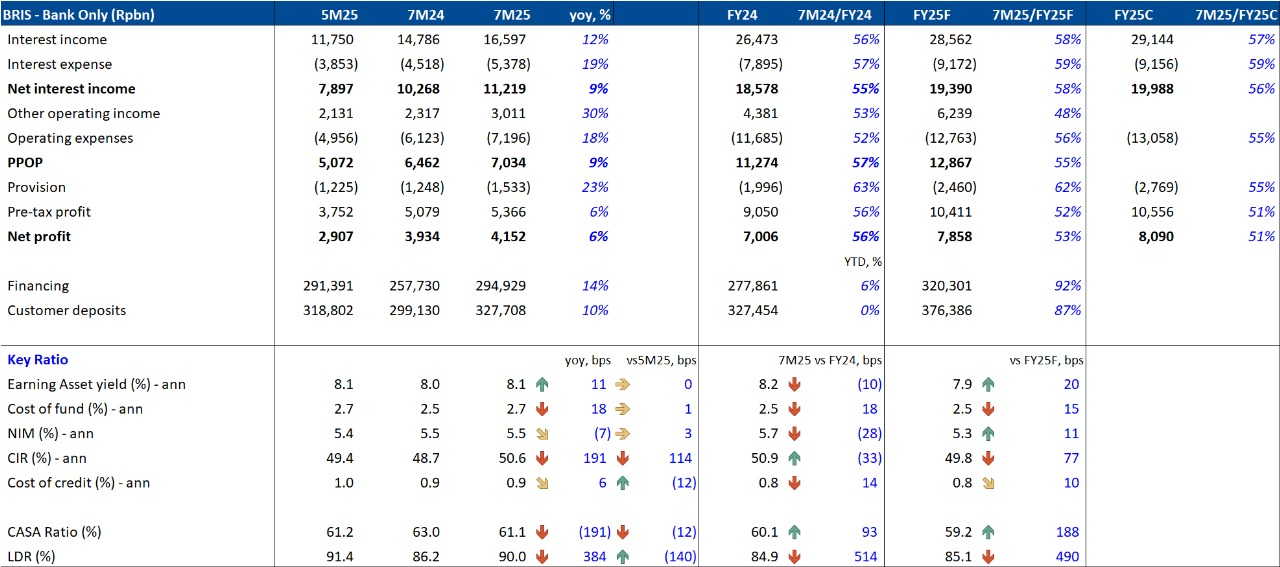

BRIS (Buy, TP: Rp2,900) Jul25 Results 7M25 Insight: · Soft net profit growth: BRIS posted 7M25 net profit of Rp4.2tr (+6% yoy), meeting 53% of our and 51% of consensus FY25F forecasts, below last year’s 56% run-rate. · Positive PPOP growth: PPOP rose 9% yoy to Rp7.0tr, supported by 9% NII growth and a solid 30% increase in fee income, despite partially offset by higher opex. · NIM slightly declined yoy: NIM eased 7bps yoy to 5.4% as CoF rose 18bps, partly offset by an 11bps improvement in EA yield. NIM was flat vs 5M25. · CIR lifted above 50% on higher opex: Opex jumped 18% yoy (mainly promotional and other expenses), driving CIR up to 50.6% (+191bps yoy, +114bps vs 5M25). · CoC elevated but within control: CoC stood at 0.9% (+6bps yoy). · LDR stayed at 90%: Loans grew 14% yoy, deposits increased 10%, lifting LDR to 90% (vs 86% in 7M24) but slightly down from 91% in 5M25.

Summary: · BRIS’s 7M25 results were soft, with higher opex and elevated CoC weighing on earnings despite strong NII and fee income growth. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

MARKET NEWS |

||||||||||||

SECTOR

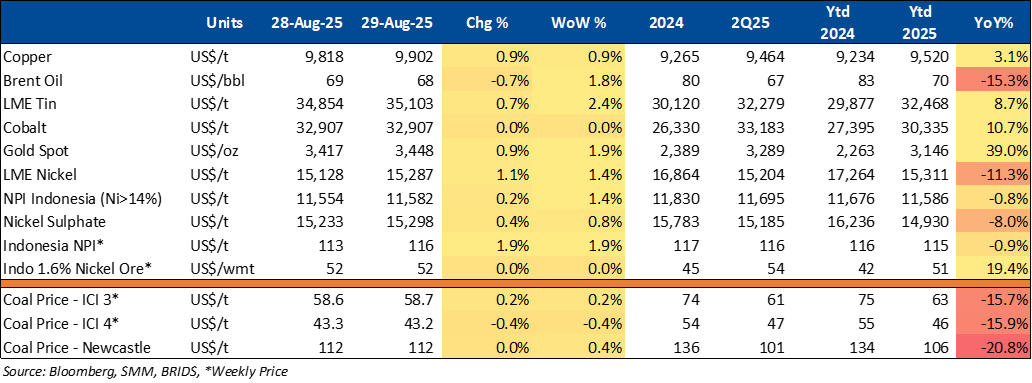

Commodity Price Daily Update August 29, 2025

Retail: APPBI Warns of Retail Losses Amid Jakarta Unrest

Indonesian Shopping Center Management Association (APPBI) cautioned that unrest in Jakarta could hurt sales at 100 malls, with hypermarkets and department stores under pressure as consumer purchasing power remains weak. Despite steady 85% occupancy and continued foot traffic, spending has shifted to cheaper items. APPBI expects only modest retail growth in 2025 unless government action boosts demand. (Kontan)

CORPORATE

CNMA Targets Additional 50-60 New Screens in FY25

CNMA targets the addition of 50–60 new screens by end-2025. As of Jul25, the company operates 1,369 screens across 261 cinemas in 67 cities, following the opening of six new locations this year. CNMA funds the expansion through operating cash flow, with part of the capex already allocated for the new sites. (Kontan)

LINK: Axiata Sells 4.76% Stake

Axiata Investments (Indonesia) Sdn Bhd has divested 136,203,259 shares, equivalent to 4.76% of LINK, at Rp3,060 per share on August 26, 2025, for a total transaction value of Rp416.7bn. Following the sale, Axiata’s ownership decreased to 70.66% from 75.42%, while public free float rose to 6.22% from 1.46%. The remaining stakes are held by EXCL at 19.22% and treasury shares at 3.9%. (Investor Daily)

To see the full version of this snapshoot, please click here